Abstract

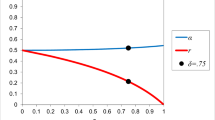

This paper deals with optimal pricing of new products over a finite planning period in a duopolistic market. Modelling saturation effects and no cost-side learning effects optimal pricing strategies for different kinds of demand functions are determined. In this direction the paper extends some results known from the monopolistic case. It turns out, that the optimal prices are decreasing functions of time, where the prices at each moment of time are higher than the marginal costs. Thus the optimal pricing strategies can be characterized as skimming policies.

Zusammenfassung

Die vorliegende Arbeit beschäftigt sich mit der optimalen Preisgestaltung von neuen Produkten in einer endlichen Planungsperiode unter der Annahme einer duopolistischen Marktform. Das Modell beschränkt sich auf die Analyse von Sättigungseffekten, wobei es möglich ist, optimale Preispfade für verschiedene Klassen von Nachfragefunktionen herzuleiten. Die Ergebnisse der Arbeit stellen Verallgemeinerungen des Monopolfalles dar. Durch die Anwendung von quantitativen Lösungsmethoden wird gezeigt, daß die optimalen Preispfade fallende Funktionen der Zeit sind. Dadurch, und durch das Resultat, daß die Preise stets größer sind als die Grenzkosten, stellen die optimalen Preisstrategien „Skimming“ Politiken dar.

Similar content being viewed by others

References

Bass, F.: A new product growth model for consumer durables. Management Science15, 1969, 215–227.

Clemhout, S., andH.Y. Wan: Pricing dynamics: intertemporal oligopoly model and limit pricing. Paper presented at the Econometric Society, North American, Winter Meeting, San Francisco, California, 1974a.

Clemhout, S., andH.Y. Wan: A class of trilinear differential games. Journal of Optimization Theory and Applications14, 1974b, 419–424.

Deal, K., S.P. Sethi, andG. Thompson: A bilinear — quadratic differential game in advertising. In: P.T. Lin and J.G. Sutinen. Eds., Control theory in mathematical economics. Proc. of the Third Kingston Conference, Part B, Marcel Dekker, New York 1979.

Dockner, E.: Optimal pricing for a monopoly against a competitive producer. Optimal Control Applications & Methods5, 1984.

Dolan, R., andP. Jeuland: Experience curves and dnyamic demand models: implications for optimal pricing strategies. Journal of Marketing45, 1981, 52–62.

Dockner, E., G. Feichtinger, andS. Jørgensen: Tractable classes of non-zero-sum open loop Nash differential games: theory and examples. Journal of Optimization Theory and Applications45, 1985, 179–198.

Feichtinger, G.: Optimal pricing in a diffusion model with nonlinear price-dependent market potential, Research Report No.43, Institute for Econometrics and Operations Research (University of Technology, Vienna 1981).

Feichtinger, G., andE. Dockner: Optimal pricing in a duopoly: a non-cooperative differential games solution. Journal of Optimization Theory and Applications45, 1985, 199–218.

Jørgensen, S.: A survey of some differential games in advertising. Paper presented at the workshop on ‘Dynamics of the Firm’, held in Brussels, October 30, 1980. European Institute for Advances Studies in Management. (To appear in J. Econom. Dynamics and Control).

—: A differential games solution to a logarithmic advertising model. The Journal of The Operational Research Society33, 1982, 425–432.

—: Optimal Control of a diffusion model of new product acceptance with price-dependent total market potential. Optimal Control Applications & Methods4, 1983, 269–276.

-: Optimal price and advertising policies for a new product. Paper presented at the workshop on “Model Building and Operations Research Applications in Marketing”, Brussels, November 1978.

Leitmann, G., andW.E. Schmitendorf: Profit maximization through advertising: a nonzero-sum differential game approach. IEEE Transactions on Automatic Control23, 1978, 645–650.

Robinson, B., andC. Lakhani: Dynamic price models for new product planning. Management Science10, 1975, 1113–1122.

Sethi, S.P., andG.L. Thompson: Optimal control theory: applications to management science. M. Nijhoff Publ., Boston 1981.

Stalford, H., andG. Leitmann: Sufficiency conditions for Nash Equilibrium in N-person differential games. In: Topics in Differential Games, A. Blaguiere (ed.), North-Holland-New York 1973.

Starr, A.W., andY.C. Ho: Nonzero-sum differential games. Journal of Optimization Theory and Applications3, 1969, 184–206.

Thépot, J., andJ. Levine: Open loop and closed loop equilibria in a dynamical duopoly. In: G. Feichtinger, Eds., Optimal Control Theory and Economic Applications, North Holland, Amsterdam 1982.

Thépot, J.: Politiques de Prix et d'Investissement d'un Duopol en Croissance, EIASM WP 79–42, 1979.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Dockner, E. Optimal pricing in a dynamic duopoly game model. Zeitschrift für Operations Research 29, B1–B16 (1985). https://doi.org/10.1007/BF01919488

Received:

Issue Date:

DOI: https://doi.org/10.1007/BF01919488