Budget constraint

Let \(w=((c_t)_{t=0}^{\infty }, (g_t)_{t=0}^{\infty },(\pi _t)_{t=0}^{\infty },\tau )\) be an admissible policy, and let \(\xi _T\) be a process defined by

$$\begin{aligned} \xi _T:= \int _0^T H_t(c_t+g_t)\, dt + H_T X^w_T. \end{aligned}$$

Suppose first that the agent has already retired, i.e., \(\tau \le 0\). By Itô’s formula, \(\xi _T\) is a local martingale. By (2.5),

$$\begin{aligned} H_T X^w_T\ge 0, \end{aligned}$$

(1.28)

and hence, \(\xi _T\) is a super-martingale. Therefore,

$$\begin{aligned} x= \xi _0\ge {\mathbb {E}}\, [\xi _T] = {\mathbb {E}}\, \left[ \int _0^T H_t (c_t+g_t)\, dt + H_T X^w_T\right] . \end{aligned}$$

(1.29)

By (1.28) and Fatou’s lemma, we have

$$\begin{aligned} \lim _{T\rightarrow \infty } {\mathbb {E}} [H_TX_T^w]\ge 0. \end{aligned}$$

(1.30)

By taking a limit in (1.29), and using (1.30) and the monotone convergence theorem, we obtain

$$\begin{aligned} x\ge {\mathbb {E}}\left[ \int _0^\infty H_t (c_t+g_t)\, dt\right] . \end{aligned}$$

Suppose that \(\xi _T\) is a martingale and \(\displaystyle \lim _{T\rightarrow \infty } {\mathbb {E}} [H_TX_T^w]=0\). Then, the budget constraint is satisfied with an equality:

$$\begin{aligned} x= {\mathbb {E}}\left[ \int _0^\infty H_t (c_t+g_t)\, dt\right] . \end{aligned}$$

We now consider the pre-retirement case, i.e., \(\tau >0\). Let \({\widetilde{\xi }}_T\) be a process defined by

$$\begin{aligned} {\widetilde{\xi }}_T:=\int _0^{T\wedge \tau } H_t (c_t+g_t)\, dt + H_{T\wedge \tau } \left( X^w_{T\wedge \tau }+ \frac{Y_{T\wedge \tau }}{r-\delta }\right) . \end{aligned}$$

By Itô’s formula, \({\widetilde{\xi }}_T\) is a local martingale. By (2.5),

$$\begin{aligned} H_T \left( X^w_T+\frac{Y_T}{r-\delta }\right) \ge \frac{\varGamma }{r} H_T \ge 0, \end{aligned}$$

and hence, \({\widetilde{\xi }}_T\) is a super-martingale. Therefore,

$$\begin{aligned} x+\frac{Y}{r-\delta } = {\widetilde{\xi }}_0\ge {\mathbb {E}} \left[ {\widetilde{\xi }}_T\right] = {\mathbb {E}} \left[ \int _0^{T\wedge \tau } H_t (c_t+g_t)\, dt + H_{T\wedge \tau } \left( X^w_{T\wedge \tau }+\frac{Y_{T\wedge \tau }}{r-\delta }\right) \right] .\nonumber \\ \end{aligned}$$

(1.31)

By Fatou’s lemma, we have

$$\begin{aligned} \liminf _{T\rightarrow \infty } {\mathbb {E}} \left[ H_{T\wedge \tau } \left( X^w_{T\wedge \tau }+\frac{Y_{T\wedge \tau }}{r-\delta }\right) \right] \ge {\mathbb {E}}\left[ H_\tau \left( X^w_\tau +\frac{Y_\tau }{r-\delta }\right) \right] . \end{aligned}$$

(1.32)

By taking a limit in (1.31), and using (1.32) and the monotone convergence theorem, we obtain budget constraint (3.18):

$$\begin{aligned} x+\frac{Y}{r-\delta }\ge {\mathbb {E}} \left[ \int _0^{\tau } H_t (c_t+g_t)\, dt + H_\tau \left( X^w_\tau +\frac{Y_\tau }{r-\delta }\right) \right] . \end{aligned}$$

Proof of lemma 5

The dual utility \({\widetilde{u}}_1(y)\) is given as follows:

$$\begin{aligned} {\widetilde{u}}_1(y)=\max _{c\ge \varGamma }\left\{ u(c)-\frac{1}{\alpha _1}yc\right\} =c^*-R(c^*)^2-\frac{1}{\alpha _1}yc^*, \end{aligned}$$

where \(c^*\) satisfies the equation \(1-2Rc^*=\frac{1}{\alpha _1}y.\) Since \(c^*\ge \varGamma \), the optimal consumption rate of the necessary good is

$$\begin{aligned} c_t^*=\left\{ \begin{array}{ll} \frac{1-\frac{1}{\alpha _1}y_t}{2R}, &{} \text{ if } 0<y_t\le \alpha _1(1-2R{\varGamma }),\\ {\varGamma }, &{} \text{ if } y_t> \alpha _1(1-2R{\varGamma }). \end{array}\right. \end{aligned}$$

Similarly, we obtain the optimal consumption rate of the luxury good.

Proof of proposition 9

From ODE (3.13), we can obtain a general solution \(\phi \) as follows:

$$\begin{aligned} \phi (y_t)=\left\{ \begin{array}{ll} a_1y_t^{m_+}+a_2 y_t^{m_-}+\frac{\gamma }{1-\gamma }\left( \frac{1}{\alpha _2}\right) ^{-\frac{1}{\gamma }}\frac{1}{K}y_t^{-\frac{1-\gamma }{\gamma }}&{}\\ \qquad \qquad -\frac{1}{4\alpha _1R(\rho -2r+\theta ^2)}y_t^2+\frac{2LR-1}{2rR}y_t+\frac{\alpha _1}{4\rho R}, &{} \text{ if } 0<y_t\le \alpha _2L^{-\gamma },\\ b_1y_t^{m_+}+b_2y_t^{m_-}-\frac{1}{4\alpha _1R(\rho -2r+\theta ^2)}y_t^2&{}\\ \qquad \qquad -\frac{1}{2rR}y_t+\frac{\alpha _1}{4\rho R}+\frac{\alpha _2L^{1-\gamma }}{\rho (1-\gamma )}, &{} \text{ if } \alpha _2L^{-\gamma }<y_t\le \alpha _1(1-2R\varGamma ),\\ c_1 y_t^{m_+}+c_2 y_t^{m_-}-\frac{\varGamma }{r}y_t+\frac{1}{\rho }&{}\\ \qquad \qquad \left\{ \alpha _1(\varGamma -R\varGamma ^2)+\frac{\alpha _2L^{1-\gamma }}{1-\gamma }\right\} , &{} \text{ if } y_t> \alpha _1(1-2R\varGamma ), \end{array}\right. \end{aligned}$$

(3.33)

where \(m_+\) and \(m_-\) are two real roots of the quadratic equation (3.15). By the transversality condition in (3.11) constants \(a_2\) and \(c_1\) should be zero. By using the smooth-pasting condition at \(y=\alpha _2 L^{-\gamma }\) and \(y=\alpha _1(1-2R\varGamma )\), we determine the coefficients as follows:

$$\begin{aligned} b_1&=\frac{\alpha _1^{1-m_+}(1-2R\varGamma )^{2-m_+}}{2R(m_+-m_-)}\left\{ \frac{2-m_-}{2(\rho -2r+\theta ^2)}+\frac{1-m_-}{r}+\frac{m_-}{2\rho }\right\} ,\\ b_2&=\frac{\alpha _2^{1-m_-} L^{1-\gamma +\gamma m_-}}{m_+ -m_-}\left\{ \left( \frac{\gamma m_+}{1-\gamma }+1\right) \frac{1}{K}+\frac{m_+-1}{r}-\frac{m_+}{\rho (1-\gamma )}\right\} ,\\ a_1&=b_1+\frac{\alpha _2^{1-m_+}L^{1-\gamma +\gamma m_+}}{m_+-m_-}\left\{ \left( \frac{\gamma m_-}{1-\gamma }+1\right) \frac{1}{K}+\frac{m_--1}{r}-\frac{m_-}{\rho (1-\gamma )}\right\} ,\\ c_2&=b_2+\frac{\alpha _1^{1-m_-}(1-2R\varGamma )^{2-m_-}}{2R(m_+-m_-)}\left\{ \frac{2-m_+}{2(\rho -2r+\theta ^2)}+\frac{1-m_+}{r}+\frac{m_+}{2\rho }\right\} . \end{aligned}$$

