Abstract

We present results from a series of experiments that allow us to measure overbidding and, in particular, underbidding in first-price auctions. We investigate the extent to which the amount of underbidding depends on the seemingly innocuous parameters of the experimental setup. To structure our data, we present and test a theory that introduces constant markdown bidders into a population of fully rational bidders. While a fraction of bidders in the experiment can be described by Bayesian Nash equilibrium bids, a larger fraction seems either to use constant markdown bids or to rationally optimise against a population with fully rational and boundedly rational markdown bidders.

Similar content being viewed by others

Notes

In this experiment the smallest possible valuation was $0 or $0.10 and the largest possible valuation ranges from $4.90–$36.10. In Fig. 1 the valuations are normalised to [0, 1] and bids are normalised correspondingly.

Another explanation for bids of zero or close to zero is that bidders, who cannot opt out of participating in the auction, may want to document their unwillingness to participate in the auction, because the probability of winning with low valuations is deemed negligible.

Kirchkamp et al. (2009).

The expected utility for any \(\alpha _i<\alpha _j-1\) or any \(\alpha _i>\alpha _j+1\) is given by \(u(\alpha _i)\) or 0, respectively.

See Appendix A for the detailed derivation.

More specifically, the shape of bidding functions for low valuations that is biased upwards in experiments not admitting substantial underbidding with low valuations, e.g., by ruling out negative bids while using a lowest possible value of zero or close to it.

A smaller number of bidders increases the probability to win the auction. An increase in the probability to win the auction increases the number of learning opportunities for bidders.

Median and quartiles are taken over all bidders and all periods (after period 6) in a given treatment.

Garratt et al. (2012) report overbidding along with underbidding in second-price auctions for bidders with extensive eBay experience.

See Hortaçsu and McAdams (2018), p.159.

The maximization problem of rational bidder i with value \(x_i=0\) is

$$\begin{aligned} \max _{b_i}\rho \cdot 0 + (1-\rho )\cdot G(b_i)\cdot (0-b_i)^r \end{aligned}$$where \(G(b_i)=b_i+r/2\) for \(b_i\in [-r/2,(2-r)/2]\) and the first-order condition follows as \((-b)^r-r(b+r/2)(-b)^{r-1}=0\) and is necessary and sufficient for a unique maximum.

This took 5 minutes with 8 parallel threads on an i7-2600 CPU @ 3.40GHz.

This took 104 minutes with 8 parallel threads on an i7-2600 CPU @ 3.40GHz.

In the \(0+\) and \(50+\) treatments the valuation would be announced precisely: “This valuation is between 0 and 50 ECU” in the \(0+\) treatment and “This valuation is between 50 and 100 ECU” in the \(50+\) treatment. Whenever x is mentioned in the remainder of the instructions, the same comment applies: In the \(0+\) and \(50+\) treatments the valuation is always announced precisely.

This sentence was not shown in the \(0+\) and \(50+\) treatments, although in all treatments the range was shown on the screen.

In the \(0+\) and \(50+\) treatments the interval was already shown exactly in the instructions and consistently also in the graphs in the instructions. In the other treatments, the interval x to \(x+50\) was, as you see in the figure, described as x to \(x+50\) on the horizontal axis. From the first round of the experiment on, the current numbers were given.

In the instructions, the following figure was shown. This figure does not show the bidding function in the graph and the specific bids, gains and losses that would be shown during the experiment.

This item is not shown in the \(0+\) and \(50+\) treatments.

Note that, in order to be able to use same instructions for all treatments, we mention the possibility of negative valuations in all, except the \(0+\) and \(50+\) treatments, even if subjects learn later that their valuation is drawn from an interval that contains only positive numbers.

This item is not shown in the \(0+\) and \(50+\) treatments.

