Abstract

We build a political competition model to analyze the welfare effect of campaign finance policies in a context where parties spend campaign contributions on mobilizing voters—rather than on advertising, as is usually done in this literature. This modification results in key consequences for the welfare evaluation of campaign finance policies. Additionally, we measure the social cost of contributions in terms of the quality lost on public works delivered by contributors. We find that subsidizing campaigns with public funds and simultaneously banning contributions is welfare-improving for citizens only if the parties’ mobilization technology is not especially productive. Combining non-matching subsidies with limits on contributions is Pareto improving under same technological conditions. Imposing a contribution lump-sum tax, while simultaneously investing these revenues on public projects is welfare-improving for citizens, and combining this policy with a limit on contributions is Pareto improving. These tax results hold regardless of parties’ mobilization productivity level.

Similar content being viewed by others

Notes

Under non-directly informative advertising, voters are influenced by ads, not because of the messages they transmit but because of the amount of money spent on them (see Milgrom and Roberts (1986)). Under directly informative advertising, ads transmit verifiable information to voters that cannot be falsified (see Tirole and Jean (1988) for a survey).

Cotton (2009) analyzes the effect of taxing contributions on constituents’ welfare under a different context; namely, one where politicians decide whether to sell policy favors or sell access to influence a unidimensional policy. This affects citizens’ welfare, inasmuch as the contributions only benefit politicians and not citizens.

One could consider that there is more than one contractor willing to contribute to each party. We discuss it below.

A relative parameter for this valuation can be introduced in the model, without affecting the qualitative results.

More precisely, we assume that \(e\in (0,4{\bar{\alpha }}]\). This guarantees that the amount of the campaign contribution determined between a party and a contractor is not zero. Only citizens with a high cost of voting and a moderate ideology are expected to abstain from voting if e is too high. Since mobilizing these citizens is too costly, parties will prefer zero contributions in this case. This is formally shown in the proof for Proposition 1 in the Appendix.

Glaeser et al. (2005) find that only 45% of citizens who declare themselves as independent vote at the Presidential elections in USA, whereas 80% of citizens who strongly identify themselves as partisan do. Hortala-Vallve and Esteve-Volart (2011) find that the probability that a citizen with stronger positions on a liberal-conservative scale votes is noticeably greater than the respective probability for their more ideologically neutral counterparts in the U.S.

Determining whether interest groups have incentives to donate to just one campaign versus more than one is beyond the scope of this paper. These questions have been already addressed in the first wave of the literature on campaign contributions (see Morton and Cameron 1992, for a survey on this literature.)

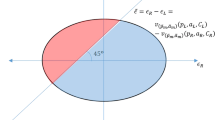

This can be formally derived by assuming that, between stages 4 and 5, party L gets an additive valence shock \(\phi\), which is uniformly distributed on the interval \([-\frac{1}{2},\frac{1}{2}]\). If this happens, the probability of victory of party L is given by \(\rho (C_L,C_R)=Pr\left[ \frac{V_L}{T} + \phi \ge \frac{1}{2} \right] =\frac{V_L}{T}\). Consequently, \(1-\rho (.)\) is the probability of victory of party R.

Using the log of the vote share of each party, this effect for party L is given by \(\frac{\partial ln\rho }{\partial \alpha (C_L)} \frac{\partial \alpha (C_L)}{\partial C_L}= \frac{{\hat{\gamma }}}{V_L} (1-\rho )\frac{\partial \alpha (C_L)}{\partial C_L}>0\). The effect for party R is given by \(\frac{1-{\hat{\gamma }}}{V_R}\rho \frac{\partial \alpha (C_R)}{\partial C_R}>0\).

Using the log of the vote share of each party, this effect for party L is given by \(\frac{\partial ln\rho }{\partial {\hat{\gamma }}} \frac{\partial {\hat{\gamma }}}{\partial C_L}= \frac{1}{V_L} \left[ \alpha (C_L)+e({\hat{\gamma }}-\frac{1}{2}) \right] \frac{\partial {\hat{\gamma }}}{\partial C_L}-\frac{1}{T}[\alpha (C_L)-\alpha (C_R)]\frac{\partial {\hat{\gamma }}}{\partial C_L}<0\). The effect for party R is given by \(-\frac{1}{V_R} \left[ \alpha (C_R)+e({\hat{\gamma }}-\frac{1}{2}) \right] \frac{\partial {\hat{\gamma }}}{\partial C_R}-\frac{1}{T}[\alpha (C_L)-\alpha (C_R)]\frac{\partial {\hat{\gamma }}}{\partial C_R}\). The sign of the first term is negative and the sign of the second one is non-negative; so the final effect is ambiguous. In a symmetric equilibrium, this second term and the second one in the effect of party L become zero.