By Assumption 3, \(\phi (y)\) satisfies the tranversality condition (3.11). The functional form of \(\phi (y)\) in (3.33) implies that \(\phi \) satisfies the growth condition (3.10). Since \(M_t\) defined in (3.12) is a martingale, Itô’s formula together with the transversality condition (3.11) implies

$$\begin{aligned} \phi (y)={\mathbb {E}}^{y_0=y}\left[ \int _0^\infty e^{-\rho s}\left\{ \alpha _1 {\widetilde{u}}_1(y_s)+\alpha _2 {\widetilde{u}}_2(y_s)\right\} ds\right] . \end{aligned}$$

Proof of lemma 10

Remark 22

From the quadratic function (3.14) and the quadratic equation (3.15), we see that

$$\begin{aligned} f_1\left( -\frac{1-\gamma }{\gamma }\right) =-K<0 \end{aligned}$$

by Assumption 3. This implies

$$\begin{aligned} m_-<-\frac{1-\gamma }{\gamma }<m_+. \end{aligned}$$

(4.34)

Remark 23

From the quadratic equation (3.15), we see that

$$\begin{aligned}&m_++m_-=-\frac{2\left( \rho -r-\frac{1}{2}\theta ^2\right) }{\theta ^2},\quad m_+m_-=-\frac{2\rho }{\theta ^2},\\&(m_+-1)+(m_--1)=-\frac{2\left( \rho -r+\frac{1}{2}\theta ^2\right) }{\theta ^2},\quad (m_+-1)(m_--1)=-\frac{2r}{\theta ^2}. \end{aligned}$$

Remark 24

From Remark 23, we obtain that

$$\begin{aligned} K&=-\frac{\theta ^2(\gamma m_++1-\gamma )(\gamma m_-+1-\gamma )}{2\gamma ^2}>0,\\ \rho&=-\frac{\theta ^2 m_+m_-}{2},\qquad r=-\frac{\theta ^2 (m_+-1)(m_--1)}{2}. \end{aligned}$$

Lemma 25

We see that

$$\begin{aligned}&\left( \frac{\gamma m_+}{1-\gamma }+1\right) \frac{1}{K}+\frac{m_+-1}{r}-\frac{m_+}{\rho (1-\gamma )}=-\frac{2}{\theta ^2m_-(m_--1)(\gamma m_-+1-\gamma )}>0,\\&\left( \frac{\gamma m_-}{1-\gamma }+1\right) \frac{1}{K}+\frac{m_--1}{r}-\frac{m_-}{\rho (1-\gamma )}=-\frac{2}{\theta ^2m_+(m_+-1)(\gamma m_++1-\gamma )}<0. \end{aligned}$$

Proof

First we use Remark 24 to obtain

$$\begin{aligned}&\left( \frac{\gamma m_+}{1-\gamma }+1\right) \frac{1}{K}+\frac{m_+-1}{r}-\frac{m_+}{\rho (1-\gamma )}\\&\quad =-\frac{2\gamma ^2}{\theta ^2(1-\gamma )(\gamma m_-+1-\gamma )}-\frac{2}{\theta ^2(m_--1)}+\frac{2}{\theta ^2 m_-(1-\gamma )}\\&\quad =-\frac{2}{\theta ^2m_-(m_--1)(\gamma m_-+1-\gamma )}>0, \end{aligned}$$

since \(\gamma m_-+1-\gamma <0\) (see the first inequality in (4.34)). Similarly, we can obtain the second identity. \(\square \)

Now we will prove Lemma 10 as follows: From Proposition 9, we see that

$$\begin{aligned} \phi '(y)=\left\{ \begin{array}{ll} m_+a_1 y^{m_+-1}-\alpha _2^{\frac{1}{\gamma }}\frac{1}{K}y^{-\frac{1}{\gamma }} &{}\\ \quad -\frac{2}{4\alpha _1R(\rho -2r+\theta ^2)}y+\frac{2LR-1}{2rR}, &{} \text{ if } 0<y< \alpha _2L^{-\gamma },\\ m_+b_1y^{m_+-1}+m_-b_2 y^{m_--1} &{}\\ \quad -\frac{2}{4\alpha _1R(\rho -2r+\theta ^2)}y-\frac{1}{2rR}, &{} \text{ if } \alpha _2L^{-\gamma }<y< \alpha _1(1-2R{\varGamma }),\\ m_-c_2 y^{m_--1}-\frac{{\varGamma }}{r}, &{} \text{ if } y> \alpha _1(1-2R{\varGamma }). \end{array}\right. \end{aligned}$$

Let us consider

$$\begin{aligned}&\phi '(\alpha _2L^{-\gamma }+)-\phi '(\alpha _2L^{-\gamma }-)\\&\quad =m_+(b_1-a_1)\alpha _2^{m_+-1}L^{-\gamma m_++\gamma }+m_-b_2 \alpha _2^{m_--1}L^{-\gamma m_-+\gamma }+\frac{1}{K}L-\frac{L}{r}\\&\quad =\frac{L}{m_+ -m_-}\left[ -\left( m_+-m_-\right) \frac{1}{K}+\frac{m_+-m_-}{r}\right] +\frac{1}{K}L-\frac{L}{r}\\&\quad =0 \end{aligned}$$

and

$$\begin{aligned}&\phi '(\alpha _1(1-2R{\varGamma })+)-\phi '(\alpha _1(1-2R{\varGamma })-)\\&\quad =-m_+b_1\alpha _1^{m_+-1}(1-2R{\varGamma })^{m_+-1}+m_-(c_2-b_2) \alpha _1^{m_--1}(1-2R{\varGamma })^{m_--1}\\&\qquad +\frac{1-2R{\varGamma }}{2R(\rho -2r+\theta ^2)}+\frac{1-2R{\varGamma }}{2rR}\\&\quad =\frac{1-2R\varGamma }{2R(m_+-m_-)}\left[ -\frac{m_+-m_-}{\rho -2r+\theta ^2}- \frac{m_+-m_-}{r} \right] \\&\qquad +\frac{1-2R\varGamma }{2R}\left( \frac{1}{\rho -2r+\theta ^2}+\frac{1}{r}\right) \\&\quad =0. \end{aligned}$$

Thus \(\phi (y)\) is differentiable for \(y>0\) and \(\phi '(y)\) is continuous for \(y>0\).

Also we see that

$$\begin{aligned} \phi ''(y)=\left\{ \begin{array}{ll} m_+(m_+-1)a_1 y^{m_+-2}+\frac{1}{\gamma }\alpha _2^{\frac{1}{\gamma }}\frac{1}{K}y^{-\frac{1}{\gamma }-1}&{}\\ \quad -\frac{2}{4\alpha _1R(\rho -2r+\theta ^2)}, &{} \text{ if } 0<y< \alpha _2L^{-\gamma },\\ m_+(m_+-1)b_1y^{m_+-2}+m_-(m_--1)b_2 y^{m_--2}&{}\\ \quad -\frac{2}{4\alpha _1R(\rho -2r+\theta ^2)}, &{} \text{ if } \alpha _2L^{-\gamma }<y< \alpha _1(1-2R{\varGamma }),\\ m_-(m_--1)c_2 y^{m_--2}, &{} \text{ if } y> \alpha _1(1-2R{\varGamma }). \end{array}\right. \end{aligned}$$

