Abstract

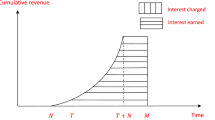

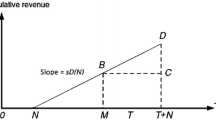

This study models a finite horizon inventory problem for deteriorating and fashion goods under trade credit and partial backlogging conditions. Demand may vary with price or time. The supplier can extend credit to the retailer. As a result, the retailer does not have to pay for goods immediately upon acquiring them, and can instead earn interest on the retail price of the goods between the time they are sold and the end of the credit period. The proposed model considers two-phase pricing and inventory decisions. In other words, it determines both the optimal prices and the lengths of the in-stock and stock-out period. This paper is the first to consider different price decisions for in-stock and stock-out periods under trade credit. We develop an algorithm to determine the optimal pricing and replenishment strategy while still maximizing the total profit. Further, this study shows that the proposed two-phase pricing strategy is superior to a one-phase pricing strategy in terms of profit maximization. Computational analysis illustrates the solution procedures and the impacts of the related parameters on decisions and profits. The results of this study can serve as references for business managers or administrators.

Similar content being viewed by others

References

Abad PL (1996) Optimal pricing and lot-sizing under conditions of perishability and partial backordering. Manage Sci 42: 1093–1104

Abad PL, Jaggi CK (2003) A joint approach for setting unit price and the length of the credit period for a seller when end demand is price sensitive. Int J Prod Econ 83: 115–122

Aggarwal SP, Jaggi CK (1995) Ordering policies of deteriorating items under permissible delay in payments. J Oper Res Soc 46: 658–662

Chang HJ, Dye CY (2001) An inventory model for deteriorating items with partial backlogging and permissible delay in payments. Int J Syst Sci 32: 345–352

Chang HJ, Hung CH, Dye CY (2001) An inventory model for deteriorating items with linear demand under condition of permissible delay in payments. Prod Plann Control 12: 274–282

Chang HJ, Hung CH, Dye CY (2002) A finite time horizon inventory model with deterioration and time-value of money under the conditions of permissible delay in payments. Int J Syst Sci 33: 141–151

Chang CT, Ouyang LY, Teng JT (2003) An EOQ model for deteriorating items under supplier credits linked to ordering quantity. Appl Math Model 27: 983–996

Chen JM, Chen TH (2005) The profit-maximization model for a multi-item distribution channel. Transp Res Part E: Logist Transp Rev 2007 43: 338–354

Chung KJ, Chang SL, Yang WD (2001) The optimal cycle time for exponentially deteriorating products under trade credit financing. Eng Econ 46: 232–242

Chung KJ, Liao JJ (2004) Lot-sizing decisions under trade credit depending on the ordering quantity. Comput Oper Res 31: 909–928

Chung KJ, Goyal SK, Huang YF (2005) The optimal inventory policies under permissible delay in payments depending on ordering quantity. Int J Prod Econ 95: 203–213

Chung KJ, Huang TS (2006) The optimal cycle time for deteriorating items with limited storage capacity under permissible delay in payments. Asia-Pacific J Oper Res 23: 347–370

Goyal SK (1985) Economics order quantity under conditions of permissible delay in payments. J Oper Res Soc 36: 335–338

Hwang H, Shinn SW (1997) Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the condition of permissible delay in payment. Comput Oper Res 24: 539–547

Jamal AMM, Sarker BR, Wang S (1997) An ordering policy for deteriorating items with allowable shortage and permissible delay in payment. J Oper Res Soc 48: 826–833

Kim J, Hwang H, Shinn S (1995) An optimal credit policy to increase supplier’s profits with price-dependent demand functions. Prod Plan Control 6(1): 45–50

Ouyang LY, Teng JT, Chen LH (2006) Optimal ordering policy for deteriorating items with partial backlogging under permissible delay in payments. J Glob Optim 34: 245–271

Ouyang LY, Teng JT, Goyal SK, Yang CT (2009) An economic order quantity model for deteriorating items with partially permissible delay in payments linked to order quantity. Eur J Oper Res 194: 418–431

Rajan A, Rakesh, Streinberg R (1992) Dynamic pricing and ordering decisions by a monopolist. Manage Sci 38: 240–262

Sheen GJ, Tsao YC (2007) Channel coordination, trade credit and quantity discounts for freight cost. Transp Res Part E: Logist Transp Rev 43: 112–128

Shinn SW (1997) Determining optimal retail price and lot size under day-terms supplier credit. Comput Ind Eng 33: 717–720

Shinn SW, Hwang H (2003) Optimal pricing and ordering policies for retailers under order size-dependent delay in payments. Comput Oper Res 30: 35–50

Teng JT, Chang CT, Goyal SK (2005) Optimal pricing and ordering under permissible delay in payments. Int J Prod Econ 97: 121–129

Tsao YC, Sheen GJ (2007) Joint pricing and replenishment decisions for deteriorating items with lot-size and time dependent purchasing cost under credit period. Int J Syst Sci 38: 549–561

Tsao YC, Sheen GJ (2008) Dynamic pricing, promotion and replenishment policies for a deteriorating item under permissible delay in payments. Comput Oper Res 35: 3562–3580

Wee HM (1995) Joint pricing and replenishment policy for deteriorating inventory with declining market. Int J Prod Econ 40: 163–171

Wee HM, Yang PC, Shih CC (2002) An inventory model with deteriorating items under permissible delay in payments. J Chin Inst Ind Eng 19(6): 116–128

Winston WL (2004) Opertions research applications and algorithms. Thomson/Brooks/Cole, Belmont, CA

Yang PC, Wee HM (2006) A collaborative inventory system with permissible delay in payments deteriorating items. Math Comput Model 43: 209–221

Yang PC, Wee HM, Yu Jonas CP (2007) Collaborative pricing and replenishment policy for Hi-tech industry Journal of the policy for Hi-tech industry. J Oper Res Soc 58: 894–900

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tsao, YC. Two-phase pricing and inventory management for deteriorating and fashion goods under trade credit. Math Meth Oper Res 72, 107–127 (2010). https://doi.org/10.1007/s00186-010-0309-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-010-0309-2