References

Bajari P, Hortaçsu A (2005) Are structural estimates of auction models reasonable? Evidence from experimental data. J Polit Econ 113(41):703–741. https://doi.org/10.3386/w9889

Blume A, Gneezy U (2010) Cognitive forward induction and coordination without common knowledge: an experimental study. Games Econ Behav 68(2):488–511. http://ideas.repec.org/a/eee/gamebe/v68y2010i2p488-511.html

Bosch-Domenech A, Montalvo JG, Nagel R, Satorra A (2002) One, two, (three), infinity,. and lab beauty-contest experiments. Am Econ Rev 92(5):1687–1701

Chen K-Y, Plott CR (1998) Nonlinear behavior in sealed bid first price auctions. Games Econ Behav 25:34–78

Cox JC, Roberson B, Smith VL (1982) Theory and behavior of single object auctions. In: Smith VL (ed) Research in experimental economics. JAI Press, Greenwich, pp 1–43

Cox JC, Smith VL, Walker JM (1983) Test of a heterogeneous bidder’s theory of first price auctions. Econ Lett 12(3–4):207–212

Cox JC, Smith VL, Walker JM (1985) Experimental development of sealed-bid auction theory: calibrating controls for risk aversion. Am Econ Rev 75(2):160–165

Cox JC, Smith VL, Walker JM (1988) Theory and individual behavior of first-price auctions. J Risk Uncertain 1:61–99

Crawford VP, Iriberri N (2007) Level-\(k\) auctions: can a nonequilibrium model of strategic thinking explain the winner’s curse and overbidding in private-value auctions? Econometrica 75(6):1721–1770

Decarolis F (2018) Comparing public procurement auctions. Int Econ Rev 59(2):391–419. https://doi.org/10.1111/iere.12274

Dyer D, Kagel JH, Levin D (1989) Resolving uncertainty about the number of bidders in independent private-value auctions: an experimental analysis. RAND J Econ 20(2):268–279. https://ideas.repec.org/a/rje/randje/v20y1989isummerp268-279.html (Summer)

Fischbacher U (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178. http://ideas.repec.org/a/kap/expeco/v10y2007i2p171-178.html

Fox JT, Patrick B (2013) Measuring the efficiency of an FCC spectrum auction. Am Econ J Microecon 5 (1):100–146. https://ideas.repec.org/a/aea/aejmic/v5y2013i1p100-146.html

Garratt R, Walker M, Wooders J (2012) Behavior in second-price auctions by highly experienced eBay buyers and sellers. Exp Econ 15(1):44–57. http://ideas.repec.org/a/kap/expeco/v15y2012i1p44-57.html

Gelman A, Rubin DB (1992) Inference from iterative simulation using multiple sequences. Stat Sci 7(4):457–472. https://doi.org/10.1214/ss/1177011136

Güth W, Ivanova-Stenzel R, Königstein M, Strobel M (2003) Learning to bid—an experimental study of bid function adjustments in auctions and fair division games. Econ J 113(487):477–494

Hong H, Shum M (2003) Econometric models of asymmetric ascending auctions. J Econom 112(2):327–358. https://ideas.repec.org/a/eee/econom/v112y2003i2p327-358.html

Hortaçsu A, McAdams D (2018) Empirical work on auctions of multiple objects. J Econ Lit 56(1):157–84. https://doi.org/10.1257/jel.20160961

Ivanova-Stenzel R, Sonsino D (2004) Comparative study of one bid versus two bid auctions. J Econ Behav Organ 54(4):561–583

Jeffreys H (1961) Theory of probability, 3rd edn. Clarendon Press, Oxford

Kagel JH, Levin D (1993) Independent private value auctions: bidder behavior in first-, second- and third-price auctions with varying numbers of bidders. Econ J 103:868–879

Kagel JH, Harstad RM, Levin D (1987) Information impact and allocation rules in auctions with affiliated private values: a laboratory study. Econometrica 55:1275–1304

Kirchkamp O, Reiß JP (2011) Out-of-equilibrium bids in first-price auctions: wrong expectations or wrong bids. Econ J 121(157):1361–1397

Kirchkamp O, Poen E, Reiß JP (2009) Outside options: another reason to choose the first-price auction. Eur Econ Rev 53(2):153–169

Krishna V (2010) Auction theory. Academic Press/Elsevier, Cambridge (ISBN 9780123745071)

