Abstract

We study the bilateral trading problem under private information. We characterize the range of possible mechanisms which satisfy ex-post efficiency, incentive compatibility, individual rationality, and budget balance. In particular, we show that the famous Myerson–Satterthwaite impossibility result no longer holds when contingent contracts are allowed.

Similar content being viewed by others

Notes

See Skrzypacz (2013) for a more detailed discussion.

There have been efforts to explain the popularity of linear contracts. See the discussion section of Carroll (2015) for an excellent literature review.

Contingent payments are also referred to as securities or security bids.

There have been other notable attempts. Saran (2011) showed that ex-post efficiency is possible if the proportion of naive traders is greater than a lower bound (which is less than 50%). Garratt and Pycia (2016) showed that ex-post efficiency is generically possible when utilities are not quasi-linear and not too responsive to private information.

By the revelation principle, it is with no loss of generality to restrict our attention to direct mechanisms.

We may consider more general value functions \(\pi _i(t_i)\) instead of \(t_i\) for \(i=1,2\). But, by defining \(t'_i = \pi (t_i)\) and changing the distributions appropriately, we return to the original formulation.

Observe that the seller’s payoff is non-positive, i.e., \(-t_1 \le 0\), when \(p(t_1, t_2)=1\), \(\alpha (t_1, t_2)=0\), and \(x(t_1, t_2)=0\). The bilateral trading is an environment with positive externality and consequently budget balance problem is nontrivial. This is in contrast with the auction problems.

We use the terms decreasing/increasing in the weak sense.

Recall that \(\alpha (t_1,t_2) \in [0,1]\), so the integrand is always non-negative.

This derivation is similar to the one in Myerson and Satterthwaite (1983).

Recall that \({\hat{q}}^0_2(t_2)\) is increasing when \(\alpha (t_1, t_2)\) is a constant function.

I thank an anonymous referee for providing this intuition.

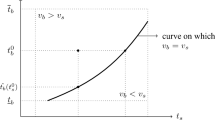

The buyer’s expected information rent is decreasing in the royalty rate and equals zero if and only if the royalty rate is equal to one. When \({\overline{t}}_1 < {\overline{t}}_2\), we have \(\int _{{\overline{t}}_{1}}^{{\overline{t}}_{2}} \bigl (1-F_2(t_2)\bigr ) dt_2 >0\) and the designer can cover the buyer’s expected information rent by imposing a sufficiently high royalty rate.

In the appendix, we consider the case when contingent payments depend on the value of the asset to the seller as well as to the buyer and show that ex-post efficiency is possible with royalty rates other than one even when \({\overline{t}}_2 \le {\overline{t}}_1\).

Kalai and Kalai (2013) present a general theory of cooperation in strategic form games and characterize the cooperative-competitive value, or coco value for short. We observe that the resulting outcome when \(\alpha (t_1,t_2)=\beta (t_1,t_2)=1/2\) corresponds to the coco value.

See section 4 of DeMarzo et al. (2005) for a related discussion.

We did not explicitly model buyer’s costs of investment in this paper, but it is a trivial matter to incorporate this feature.

Suppose the buyer can either take an unobservable action to invest or not. If the costs of investment cannot be fully reimbursed by the seller due to moral hazard, then she would not invest when \(\alpha =1\) or close. We do not believe that a full-blown model of moral hazard would require a deeper insight beyond this simple observation.

Note that \(1-F(x)=0\) for \(x \ge {\overline{t}}_2\) and \(F_1(x)=0\) for \(x \le {\underline{t}}_1\). Hence, these terms are non-negative even when \({\overline{t}}_2 < {\overline{t}}_1\) and \({\underline{t}}_2 < {\underline{t}}_1\).

References

Bhattacharyya S, Lafontaine F (1995) Double-sided moral hazard and the nature of share contracts. Rand J Econ 26:761–781

Carroll G (2015) Robustness and linear contracts. Am Econ Rev 105:536–563

Che Y-K, Kim J (2010) Bidding with securities: comment. Am Econ Rev 100:1929–1935

Cramton P, Gibbons R, Klemperer P (1987) Dissolving a partnership efficiently. Econometrica 55:615–632

Crémer J (1987) Auctions with contingent payments: comment. Am Econ Rev 77:746

DeMarzo PM, Kremer I, Skrzypacz A (2005) Bidding with securities: auctions and security design. Am Econ Rev 95:936–959

Ekmekci M, Kos N, Vohra R (2016) Just enough or all: selling a firm. Am Econ J Microecon 8:223–256

Garratt R, Pycia M (2016) Efficient bilateral trade (manuscript)

Hansen RG (1985) Auctions with contingent payments. Am Econ Rev 75:862–865

Kalai A, Kalai E (2013) Cooperation in strategic games revisited. Q J Econ 128:917–966

McAfee RP, Reny P (1992) Correlated information and mechanism design. Econometrica 60:395–421

Myerson R, Satterthwaite M (1983) Efficient mechanisms for bilateral trading. J Econ Theory 29:265–281