Let us consider

$$\begin{aligned}&\phi ''(\alpha _2L^{-\gamma }+)-\phi ''(\alpha _2L^{-\gamma }-)\\&\quad =m_+(m_+-1)(b_1-a_1)\alpha _2^{m_+-2}L^{-\gamma (m_+-2)} +m_-(m_--1)b_2\alpha _2^{m_--2}L^{-\gamma (m_--2)}\\&\qquad -\frac{1}{\gamma }\frac{1}{K}\alpha _2^{-1}L^{1+\gamma }\\&\quad =-\frac{m_+(m_+-1)}{m_+-m_-}\left\{ \left( \frac{\gamma m_-}{1-\gamma }+1\right) \frac{1}{K}+\frac{m_--1}{r}-\frac{m_-}{\rho (1-\gamma )}\right\} \alpha _2^{-1}L^{1+\gamma }\\&\qquad +\frac{ m_-(m_--1)}{m_+ -m_-}\left\{ \left( \frac{\gamma m_+}{1-\gamma }+1\right) \frac{1}{K}+\frac{m_+-1}{r}-\frac{m_+}{\rho (1-\gamma )}\right\} \alpha _2^{-1}L^{1+\gamma }\\&\qquad -\frac{1}{\gamma }\frac{1}{K}\alpha _2^{-1}L^{1+\gamma }\\&\quad =\alpha _2^{-1}L^{1+\gamma }\left[ -\frac{1}{K}\left\{ \frac{2 \rho \gamma }{(\gamma -1)\theta ^2}-\frac{2\left( \rho -r-\frac{1}{2}\theta ^2\right) }{\theta ^2}-1+\frac{1}{\gamma }\right\} +\frac{2\gamma }{(\gamma -1)\theta ^2}\right] =0 \end{aligned}$$

and

$$\begin{aligned}&\phi ''(\alpha _1(1-2R{\varGamma })+)-\phi ''(\alpha _1(1-2R{\varGamma })-)\\&\quad =m_-(m_--1)(c_2-b_2) \alpha _1^{m_--2}(1-2R{\varGamma })^{m_--2}\\&\qquad -m_+(m_+-1)b_1\alpha _1^{m_+-2}(1-2R{\varGamma })^{m_+-2}\\&\qquad +\frac{1}{2\alpha _1R(\rho -2r+\theta ^2)}\\&\quad =\frac{m_-(m_--1)}{2\alpha _1R(m_+-m_-)}\left\{ \frac{2-m_+}{2(\rho -2r+\theta ^2)}+\frac{1-m_+}{r}+\frac{m_+}{2\rho }\right\} \\&\qquad -\frac{m_+(m_+-1)}{2\alpha _1R(m_+-m_-)}\left\{ \frac{2-m_-}{2(\rho -2r+\theta ^2)}+\frac{1-m_-}{r}+\frac{m_-}{2\rho }\right\} +\frac{1}{2\alpha _1R(\rho -2r+\theta ^2)}\\&\quad =\frac{1}{2\alpha _1R}\left[ \frac{(m_+-1)(m_--1)-(m_++m_-)+1}{2(\rho -2r+\theta ^2)}+\frac{(m_+-1)(m_--1)}{r}\right. \\&\qquad \left. -\frac{m_+m_-}{2\rho }+\frac{1}{\rho -2r+\theta ^2}\right] =0. \end{aligned}$$

Thus \(\phi '(y)\) is differentiable for \(y>0\) and \(\phi ''(y)\) is continuous for \(y>0\).

Proof of theorem 11

Let us define

$$\begin{aligned} \widehat{{\mathcal {X}}}(y):=-\phi '(y),~\text{ for }~y>0. \end{aligned}$$

Then we see that

$$\begin{aligned}&\lim _{y\rightarrow 0+}\widehat{{\mathcal {X}}}(y)=-\lim _{y\rightarrow 0+}\left[ m_+a_1 y^{m_+-1}-\alpha _2^{\frac{1}{\gamma }}\frac{1}{K}y^{-\frac{1}{\gamma }}-\frac{2}{4\alpha _1R(\rho -2r+\theta ^2)}y\right. \\&\quad \left. +\frac{2LR-1}{2rR}\right] =+\infty ,\\&\lim _{y\rightarrow +\infty }\widehat{{\mathcal {X}}}(y)=-\lim _{y\rightarrow +\infty }\left[ m_-c_2 y^{m_--1}-\frac{{\varGamma }}{r}\right] =\frac{{\varGamma }}{r},\\&\lim _{y\rightarrow 0+}\widehat{{\mathcal {X}}}'(y)=-\lim _{y\rightarrow 0+}\left[ m_+(m_+-1)a_1 y^{m_+-2}+\frac{1}{\gamma }\alpha _2^{\frac{1}{\gamma }}\frac{1}{K}y^{-\frac{1}{\gamma }-1}\right. \\&\qquad \left. -\frac{2}{4\alpha _1R(\rho -2r+\theta ^2)}\right] =-\infty ,\\&\lim _{y\rightarrow +\infty }\widehat{{\mathcal {X}}}'(y)=-\lim _{y\rightarrow +\infty }m_-(m_--1)c_2 y^{m_--2}=0. \end{aligned}$$

Furthermore we see that \(\phi (y)\) is convex since \({\widetilde{u}}_1\) and \({\widetilde{u}}_2\) are convex (see Remark 4), that is, for any \(\eta \in [0,1]\),

$$\begin{aligned}&\phi (y)=\phi (\eta y+(1-\eta ) y)\\&\quad ={\mathbb {E}}\left[ \int _0^\infty e^{-\rho t}\left\{ \alpha _1\cdot {\widetilde{u}}_1(\eta y_t+(1-\eta ) y_t)+\alpha _2\cdot {\widetilde{u}}_2(\eta y_t+(1-\eta ) y_t)\right\} dt\right] \\&\quad \le {\mathbb {E}}\left[ \int _0^\infty e^{-\rho t}\left\{ \alpha _1\cdot \eta {\widetilde{u}}_1(y_t)+\alpha _1\cdot (1-\eta ) {\widetilde{u}}_1(y_t)+\alpha _2\cdot \eta {\widetilde{u}}_2(y_t)+ \alpha _2\cdot (1-\eta ){\widetilde{u}}_2(y_t)\right\} dt\right] \\&\quad =\eta \phi (y)+(1-\eta ) \phi (y). \end{aligned}$$

Thus \(\widehat{{\mathcal {X}}}(y)\) is decreasing and one-to-one mapping from \((0,+\infty )\) to \((\varGamma /r,+\infty )\) and we see that there exists a unique \(y^*\in (0,+\infty )\) such that

$$\begin{aligned} y^*=(\phi ')^{-1}(-x). \end{aligned}$$

Hence

$$\begin{aligned} x= \widehat{{\mathcal {X}}}(y^*). \end{aligned}$$

(5.35)

Let \(y^*_t= y^* e^{\rho t}H_t\) and define \({\widetilde{M}}_{t,s}\), for \(t\le s,\) by

$$\begin{aligned} {\widetilde{M}}_{t,s} := \int _t^s H_v (c_v^*+g_v^*) dv + H_s \widehat{{\mathcal {X}}}(y^*_s), \end{aligned}$$

where \(c_s^*, g^*_s\) are as in Lemma 5 with \(y_t=y^*_t.\) Since \(\widehat{{\mathcal {X}}}' (y)=-\phi ''(y)\) satisfies a growth condition of the form (3.10), Itô’s formula implies that the process \(({\widetilde{M}}_{t,s})_{s\ge t}\) is a martingale. Thus,

$$\begin{aligned} H_t\widehat{{\mathcal {X}}}(y^*_t)= {\mathbb {E}} \left[ \left. \int _t^s H_v (c_v^*+g_v^*) dv + H_s \widehat{{\mathcal {X}}}(y^*_s) \,\right| \, {{\mathcal {F}}}_t \right] . \end{aligned}$$

(5.36)

Assumption 3 implies that

$$\begin{aligned} \lim _{s\rightarrow \infty } {\mathbb {E}} \left[ \left. H_s \widehat{{\mathcal {X}}}(y^*_s)\, \right| \, {{\mathcal {F}}}_t \right] =0. \end{aligned}$$

Thus, by (5.36) and the monotone convergence theorem,

$$\begin{aligned} H_t\widehat{{\mathcal {X}}}(y^*_t)= {\mathbb {E}} \left[ \left. \int _t^{\infty } H_s (c_s^*+g_s^*) ds \,\right| \, {{\mathcal {F}}}_t \right] . \end{aligned}$$

In particular, by (5.35)

$$\begin{aligned} x= {\mathbb {E}} \left[ \int _0^{\infty } H_s (c_s^*+g_s^*) ds \right] . \end{aligned}$$

We can now derive the algebraic equation for each region in Theorem 11 by the relationship \(x=-\phi '(y^*)\). Furthermore, the proof of (3.16) is standard and can be given in a way similar to that in Karatzas et al. (1987).

