Abstract

A classic result in the theory of incentive compatibility is Hurwicz (Decision and organization: a volume in honor of Jacob Marschak, 1972). The paper showed that strategy-proof (SP), Pareto-efficient and individually rational social choice functions do not exist in two-good, two-agent exchange economies. This result has been extended in several ways, for instance, to arbitrary numbers of agents and goods and to restricted domains. In this paper, we extend the result to economies with production. We consider a two-good economy with a single public good that can be produced from a private good according to a convex cost function. Agents have initial endowments of the private good. We show that SP, Pareto-efficient, individually-rational and continuous social choice functions do not exist in this environment. Pareto-efficiency, individual rationality and continuity axioms apply only to a “small” domain of preferences parametrized by a real number.

Similar content being viewed by others

Notes

In their model, although production of the public good does not appear explicitly, it can be embedded without loss of generality in a model with endowments and a linear production technology.

The no-exploitation condition can be regarded as weak. However our model and assumptions allow for the possibility of its violation. On the other hand, we impose a continuity assumption albeit on a specific sub-domain. Our results are therefore independent of (Serizawa (1996)and Deb and Ohseto (1999)).

We would like to the thank the Associate Editor for bringing this to our attention.

The absolute value of the slope of \(IC(\theta _i,b)\) at point \(b\) is strictly greater than the absolute value of the slope of \(L(a,b)\).

The absolute value of the slope of \(IC(\theta _i,b)\) at point \(b\) is strictly greater than the absolute value of the slope of \(L(a,b)\).

\(\text {Int}\ S\) denotes the interior of set \(S\).

\(L(d^{\prime },c)\) is downward sloping since \(d^{\prime }\) is chosen such that the level of public good at \(d^{\prime }\) is strictly greater than \(M\) which is the level of public good at \(c\). Also the level of private good at \(d^{\prime }\) is strictly less than the level of private good at \(c\).

Note that if Curve \(A\) is vertical, then our claim is trivially true.

Note that in this case, condition (iv) of Lemma 3 is satisfied trivially because \(L(e,h)\) is upward sloping.

The domain \({\mathcal {D}}\) is a single-crossing domain. These properties hold generally for such domains—for details see Goswami (2013).

References

Barberà S, Jackson M (1995) Strategy-proof exchange. Econometrica 63:51–87

Beviá C, Corchón L (1995) On the generic impossibility of truthful behavior: a simple approach. Econ Theory 6:365–371

Campbell DE, Truchon M (1988) Boundary optima and the theory of public goods supply. J Pub Econ 35:241–249

Corchón LC, Rueda-Llano J (2008) Differentiable strategy-proof mechanisms for private and public goods in domains that are not necessarily large or quasi-linear. Rev Econ Des 12:279–291

Deb R, Ohseto S (1999) Strategy-proof and individually rational social choice functions for public good economies: a note. Econ Theory 14:685–689

Goswami MP (2013) Non fixed-price trading rules in single-crossing classical exchange economies. Soc Choice Welf 44:1–34

Goswami MP, Mitra M, Sen A (2014) Strategy proofness and Pareto efficiency in quasilinear exchange economies. Theor Econ 9:361–381

Hashimoto K (2008) Strategy-proofness versus efficiency on the Cobb-Douglas domain of exchange economies. Soc Choice Welf 31:457–473

Hurwicz L (1972) On informationally decentralized systems. In: McGuire CB, Radner Roy (eds) Decision and organization: a volume in honor of Jacob Marschak. North-Holland, Amsterdam

Hurwicz L, Walker M (1990) On the generic nonoptimality of dominant-strategy allocation mechanisms: a general theorem that includes pure exchange economies. Econometrica 58:683–704

Jackson MO (2003) Mechanism theory. Optimization andoperations. In: Derigs U (ed) Encyclopedia of life support systems. EOLSS, Oxford

Moulin H (1980) On strategy-proofness and single peakedness. Pub Choice 35:437–455

Nicoló A (2004) Efficiency and truthfulness with Leontief preferences. A note on two-agent, two-good economies. Rev Econ Des 8:373–382

Rudin W (1976) Principles of mathematical analysis, vol 3. McGraw-Hill, New York

Saporiti A (2009) Strategy-proofness and single-crossing. Theor Econ 4:127–163

Satterthwaite MA, Sonnenschein H (1981) Strategy-proof allocation mechanisms at differentiable points. Rev Econ Stud 48(4):587–597

Serizawa S (1996) Strategy-proof and individually rational social choice functions for public good economies. Econ Theory 7:501–512

Serizawa S (2002) Inefficiency of strategy-proof rules for pure exchange economies. J Econ Theory 106:219–241

Serizawa S (2006) Pairwise strategy-proofness and self-enforcing manipulation. Soc Choice Welf 26:305–331

