Abstract

In this paper, we propose multivariate stochastic volatility models with a spherical parameterization of a Cholesky decomposition to make a time-dependent correlation matrix be positive definite without any constraints. An attractive feature of our model is that it can be easily fit using the R package NIMBLE. In addition to the spherical transformation, we introduce a multivariate L measure as a Bayesian model comparison criterion to assess the fit of different models. We present extensive simulation studies to examine the empirical performance of the proposed method and illustrate the methodology on time series of energy usage in a science building on the main campus of the University of Connecticut.Please confirm if the inserted city and country name is correct. Amend if necessary.RightPlease confirm if the corresponding author is correctly identified. Amend if necessary.Right

Similar content being viewed by others

References

Barnett G, Kohn R, Sheather S (1996) Bayesian estimation of an autoregressive model using Markov chain Monte Carlo. J Econom 74(2):237–254

Bickel PJ, Levina E (2008) Covariance regularization by thresholding. Ann Stat 2577–2604

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 31(3):307–327

Chen MH, Shao QM (1999) Monte Carlo estimation of Bayesian credible and HPD intervals. J Comput Graph Stat 8(1):69–92

Chib S, Nardari F, Shephard N (2006) Analysis of high dimensional multivariate stochastic volatility models. J Econom 134(2):341–371

Chib S, Omori Y, Asai M (2009) Multivariate stochastic volatility. Handbook of financial time series. Springer, Berlin, pp 365–400

de Valpine P, Turek D, Paciorek CJ, Anderson-Bergman C, Lang DT, Bodik R (2017) Programming with models: writing statistical algorithms for general model structures with nimble. J Comput Graph Stat 26(2):403–413

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econom J Econom Soc 987–1007

Engle RF, Kroner KF (1995) Multivariate simultaneous generalized ARCH. Econom Theory 11(1):122–150

Fox EB, Dunson DB (2015) Bayesian nonparametric covariance regression. J Mach Learn Res 16:2501–2542

Harvey A, Ruiz E, Shephard N (1994) Multivariate stochastic variance models. Rev Econ Stud 61(2):247–264

Hoff PD, Niu X (2012) A covariance regression model. Statistica Sinica 729–753

Ibrahim JG, Laud PW (1994) A predictive approach to the analysis of designed experiments. J Am Stat Assoc 89(425):309–319

Ibrahim JG, Chen MH, Sinha D (2001) Criterion-based methods for Bayesian model assessment. Statistica Sinica 419–443

Ibrahim JG, Kim S, Chen MH, Shah AK, Lin J (2019) Bayesian multivariate skew meta-regression models for individual patient data. Stat Methods Med Res 28(10–11):3415–3436

Kastner G (2016) factorstochvol: Bayesian estimation of (sparse) latent factor stochastic volatility models. R package version 08 3:908

Kastner G, Frühwirth-Schnatter S, Lopes HF (2017) Efficient Bayesian inference for multivariate factor stochastic volatility models. J Comput Graph Stat 26(4):905–917

Kim S, Shephard N, Chib S (1998) Stochastic volatility: likelihood inference and comparison with ARCH models. Rev Econ Stud 65(3):361–393

Laud PW, Ibrahim JG (1995) Predictive model selection. J Roy Stat Soc Ser B (Methodol) 57(1):247–262

Nakajima J (2017) Bayesian analysis of multivariate stochastic volatility with skew return distribution. Econom Rev 36(5):546–562

Pai JS, Ravishanker N (1996) Bayesian modelling of ARFIMA processes by Markov chain Monte Carlo methods. J Forecast 15(2):63–82

Pinheiro JC, Bates DM (1996) Unconstrained parametrizations for variance–covariance matrices. Stat Comput 6(3):289–296

Pourahmadi M (1999) Joint mean-covariance models with applications to longitudinal data: unconstrained parameterisation. Biometrika 86(3):677–690

Rambharat BR, Brockwell AE (2010) Sequential Monte Carlo pricing of American-style options under stochastic volatility models. Ann Appl Stat 222–265

Tsay RS (2005) Analysis of financial time series, vol 543. Wiley, New York

Virbickaitė A, Lopes HF, Ausín MC, Galeano P (2019) Particle learning for Bayesian semi-parametric stochastic volatility model. Econom Rev 38(9):1007–1023

Wu Y, Hernández-Lobato JM, Zoubin G (2013) Dynamic covariance models for multivariate financial time series. In: International conference on machine learning, PMLR, pp 558–566

Yu J, Meyer R (2006) Multivariate stochastic volatility models: Bayesian estimation and model comparison. Econom Rev 25(2–3):361–384

Zhang W, Leng C, Tang CY (2015) A joint modelling approach for longitudinal studies. J Roy Stat Soc Ser B (Stat Methodol) 77(1):219–238

Zou T, Lan W, Wang H, Tsai CL (2017) Covariance regression analysis. J Am Stat Assoc 112(517):266–281

Acknowledgements

We would like to thank the editor and two reviewers for their valuable comments. We thank the staff of the Department of Facilities at the University of Connecticut for providing the energy usage data. Dr. Chen’s research was partially supported by NIH Grants #GM70335 and #P01CA142538.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Trace plots for convergence diagnostics

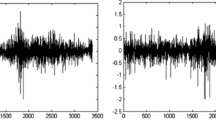

In order to check the convergence of the MCMC algorithm, we get two random MCMC samples from a simulation replicate. The trace plots shown in Fig. 5 confirm that our proposed method has good convergence.

Appendix B: Marginal likelihood comparison

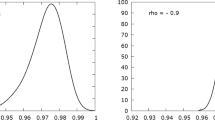

In order to check the performance of the marginal likelihood for model selection, we present selection results for Scenario 1 in Simulation III. We generate data from the SP-DMSV model. We fit both the SP-DMSV and FSV models, and compute the marginal likelihood under each model fit on the 2000 posterior samples. We have 100 replicates in Scenario 1. The logarithms of differences is shown in Fig. 6.

Appendix C: Posterior estimates with credible bands

The posterior estimates with 95% credible bands for the last 50 time points are shown in Fig. 7.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hu, G., Chen, MH. & Ravishanker, N. Bayesian analysis of spherically parameterized dynamic multivariate stochastic volatility models. Comput Stat 38, 845–869 (2023). https://doi.org/10.1007/s00180-022-01266-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00180-022-01266-9