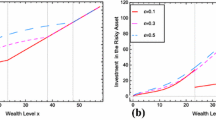

Proof of theorem 12

The post-retirement value function U in (3.16) attains a minimum value when the equation

$$\begin{aligned} x=-\phi '(y) \end{aligned}$$

is satisfied. Thus the optimal wealth \(x^*\) are given as follows:

$$\begin{aligned} x^*=\left\{ \begin{array}{ll} -m_+a_1 y^{m_+-1}+\left( \frac{1}{\alpha _2}\right) ^{-\frac{1}{\gamma }}\frac{1}{K}y^{-\frac{1}{\gamma }}&{}\\ \quad +\frac{1}{2\alpha _1R(\rho -2r+\theta ^2)}y-\frac{2LR-1}{2rR}, &{} \text{ if } 0<y\le \alpha _2L^{-\gamma },\\ -m_+b_1y^{m_+-1}-m_-b_2 y^{m_--1}&{}\\ \quad +\frac{1}{2\alpha _1R(\rho -2r+\theta ^2)}y+\frac{1}{2rR}, &{} \text{ if } \alpha _2L^{-\gamma }<y\le \alpha _1(1-2R\varGamma ),\\ -m_-c_2 y^{m_--1}+\frac{\varGamma }{r}, &{} \text{ if } y> \alpha _1(1-2R\varGamma ). \end{array}\right. \end{aligned}$$

Applying Itô’s formula to the equation

$$\begin{aligned} X_t=-\phi '(y_t) \end{aligned}$$

which expresses the relationships between wealth process \(X_t\) and its dual variable process \(y_t\), then we obtain the following optimal portfolio \(\pi _t^*\) by comparing with the wealth equation (2.4) and equating coefficients:

$$\begin{aligned} \pi ^*_t=\frac{\theta }{\sigma }y_t \phi ''(y_t). \end{aligned}$$

Let

$$\begin{aligned} \widehat{{\mathcal {X}}}(y_t):=-\phi '(y_t)=X_t,~\text{ for }~y_t>0, \end{aligned}$$

then we see that \(\widehat{{\mathcal {X}}}(y_t)\) is decreasing and one-to-one mapping from \((0,+\infty )\) to \((\varGamma /r,+\infty )\). Also note that

$$\begin{aligned} \widehat{{\mathcal {X}}}(\alpha _1(1-2R\varGamma ))=&-m_-c_2 (\alpha _1(1-2R\varGamma ))^{m_--1}+\frac{\varGamma }{r}\\ =&-m_+b_1(\alpha _1(1-2R\varGamma ))^{m_+-1}-m_-b_2 (\alpha _1(1-2R\varGamma ))^{m_--1}\\&+\frac{1-2R\varGamma }{2 R(\rho -2r+\theta ^2)}+\frac{1}{2rR}\\ =:&{\widehat{x}}_{\alpha _1(1-2R{\varGamma })} \end{aligned}$$

and

$$\begin{aligned} \widehat{{\mathcal {X}}}(\alpha _2L^{-\gamma })=&-m_+b_1(\alpha _2L^{-\gamma })^{m_+-1}-m_-b_2 (\alpha _2L^{-\gamma })^{m_--1}\\&+\frac{\alpha _2L^{-\gamma }}{2\alpha _1R(\rho -2r+\theta ^2)}+\frac{1}{2rR}\\ =&-m_+a_1 (\alpha _2L^{-\gamma })^{m_+-1}+\frac{L}{K}+\frac{\alpha _2L^{-\gamma }}{2\alpha _1R(\rho -2r+\theta ^2)}-\frac{2LR-1}{2rR}\\ =:&{\widehat{x}}_{\alpha _2L^{-\gamma }} \end{aligned}$$

since \(\phi '(y)\) is continuous for \(y>0\). Thus \(\widehat{{\mathcal {X}}}(y_t)\) is one-to-one mapping from \((0,\alpha _2L^{-\gamma })\) to \(({\widehat{x}}_{\alpha _2L^{-\gamma }},+\infty )\) and from \((\alpha _2L^{-\gamma },\alpha _1(1-2R\varGamma ))\) to \(({\widehat{x}}_{\alpha _1(1-2R{\varGamma })},{\widehat{x}}_{\alpha _2L^{-\gamma }})\). Therefore if \({\widehat{x}}_{\alpha _1(1-2R{\varGamma })}<X_t<{\widehat{x}}_{\alpha _2L^{-\gamma }}\), then \({\widehat{\xi }}_t\) is the unique solution to the following equation

$$\begin{aligned}&X_t=-m_+b_1{\widehat{\xi }}_t^{m_+-1}-m_-b_2 {\widehat{\xi }}_t^{m_--1}+\frac{1}{2\alpha _1R(\rho -2r+\theta ^2)}{\widehat{\xi }}_t\\&\quad +\frac{1}{2rR}, ~\text{ for } \alpha _2L^{-\gamma }<{\widehat{\xi }}_t< \alpha _1(1-2R{\varGamma }), \end{aligned}$$

and, if \(X_t>{\widehat{x}}_{\alpha _2L^{-\gamma }}\), then \({\widehat{\zeta }}_t\) is the unique solution to the following equation

$$\begin{aligned}&X_t=-m_+a_1 {\widehat{\zeta }}_t^{m_+-1}+\left( \frac{1}{\alpha _2}\right) ^{-\frac{1}{\gamma }}\frac{1}{K}{\widehat{\zeta }}_t^{-\frac{1}{\gamma }}+\frac{1}{2\alpha _1R(\rho -2r+\theta ^2)}{\widehat{\zeta }}_t\\&\quad -\frac{2LR-1}{2rR}, ~ \text{ for } 0<{\widehat{\zeta }}_t<\alpha _2L^{-\gamma }. \end{aligned}$$

Also the optimal consumption rates of necessity and luxury goods are derived during calculating the dual utility functions \({\widetilde{u}}_1\) and \({\widetilde{u}}_2\) (see Lemma 5).

Derivation of equation (3.19)

The first equality of (3.19) is the definition of V(x) and we need to prove the second equality. The “\(\le \)," i.e., the RHS is greater than or equal to the LHS follows easily from the property of maximum. We will show “\(\ge \)," i.e., the RHS is less than or equal to the LHS.

We assume here the existence of strong Markov optimal policies and will establish the existence of such optimal policies and these policies are strong Markov processes in Appendix J. Suppose that \(w^b=((c^b_t)_{t=0}^{\tau ^*}, (g^b_t)_{t=0}^{\tau ^*}, (\pi ^b_t)_{t=0}^{\tau ^*}, \tau ^*)\) is optimal for the maximization problem in the RHS. Suppose also that \(((c^{a}_t)_{t=0}^{\infty }, (g^a_t)_{t=0}^{\infty }, (\pi ^a_t)_{t=0}^{\infty })\) is optimal for the post-retirement problem with \(x=X^{w^b}_{\tau ^*}\). Define

$$\begin{aligned} c^*_t= {\left\{ \begin{array}{ll} c^b_t &{} \hbox {if}\ t\le \tau ^* \\ c^a_{t-\tau ^*} &{} \hbox {if}\ t>\tau ^* \end{array}\right. }, \quad g^*_t= {\left\{ \begin{array}{ll} g^b_t &{} \hbox {if}\ t\le \tau ^* \\ g^a_{t-\tau ^*} &{} \hbox {if}\ t>\tau ^* \end{array}\right. }, \quad \pi ^*_t= {\left\{ \begin{array}{ll} \pi ^b_t &{} \hbox {if}\ t\le \tau ^* \\ \pi ^a_{t-\tau ^*} &{} \hbox {if}\ t>\tau ^* \end{array}\right. }. \end{aligned}$$