As anticipated above, since the equilibrium is symmetric, the effect of campaign contributions on T through the sympathizer channel becomes zero.

This proof is available upon request.

These proofs are available upon request.

These results are available upon request.

References

Aldashev G (2015) Voter turnout and political rents. J Pubic Econ Theory 17(4):528–552

Ashworth S (2006) Campaign finance and voter welfare with entrenched incumbents. Am Polit Sci Rev 100(1):55–68

Austen-Smith D (1987) Interest groups, campaign contributions, and probabilistic voting. Public Choice 54(2):123–139

Baron D (1994) Electoral competition with informed and uninformed voters. Am Polit Sci Rev 88(1):33–47

Boas TC, Hidalgo FD, Richardson NP (2014) The spoils of victory: campaign donations and government contracts in Brazil. J Polit 76(2):415–429

Bombardini M, Trebbi F (2020) Empirical models of lobbying. Ann Rev Econ 12:391–413

Brennan G, Hamlin A (1998) Expressive voting and electoral equilibrium. Public Choice 95(1–2):149–175

Coate S (2004a) Pareto-improving campaign finance policy. Am Econ Rev 94(3):628–655

Coate S (2004b) Political competition with campaign contributions and informative advertising. J Eur Econ Assoc 2(5):772–804

Cotton C (2009) Should we tax or cap political contributions? A lobbying model with policy favors and access. J Public Econ 93:831–842

Falguera E, Jones S, Ohman M (2014) Funding of political parties and election campaigns: a handbook on political finance. Idea

Fiorina MP (1976) The voting decision: instrumental and expressive aspects. J Polit 38(2):390–413

Gerber A (1996) Rational voters, candidate spending, and incomplete information: a theoretical analysis with implications for campaign finance reform. Yale University, Tech. rep.

Glaeser EL, Ponzetto GA, Shapiro JM (2005) Strategic extremism: why republicans and democrats divide on religious values. Q J Econ 120(4):1283–1330

Grossman G, Helpman E (1996) Electoral competition and special interest policies. Rev Econ Stud 63:265–286

Herrera H, Levine DK, Martinelli C (2008) Policy platform, campaign spending and voter participation. J Public Econ 92:501–513

Hillman AL (2010) Expressive behavior in economics and politics. Eur J Polit Econ 26(4):403–418

Hortala-Vallve R, Esteve-Volart B (2011) Voter turnout in a multidimensional policy space. Econ Gov 12(1):25–49

Milgrom P, Roberts J (1986) Price and advertising signals of product quality. J Polit Econ 94:796–821

Morton R, Cameron C (1992) Elections and the theory of campaign contributions: a survey and critical analysis. Econ Politics 1:79–108

Potters J, Sloof R, Van Winden F (1997) Campaign expenditures, contributions and direct endorsements: the strategic use of information and money to influence voter behavior. Eur J Polit Econ 13(1):1–31

Prat A (2000) Campaign spending with office-seeking politicians, rational voters, and multiple lobbies. J Econ Theory 103(1):162–189

Prat A (2002) Campaign advertising and voter welfare. Rev Econ Stud 69:999–1017

Ruiz NA (2017) The Power of Money. Tech. rep, The Consequences of Electing a Donor Funded Politician. https://doi.org/10.2139/ssrn.3123592

Schnakenberg KE (2017) Informational lobbying and legislative voting. Am J Polit Sci 61(1):129–145

Schuessler AA (2000) Expressive voting. Ration Soc 12(1):87–119

Tirole J, Jean T (1988) The theory of industrial organization. MIT Press, Cambridge

Acknowledgements

We thank Andrés Zambrano and Marcela Eslava for very useful comments and discussions. We also thank participants at 2018 Annual Colombian Economics Conference, 2019 Annual Meetings of the Association for Public Economic Theory, 2019 Latin American and Caribbean Economic Association Annual Meeting and 2021 Journées Louis-André Gérard-Varet. Finally, we would like to thank our editor and 3 anonymous referees for their helpful comments that greatly improved the manuscript.

Funding

The authors received no financial support for the research, authorship, and/or publication of this article.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and analysis. All authors wrote, read and approved the final manuscript and all previous versions.

Corresponding author

Ethics declarations

Conflict of interest

The authors Oskar Nupia and Francisco Eslava certify that they have no affiliations with or involvement in any organization or entity with any financial interest (such as honoraria; educational grants; participation in speakers’ bureaus; membership, employment, consultancies, stock ownership, or other equity interest; and expert testimony or patent-licensing arrangements), or non-financial interest (such as personal or professional relationships, affiliations, knowledge or beliefs) in the subject matter or materials discussed in this manuscript.