Masiliunas A, Friederike M, Reiß JP (2014) Behavioral variation in Tullock contests, KIT working paper series in economics, No. 55, February 2014. http://econpapers.wiwi.kit.edu/downloads/KITe_WP_55.pdf

Pezanis-Christou P, Sadrieh A (2003) Elicited bid functions in (a)symmetric first-price auctions. Discussion paper 2003-58, CentER, Tilburg University

Selten R, Buchta J (1999) Experimental sealed bid first price auctions with directly observed bid functions. In: Bodescu D, Erev I, Zwick R (eds) Games and human behaviour. Lawrence Erlbaum Aussociates Inc., Mahwah, pp 79–102

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank audiences at Amsterdam, Atlanta, Bonn, Cologne, Düsseldorf, Essen, Graz, OSU and two anonymous referees for useful comments and suggestions. Financial support from the Deutsche Forschungsgemeinschaft through SFB 504 is gratefully acknowledged.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

A. Derivation of the best-response function \(\alpha _i^{*}(\alpha _j)\) with markdown bids as given by (4)

With the uniform distribution \(f(x_i)=f(x_j)=1\) for \(x_i,x_j\in [0,1]\), and CRRA utility, the expected utility function simplifies to

To ease the exposition, define auxiliary functions \(h_{-}(z)\) and \(h_{+}(z)\) corresponding to the two cases of the expected utility function as follows:

-

Case I: \(h_{-}(z)\) is maximised on the interval \([\underline{z},\alpha _j]\) at \(z^{*}_{-}=\min \{z_1,\,\alpha _j\}\), where \(z_1\) is defined further below. The first derivative of \(h_{-}(z)\) is

$$\begin{aligned} h'_{-}(z)=\frac{r\,z^{r-1}}{2}\, \left[ 2-(z-\alpha _j+1)^2-\frac{2z}{r}\,(z-\alpha _j+1)\right] \end{aligned}$$and exhibits two non-zero roots \(z_1,z_2\ne 0\) such that

$$\begin{aligned} z_{1,2}=\frac{(1+r)\,(\alpha _j-1)}{2+r}\pm \frac{1}{2+r}\,\sqrt{2r(2+r)+(\alpha _j-1)^2}. \end{aligned}$$It is straightforward to show that \(\underline{z}<z_1<\alpha _j-1+\sqrt{2}\). There exists \(z'\in (\underline{z},z_1)\) such that \(h'_{-}(z')>0\); further, \(h'_{-}(z_1)=0\), and \(h'_{-}(\alpha _j-1+\sqrt{2})<0\). Because \(z_2<\underline{z}\), \(z_1\) is the unique root of \(h'_{-}(z)\) for \(z>\underline{z}\) so that, with continuous differentiability of \(h_{-}(z)\) for \(z>\underline{z}\) and continuity of \(h_{-}(z)\) for \(z\ge \underline{z}\), \(h_{-}(z_1)\) is the maximum on interval \([\underline{z},\alpha _j-1+\sqrt{2}]\). Therefore, \(z^{*}_{-}=z_1\) is the maximiser on interval \([\underline{z},\alpha _j]\) for \(z_1\le \alpha _j\) and \(z^{*}_{-}=\alpha _j\) emerges as the boundary solution for \(z_1>\alpha _j\).

-

Case II: \(h_{+}(z)\) is maximised on \([\alpha _j,\,\alpha _j+1]\) at \(z^{*}_{+}=\max \{z_4,\alpha _j\}\) where \(z_4\) is defined further below. The first derivative of \(h_{+}(z)\) is