Clearly, \(w= ((c^{*}_t)_{t=0}^{\infty }, (g^*_t)_{t=0}^{\infty }, (\pi ^*_t)_{t=0}^{\infty }, \tau ^*)\) is an admissible policy. We know

$$\begin{aligned} V&=\max _{(c,g,\pi ,\tau )\in {\mathcal {A}}(x)}{\mathbb {E}}\left[ \int _0^\tau e^{-\rho t} \left\{ \alpha _1 {u(c_t)}+\alpha _2\frac{(g_t+L)^{1-\gamma }}{1-\gamma }-l\right\} dt\right. \\&\quad \left. +\int _\tau ^\infty e^{-\rho t} \left\{ \alpha _1 {u(c_t)}+\alpha _2\frac{(g_t+L)^{1-\gamma }}{1-\gamma }\right\} dt\right] \\&\ge {\mathbb {E}}\left[ \int _0^{\tau ^*} e^{-\rho t} \left\{ \alpha _1 {u(c^*_t)}+\alpha _2\frac{(g^*_t+L)^{1-\gamma }}{1-\gamma }-l\right\} dt \right. \\&\quad \left. +e^{-\rho \tau ^*}\int _{\tau ^*}^\infty e^{-\rho (t-\tau ^*)} \left\{ \alpha _1 {u(c^*_t)}+\alpha _2\frac{(g^*_t+L)^{1-\gamma }}{1-\gamma }\right\} dt\right] \\&= {\mathbb {E}}\left[ \int _0^{\tau ^*} e^{-\rho t} \left\{ \alpha _1 {u(c^*_t)}+\alpha _2\frac{(g^*_t+L)^{1-\gamma }}{1-\gamma }-l\right\} dt \right. \\&\quad \left. +e^{-\rho \tau ^*}{\mathbb {E}}\left[ \left. \int _{\tau ^*}^\infty e^{-\rho (t-\tau ^*)} \left\{ \alpha _1 {u(c^*_t)}+\alpha _2\frac{(g^*_t+L)^{1-\gamma }}{1-\gamma }\right\} dt\right| {{\mathcal {F}}}_{\tau ^*}\right] \right] \\&= {\mathbb {E}}\left[ \int _0^{\tau ^*} e^{-\rho t} \left\{ \alpha _1 {u(c^*_t)}+\alpha _2\frac{(g^*_t+L)^{1-\gamma }}{1-\gamma }-l\right\} dt \right. \\&\quad \left. +e^{-\rho \tau ^*}{\mathbb {E}}\left[ \left. \int _{\tau ^*}^\infty e^{-\rho (t-\tau ^*)} \left\{ \alpha _1 {u(c^*_t)}+\alpha _2\frac{(g^*_t+L)^{1-\gamma }}{1-\gamma }\right\} dt\right| X_{\tau ^*}\right] \right] \\&=\max _{(c,g,\pi ,\tau )\in {\mathcal {A}}(x)}{\mathbb {E}}\left[ \int _0^\tau e^{-\rho t} \left\{ \alpha _1 {u(c_t)}+\alpha _2\frac{(g_t+L)^{1-\gamma }}{1-\gamma }-l\right\} dt+e^{-\rho \tau } U(X_\tau )\right] ,\!\!\! \end{aligned}$$

where we have used the strong Markov property of optimal policies and the last equality follows from the definition of \(w= ((c^{*}_t)_{t=0}^{\infty }, (g^*_t)_{t=0}^{\infty }, (\pi ^*_t)_{t=0}^{\infty }, \tau ^*)\). This proves the assertion.

Proof of proposition 19

It can be easily obtained that

$$\begin{aligned} \left( \frac{\partial }{\partial t}+ {\mathcal {L}}\right) {\widehat{U}}(y,Y_t)+\alpha _1{\widetilde{u}}_1(y)+\alpha _2 {\widetilde{u}}_2(y)-l= & {} \left( \frac{\partial }{\partial t}+ {\mathcal {L}}\right) \left[ \phi (y)-\frac{Y_t}{r-\delta }y\right] \\&+\,\alpha _1{\widetilde{u}}_1(y)+\alpha _2 {\widetilde{u}}_2(y)-l\\= & {} Y_ty-l. \end{aligned}$$

Let \(P(t,y):={\widetilde{\varphi }}(t,y)-{\widehat{U}}(y,Y_t)\), then we see that

$$\begin{aligned}&\left( \frac{\partial }{\partial t}+ {\mathcal {L}}\right) {\widetilde{\varphi }}(t,y)+\alpha _1{\widetilde{u}}_1(y)+\alpha _2 {\widetilde{u}}_2(y)-l\\&\quad =\left( \frac{\partial }{\partial t}+ {\mathcal {L}}\right) P(t,y)+\left( \frac{\partial }{\partial t}+ {\mathcal {L}}\right) {\widehat{U}}(y,Y_t)+\alpha _1{\widetilde{u}}_1(y)+\alpha _2 {\widetilde{u}}_2(y)-l\\&\quad =\left( \frac{\partial }{\partial t}+ {\mathcal {L}}\right) P(t,y)+Y_ty-l. \end{aligned}$$

Thus, Variational Inequality (VI) (3.22) can be considered as

$$\begin{aligned} \max \left\{ \left( \frac{\partial }{\partial t}+{\mathcal {L}}\right) P(t,y)+Y_ty-l,-P(t,y)\right\} =0. \end{aligned}$$

(8.37)

We will now proceed to solve VI (8.37). Suppose

$$\begin{aligned} P(t,y_t)=Q(z_t), \end{aligned}$$

where \(z_t= Y_ty_t= e^{\delta t}Yy_t.\) Then, VI (8.37) becomes

$$\begin{aligned} \max \left\{ \bar{{\mathcal {L}}}Q(z)+z-l,-Q(z)\right\} =0, \end{aligned}$$

(8.38)

where

$$\begin{aligned} \bar{{\mathcal {L}}}:=\frac{1}{2}\theta ^2z^2\frac{d^2}{d z^2}+(\rho +\delta -r)z\frac{d}{d z}-\rho . \end{aligned}$$

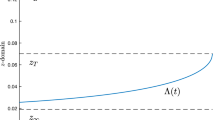

Thus the optimal retirement threshold \({\bar{z}}\) is given by

$$\begin{aligned} {\bar{z}}=\inf \left\{ z>0\,|\,Q(z)>0\right\} . \end{aligned}$$

Now we can take the following free boundary value problem (FBVP) into consideration:

$$\begin{aligned} \left\{ \begin{array}{ll} \bar{{\mathcal {L}}}Q(z)+z-l=0,&{}~\text{ for } z>{\bar{z}},\\ Q(z)=0,&{}~\text{ for } 0<z\le {\bar{z}},\\ Q({\bar{z}})=Q'({\bar{z}})=0. \end{array}\right. \end{aligned}$$

(8.39)

From the FBVP (8.39), we obtain

$$\begin{aligned} Q(z)=\left\{ \begin{array}{ll} A_2z^{n_-}+\frac{1}{r-\delta }z-\frac{l}{\rho },&{}~\text{ for } z>{\bar{z}},\\ 0,&{}~\text{ for } 0<z\le {\bar{z}}. \end{array}\right. \end{aligned}$$

(8.40)

Also, from the free boundary conditions in (8.39), we derive

$$\begin{aligned} {\bar{z}}=\frac{n_-}{n_--1}\frac{(r-\delta )l}{\rho }>0\quad \text{ and }\quad A_2=\frac{1}{1-n_-}\frac{l}{\rho }{\bar{z}}^{-n_-}>0. \end{aligned}$$

Thus the inequality (3.25) in Assumption 17 implies

$$\begin{aligned} {\bar{z}}<\alpha _2 L^{-\gamma }Y\le \alpha _2 L^{-\gamma }Y_t,~\text{ for } t\ge 0. \end{aligned}$$

Lemma 26

Q(z) in (8.40) satisfies VI (8.38).

