Abstract

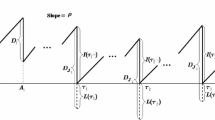

We consider a supplier selling a product with a relatively short life cycle and following a non-increasing price curve. Because of the short cycle, there is a single procurement opportunity at the beginning of the cycle. The objective of the supplier is to determine the initial order quantity and the time to remove the product from the market in order to maximize her profits. We study this problem in a continuous-time framework where the demand is modeled with a non-homogeneous Poisson process having a general intensity function and the pricing strategy is given by an arbitrary non-increasing function. We give a rigorous mathematical analysis for the problem and show how it can be solved in two stages. We also consider the special case with piecewise constant intensity and price functions. For this case, we show that the optimal exit time is included in the set of break points of these functions. This brings a fast method to obtain the optimal solution for this special case.

Similar content being viewed by others

References

Aviv Y, Pazgal A (2008) Optimal pricing of seasonal products in the presence of forward-looking consumers. Manuf Serv Oper Manag 10(3):339–359

Axsäter S (2015) Inventory Control. International series in operations research and management science, 3rd edn. Springer, Berlin

Aytac B, Wu SD (2011) Modelling high-tech product life cycles with short-term demand information: a case study. J Oper Res Soc 62(3):425–432

Bensoussan A (2011) Dynamic programming and inventory control. Studies in probability, optimization and statistics, vol 3. IOS Press, Amsterdam

Bitran GR, Caldentey R (2003) An overview of pricing models for revenue management. Manuf Serv Oper Manag 5:203–229

Caro F, Gallien J (2010) Inventory management of a fast-fashion retail network. Oper Res 58(2):257–273

Çınlar E (2011) Probability and Stochastics. Springer, Berlin

Dasu S, Tong C (2010) Dynamic pricing when consumers are strategic: analysis of posted and contingent pricing schemes. Eur J Oper Res 204(3):662–671

Elmaghraby W, Keskinocak P (2003) Dynamic pricing in the presence of inventory considerations: research overview, current practices, and future directions. Manag Sci 49:1287–1309

Elmaghraby W, Gülcü A, Keskinocak P (2008) Designing optimal preannounced markdowns in the presence of rational customers with multiunit demands. Manuf Serv Oper Manag 10(1):126–148

Feng Y, Gallego G (2000) Perishable asset revenue management with Markovian time dependent demand intensities. Manag Sci 46(7):941–956

Fortuin L (1980) The all-time requirement of spare parts for service after sales—theoretical analysis and practical results. Int J Oper Prod Manag 1(1):59–70

Fortuin L (1981) Reduction of all-time requirements for spare parts. Int J Oper Prod Manag 2(1):29–37

Frenk JBG, Javadi S, Pourakbar M, Sezer SO (2019) An exact static solution approach for the service parts end-of-life inventory problem. Eur J Oper Res 272(2):496–504

Ghemawat P, Nueno JL (2003) Zara: fast fashion. HBS case 9-703-497. Harvard Business School, Boston

Hong JS, Koo HY, Lee CS, Ahn J (2009) Forecasting service parts demand for a discontinued product. IIE Trans 40(7):640–649

Kleinrock L (1975) Queueing systems, volume 1: theory. Wiley, New York

Levin Y, McGill J, Nediak M (2010) Optimal dynamic pricing of perishable items by a monopolist facing strategic consumers. Prod Oper Manag 19(1):40–60

Moore JR (1971) Forecasting and scheduling for past-model replacement parts. Manag Sci 18:B200–B213

Nagle T, Hogan J (2002) The strategy and tactics of pricing: a guide to growing more profitably, 3rd edn. Prentice Hall, New York

Noble PM, Gruca TS (1999) Industrial pricing: theory and managerial practice. Mark Sci 18(3):435–454

Parlar M, Weng ZK (1997) Designing a firm’s coordinated manufacturing and supply decisions with short product life cycles. Manag Sci 43(10):1329–1344

Porteus EL (2002) Foundations of stochastic inventory theory. Stanford Business Books, Redwood City

Pourakbar M, Frenk JBG, Dekker R (2012) End-of-life inventory decisions for consumer electronics service parts. Prod Oper Manag 21(5):889–906

Pourakbar M, van der Laan E, Dekker R (2014) End-of-life inventory problem with phaseout returns. Prod Oper Manag 23(9):1561–1576

Ritchie E, Wilcox P (1977) Renewal theory forecasting for stock control. Eur J Oper Res 1(2):90–93

Stoyan D (1983) Comparison methods for queues and other stochastic models. Wiley, New York

Talluri KT, van Ryzin GJ (2005) The theory and practice of revenue management. International series in operations research and management science. Springer, New York

Tellis GJ (1986) Beyond the many faces of price: an integration of pricing strategies. J Mark 50(4):146–160