$$\begin{aligned} h'_{+}(z)=\frac{1}{2}\,z^{r-1}\,(\alpha _j-z+1)\,\left[ r\,(\alpha _j-z+1)-2z\right] \end{aligned}$$and exhibits two non-zero roots: \(z_3=\alpha _j+1\) and \(z_4=r(\alpha _j+1)/(2+r)\). Because \(h_{+}(z_3)=0\) and \(h_{+}(z)>0\) for \(z\in [\alpha _j,\,\alpha _j+1)\), \(z_3\) identifies a minimum. It is obvious that \(0<z_4<\alpha _j+1\). There exists \(z'\in (0,z_4)\) such that \(h'_{+}(z')>0\); further, \(h'_{+}(z_4)=0\), and there exists \(z''\in (z_4,\alpha _j+1)\) such that \(h'_{+}(z'')<0\). Because \(z_4\) is the unique root of \(h'_{+}(z)\) for \(0<z<\alpha _j+1\), with continuous differentiability of \(h_{+}(z)\) for \(0<z<\alpha _j+1\) and continuity of \(h_{+}(z)\) for \(z\ge 0\), \(h_{+}(z_4)\) is the maximum on interval \([0,\alpha _j+1]\). For \(\alpha _j\le r/2\), \(z_4\ge \alpha _j\); hence, \(z^{*}_{+}=z_4\) is the maximiser of \(h_{+}(z)\) on interval \([\alpha _j,\alpha _j+1]\) for \(\alpha _j\le r/2\). Further, \(z^{*}_{+}=\alpha _j\) for \(\alpha _j>r/2\) because then \(z_4<\alpha _j\).

By \(h_{-}(\alpha _j)=h_{+}(\alpha _j)\) and, for \(\alpha _j>0\), \(h'_{-}(\alpha _j)=h'_{+}(\alpha _j)=\alpha _j^{r-1}\,(r-2\alpha _j)/2\), expected utility \(\text {EU}_{i}(\alpha _{i})\) is maximised (i) by \(z_1\) for \(\alpha _j>r/2\), (ii) by \(z_1\) and \(z_4\) for \(\alpha _j=r/2\) (implying \(z_1=z_4\)), and (iii) by \(z_4\) for \(0<\alpha _j<r/2\). The comparison of \(h_{-}(z_{-}^{*}=0)=0\) and \(h_{+}(z_{+}^{*}=z_4)>0\) implies that \(\text {EU}_{i}(\alpha _{i})\) is maximised by \(z_4\) for \(\alpha _j=0\). The best-response function \(\alpha _i^{*}(\alpha _j)\) as given by (4) follows immediately.

B. Rational bidders alongside markdown bidders

In Sect. 2.3 we considered the situation of a heterogeneous population. A share \(\rho \in [0,1)\) of the population is perfectly rational. The rest, a share \(1-\rho \), consists of markdown bidders. In this appendix we derive the equilibrium conditions for this case.

Let \(\theta _j\in \{\text {R}, \overline{\text {R}}\}\) denote the rationality type of player j that can be either fully rational, \(\theta _j=\text {R}\), or boundedly rational in the sense of markdown bidding, \(\theta _j=\overline{\text {R}}\). Then, a fully rational bidder’s prior probability of competing with another fully rational bidder is \(\rho \) and that of facing a markdown bidder is \(1-\rho \). Assume there is an equilibrium such that the fully rational type bids according to \(\gamma (x)\) and the boundedly rational type bids according to \({\bar{\gamma }}(x)\), where both equilibrium bid functions are strictly increasing. The expected utility of a fully rational bidder i facing the competitor j, who is randomly drawn from the population of bidders, is (assuming that bidder j bids according to the proposed equilibrium) given by:

Because the assumed equilibrium bid function of the fully rational type is strictly increasing, there exists the inverse \(\chi (b):=\gamma ^{-1}(b)\) that maps a fully rational player’s bid b to the corresponding value x. The probability that player i outbids another fully rational bidder follows as \(F(\chi (b_i))\). Let G(b) denote the cumulative distribution function of bids submitted by the boundedly rational type so that the probability of player i outbidding this type is \(G(b_i)\). By markdown bidding as described by (5) together with the distribution of values F(x), we have \(G(b)=b+r/2\) for \(b\in {[-r/2,(2-r)/2]}\). Therefore, the maximization problem of fully rational bidder i that competes with bid \(b_i\) against an equilibrium bidder of unknown rationality type is given by

The first-order condition follows as

For a fully rational bidder i, it cannot be beneficial to deviate from the equilibrium strategy in equilibrium; hence, \(x_i=\chi (b_i)\). Using this property and substituting for probability densities yields the following differential equation whose solution (with an appropriate initial value to be determined below) is the inverse of the equilibrium bid function of the fully rational type \(\chi (b)\):