Riley J (1988) Ex post information in auctions. Rev Econ Stud 55:409–429

Saran R (2011) Bilateral trading with naive traders. Games Econ Behav 72:544–557

Saumelson W (1987) Auctions with contingent payments: comment. Am Econ Rev 77:740–745

Schmalensee R (1989) Good regulatory regimes. Rand J Econ 20:417–436

Segal I, Whinston M (2011) A simple status quo that ensures participation (with application to efficient bargaining). Theor Econ 6:109–125

Skrzypacz A (2013) Auctions with contingent payments—an overview. Int J Ind Organ 31:666–675

Acknowledgements

I thank the referees and an associate editor for invaluable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

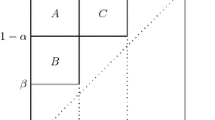

In this appendix, we consider contingent payments that depend on the value of the asset to the seller as well as to the buyer. Thus, the seller’s payoff is \(p(t_1, t_2) \bigl ( \alpha (t_1,t_2)t_2-(1-\beta (t_1,t_2))t_1 \bigr ) + x(t_1, t_2)\) and the buyer’s payoff is \(p(t_1, t_2) \bigl ( (1-\alpha (t_1, t_2))t_2 - \beta (t_1, t_2) t_1 \bigr ) - x(t_1, t_2)\), where \(\alpha (t_1, t_2)\) is the royalty rate and \(\beta (t_1, t_2)\) is the cost-sharing rate.

We defined \(y_1(s_1)\), \(y_2(s_2)\), \(q_1(s_1)\) and \(q_2(s_2)\) in the text. In addition, define

If the seller believes that the buyer will report truthfully, and he reports \(s_1\) when his true type is \(t_1\), then his expected payoff is

Likewise, if the buyer believes that the seller will report truthfully, and she reports \(s_2\) when her true type is \(t_2\), then her expected payoff is

Define, as in the text, \(U_i(t_i) {\mathop {=}\limits ^{\mathrm{def}}}U_i(t_i,t_i)\) for \(i=1,2\) as well as (IC) and (IR) conditions. We can establish the following propositions.

Proposition A1

The mechanism \((p,\alpha , \beta , x)\) is incentive compatible if and only if

-

(i)

\({\hat{q}}_1(t_1)\) is decreasing,

-

(ii)

\({\hat{q}}_2(t_2)\) is increasing,

-

(iii)

\(U_1(t_1)=U_1({\overline{t}}_1)+\int _{t_{1}}^{{\overline{t}}_{1}} {\hat{q}}_1(\tau ) d\tau \),

-

(iv)

\(U_2(t_2)=U_2({\underline{t}}_2)+ \int _{{\underline{t}}_{2}}^{t_{2}} {\hat{q}}_2(\tau ) d\tau \).

Proposition A2

Given any probability of trade \(p: T \rightarrow [0,1]\), royalty rate \(\alpha : T \rightarrow [0,1]\) and cost-sharing rate \(\beta : T \rightarrow [0,1]\), we can find a cash payment \(x: T \rightarrow {\mathbb {R}}\) such that \((p,\alpha ,\beta ,x)\) is incentive compatible as long as \({\hat{q}}_1(t_1)\) is decreasing and \({\hat{q}}_2(t_2)\) is increasing.

Proposition A3

An incentive compatible mechanism \((p,\alpha ,\beta ,x)\) is individually rational if and only if

With the probability of trade \(p^0(t_1,t_2)\) defined in the text, we have

A sufficient condition for \({\hat{q}}^0_1(t_1)\) to be decreasing and \({\hat{q}}^0_2(t_2)\) to be increasing is:

That is, the royalty rate is decreasing in player 2’s type and the cost-sharing rate is increasing in player 1’s type. In particular, this condition is satisfied when both \(\alpha (t_1, t_2)\) and \(\beta (t_1, t_2)\) are constant functions, i.e., \(\alpha (t_1, t_2) = \alpha \) and \(\beta (t_1, t_2)=\beta \) for all \((t_1, t_2) \in T\). Let us choose any royalty rate \(\alpha : T \rightarrow [0,1]\) and cost-sharing rate \(\beta : T \rightarrow [0,1]\) that make \({\hat{q}}^0_1(t_1)\) decreasing in \(t_1\) and \({\hat{q}}^0_2(t_2)\) increasing in \(t_2\). Then, there exists an incentive compatible mechanism \((p^0, \alpha , \beta , x)\) by Proposition A2.

Define

Then,

Assume that \(\alpha (t_1, t_2)=\alpha (t_2)\) and \(\beta (t_1, t_2)=\beta (t_1)\). Then, \(\Delta \) becomes

Since the last two terms are non-negative, \(\Delta \) is positive as long as \(\alpha (x)+\beta (x)\ge 1\).Footnote 19

Rights and permissions

About this article

Cite this article

Yoon, K. Bilateral trading with contingent contracts. Int J Game Theory 49, 445–461 (2020). https://doi.org/10.1007/s00182-019-00699-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-019-00699-9