Teunter RH, Fortuin L (1999) End-of-life service. Int J Prod Econ 59:487–497

Tijms HC (1995) Stochastic models: an algortihmic approach. Wiley, New York

Toptal A, Çetinkaya S (2015) The impact of price skimming on supply and exit decisions. Appl Stoch Models Bus Ind 31:551–574

van Kooten JPJ, Tan T (2009) The final order problem for repairable spare parts under condemnation. J Oper Res Soc 60(10):1449–1461

Wu SD, Aytac B, Berger RT, Armbruster CA (2006) Managing short life-cycle technology products for agere systems. Interfaces 36(3):234–247

Zipkin P (2000) Foundations of inventory management. McGraw-Hill/Irwin, New York

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Approximating the intensity and price functions

In this section, we give a proof of Lemma 10. In this proof we show how one can control the error associated with approximating the true intensity and price functions by piecewise constant functions selected according to (37). For this optimization problem we have shown after Lemma 14 that one can reduce the search for the optimal \(\tau \) to a finite predetermined set. Below, we introduce some notation and give auxiliary results to pave the way for the proof of Lemma 10. To start, we first derive the following easy inequalities.

Let for any \(a\in {\mathbb {N}}\) and \(a_{*}\in {\mathbb {N}}\) the functions \(\lambda _a\) and \(p_{a_{*}}\) denote these approximating functions as given in (36–38) with the error

The integers a and \(a_{*}\) can be the same or different.

If we define \(\Lambda _a (t) := \int _0^t \lambda _a (s) \, ds \), then it is easy to see that

Also, by the triangular inequality, \(p_{a_{*}}\le p\), and p being a non-increasing function, it follows that

where \({\overline{\lambda }} := \Vert \lambda \Vert = \sup _{t \le {\overline{\tau }}} \lambda (t) < \infty \,\) (recall that \(\lambda \) is assumed to be locally bounded and we have \(\lim _{t \rightarrow \infty } \lambda (t) = 0\)). Note, by using a different intensity function we implicitly consider a separate Poisson process \(N_a\). Let \(\sigma _{i,a}\) be the ith arrival moment of this new process \(N_a\). Using this notation, one can show the following auxiliary result.

Corollary 18

For \(t \ge 0\) and \(i \ge 1\), the absolute difference of the tail probabilities of \(\sigma _{i}\) and \(\sigma _{i,a}\) is bounded as

Proof

Using a time transformation argument, the ith arrival time of the nonhomogeneous Poisson process N can be represented as \(\sigma _i = \Lambda ^{\leftarrow } (S_i)\) with \(S_i\) denoting the ith arrival time of a homogeneous Poisson process with unit arrival rate. This shows

By a similar argument we obtain

This yeilds using \(\Lambda _a ( t )\le \Lambda (t)\) for every \(t\ge 0\)

Applying now (66) and \(e^{-u}\le 1\) for every \(u\ge 0\), we obtain

and this shows the desired result. \(\square \)

In the next corollary, we give an upperbound on the absolute difference between the revenues obtained when we use the product of the approximating price and arrival intensity functions, and the one obtained with the product of the original price and arrival intensity function.

Corollary 19

Introducing

the absolute difference in revenues (see (4)) is bounded as

Proof

We write the absolute difference in (69) as

By the triangle inequality it follows using (67) and (68) that

This implies by relation (70) that

and we have shown (69). \(\square \)

An easy consequence of Corollary 19 (take \(p(t) = p_{a_{*}} (t) = 1\) for all \(t \ge 0\) and hence \(a_{*}=\infty \)) is

Finally we give in the next corollary an upperbound on the absolute difference in expected inventory costs under arrival processes N and \(N_a\).

Corollary 20

The absolute difference of inventory holding costs (see (6)) under N and \(N_a\) is bounded as

Proof

In order to use our bounds on the difference of tail probabilities in Corollary 18 we rewrite this difference in terms of the arrival times as

Observe that \( \sigma _{i} \wedge \tau = \int _0^\tau 1_{ \{ s < \sigma _{i} \} } \, ds \), and so by Fubini’s Theorem, \({\mathbb {E}}\, (\sigma _{i} \wedge \tau ) = \int _0^\tau {\mathbb {P}}(s < \sigma _{i}) \, ds.\) Similarly, we also have \({\mathbb {E}}(\, \sigma _{i,a} \wedge \tau ) = \int _0^\tau {\mathbb {P}}( s < \sigma _{i,a} ) \, ds\). This yields

Applying Corollary 18 to the difference of probabilities for a given i above we obtain

Finally using this upperbound for every \(1\le i\le x\) in (73) yields

and this shows the desired inequality. \(\square \)

We can now give the proof of Lemma 10.