Availability of data and material

Not applicable.

Code availability

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof for Proposition 1

We already know from the discussion in the main text that: (1) \(s_{(\gamma ,x)}^*=L\) if \(\gamma \le {\hat{\gamma }}\), and \(s_{(\gamma ,x)}^*=R\) otherwise; (2) \(\nu _{(\gamma ,x)}^*=0\) if \(e\left| \frac{1}{2}-\gamma \right| <x-\alpha (C_k)\), and \(\nu _{(\gamma ,x)}^*=1\) otherwise; and (3) contractor 1 chooses A if and only if (10) holds, and N otherwise, and contractor 2 chooses A if and only if (11) holds, and N otherwise.

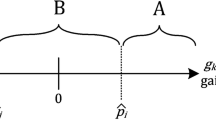

Let us now consider parties’ contribution offers. We begin by considering interior solutions. Solving the programs in (12) and (13), and assuming that the respective constraints are not binding, the parties’ optimal campaign contribution offers are implicitly defined by \(\frac{\partial V_L(.)}{\partial C_L}=\frac{\partial T(.)}{\partial C_L}\rho\), and \(\frac{\partial V_R(.)}{\partial C_R}=\frac{\partial T(.)}{\partial C_R}(1-\rho )\). We show first that at an interior equilibrium, \(C_L=C_R\). Using Eqs. (6), (7) and (8) to compute \(\frac{\partial V_L}{\partial C_L}\), \(\frac{\partial V_R}{\partial C_R}\), \(\frac{\partial T}{\partial C_L}\), and \(\frac{\partial T}{\partial C_R}\), by plugging these derivatives into the equilibrium conditions, and taking into account that \(-\frac{\partial {\hat{\gamma }}}{\partial C_L}=\frac{\partial {\hat{\gamma }}}{\partial C_R}=\frac{\delta }{2}\frac{\partial q}{\partial I}\), the equilibrium conditions can be written as:

\(\square\)

Combining (1A) and (2A), it follows that at an interior equilibrium:

Assume that at equilibrium, \(C_L<C_R\). If this happens, the following three facts are true: First, \({\hat{\gamma }}>\frac{1}{2}\). Second, it follows from the properties of \(\alpha (.)\) that \(\frac{\partial \alpha (C_L)/\partial C}{\partial \alpha (C_R)/\partial C}\ge 1\). Finally, it follows from the properties of q(.) that \(\frac{\partial q(I^0-C_L)/\partial I}{\partial q(I^0-C_R)/\partial I}\le 1\). Combining these three facts, it follows that \(\frac{\partial \alpha (C_L)/\partial C}{\partial \alpha (C_R)/\partial C}{\hat{\gamma }}> \frac{\partial q(I^0-C_L)/\partial I}{\partial q(I^0-C_R)/\partial I}(1-{\hat{\gamma }})\), which based on Eq. (3A) implies that \(\rho >1-\rho\). Therefore, party R will be better off by deviating to \(C_R=C_L\), where \(\rho =\frac{1}{2}\). Consequently, \(C_L<C_R\) cannot happen at an interior equilibrium. Following the same steps, it can also be proved that \(C_R<C_L\) never happens. To do so, some adjustment to our computations are required. Since the assumption that \(C_R\le C_L\) implies that \({\hat{\gamma }}\le \frac{1}{2}\), Eqs. (6), (7), and (8) change: one must replace \(C_L\) by \(C_R\) and vice versa in all these equations. Hence, \(C_R=C_L\) at equilibrium. Using this fact, the conditions in Eqs. (1A) and (2A) reduce to Eq. (14). The concavity of \(\alpha (.)\) and q(.) are not enough to guarantee that \(C^*\) represents a maximum. It can be proved that \(\frac{\partial ^2 B_k}{\partial C^2}<0\) if \(e\le 4{\bar{\alpha }}\) (recall that \(B_L=\rho\), and \(B_R=1-\rho\)). From here, we get the restriction on the upper bound of e.

We now prove that this equilibrium exists and is unique. It can be verified that the left-hand side function in Eq. (14) is a continuous strictly increasing function of C that goes from \(\delta \lim _{I\rightarrow 1}\frac{\partial q}{\partial I}\in [0,\infty )\) (as C goes to zero) to infinity (as C goes to \(I^0\)). It can be also verified that the right-hand side function in Eq. (14) is a continuous, strictly decreasing function of C, that goes from infinity (as C goes to zero) to \(\frac{1}{2}\frac{a}{\alpha (I^0)}\) (as C goes to \(I^0\)), where \(a>\lim _{C_k\rightarrow 1}\frac{\partial \alpha }{\partial C_k}\), and \(\alpha (I^0)<{\bar{\alpha }}\). Therefore, the marginal cost and the marginal benefit of contributions always cross each other at some unique point \(C^*\in (0,I^0)\), meaning that an interior equilibrium always exists. Furthermore, this is unique.

