Abstract

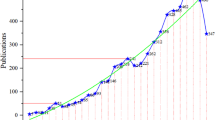

This paper conducted a comprehensive scientometric review of Fraud Detection between 1984 and 2021 to depict the landscapes, research hotspots, and emerging trends in this field. Besides scientific outputs evaluation using statistical analysis and comparative analysis, scientometric methods such as co-occurrence analysis, cocitation analysis, and coupling analysis were used to analyze the knowledge structure of Fraud detection. Results showed that Fraud Detection research went up significantly in the past two decades, in addition to conventional scientometric results, keywords with the strongest citation burst such as Intrusion Detection, Audit Planning, Pattern Recognition, Data Mining, Insurance Fraud, Benfords Law, Business Intelligence, Outlier Detection, Genetic Algorithm, Big Data, and Deep Learning, demonstrate the emerging trends of Fraud Detection.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Fraud: Detection, Prevention, and Analytics! In: Fraud Analytics Using Descriptive, Predictive, and Social Network Techniques, pp. 1–36. John Wiley and Sons, Inc., Hoboken (2015)

Sun, C., Li, Q., Cui, L., Yan, Z., Li, H., Wei, W.: An effective hybrid fraud detection method. In: Zhang, S., Wirsing, M., Zhang, Z. (eds.) KSEM 2015. LNCS (LNAI), vol. 9403, pp. 563–574. Springer, Cham (2015). https://doi.org/10.1007/978-3-319-25159-2_51

Yu, F., Yu, X.: Corporate lobbying and fraud detection. J. Financ. Quant. Anal. 46, 1865–1891 (2011)

Viaene, S., Derrig, R.A., Baesens, B., Dedene, G.: A comparison of state-of-the-art classification techniques for expert automobile insurance claim fraud detection. J. Risk Insur. 69, 373–421 (2002). https://doi.org/10.1111/1539-6975.00023

Cecchini, M., Aytug, H., Koehler, G.J., Pathak, P.: Detecting management fraud in public companies. Manage. Sci. 56, 1146–1160 (2010). https://doi.org/10.1287/mnsc.1100.1174

Bauder, R., Khoshgoftaar, T.M., Seliya, N.: A survey on the state of healthcare upcoding fraud analysis and detection. Health Serv. Outcomes Res. Method. 17(1), 31–55 (2016). https://doi.org/10.1007/s10742-016-0154-8

Bolton, R., Hand, D.: Statistical fraud detection: a review. Stat. Sci. 17, 235–249 (2002)

Kou, Y., et al.: Survey of fraud detection techniques. In: Proceedings of the 2004 IEEE International Conference on Networking, Sensing and Control, vol. 2, pp. 749–754 (2004)

West, J., Bhattacharya, M.: Intelligent financial fraud detection: a comprehensive review. Comput. Secur. 57, 47–66 (2016)

Ashtiani, M.N., Raahemi, B.: Intelligent fraud detection in financial statements using machine learning and data mining: a systematic literature review. IEEE Access 10, 72504–72525 (2022)

Callao, M.P., Ruisanchez, I.: An overview of multivariate qualitative methods for food fraud detection. Food Control 86, 283–293 (2018)

Omair, B., Alturki, A.: A systematic literature review of fraud detection metrics in business processes. IEEE Access 8, 26893–26903 (2020)

Pourhabibi, T., et al.: Fraud detection: a systematic literature review of graph-based anomaly detection approaches. Decis. Support Syst. 133, 113303 (2020)

Gupta, S., Mehta, S.K.: Data mining-based financial statement fraud detection: systematic literature review and meta-analysis to estimate data sample mapping of fraudulent companies against non-fraudulent companies. Glob. Bus. Rev. (2021). 097215092098485

Al-Hashedi, K.G., Magalingam, P.: Financial fraud detection applying data mining techniques: a comprehensive review from 2009 to 2019. Comput. Sci. Rev. 40, 100402 (2021)

Nana, W., Wang, F.: Comparative analysis on domestic and foreign financial fraud research based on knowledge map-web of science core collection. In: Proceedings of the 2017 4th International Conference on Management Innovation and Business Innovation (ICMIBI 2017), vol. 81, no. 2017, pp. 81–90 (2017)