Proof of Lemma 10

Decomposing the cost and revenue components in (7), and writing the difference between the true model and that of the approximation we obtain by (71) and Corollary 19 and 20

This establishes the desired result. \(\square \)

Appendix B: Discretization of \(\tau \)-space when \(\Lambda (\infty ) = \infty \)

Here, we show how one can construct the finite discretization set \({\mathcal {D}}_\varepsilon \) on the \(\tau \)-space for Stage II of the optimization procedure when \(\Lambda (\infty ) = \infty \); see the construction in (32) in Sect. 4. Note that when \(\Lambda (\infty ) = \infty \),

In particular, we have an easy upper bound thanks to Markov inequality \({\mathbb {P}}[ \Lambda (\sigma _i) > \Lambda (\tau ) ] \le \frac{1}{\Lambda (\tau )} {\mathbb {E}}\Lambda (\sigma _i) = \frac{i}{\Lambda (\tau )}\). Alternatively, it also follows directly

Lemma 21

For \(x \le {\overline{x}}\) any \(\tau \le p^{\leftarrow }(\upsilon ) \le \infty \) we have

Proof

To show the above inequality it follows using the explicit form of \(\Psi (x,\tau )\) in (7)

where the last identity follows from an application of Doob’s stopping theorem. Since p is non-increasing, we obtain

and this shows the result. \(\square \)

An immediate corollary of Lemma 21 is the following result.

Corollary 22

We know by Lemma 4 that \({\overline{x}}\) in (13) is an upper bound for the optimal order quantity. This shows \(x_Q(p^{\leftarrow }(\upsilon )) \le {\overline{x}}\) (see also (16)), and since \(x_Q(p^{\leftarrow }(\upsilon ))\) is also feasible for (\(Q_{\tau }\)) with any \(\tau \le p^{\leftarrow }(\upsilon )\), we obtain due to (74) that

Therefore in problem (Q), we can set the right end point

which is the smallest \(\tau \) value for which the error terms in (75) are less than the given \(\varepsilon > 0\). Then, we fill in the sets \({\mathcal {D}}_{\varepsilon }\) again starting from \(\tau _{0} = 0\) and iterating relation (32) once again until this right end point is reached.

Appendix C: Supplementary proofs

Proof of Lemma 2

Since \(t \mapsto p(t) - \upsilon \) is non-increasing it follows using the definition of the objective function \(\Psi \) in (7), for \(\tau \le \Lambda ^{\leftarrow } (\alpha x)\) that

and that concludes the proof. \(\square \)

Proof of Lemma 3

To show \(\Psi (x, \tau ) \le 0\) we observe using Jensen’s inequality that

Using the lower bound in (76) and \({\mathbb {E}}\int _{0}^{\sigma _{x}}dN(t)=x\), we obtain for \(\Lambda ^{\leftarrow }(\alpha x)\) finite and \(\tau \ge \Lambda ^{\leftarrow }(\alpha x)\) that

Since \(x\ge {\overline{x}}:=\left\lceil \frac{1}{\alpha }\Lambda \left( \frac{p(0)-\upsilon }{h}\right) \right\rceil \) and \(\alpha :=\frac{c-\upsilon }{p(0)-\upsilon }\) it follows

and substituting this in (77) gives a non-positive upper bound. For \(\Lambda ^{\leftarrow }(\alpha x)\) infinite and hence \(\Lambda (t)\le \alpha x\) we obtain \(\int _{0}^{\tau }(x-\Lambda (t))dt\ge \tau (1-\alpha )x\), and this shows \(\Psi (x,\tau )\le (p(0)-c)x-\tau (1-\alpha )x.\) Hence for \(\tau =\infty =\Lambda ^{\leftarrow }(\alpha x)\) and \(x\ge {\overline{x}}\) we again obtain \(\Psi (x,\infty )=-\infty \le 0\). \(\square \)

Proof of Lemma 16

It follows for every \(i=1,\ldots ,n\) that

By relation (23) we observe \(f_{\sigma _{k+2}}(t)-f_{\sigma _{k+1}} (t)=-f_{k+1}^{^{\prime }}(t)\) with \(f_{k+1}^{^{\prime }}(t)\) the derivative of the function \(f_{k+1}:{\mathbb {R}}_{+}\rightarrow {\mathbb {R}}_{+}\) given by

and so we obtain using \(N(a_{1})=0\) and (78)

Hence we have verified relation (58). \(\square \)

Rights and permissions

About this article

Cite this article

Frenk, J.B.G., Pehlivan, C. & Sezer, S.O. Order and exit decisions under non-increasing price curves for products with short life cycles. Math Meth Oper Res 90, 365–397 (2019). https://doi.org/10.1007/s00186-019-00682-w

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-019-00682-w