Abstract

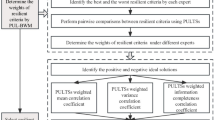

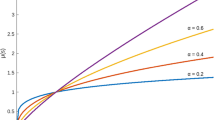

A power market is a special kind of e-market. In a power market, all trading processes are related to three parties: buyers, suppliers and brokers. A broker acts as middlemen between buyers and suppliers in a trading process. In a power market, how to select a potential supplier for a buyer through a broker based on the buyer’s requirements is a challenging research problem. This paper proposes relaxation strategy with fuzzy constraints for supplier selection. The strategy includes three components, i.e., a supplier selection, a fuzzy constraint relaxation, and a decision making. The major contributions of this paper are that (1) the trading process between buyers and suppliers through brokers is modeled by using fuzzy constraints through the consideration of multiple attributes of the buyer’s requirements as well as potential power suppliers; and (2) a buyer can utilize a relaxation with fuzzy constraints to change its requirements in difficult situations when a broker cannot find any supplier to satisfy a buyer’s requirements. Experimental results show that our approach is successfully applied in a simulated power market.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Bichler, M.: The Future of e-markets: Multidimensional Market Mechanisms. Cambridge University Press, Cambridge (2001)

Blume, L.E., Easley, D., Kleinberg, J., Tardos, E.: Trading networks with price-setting agents. Games Econ. Behav. 67(1), 36–50 (2009)

Fatima, S., Wooldridge, M., Jennings, N.R.: An analysis of feasible solutions for multi-issue negotiation involving nonlinear utility functions. In: Proceedings of The 8th International Conference on Autonomous Agents and Multiagent Systems, vol. 2, pp. 1041–1048. International Foundation for Autonomous Agents and Multiagent Systems (2009)

Gale, D.M., Kariv, S.: Financial networks. Am. Econ. Rev. 97(2), 99–103 (2007)

Ketter, W., Collins, J., Reddy, P., Flath, C., Weerdt, M.: The 2012 power trading agent competition. ERIM Report Series Reference No. ERS-2012-010-LIS (2012)

Luo, X., Jennings, N.R., Shadbolt, N., Leung, H., Lee, J.H.: A fuzzy constraint based model for bilateral, multi-issue negotiations in semi-competitive environments. Artif. Intell. 148(1), 53–102 (2003)

Nicolaisen, J., Petrov, V., Tesfatsion, L.: Market power and efficiency in a computational electricity market with discriminatory double-auction pricing. IEEE Trans. Evol. Comput. 5(5), 504–523 (2001)

Ren, F., Zhang, M.: Desire-based negotiation in electronic marketplaces. In: Innovations in Agent-Based Complex Automated Negotiations, pp 27–47. Springer (2010)

Ren, F., Zhang, M., Fulcher, J.: Bilateral single-issue negotiation model considering nonlinear utility and time constraint. In: New Trends in Agent-Based Complex Automated Negotiations, pp. 21–37. Springer (2012)

Rubinstein, A., Wolinsky, A.: Middlemen. Q. J. Econ. 102(3), 581–593 (1987)

Sarma, A.D., Chakrabarty, D., Gollapudi, S.: Public advertisement broker markets. In: Internet and Network Economics, pp. 558–563. Springer (2007)

Wijaya, T.K., Larson, K., Aberer, K.: Matching demand with supply in the smart grid using agent-based multiunit auction. In: Fifth International Conference on Communication Systems and Networks (COMSNETS), pp. 1–6. IEEE (2013)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer Japan

About this chapter

Cite this chapter

Le, D.T., Zhang, M., Ren, F. (2015). A Relaxation Strategy with Fuzzy Constraints for Supplier Selection in a Power Market. In: Bai, Q., Ren, F., Zhang, M., Ito, T., Tang, X. (eds) Smart Modeling and Simulation for Complex Systems. Studies in Computational Intelligence, vol 564. Springer, Tokyo. https://doi.org/10.1007/978-4-431-55209-3_6

Download citation

DOI: https://doi.org/10.1007/978-4-431-55209-3_6

Published:

Publisher Name: Springer, Tokyo

Print ISBN: 978-4-431-55208-6

Online ISBN: 978-4-431-55209-3

eBook Packages: EngineeringEngineering (R0)