Mansour, A.Z., Ahmi, A., Popoola, O.M.J., Znaimat, A.: Discovering the global landscape of fraud detection studies: a bibliometric review. J. Financ. Crime 29, 701–720 (2021). https://doi.org/10.1108/jfc-03-2021-0052

van Eck, N.J., Waltman, L.: VOS: a new method for visualizing similarities between objects. In: Decker, R., Lenz, H.-J. (eds.) Advances in Data Analysis. SCDAKO, pp. 299–306. Springer, Heidelberg (2007). https://doi.org/10.1007/978-3-540-70981-7_34

Li, Z., Li, Z., Zhao, Z., et al.: Landscapes and emerging trends of virtual reality in recent 30 years: a bibliometric analysis. In: Proceedings of the 2018 IEEE SmartWorld, Ubiquitous Intelligence & Computing, Advanced & Trusted Computing, Scalable Computing & Communications, Cloud & Big Data Computing, Internet of People and Smart City Innovation (SmartWorld/SCALCOM/UIC/ATC/CBDCom/IOP/SCI). IEEE (2018)

Aria, M., Cuccurullo, C.: Bibliometrix : an R-tool for comprehensive science mapping analysis. J. Informet. 11(4), 959–975 (2017)

Chen, C.: CiteSpace II: detecting and visualizing emerging trends and transient patterns in scientific literature. J. Am. Soc. Inform. Sci. Technol. 57(3), 359–377 (2006)

Kleinberg, J.: Bursty and hierarchical structure in streams. In: Proceedings of the Eighth ACM SIGKDD International Conference on Knowledge Discovery and Data Mining - KDD 2002. ACM Press (2002)

Rogosa, D., Brandt, D., Zimowski, M.: A growth curve approach to the measurement of change. Psychol. Bull. 92(3), 726–748 (1982)

Egghe, L.: Theory and practise of the g-index. Scientometrics 69, 131–152 (2006)

Blondel, V.D., Guillaume, J.-L., Lambiotte, R., Lefebvre, E.: Fast unfolding of communities in large networks. J. Stat. Mech: Theory Exp. 2008(10), P10008 (2008)

Chen, C., Leydesdorff, L.: Patterns of connections and movements in dual-map overlays: A new method of publication portfolio analysis. J. Am. Soc. Inf. Sci. 65(2), 334–351 (2013)

Fawcett, T., Provost, F.: Adaptive fraud detection. Data Min. Knowl. Discovery 1, 291–316 (1997). https://doi.org/10.1023/A:1009700419189

Ngai, E.W.T., Hu, Y., Wong, Y.H., Chen, Y., Sun, X.: The application of data mining techniques in financial fraud detection: a classification framework and an academic review of literature. Decis. Support Syst. 50, 559–569 (2011). https://doi.org/10.1016/j.dss.2010.08.006

Chan, P., Fan, W., Prodromidis, A., Stolfo, S.: Distributed data mining in credit card fraud detection. IEEE Intell. Syst. Their Appl. 14, 67–74 (1999). https://doi.org/10.1109/5254.809570

Abdallah, A., Maarof, M.A., Zainal, A.: Fraud detection system: a survey. J. Netw. Comput. Appl. 68, 90–113 (2016). https://doi.org/10.1016/j.jnca.2016.04.007

Srivastava, A., Kundu, A., Sural, S., Majumdar, A.K.: Credit card fraud detection using hidden Markov model. IEEE Trans. Dependable Secure Comput. 5, 37–48 (2008). https://doi.org/10.1109/TDSC.2007.70228

Sahin, Y., Bulkan, S., Duman, E.: A cost-sensitive decision tree approach for fraud detection. Expert Syst. Appl. 40, 5916–5923 (2013). https://doi.org/10.1016/j.eswa.2013.05.021

Dal Pozzolo, A., Caelen, O., Le Borgne, Y.-A., Waterschoot, S., Bontempi, G.: Learned lessons in credit card fraud detection from a practitioner perspective. Expert Syst. Appl. 41, 4915–4928 (2014). https://doi.org/10.1016/j.eswa.2014.02.026