Proof

For \(z>{\bar{z}}\), we see that

$$\begin{aligned} Q'(z)=n_-A_2z^{n_--1}+\frac{1}{r-\delta }\quad \text{ and }\quad Q''(z)=n_-(n_--1)A_2z^{n_--2}>0. \end{aligned}$$

(8.41)

So \(Q'(z)\) is an increasing function for \(z>{\bar{z}}\) and Q(z) is also an increasing function for \(z>{\bar{z}}\) since \(Q'({\bar{z}})=0\). Thus \(Q(z)>0\) for \(z>{\bar{z}}\) since \(Q({\bar{z}})=0\). Therefore we have, for \(z>{\bar{z}}\),

$$\begin{aligned} \bar{{\mathcal {L}}}Q(z)+z-l=0\quad \text{ and }\quad -Q(z)<0. \end{aligned}$$

For \(0<z\le {\bar{z}}\), we see that \(Q(z)=0\) and consequently \(\bar{{\mathcal {L}}}Q(z)=0\). The inequality (3.24) implies

$$\begin{aligned} \frac{n_-}{n_--1}<\frac{\rho }{r-\delta }~\Rightarrow ~{\bar{z}}=\frac{n_-}{n_--1}\frac{(r-\delta )l}{\rho }<l, \end{aligned}$$

that is, \(z-l<0\) for \(0<z\le {\bar{z}}\). Therefore we have, for \(0<z\le {\bar{z}}\),

$$\begin{aligned} \bar{{\mathcal {L}}}Q(z)+z-l<0\quad \text{ and }\quad -Q(z)=0. \end{aligned}$$

\(\square \)

Let

$$\begin{aligned} \varPhi (t,y_t):=P(t,y_t)+{\widehat{U}}(y_t,Y_t)=Q(z_t)+\phi (y_t)-\frac{z_t}{r-\delta }. \end{aligned}$$

(8.42)

Then, for \({\bar{z}}/Y_t<y_t<\alpha _2L^{-\gamma }\), we have

$$\begin{aligned} \varPhi (t,y_t)= & {} a_1 y_t^{m_+}+A_2 y_t^{n_-}Y_t^{n_-}+\frac{\gamma }{1-\gamma }\left( \frac{1}{\alpha _2}\right) ^{-\frac{1}{\gamma }}\frac{1}{K}y_t^{-\frac{1-\gamma }{\gamma }}\\&-\,\frac{1}{4\alpha _1R(\rho -2r+\theta ^2)}y_t^2+\frac{2LR-1}{2rR}y_t+\frac{\alpha _1}{4\rho R}-\frac{l}{\rho }. \end{aligned}$$

For \(\alpha _2L^{-\gamma }<y_t\le \alpha _1(1-2R\varGamma )\), we have

$$\begin{aligned} \varPhi (t,y_t)= & {} b_1y_t^{m_+}+b_2y_t^{m_-}+A_2 y_t^{n_-}Y_t^{n_-}-\frac{1}{4\alpha _1R(\rho -2r+\theta ^2)}y_t^2-\frac{1}{2rR}y_t\\&+\,\frac{\alpha _1}{4\rho R}+\frac{\alpha _2L^{1-\gamma }}{\rho (1-\gamma )}-\frac{l}{\rho }. \end{aligned}$$

For \(y_t> \alpha _1(1-2R\varGamma )\), we have

$$\begin{aligned} \varPhi (t,y_t)=c_2 y_t^{m_-}+A_2 y_t^{n_-}Y_t^{n_-}-\frac{\varGamma }{r}y_t+\frac{1}{\rho }\left\{ \alpha _1(\varGamma -R\varGamma ^2)+\frac{\alpha _2L^{1-\gamma }}{1-\gamma }-l\right\} . \end{aligned}$$

Also note that

$$\begin{aligned} \varPhi (t,y_t)=\phi (y_t)-\frac{1}{r-\delta }Y_ty_t,~\text{ for }~0<y_t\le {\bar{z}}/Y_t. \end{aligned}$$

Since \(\phi (y)\) is a \(C^2\)-function for \(y>0\), it can be easily checked that \(\varPhi (t,y)\) is also a \(C^2\)-function for \(y>0\) except at \(y_t={\bar{z}}/Y_t\) (we see that \(\varPhi (t,y)\) is a \(C^1\)-function at \(y_t={\bar{z}}/Y_t\)).

Notice that \(Q(z)-\frac{z}{r-\delta }\) satisfies growth condition of the form (3.10) and \(z_t\) follows the dynamics

$$\begin{aligned} \frac{dz_t}{z_t}=(\rho +\delta -r) dt -\theta dB(t). \end{aligned}$$

Define the process \(N_t\) by

$$\begin{aligned} N_t:=\int _0^{t}e^{-\rho s} \theta y_s \frac{\partial \varPhi }{\partial y} (t,y_s) ds. \end{aligned}$$

Then, by the growth condition, \(N_t\) is a martingale.

Equation (8.42) implies that the following transversality condition is satisfied:

$$\begin{aligned} \lim _{t\rightarrow \infty } e^{-\rho t}{\mathbb {E}} \left[ |\varPhi (t,y_t)|\right] =0. \end{aligned}$$

Hence, by Theorem 3.2 of Knudsen et al. (1998) we know

$$\begin{aligned}&\varPhi (t,y) = {\mathbb {E}}^{y_0=y}\left[ \int _0^{ \tau ^*}e^{-\rho t} \left\{ \alpha _1{\widetilde{u}}_1(y_t)+\alpha _2 {\widetilde{u}}_2(y_t)-l\right\} dt \right. \\&\left. + e^{-\rho \tau ^*} \left( \phi (y_{\tau ^*}) -\frac{Y_{\tau ^*}}{r-\delta }y_{\tau ^*}\right) \right] ={\widetilde{V}}. \end{aligned}$$

Proof of theorem 20

Let us define

$$\begin{aligned} {\mathcal {X}}(t,y):=-\frac{\partial }{\partial y}\varPhi (t,y)-\frac{Y_t}{r-\delta }, ~\text{ for }~y> 0. \end{aligned}$$

Then we see that

$$\begin{aligned}&\lim _{y\rightarrow 0+}{\mathcal {X}}(t,y)\\&\quad =-\lim _{y\rightarrow 0+}\left[ m_+a_1 y^{m_+-1}-\alpha _2^{\frac{1}{\gamma }}\frac{1}{K}y^{-\frac{1}{\gamma }}-\frac{2}{4\alpha _1R(\rho -2r+\theta ^2)}y+\frac{2LR-1}{2rR}\right] \\&\quad =+\infty ,\\&\lim _{y\rightarrow +\infty }{\mathcal {X}}(t,y)\\&\quad =-\lim _{y\rightarrow +\infty }\left[ m_-c_2y^{m_--1}+n_-A_2 y^{n_--1}Y_t^{n_-}-\frac{{\varGamma }}{r}+\frac{Y}{r-\delta }\right] =\frac{{\varGamma }}{r}-\frac{Y}{r-\delta },\\&\lim _{y\rightarrow 0+}{\mathcal {X}}'(t,y)\\&\quad =-\lim _{y\rightarrow 0+}\left[ m_+(m_+-1)a_1 y^{m_+-2}+\frac{1}{\gamma }\alpha _2^{\frac{1}{\gamma }}\frac{1}{K}y^{-\frac{1}{\gamma }-1}-\frac{2}{4\alpha _1R(\rho -2r+\theta ^2)}\right] \\&\quad =-\infty ,\\&\lim _{y\rightarrow +\infty }{\mathcal {X}}'(t,y)\\&\quad =-\lim _{y\rightarrow +\infty }\left[ m_-(m_--1)c_2 y^{m_--2}+n_-(n_--1)A_2 y^{n_--2}Y_t^{n_-} \right] =0. \end{aligned}$$

We see that \(Q''(z)>0\), for \(z>{\bar{z}}\) from (8.41) in Lemma 26. Thus

$$\begin{aligned} \frac{\partial ^2}{\partial y^2}P(t,y_t)=Y_t^2Q''(z_t)>0,~\text{ for } y_t>\frac{{\bar{z}}}{Y_t}. \end{aligned}$$

This implies that \(P(\cdot ,y)\) is a strictly convex function for \(y>{\bar{z}}/Y\). Also we have shown that \(\phi (y)\) is a convex function for \(y>0\) in Appendix E. Since

$$\begin{aligned} \varPhi (t,y_t)=P(t,y_t)+\phi (y_t)-\frac{Y_t}{r-\delta }y_t,~\text{ for }~~y_t>\frac{{\bar{z}}}{Y_t}, \end{aligned}$$

it is also clear that \(\varPhi (\cdot ,y)\) is a convex function for \(y>{\bar{z}}/Y\). Furthermore since

$$\begin{aligned} \varPhi (t,y_t)=\phi (y_t)-\frac{Y_t}{r-\delta }y_t,~\text{ for }~0<y_t\le \frac{{\bar{z}}}{Y_t}, \end{aligned}$$

it is clear that \(\varPhi (\cdot ,y)\) is a convex function for \(0<y\le {\bar{z}}/Y \).

