Abstract

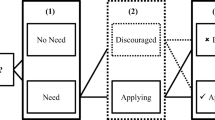

Advancements in technology are changing the traditional way of financial transactions. The cash oriented society is transformed into a “plastic money” society. During the last few years, credit card usage has expanded rapidly worldwide. Customers use their cards for a number of reasons such as paying regular bills, emergencies, spontaneous spending etc. The credit cards industry is in the growth stage of its product life cycle and it is a profitable business for banks. In this paper, based on a data sample from a large Greek bank, we identify factors that are important for a bank’s management in order to approve or reject an application for a credit card, while at the same time attempting to retain the institution’s clientele. We model multivariate categorical data using the logistic regression model. To motivate our choice model we assume that the approval of an application depends on a number of explanatory variables, and our principle objective is to understand the potential factors that contribute in the final decision and to identify the important covariates in predicting the binary outputs.

Similar content being viewed by others

References

Agresti, A. (1990).Categorical Data Analysis. First Edition, John Wiley & Sons, Inc.

Ausubel, L. (1991) “The Failure of Competition in the Credit Card Market”The American Economic Review 81 (1), 50–81

Collett, D. (1991),Modelling Binary Data. First Edition, Chapman & Hall

Dobson, A. (2002),An Introduction to Generalized Linear Models. Second Edition, Chapman & Hall

Feller, W. (1968),An Introduction to Probability Theory and its Applications. Third Edition, Willey, New York.

Gujarati, D. (2003),Basic Econometrics. Forth Edition, McGraw-Hill International Editions.

Lucas, A. (2001), “Statistical challenges in credit card issuing”Applied Stohastic models in business and industry 17, 83–92

Neider, J., P. McCullagh ‘Generalized Linear Models’ Second Edition, Chapman & Hall

Nash, R., J. Sinkey (1997), ‘On competition, Risk and Hidden Assets in the Market for Bank Credit Cards’Journal of Banking and Finance 21, 89–112.

Park, S. (1998) “Non-traditional activities and the efficiency of US commercial banks”Journal of Banking and Finance,22(4), 487–462

Snell, D., R.Cox (1989) “Analysis of Binary Data’ Second Edition, Chapman & Hall

Zopounidis, C., M. Doumpos (2002), “Multi-group discrimination using multi-criteria analysis: Illustrations from the field of finance.European Journal Of Operational Research 139 (2), 371–389

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Mavri, M., Ioannou, G. An empirical study for credit card approvals in the Greek banking sector. Oper Res Int J 4, 29–44 (2004). https://doi.org/10.1007/BF02941094

Issue Date:

DOI: https://doi.org/10.1007/BF02941094