Serizawa S, Weymark JA (2003) Efficient strategy-proof exchange and minimum consumption guarantees. J Econ Theory 109:246–263

Tian G (1996) On the existence of optimal truth-dominant mechanisms. Econ Lett 53:17–24

Weymark JA (2011) A unified approach to strategy-proofness for single-peaked preferences. SERIEs 2:529–550

Zhou L (1991) Inefficiency of strategy-proof allocation mechanisms in pure exchange economies. Soc Choice Welf 8:247–254

Acknowledgments

We wish to thank Anirban Bose, Siddharth Chatterjee, Debasis Mishra, Swaprava Nath, Shigehiro Serizawa and John Weymark for useful discussions. In addition, we are also grateful to two referees and an Associate Editor of the journal for several helpful comments and suggestions. Mridu Prabal Goswami also thanks the Council for Higher Education, Israel for a PBC Fellowship.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

We provide a formal proof of Lemma 3.

Proof

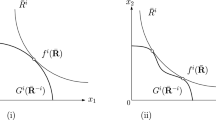

Let \((x_i^{\prime },y^{\prime }),(x_i^{\prime \prime },y^{\prime \prime })\in \mathfrak {R}_+^{2}\) and \(\theta _i,\theta _i^{\prime }\) be specified in accordance with the statement of Lemma 3. Assume without loss of generality, \(x_i^{\prime }<x_i^{\prime \prime }\) and \(y^{\prime }>y^{\prime \prime }\). We note that \(\theta _i<\theta _i^{\prime }\), in all the sections where Lemma 3 is used.

In Fig. 9, the points \((x_i^{\prime },y^{\prime })\) and \((x_i^{\prime \prime },y^{\prime \prime })\) are denoted by \(a\) and \(b\) respectively. Let \(L(a,b)\) denote the line joining \(a\) and \(b\). The point of intersection of \(L(a,b)\) and the \(y\) axis is denoted by \(c\). In view of our hypothesis, \(IC(\theta _i,a)\) is not tangential to \(L(a,b)\) at \(a\), i.e it must intersect \(L(a,b)\) at \(a\).

Choose \(\tilde{\theta }\) such that \(\tilde{\theta }> \theta _i^{\prime }\). A direct computation of slopes at \(a\) reveals that \(IC(\tilde{\theta },a)\) cuts \(IC(\theta _i,a)\) from above at \(a\). Also, \(IC(\tilde{\theta },b)\) cuts \(IC(\theta _i^{\prime },b)\) from above at \(b\).Footnote 14

We denote the absolute value of the slope of \(L(a,b)\) by \(\bar{c}\). In view of our hypothesis, specifically condition (iv) we have,

Thus we can choose \(\hat{\theta }\) such that \(\theta _i>\hat{\theta }>2\bar{c}\sqrt{x_i^{\prime \prime }}\). It follows from our construction that \(IC(\hat{\theta },b)\) cuts \(L(a,b)\) from above at \(b\).

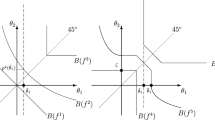

The parameters \(\tilde{\theta }\) and \(\hat{\theta }\) chosen above can be used to construct a preference \(R_i\) which is a concavification of \(\theta _i\) at \((x_i^{\prime },y^{\prime })\) and \(\theta _i^{\prime }\) at \((x_i^{\prime \prime },y^{\prime \prime })\). The regions \(G_1\) and \(G_2\) are indicated in Fig. 10. An additional parameter \(t\) is computed as follows.

Pick an arbitrary \((x_i,y)\in G_1\). Let \(h= (x_i(h),y(h))\) be such that

-

(i)

\(\tilde{\theta }\sqrt{x_i}+y=\tilde{\theta }\sqrt{x_i(h)}+y(h)\) and

-

(ii)

\([(x_i(h)<x_i^{\prime \prime }, y(h)>y^{\prime \prime })\ \text {and} (x_i(h),y(h))\ \text {lies on}\ L(c,b)]\) or \([x_i(h)\ge x_i^{\prime \prime }, y(h)=y^{\prime '}]\).

Let \(t=\frac{x_i(h)}{x_i^{\prime }}\). The preference ordering \(R_i\) is defined below.

We omit the verification of the following facts.

-

(i)

\(R_i\) is a classical preference.

-

(ii)

It concavifies \(\theta _i\) at \((x_i^{\prime },y^{\prime })\) and \(\theta _i^{\prime }\) at \((x_i^{\prime \prime },y^{\prime \prime })\).

Requirement (iv) in the statement of Lemma 3 ensures that the indifference curves for \(R_i\) do not intersect each other. \(\square \)

Rights and permissions

About this article

Cite this article

Goswami, M.P., Sen, A. & Yadav, S. A Hurwicz type result in a model with public good production. Soc Choice Welf 45, 867–887 (2015). https://doi.org/10.1007/s00355-015-0888-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-015-0888-1