Thus \({\mathcal {X}}(\cdot ,y)\) is decreasing and one-to-one mapping from \((0,+\infty )\) to \((\varGamma /r-Y/(r-\delta ),+\infty )\) and we see that there exists a unique \({\mathcal {Y}}^*\in (0,+\infty )\) such that

$$\begin{aligned} x= {\mathcal {X}}(0,{\mathcal {Y}}^*). \end{aligned}$$

From the inequality (3.20), we obtain

$$\begin{aligned} V\le \min _{y>0}\left[ \varPhi (0,y)+y\left( x+\frac{Y}{r-\delta }\right) \right] . \end{aligned}$$

Let \(y^*_t= {\mathcal {Y}}^* e^{\rho t}H_t\).

We will now show that the budget constraint holds with equality for the optimal policies by proceeding similarly to the proof of Theorem 3.2 part b), Knudsen et al. (1998). Define

$$\begin{aligned} {\widetilde{N}}_{t}:= \frac{1}{{{\mathcal {Y}}}^*}\int _0^{t} e^{-\rho s} \theta y_s^* \left( {\mathcal {X}}(s,y^*_s)+ \frac{Y_s}{r-\delta }+ y_s^*\frac{\partial }{\partial y}{\mathcal {X}}(s,y^*_s)\right) \,dB(s). \end{aligned}$$

We know \(H_t= e^{-\rho t}\frac{1}{{\mathcal {Y}}^*} y^*_t ,\) and \( y_t^* {\mathcal {X}}(t,y^*_t)\) and \((y_t^*)^2\frac{\partial }{\partial y}{\mathcal {X}}(t,y^*_t)\) are composed of parts satisfying growth conditions of the form (3.10). Hence, the process \({\widetilde{N}}_{t}\) is a martingale. Furthermore, we know

$$\begin{aligned} \lim _{t\rightarrow \infty } {\mathbb {E}}\left[ H_t \left( {\mathcal {X}}(t,y^*_t)+\frac{Y_t}{r-\delta }\right) \right] =0. \end{aligned}$$

(9.43)

Then, Itô’s formula implies

$$\begin{aligned} \int _0^{t\wedge \tau ^*} H_s (c^*_s+g^*_s)ds + H_{t\wedge \tau ^*}\left( {\mathcal {X}}_{t\wedge \tau ^*}+ \frac{Y_{t\wedge \tau ^*}}{r-\delta }\right) = {\mathcal {X}}(0,{{\mathcal {Y}}}^*) +\frac{Y}{r-\delta } - {\widetilde{N}}_{t\wedge \tau ^*}, \end{aligned}$$

where \(c^*_s\) and \(g^*_s\) are as in Lemma 5 with \(y_t=y_t^*.\) Hence,

$$\begin{aligned}&\int _0^{t\wedge \tau ^*} H_s (c^*_s+g^*_s)ds+\mathbf{1}_{\{\tau ^*<t\}} H_{\tau ^*}\left( {\mathcal {X}}_{\tau ^*}+ \frac{Y_{\tau ^*}}{r-\delta }\right) \\&\quad = {\mathcal {X}}(0,{{\mathcal {Y}}}^*)+\frac{Y}{r-\delta }- \mathbf{1}_{\{\tau ^*\ge t\}} H_t \left( {\mathcal {X}}(t,y^*_t)+\frac{Y_t}{r-\delta }\right) - {\widetilde{N}}_{t\wedge \tau ^*}. \end{aligned}$$

Taking expectations, we have

$$\begin{aligned} \begin{aligned} {\mathbb {E}}&\left[ \int _0^{t\wedge \tau ^*} H_s (c^*_s+g^*_s)ds + \mathbf{1}_{\{\tau ^*<t\}} H_{\tau ^*}\left( {\mathcal {X}}_{\tau ^*}+ \frac{Y_{\tau ^*}}{r-\delta }\right) \right] \\&\qquad =\, {\mathcal {X}}(0,{{\mathcal {Y}}}^*)+\frac{Y}{r-\delta } -{\mathbb {E}}\left[ \mathbf{1}_{\{\tau ^*\ge t\}} H_t \left( {\mathcal {X}}(t,y^*_t)+\frac{Y_t}{r-\delta }\right) \right] . \end{aligned} \end{aligned}$$

(9.44)

By (9.43)

$$\begin{aligned} 0\le \lim _{t\rightarrow \infty }{\mathbb {E}} \left[ \mathbf{1}_{\{\tau ^*\ge t\}} H_t \left( {\mathcal {X}}(t,y^*_t)+\frac{Y_t}{r-\delta }\right) \right] \le \lim _{t\rightarrow \infty } {\mathbb {E}}\left[ H_t \left( {\mathcal {X}}(t,y^*_t)+\frac{Y_t}{r-\delta }\right) \right] =0.\nonumber \\ \end{aligned}$$

(9.45)

Thus, by (9.44) and (9.45), the monotone convergence theorem implies

$$\begin{aligned} \begin{aligned}&x +\frac{Y}{r-\delta }= {\mathcal {X}}(0,{{\mathcal {Y}}}^*)+\frac{Y}{r-\delta }\\&\quad = \lim _{t\rightarrow \infty }{\mathbb {E}} \left[ \int _0^{t\wedge \tau ^*} H_s (c^*_s+g^*_s)ds + \mathbf{1}_{\{\tau ^*<t\}} H_{\tau ^*}\left( {\mathcal {X}}_{\tau ^*}+ \frac{Y_{\tau ^*}}{r-\delta }\right) \right] \\&\quad = {\mathbb {E}}\left[ \int _0^{\tau ^*} H_t(c_t^*+g_t^*)dt+H_{ \tau ^*}\left( {\mathcal {X}}\left( \tau ^*,y_{\tau ^*}\right) +\frac{Y_{\tau ^*}}{r-\delta }\right) \right] . \end{aligned} \end{aligned}$$

(9.46)

Then,

$$\begin{aligned} V&\ge {\mathbb {E}}\left[ \int _0^{\tau ^*} e^{-\rho t} \left\{ \alpha _1 u(c_t^*)+\alpha _2\frac{(g_t^*+L)^{1-\gamma }}{1-\gamma }-l\right\} dt+e^{-\rho \tau ^*} U(X_{\tau ^*}^{(c^*,g^*,\pi ^*,\tau ^*)})\right] \\&\quad ={\mathbb {E}}\left[ \int _0^{\tau ^*} e^{-\rho t} \left\{ \alpha _1 u(c_t^*)+\alpha _2\frac{(g_t^*+L)^{1-\gamma }}{1-\gamma }-l\right\} dt+e^{-\rho \tau ^*} U(X_{\tau ^*}^{(c^*,g^*,\pi ^*,\tau ^*)})\right] \\&\qquad -{\mathcal {Y}}^*\,{\mathbb {E}}\left[ \int _0^{\tau ^*} H_t(c_t^*+g_t^*)dt+H_{\tau ^*}\left( X_{\tau ^*}^{(c^*,g^*,\pi ^*,\tau ^*)}+\frac{Y_{\tau ^*}}{r-\delta }\right) \right] +{\mathcal {Y}}^*\left( x+\frac{Y}{r-\delta }\right) \\&\quad = \varPhi (0,{\mathcal {Y}}^*)+{\mathcal {Y}}^*\left( x+\frac{Y}{r-\delta }\right) \\&\quad \ge \min _{y>0}\left[ \varPhi (0,y)+y\left( x+\frac{Y}{r-\delta }\right) \right] ,\\ \end{aligned}$$

where the first equality follows from (9.46).