In equilibrium, a rational bidder with the smallest possible value of 0 never wins against another rational bidder but only against boundedly rational bidders. With the distribution of bids submitted by markdown bidders G(b), the optimal bid of rational bidder i with \(x_i=0\) follows asFootnote 12

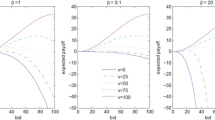

The initial condition follows as \(\chi (-r^2/(2(1+r)))=0\). Because differential equation (21) is non-linear and non-autonomous, an explicit solution is not known in general. We can, however, derive a good numerical approximation. Figure 3 shows the equilibrium bids for different attitudes towards risk r and various population mixes \(\rho \).

For the special case of a population with equilibrium markdown bidders only, i.e., \(\rho =0\), Eq. (21) simplifies to

implying for a rational bidder who optimises against an equilibrium markdown bidder with \(\alpha ^*=r/2\) to bid according to

With non-equilibrium markdown bidders who shade valuations by arbitrary \(\alpha >0\), so that \(G(b)=b+\alpha \) for \(b\in [-\alpha ,1-\alpha ]\), a rational bidder’s best-response is

conditional on non-extreme markdowns of \(\alpha \le r\), which ensures that a rational bidder with the highest possible valuation does not overbid the highest possible bid of a markdown bidder of \(1-\alpha \); otherwise, for \(\alpha >r\), there emerges a flat portion of a rational bidder’s best-response, where \(b(x)=1-\alpha \) for all \(x\ge 1+r-\alpha \). For extreme markdowns, \(\alpha \ge 1+r\), the rational bidder – whatever the valuation – would prefer to always win the auction. In this case the best response would be a flat bid of \(1-\alpha \) (equal to the highest possible bid of a markdown bidder) for all \(x\ge 0\).

C. Further estimation results

1.1 C.1. Estimating Eqs. (6)–(10)

To calculate the posterior distribution for Eqs. (6)–(10), we use JAGS 4.0.0 with 8 different chains, each with 5000 burnin steps. For each chain, we take 10000 actual samples. The posterior distributions for each case are therefore based on 80,000 actual samples.Footnote 13 Table 3 provides the effective sample size and potential scale reduction factor (Gelman and Rubin 1992) for \(\beta _3\) from Eq. (7).

1.2 C.2. Estimates and convergence for Eqs. (12)–(20)

For each treatment, we calculate posteriors separately, each time using JAGS with 8 different chains, each chain with 5000 burnin steps. For each chain, we take 10000 samples with a thinning parameter of 10. The posterior distributions for each treatment are therefore based on \(8\times 10^{5}\) actual samples.Footnote 14 Table 4 shows medians of the distribution for \(\delta _c\) from Eq. (19). Numbers are given as percentages. 95% credible intervals are given in brackets.

The left part of Table 5 shows the potential scale reduction factor for \(\delta _c\) . The right part shows the effective sample size.

D. Conducting the experiment and instructions

Participants were recruited by email and could register for the experiment on the internet. At the beginning of the experiment, participants drew balls from an urn to determine their allocation to seats. Being seated, participants then obtained written instructions in German. In the following, we give a translation of the instructions.

After answering control questions on the screen, subjects entered the treatment described in the instructions. After completing the treatment, they answered a short questionnaire on the screen and, then, were paid in cash. The experiment was conducted with z-Tree, (Fischbacher (2007)).

1.1 D.1. General information

You are participating in a scientific experiment that is sponsored by the Deutsche Forschungsgemeinschaft (German Research Foundation). If you read the following instructions carefully, then you can—depending on your decision—gain a considerable amount of money. It is, hence, very important that you read the instructions carefully.

The instructions that you have received are only for your private information. During the experiment, no communication is permitted. Whenever you have questions, please raise your hand. We then answer your question at your seat. Not following this rule leads to exclusion from the experiment and all payments.