Small, H.: Co-citation in the scientific literature: a new measure of the relationship between two documents. J. Am. Soc. Inform. Sci. 24, 265–269 (1973). https://doi.org/10.1002/asi.4630240406

Correa Bahnsen, A., Aouada, D., Stojanovic, A., Ottersten, B.: Feature engineering strategies for credit card fraud detection. Expert Syst. Appl. 51, 134–142 (2016). https://doi.org/10.1016/j.eswa.2015.12.030

Van Vlasselaer, V., et al.: APATE: A novel approach for automated credit card transaction fraud detection using network-based extensions. Decis. Support Syst. 75, 38–48 (2015). https://doi.org/10.1016/j.dss.2015.04.013

Jurgovsky, J., et al.: Sequence classification for credit-card fraud detection. Expert Syst. Appl. 100, 234–245 (2018). https://doi.org/10.1016/j.eswa.2018.01.037

Nami, S., Shajari, M.: Cost-sensitive payment card fraud detection based on dynamic random forest and k-nearest neighbors. Expert Syst. Appl. 110, 381–392 (2018). https://doi.org/10.1016/j.eswa.2018.06.011

Rushin, G., Stancil, C., Sun, M., Adams, S., Beling, P.: Horse race analysis in credit card fraud—deep learning, logistic regression, and gradient boosted tree. In: Proceedings of the 2017 Systems and Information Engineering Design Symposium (SIEDS). IEEE (2017)

Zheng, L., Liu, G., Yan, C., Jiang, C.: Transaction fraud detection based on total order relation and behavior diversity. IEEE Trans. Comput. Soc. Syst. 5, 796–806 (2018). https://doi.org/10.1109/tcss.2018.2856910

Chen, T., Guestrin, C.: XGBoost. In: Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining. ACM, New York, NY, USA (2016)

Herland, M., Khoshgoftaar, T.M., Bauder, R.A.: Big Data fraud detection using multiple medicare data sources. J. Big Data 5(1), 1–21 (2018). https://doi.org/10.1186/s40537-018-0138-3

Wang, Y., Xu, W.: Leveraging deep learning with LDA-based text analytics to detect automobile insurance fraud. Decis. Support Syst. 105, 87–95 (2018)

Hodge, A.: A survey of outlier detection methodologies. Artif. Intell. Rev. 22, 85–126 (2004). https://doi.org/10.1007/s10462-004-4304-y

Maranzato, R., Pereira, A., Neubert, M., do Lago, A.P.: Fraud detection in reputation systems in e-markets using logistic regression and stepwise optimization. ACM SIGAPP Appl. Comput. Rev. 11, 14–26 (2010)

Cleary, R., Thibodeau, J.C.: Applying digital analysis using Benford’s law to detect fraud: the dangers of type I errors. Auditing J. Pract. Theory 24, 77–81 (2005). https://doi.org/10.2308/aud.2005.24.1.77

Liu, Z., Chen, C., Yang, X., Zhou, J., Li, X., Song, L.: Heterogeneous graph neural networks for malicious account detection. In: Proceedings of the 27th ACM International Conference on Information and Knowledge Management. ACM, New York (2018)

Wang, D., et al.: A semi-supervised graph attentive network for financial fraud detection. In: Proceedings of the 2019 IEEE International Conference on Data Mining (ICDM). IEEE (2019)

Liu, Z., Dou, Y., Yu, P.S., Deng, Y., Peng, H.: Alleviating the inconsistency problem of applying graph neural network to fraud detection. In: Proceedings of the 43rd International ACM SIGIR Conference on Research and Development in Information Retrieval. ACM, New York (2020)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Zeng, L., Li, Y., Li, Z. (2022). Research Hotspots, Emerging Trend and Front of Fraud Detection Research: A Scientometric Analysis (1984–2021). In: Tan, Y., Shi, Y. (eds) Data Mining and Big Data. DMBD 2022. Communications in Computer and Information Science, vol 1745. Springer, Singapore. https://doi.org/10.1007/978-981-19-8991-9_8

Download citation

DOI: https://doi.org/10.1007/978-981-19-8991-9_8

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-8990-2

Online ISBN: 978-981-19-8991-9

eBook Packages: Computer ScienceComputer Science (R0)