Abstract

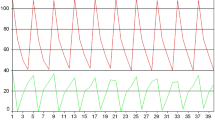

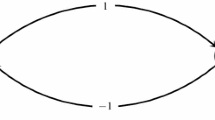

We present a discrete model of two-person constant-sum dynamic strategic market game. We show that for every value of discount factor the game with discounted rewards possesses a pure stationary strategy equilibrium. Optimal strategies have some useful properties, such as Lipschitz property and symmetry. We also show value of the game to be nondecreasing both in state and discount factor. Further, for some values of discount factor, exact form of optimal strategies is found. For β less than \({2-\sqrt{2}}\), there is an equilibrium such that players make large bids. For β close to 1, there is an equilibrium with small bids. Similar result is obtained for the long run average reward game.

Similar content being viewed by others

References

Blackwell D (1962). Discrete dynamic programming. Ann Math Stat 33: 719–726

Filar J and Vrieze K (1997). Competitive Markov decision processes. Springer, New York

Karatzas I, Shubik M and Sudderth WD (1992). Construction of stationary Markov equilibria in a strategic market game. Math Oper Res 19(4): 975–1006

Karatzas I, Shubik M and Sudderth WD (1997). A strategic market game with secured lending. J Math Econ 28: 207–247

Secchi P, Sudderth WD (1996) How to bid for a pizza. Quaderni di Dipartamento 42(5-96). Dipartamento di Economia Politica e Metodi Quantitivi, Università di Pavia

Secchi P, Sudderth WD (1998) A two-person strategic market game. Quaderni di Dipartamento 83(6-98). Dipartamento di Economia Politica e Metodi Quantitivi, Università di Pavia

Secchi P and Sudderth WD (2005). A simple two-person stochastic game with money. In: Nowak, AS and Szajowski, K (eds) Advances in dynamic games. Applications to economics, finance, optimization and stochastic control. Annals of the international society of dynamic games, vol 7, pp 39–66. Birkhäuser, Boston

Shapley LS (1953). Stochastic games. Proc Natl Acad Sci 39: 1095–1100

Shubik M and Whitt W (1973). Fiat money in an economy with one nondurable good and no credit. A noncooperative sequential game. In: Blaquiere, A (eds) Topics in differential games, pp 401–449. North-Holland, Amsterdam

Zygmund A (1968). Trigonometric series. Cambridge University Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Więcek, P. Pure equilibria in a simple dynamic model of strategic market game. Math Meth Oper Res 69, 59–79 (2009). https://doi.org/10.1007/s00186-008-0210-4

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-008-0210-4