Abstract

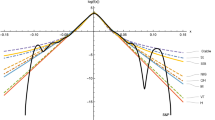

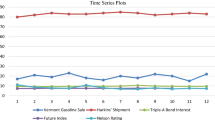

The so called Dual Moving Average Crossovers are said to be useful signals for forecasting trends of stock prices, as one of the technical analysis methods. First, we examined the usefulness of these crossovers by using historical daily closing price data and tick by tick price data of Japanese stocks. The results revealed that these crossovers were useful as confirmatory signals for forecasting market trends. Second, we tried to identify the underlying reasons for the usefulness of the crossovers. A model, which followed the Efficient Market Hypothesis, was found to fail to generate the price fluctuation where the crossovers were useful. We then developed a model that incorporated investor's suspicion about current price validity and two famous behavioral biases: conservativeness and representativeness. We identified the mechanism that those crossovers were closely related to investor's suspicion and the behavioral biases.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Andrei, S., “A Model of Investor Sentiment,”Inefficient Markets: An Introduction to Behavioral Finance, Oxford University Press, Oxford, pp. 112–153, 2000.

Balsara, N., Carlson, K. and Rao, N. V., “Unsystematic Futures Profits with Technical Trading Rules: A Case for Flexibility,”Journal of Financial and Strategic Decisions, 9, 1996, Prentice Hall; Englewood Cliffs, NJ, 1960.

Barberis, N., Shleifer, A. and Vishny, R., “A Model of Investor Sentiment,”Journal of Financial Economics, 49, 1998.

Black, F. and Scholes, M., “The Pricing of Options and Corporate Liabilities,”Journal of Political Economy, 81, 1973.

Brock, W., Lakonishok, J. and Lebaron, B., “Simple Technical Trading Rules and the Stochastic Properties of Stock Returns,”Journal of Finance, 47, 1992.

Edwards, W., “Conservatism in Human Information Processing,”Formal Representation of Human Judgment (Kleinmuntz, B., Ed.), Wiley, New York, 1968.

Fama, E. F., “Efficient Capital Markets: A review of the Theory and Empirical Evidence,”Journal of Finance, 25, 1970.

Fama, E. F., “Efficient Capital Markets II,”Journal of Finance, 46, 1991.

Granville, J.,Strategy of Daily Stock Market Timing, Prentice Hall, Englewood Cliffs, NJ, 1960.

Kahneman, D. and Riepe, M., “Aspects of investor psychology,”Journal of Portfolio Management, 24, 1998.

Lo, A. W. and MacKinlay, A. C., “Stock Market Prices do not Follow Random Walks: Evidence from a Simple Specification Test,”Review of Financial Studies 1, pp. 41–66, 1998.

Lo, A. W. and MacKinlay, A. C.,A Non-Random Walk down Wall Street, Princeton University Press, NJ, 1999.

Neftci, S., “Naive Trading Rules in Financial Markets and Wiener-Kolmogorov Prediction Theory: A Study of Technical analysis,”Journal of Business, 64, 1991.

Taylor, S. J., “Profitable Currency Futures Trading: a Comparison of Technical and Time-series Trading Rules,”The Currency Hedging Debate (Lee R. Thomas III, Ed.), IFR Publishing, London, 1990.

Tversky, A. and Kahneman, D., “Judgment Under Uncertainly: Heuristic and Biases,”Science, 22, 1974.

Author information

Authors and Affiliations

Corresponding author

Additional information

Kotaro Miwa: He is a Ph.D. candidate at the University of Tokyo. He is also a quantitative financial analyst and fund manager at Tokio Marine Asset Managements. He received his B.A. degree from the Faculty of Engineering at the University of Tokyo in 2001. He also received M.A. degree from the Department of Systems Science at the University of Tokyo in 2003. His current research interests include behavioral finance and financial engineering.

Kazuhiro Ueda, Ph.D.: He is an associate professor at the University of Tokyo. He received his B.A. degree from the Faculty of Liberal Arts and Science at the University of Tokyo in 1988. He also received M.A. and Ph.D. degrees in cognitive science from the Department of Systems Science at the University of Tokyo in 1990 and 1993. His current research interests include cognitive analysis on scientific problem solving, adaptive human-machine interface, artificial market and behavioral finance and cognitive robotics.

About this article

Cite this article

Miwa, K., Ueda, K. The influence of investor's behavioral biases on the usefulness of the Dual Moving Average Crossovers. New Gener Comput 23, 67–75 (2005). https://doi.org/10.1007/BF03037651

Received:

Issue Date:

DOI: https://doi.org/10.1007/BF03037651