Abstract

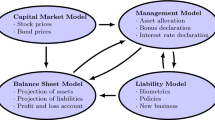

Short-sighted asset/liability strategies of the seventies left financial intermediaries — banks, insurance and pension fund companies, and government agencies — facing a severe mismatch between the two sides of their balance sheet. A more holistic view was introduced with a generation ofportfolio immunization techniques. These techniques have served the financial services community well over the last decade. However, increased interest rate volatilities, and the introduction of complex interest rate contingencies and asset-backed securities during the same period, brought to light the shortcomings of the immunization approach. This paper describes a series of (optimization) models that take a global view of the asset/liability management problem using interest rate contingencies. Portfolios containingmortgage-backed securities provide the typical example of the complexities faced by asset/liability managers in a volatile financial world. We use this class of instruments as examples for introducing the models. Empirical results are used to illustrate the effectiveness of the models, which become increasingly more complex but also afford the manager increasing flexibility.

Similar content being viewed by others

References

D.F. Babbel and S.A. Zenios, Pitfalls in the analysis of option-adjusted spreads, Fin. Anal. J. (July/August, 1992) 65–69.

F. Black, E. Derman and W. Troy, A one-factor model of interest rates and its application to treasury bond options, Fin. Anal. J. (Jan./Feb. 1990) 33–39.

P. Boyle, Options: A Monte Carlo approach, J. Fin. Econ. 4(1977)323–338.

S.P. Bradley and D.B. Crane, A dynamic model for bond portfolio management, Manag. Sci. 19(1972)139–151.

P.E. Christensen and F.J. Fabozzi, Bond immunization: An asset liability optimization strategy, in:The Handbook of Fixed Income Securities, ed. F.J. Fabozzi and I.M. Pollack (Dow Jones Irwin, 1987).

J.C. Cox, Jr., E. Ingersoll and S.A. Ross, A theory of the term structure of interest rates, Econometrica 53(1985)385–407.

C. Vassiadou-Zeniou and S.A. Zenios, Robust optimization models for managing callable bond portfolios, Euro. J. Oper. Res. (1995).

H. Dahl, A. Meeraus and S.A. Zenios, Some financial optimization models: I. Risk management, in:Financial Optimization, ed. S.A. Zenios (Cambridge University Press, 1993) pp. 3–36.

G.B. Dantzig, Linear programming under uncertainty, Manag. Sci. 1(1955)197–206.

B. Golub, M. Holmer, R. McKendall, L. Pohlman and S.A. Zenios, Stochastic programming models for money management, Euro. J. Oper. Res. (1995).

R.R. Grauer and N.H. Hakansson, Returns on levered actively managed long-run portfolios of stocks, bonds and bills, Fin. Anal. J. (Sept. 1985) 24–43.

R.S. Hiller and J. Eckstein, Stochastic dedication: Designing fixed income portfolios using massively parallel Benders decomposition, Manag. Sci. 39(1994)1422–1438.

M.R. Holmer, The asset/liability management system at Fannie Mae, Interfaces 24(1994)3–21.

J.M. Hutchinson and S.A. Zenios, Financial simulations on a massively parallel Connection Machine, Int. J. Supercomp. Appl. 5(1991)27–45.

J.E. Ingersoll, Jr.,Theory of Financial Decision Making, Studies in Financial Economics (Rowman and Littlefield, Totowa, NJ, 1987).

H. Konno and H. Yamazaki, Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market, Manag. Sci. 37(1991)519–531.

H. Markowitz, Portfolio selection, J. Fin. 7(1952)77–91.

H. Markowitz,Mean-Variance Analysis in Portfolio Choice and Capital Markets (Basil Blackwell, Oxford, 1987).

J.M. Mulvey and H. Vladimirou, Stochastic network optimization models for investment planning, Ann. Oper. Res. 20(1989)187–217.

J.M. Mulvey and S.A. Zenios, Capturing the correlations of fixed-income instruments, Manag. Sci. 40(1994)1329–1342.

R.B. Platt (ed.),Controlling Interest Rate Risk, Wiley Professional Series in Banking and Finance (Wiley, New York, 1986).

R.J-B Wets, Stochastic programs with fixed resources: The equivalent deterministic problem, SIAM Rev. 16(1974)309–339.

K.J. Worzel, C. Vassiadou-Zeniou and S.A. Zenios, Integrated simulation and optimization models for tracking fixed-income indices, Oper. Res. 42(1994)223–233.

S.A. Zenios, Massively parallel computations for financial modeling under uncertainty, in:Very Large Scale Computing in the 21st Century, ed. J. Mesirov (SIAM, Philadelphia, PA, 1991) pp. 273–294.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Zenios, S.A. Asset/liability management under uncertainty for fixed-income securities. Ann Oper Res 59, 77–97 (1995). https://doi.org/10.1007/BF02031744

Issue Date:

DOI: https://doi.org/10.1007/BF02031744