During the experiment, we do not talk about Euro, but about ECU (Experimental Currency Unit). Your entire income is first determined in ECU. The total amount of ECU that you have obtained during the experiment is converted into Euro at the end and paid to you in cash. The conversion rate is shown on your screen at the beginning of the experiment.

1.2 D.2. Information regarding the experiment

Today you are participating in an experiment on auctions. The experiment is divided into separate rounds. We conduct 12 rounds. In the following, we explain what happens in each round.

In each round, you bid for an object that is auctioned. Together with you, another participant also bids for the same object. Hence, in each round, there are two bidders. In each round, you are allocated randomly to another participant for the auction. Your co-bidder in the auction changes in every round. The bidder with the highest bid obtains the object. If bids are the same, the object is allocated randomly.

For the auctioned object you have a valuation in ECU. This valuation is between x and \(x+50\) ECU and is determined randomly in each round.Footnote 15 The range from x to \(x+50\) is shown to you at the beginning of the experiment on the screen and is the same in each round.Footnote 16From this range you obtain new and random valuations for the object in each round. The other bidder in the auction also has a valuation for the object. The valuation that the other bidder attributes to the object is determined by the same rules as your valuation and changes in each round, too. All possible valuations of the other bidder are also in the interval from x to \(x+50\) from which also your valuations are drawn. All valuations between x and \(x+50\) are equally probable. Your valuations and those of the other player are determined independently. You will be told your valuation in each round. You will not know the valuation of the other bidder.

1.2.1 D.2.1. Experimental procedure

The experimental procedure is the same in each round and is described in the following. Each round in the experiment has two stages.

1. Stage

In the first stage of the experiment, you see the following screen:Footnote 17

At that stage you do not know your own valuation for the object in this round. On the right side of the screen, you are asked to enter a bid for six hypothetical valuations that you may have for the object. These six hypothetical valuations are x, \(x+10\), \(x+20\), \(x+30\), \(x+40\), and \(x+50\) ECU. Your input into this table will be shown in the graph on the left side of the screen when you click on “draw bids”. In the graph, the hypothetical valuation is shown on the horizontal axis, the bids are shown on the vertical axis. Your input in the table is shown as six points in the diagram. Neighbouring points are connected with a line automatically. These lines determine your bid for all valuations between the six points for those you have made an input. For the other bidder, the screen in the first stage looks the same and there are as well bids for six hypothetical valuations. The other bidder cannot see your input.

2. Stage The actual auction takes place in the second stage of each round. In each round, we play not only a single auction but five auctions. This is done as follows: Five times a random valuation is determined that you have for the object. Similarly for the other bidder five random valuations are determined. You see the following screen:Footnote 18

For each of your five valuations, the computer determines your bid according to the graph from stage 1. If a valuation is precisely at x, \(x+10\), \(x+20\), \(x+30\), \(x+40\), or \(x+50\) the computer takes the bid that you gave for this valuation. If a valuation is between these points, your bid is determined according to the joining line. In the same way, the bids of the other bidder are determined for his five valuations. Your bid is compared with the one of the other bidder. The bidder with the higher bid obtains the object.

Your income from the auction: For each of the five auctions the following holds:

-

The bidder with the higher bid obtains the valuation he had for the object in this auction added to his account minus his bid for the object.

-

If the bidder with the higher bid has a negative valuation for the object, the ECU account is reduced by this amount.Footnote 19

-

If the bid of bidder with the higher is a negative number, the amount is added to his ECU account.Footnote 20

-

The bidder with the smaller bid obtains no income from this auction.

You total income in a round is the sum of the ECU income from those auctions in this round where you have made the higher bid.

This ends one round of the experiment and you see the input screen from stage 1 again in the next round.

At the end of the experiment, your total ECU income from all rounds will be converted into Euro and paid to you in cash together with your Show-Up Fee of 3.00 Euro.

Please raise your hand if you have questions.

Rights and permissions

About this article

Cite this article

Kirchkamp, O., Reiß, J.P. Heterogeneous bids in auctions with rational and boundedly rational bidders: theory and experiment. Int J Game Theory 48, 1001–1031 (2019). https://doi.org/10.1007/s00182-019-00678-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-019-00678-0