Abstract.

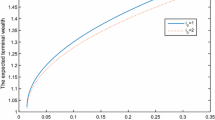

A portfolio selection problem in which the prices of stocks follow jump-diffusion process is studied. The objective is to maximize the expected terminal return and minimize the variance of the terminal wealth. A stochastic linear-quadratic control problem is introduced as auxiliary problem of the initial problem. In order to solve the auxiliary problem, a verification theorem for general stochastic optimal control with states following an jump-diffusion process is showed. By applying the verification theorem and solving the HJB equation, the optimal strategies in an explicit form for the auxiliary and initial control problem are presented. Finally, the efficient frontier in a closed form for the initial portfolio selection problem is derived.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

Manuscript received: June 2003/Final version received: January 2004

Project supported by NNSF of China (70471071)

Rights and permissions

About this article

Cite this article

Guo, W., Xu, C. Optimal portfolio selection when stock prices follow an jump-diffusion process. Math Meth Oper Res 60, 485–496 (2004). https://doi.org/10.1007/s001860400365

Issue Date:

DOI: https://doi.org/10.1007/s001860400365