Summary

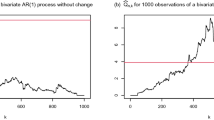

The cumulative sums of squares (CUSUMSQ) provide a means for detecting change points in the volatility (variance) of time series. In this paper a new method for detecting such change points is proposed. The method is based on a combination of two existing algorithms and is intended to combine their positive features in a single algorithm. The results of a simulation experiment to compare the performance of the algorithms are presented and, as an example, the algorithm is applied to the CUSUMSQ of pseudo-residuals. This provides a method of detecting periods in which a time series model fails to predict the observed volatility.

Similar content being viewed by others

References

Akima, H. (1978), A Method of Bivariate Interpolation and Smooth Surface Fitting for Irregularly Distributed Data Points, ACM Transactions on Mathematical Software 4(2), 148–164.

Akima, H. (1996), Algorithm 761: Scattered-Data Surface Fitting that has the Accuracy of a Cubic Polynomial, ACM Transactions on Mathematical Software 22(2), 362–371.

Berkowitz, J. (2001), Testing Density Forecasts, With Applications to Risk Management, Journal of Business & Economic Statistics 19(4), 465–474.

Bowman, A.W. & Azzalini, A. (1997), Applied Smoothing Techniques for Data Analysis, Oxford University Press New York.

Bos, T., Ding, D. & Fetherston, T.A. (1998), Searching for Periods of Volatility: A Study of the Behavior of Volatility in Thai Stocks, Pacific-Basin Finance Journal 6(3), 295–306.

Brown, R.L., Durbin, J. & Evans, J.M. (1975), Techniques for Testing the Constancy of Regression Relationships over Time, Journal of the Royal Statistical Society, Series B 37(2), 149–163.

Diebold, F.X., Günther, T.A. & Tay, A.S. (1998), Evaluating Density Forecasts, International Economic Review 39(4), 863–883.

Ihaka, R. & Gentleman, R. (1996), R: A Language for Data Analysis and Graphics, Journal of Computational and Graphical Statistics 5(3), 299–314.

Inclan, C. & Tiao, G.C. (1994), Use of Cumulative Sums of Squares for Retrospective Detection of Changes of Varaince, Journal of the Amarican Statistical Association 84(427), 913–923.

Kim, S., Shepard, N. & Chib, S. (1998), Stochastic Volatility: Likelihood Inference and Comparison with ARCH Models, Review of Economic Studies 65(3), 361–393.

MacDonald, I.L. & Zucchini, W. (1997), Hidden Markov and Other Models for Discrete-valued Time Series, Chapman & Hall London.

Neumann, K. (2000), Zeitreihenmodelle zur Schätzung des Value at Risk von Aktien, Josef Eul Verlag Köln.

Tanizaki, H. (1995), Asymtotically Exact Confidence Intervalls od CUSUM and CUSUMSQ Tests, Communications in Statistics-Simulation and Computation 24(4), 1019–1036.

Zucchini, W. & Neumann, K. (2001), A comparison of several time series models for assessing the value at risk of shares, Applied Stochastic Models in Business and Industry 17(1), 135–148.

Acknowledgesments

The valuable suggestions of two anonymous reviewers are gratefully acknowledged. I would also like to thank Walter Zucchini for helpful comments and overall support.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Stadie, A. Detecting periods in which a time series model fails to predict the observed volatility. Computational Statistics 18, 375–386 (2003). https://doi.org/10.1007/BF03354604

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03354604