Thus we have

$$\begin{aligned} V=\min _{y>0}\left[ \varPhi (0,y)+y\left( x+\frac{Y}{r-\delta }\right) \right] . \end{aligned}$$

Proof of theorem 21

The main value function V in (3.27) attains a minimum value when the equation

$$\begin{aligned} x=-\frac{\partial }{\partial y}\varPhi (t,y)-\frac{Y}{r-\delta } \end{aligned}$$

is satisfied. Thus, from \(\varPhi (t,y)\) in (3.26), the optimal wealth \(x^*\) are derived as follows:

$$\begin{aligned} x^*=\left\{ \begin{array}{ll} - m_+a_1 y^{m_+-1}-n_-A_2 y^{n_- -1}Y^{n_-}+\left( \frac{1}{\alpha _2}y\right) ^{-\frac{1}{\gamma }} \frac{1}{K} &{}\\ \qquad \qquad +\frac{1}{2 \alpha _1R(\rho -2r+\theta ^2)}y-\frac{2LR-1}{2r R}-\frac{Y}{r-\delta }, &{} \text{ if } {\bar{z}}/Y<y\le \alpha _2 L^{-\gamma },\\ -m_+b_1 y^{m_+-1}- m_-b_2y^{m_- -1}-n_-A_2 y^{n_--1}Y^{n_-}&{}\\ \qquad \qquad +\frac{1}{2 \alpha _1R(\rho -2r+\theta ^2)}y+\frac{1}{2r R}-\frac{Y}{r-\delta }, &{} \text{ if } \alpha _2 L^{-\gamma }<y\le \alpha _1(1-2R\varGamma ) ,\\ -m_- c_2 y^{m_--1}-n_-A_2 y^{n_--1}Y^{n_-}-\left( \frac{Y}{r-\delta }-\frac{\varGamma }{r}\right) , &{} \text{ if } y>\alpha _1(1-2R\varGamma ). \end{array}\right. \end{aligned}$$

Applying Itô’s formula to the equation

$$\begin{aligned} X_t=-\frac{\partial }{\partial y}\varPhi (t,y_t)-\frac{Y_t}{r-\delta } \end{aligned}$$

which expresses the relation of wealth process \(X_t\) and its dual variable process \(y_t\), we obtain the following optimal portfolio \(\pi _t^*\) by comparing with the wealth equation (2.4) and equating coefficients:

$$\begin{aligned} \pi ^*_t=\frac{\theta }{\sigma }y_t \frac{\partial ^2}{\partial y^2}\varPhi (t,y_t). \end{aligned}$$

Let

$$\begin{aligned} {\mathcal {X}}(t,y_t):=-\frac{\partial }{\partial y}\varPhi (t,y_t)-\frac{Y_t}{r-\delta }=X_t, ~\text{ for }~y_t> 0, \end{aligned}$$

then we see that \({\mathcal {X}}(\cdot ,y_t)\) is decreasing and one-to-one mapping from \((0,+\infty )\) to \((-Y_t/(r-\delta )+\varGamma /r,+\infty )\). Also note that

$$\begin{aligned}&{\mathcal {X}}(t,\alpha _1(1-2R\varGamma ))=-m_- c_2 \{\alpha _1(1-2R\varGamma )\}^{m_--1}-n_-A_2 \{\alpha _1(1-2R\varGamma )\}^{n_--1}Y_t^{n_-}\\&\qquad -\left( \frac{Y_t}{r-\delta }-\frac{\varGamma }{r}\right) \\&\quad =-m_+b_1 \{\alpha _1(1-2R\varGamma )\}^{m_+-1}- m_-b_2\{\alpha _1(1-2R\varGamma )\}^{m_- -1}\\&\qquad -n_-A_2 \{\alpha _1(1-2R\varGamma )\}^{n_--1}Y_t^{n_-}\\&\qquad +\frac{(1-2R\varGamma )}{2 R(\rho -2r+\theta ^2)} +\frac{1}{2r R}-\frac{Y_t}{r-\delta }\\&\quad =:x_{\alpha _1(1-2R\varGamma ),t},\\&{\mathcal {X}}(t,\alpha _2L^{-\gamma })=-m_+b_1 (\alpha _2 L^{-\gamma })^{m_+-1}- m_-b_2(\alpha _2 L^{-\gamma })^{m_- -1}-n_-A_2 (\alpha _2 L^{-\gamma })^{n_--1}Y_t^{n_-}\\&\qquad +\frac{\alpha _2 L^{-\gamma }}{2 \alpha _1R(\rho -2r+\theta ^2)} +\frac{1}{2r R}-\frac{Y_t}{r-\delta }\\&\quad =-m_+a_1 ( \alpha _2 L^{-\gamma })^{m_+-1}-n_- A_2 ( \alpha _2 L^{-\gamma })^{n_- -1}Y_t^{n_-}\\&\qquad + \frac{L}{K}+\frac{\alpha _2 L^{-\gamma }}{2 \alpha _1R(\rho -2r+\theta ^2)}-\frac{2LR-1}{2r R}-\frac{Y_t}{r-\delta }\\&\quad =:x_{\alpha _2L^{-\gamma },t}, \end{aligned}$$

and

$$\begin{aligned}&{\mathcal {X}}(t,{\bar{z}}/Y_t)=-m_+ a_1 \left( \frac{{\bar{z}}}{Y_t}\right) ^{m_+-1}-n_- A_2{\bar{z}}^{n_- -1}Y_t+\left( \frac{{\bar{z}}}{\alpha _2Y_t}\right) ^{-\frac{1}{\gamma }} \frac{1}{K}\\&\quad +\frac{1}{2 \alpha _1 R(\rho -2r+\theta ^2)}\frac{{\bar{z}}}{Y_t}-\frac{2LR-1}{2r R}-\frac{Y_t}{r-\delta }=:{\bar{x}}_t \end{aligned}$$

since \(\frac{\partial }{\partial y}\varPhi (\cdot ,y)\) is continuous for \(y>0\). Thus \({\mathcal {X}}(\cdot ,y_t)\) is one-to-one mapping from \((\alpha _1(1-2R\varGamma ),+\infty )\) to \((-(Y_t/(r-\delta )-\varGamma /r),x_{\alpha _1(1-2R{\varGamma }),t})\), from \((\alpha _2L^{-\gamma },\alpha _1(1-2R\varGamma ))\) to \((x_{\alpha _1(1-2R{\varGamma }),t},x_{\alpha _2L^{-\gamma },t})\), and from \(({\bar{z}}/Y_t,\alpha _2L^{-\gamma })\) to \((x_{\alpha _2L^{-\gamma },t},{\bar{x}}_t)\). Therefore if \(-(Y_t/(r-\delta )-\varGamma /r)<X_t<x_{\alpha _1(1-2R{\varGamma }),t}\), then \(\varXi _t\) is a unique solution to the following equation

$$\begin{aligned} X_t=-m_-c_2 \varXi _t^{m_--1}-n_-A_2 \varXi _t^{n_- -1}Y_t^{n_-}+\frac{\varGamma }{r}-\frac{Y_t}{r-\delta }, ~\text{ for } \varXi _t> \alpha _1(1-2R\varGamma ), \end{aligned}$$

if \(x_{\alpha _1(1-2R{\varGamma }),t}<X_t<x_{\alpha _2L^{-\gamma },t}\), then \(\xi _t\) is a unique solution to the following equation

$$\begin{aligned}&X_t=-m_+b_1 \xi _t^{m_+-1}-m_-b_2\xi _t^{m_- -1}-n_-A_2 \xi _t^{n_- -1}Y_t^{n_-}+\frac{1}{2 \alpha _1R(\rho -2r+\theta ^2)}\xi _t\\&\quad +\frac{1}{2r R}-\frac{Y_t}{r-\delta }, ~\text{ for } \alpha _2L^{-\gamma }<\xi _t< \alpha _1(1-2R\varGamma ), \end{aligned}$$

and, if \(x_{\alpha _2L^{-\gamma },t}<X_t<{\bar{x}}_t\), then \(\zeta _t\) is a unique solution to the following equation

$$\begin{aligned}&X_t=-m_+a_1 \zeta _t^{m_+-1}-n_- A_2 \zeta _t^{n_- -1}Y_t^{n_-}+\left( \frac{1}{\alpha _2}\zeta _t\right) ^{-\frac{1}{\gamma }} \frac{1}{K}\\&\quad +\frac{1}{2 \alpha _1R(\rho -2r+\theta ^2)}\zeta _t-\frac{2LR-1}{2r R}-\frac{Y_t}{r-\delta }, ~ \text{ for } {\bar{z}}/Y_t<\zeta _t< \alpha _2L^{-\gamma }. \end{aligned}$$

The optimal consumption rates of necessity and luxury goods can be derived during calculating the dual utility functions \({\widetilde{u}}_1\) and \({\widetilde{u}}_2\) (see Lemma 5 and Remark 14).

We have shown that the wealth \(X_t\) is determined as a function of \(y_t\) in Appendices E and I. Since \(y_t\) is a geometric Brownian motion, and hence, strongly Markovian. Thus, \(X_t\) is a strong Markov process. The optimal policies are determined as functions of wealth in Theorem 21, and are strong Markov processes.