Abstract

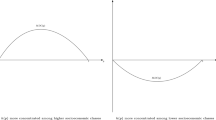

Income share elasticity is a function π which can describe the size distribution of income (Esteban in Intern Econ Rev 27:439–444, 1986). On the other hand, the conventional density representation of the latter gives parameters of first or second order stochastic dominance (SD), widely used to describe shifts in income distribution, to which inequality measures are attached. The paper draws a link between the two, by providing conditions such that a given shift to π is equivalent to a first or second order SD shift of the distribution of income. Some applications to Lorenz rankings are also provided.

Similar content being viewed by others

References

Benassi C, Chirco A (2004) Income distribution, price elasticity, and the ‘Robinson effect’. Manch School 72:591–600

Benassi C, Chirco A, Scrimitore M (2002) Income concentration and market demand. Oxford Econ Papers 54:584–596

Chakravarty SR, Majumder A (1990) Distribution of personal income: development of a new model and its application to U.S. Income Data. J Appl Econ 5:189–196

Creedy J, Gemell N (2004) The built-in flexibility of income and consumption taxes. J Econ Surv 16:509–532

Dardanoni V, Lambert PJ (2002) Progressivity comparisons. J Publ Econ 86:99–122

Esteban J (1986) Income share elasticity and the size distribution of income. Intern Econ Rev 27:439–444

Fellman J (1976) The effect of transformations of Lorenz curves. Econometrica 44:823–824

Hart O, Holström B (1987). The theory of contracts. In: Bewley TF (eds). Advances in economic theory. Fifth world congress, econometric society monographs no. 12. Cambridge University Press, Cambridge, pp 71–155

Hayes KJ, Lambert PJ, Slottje DJ (1995) Evaluating effective income tax progression. J Publ Econ 56:461–474

Hemming R, Keen MJ (1983) Single crossing conditions in comparisons of tax progressivity. J Publ Econ 20:373–380

Hirshleifer J, Riley JG (1992) The analytics of uncertainty and information. Cambridge University Press, Cambridge

Jakobsson U (1976) On the measurement of the degree of progression. J Publ Econ 5:161–168

Johnson NL, Kotz S, Balakrishnan N (1994) Continuous univariate distributions, vol 1. Wiley, New York

Kakwani NC (1977) Applications of Lorenz curves in economic analysis. Econometrica 45:719–727

Latham R (1988) Lorenz dominating income tax functions. Intern Econ Rev 29:185–198

Lambert PJ (2001) The distribution and redistribution of income. Manchester University Press, Manchester

McDonald JB (1984) Some generalized functions for the size distribution of income. Econometrica 52:647–664

Moyes P (1999). Stochastic dominance and the Lorenz curve. In: Silber J (eds). Handbook of income inequality measurement. Kluwer, Boston, 199–226

Moyes P, Shorrocks A (1998) The impossibility of a progressive tax structure. J Publ Econ 69:49–65

Shorrocks AF (1983) Ranking income distributions. Economica 50:3–17

Shorrocks AF, Foster J (1987) Transfer sensitive inequality measures. Rev Econ Stud 54:485–497

Zoli C (2002) Inverse stochastic dominance, inequality measurement and Gini indices. J Econ 9(Suppl):119–161

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Benassi, C., Chirco, A. Income Share Elasticity and Stochastic Dominance. Soc Choice Welfare 26, 511–525 (2006). https://doi.org/10.1007/s00355-006-0089-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-006-0089-z