Let us now consider corner solutions. First, assume that both (10) and (11) are binding—i.e., both hold with equality—and that at equilibrium \(C_L<C_R\). This last inequality holds if and only if \(\frac{C_L}{\mu +C_L}<\frac{C_R}{\mu +C_R}\), which in turn implies that \(\rho <1-\rho\). Thus, party L has incentive to increase \(C_L\) and consequently it cannot be an equilibrium. Following the same steps, and keeping in mind the change mentioned above on Eqs. (6), (7), and (8), it can be also proved that \(C_R<C_L\) never happens. Hence, in this case, \(C_L^{*}=C_R^{*}\). Using this result and the constraints in Eqs. (10) and (11) with equality, it follows that \(C_L^{*}=C_R^{*}=\mu\). Due to symmetry, the case where only one contractor’s constraint binds cannot be an equilibrium. If there exist a \(C_L^*\) such that (1A) holds with equality, then \(C_R=C_L^*\) also satisfies Eq. (2A) and vice versa.

Proof for Proposition 2

-

(a)

We already know from the main text that, regardless of the value of \(\alpha (C^*)\), a small reduction in contributions below \(C^*\) leaves unchanged the payoffs of parties and contractors 3 to n; and increase the payoffs of contractors 1 and 2, and always-abstainers. Assuming that \(\alpha (C^*)<\frac{1}{2}\), we now analyze how this reduction affects the welfare of the rest of the citizens. Imposing this assumption and using Eq. (14), it follows that \(\frac{\partial \alpha (C^*)}{\partial C}<\delta \frac{\partial q(I^0-C^*)}{\partial I}\). Consider first always-voters. The change in their payoffs where there is a small reduction in contributions below \(C^*\) is given by \(\delta \frac{\partial q(I^0-C^*)}{\partial I}\)-\(\frac{\partial \alpha (C^*)}{\partial C}\). The assumption on \(\alpha (C^*)\) guarantees that this change is positive.

Let us now consider switchers. As there is a small reduction in contributions from \(C^*\) to \(C'\), switchers are also confronted with loses and gains. On the one hand, since \(e\left| \frac{1}{2}-\gamma \right| -x+\alpha (C')<0\) and \(e\left| \frac{1}{2}-\gamma \right| - x + \alpha (C^*)\ge 0\), it follows that switchers’ voting costs satisfy the following conditions: \(e\left| \frac{1}{2}-\gamma \right| + \alpha (C')<x\le e\left| \frac{1}{2}-\gamma \right| + \alpha (C^*)\). Consequently, as contributions go from \(C^*\) to \(C'\), the maximum payoff lost by a switcher is given by \(\alpha (C^*)-\alpha (C')\), while the minimum payoff lost by a switcher is zero. On the other hand, switchers’ gains as contributions are reduced are given by \(\delta [q(I^0-\alpha (C'))-q(I^0-\alpha (C^*))]\). Comparing losses and gains, it follows that the total payoff for switchers increases as contributions are reduced if and only if \(\frac{\partial \alpha (C^*)}{\partial C}<\delta \frac{\partial q(I^0-C^*)}{\partial I}\). Hence, we conclude that contributions \(C^*\) are Pareto inefficient if \(\alpha (C^*)<\frac{1}{2}\), and that a small reduction in contributions below \(C^*\) Pareto dominates unrestricted contributions.

-

(b)

Assume now that \(\alpha (C^*)\ge \frac{1}{2}\), which from Eq. (14) implies in turn that \(\frac{\partial \alpha (C^*)}{\partial C}\ge \delta \frac{\partial q(I^0-C^*)}{\partial I}\). As we already know from the main text, regardless of the value of \(\alpha (C^*)\), there is no contribution \(C\in (C^*,1)\) that Pareto dominates \(C^*\); increasing contributions above \(C^*\) to any value in this interval always has a negative effect on the welfare of always-abstainers and contractors 1 and 2. Nevertheless, it is important to notice that following the same arguments used in the proof for Proposition 2(a), and due to the initial assumption on \(\alpha (C^*)\), a small increment of contributions above \(C^*\) is welfare improving for always-voters and switchers.

By the same token, it follows that any symmetric reduction in contributions in the interval \([0,C^*)\) negatively affects the payoffs of always-voters and switchers, although it improves the welfare of always-abstainers and contractors 1 and 2. Hence, \(C^*\) is not Pareto dominated by any other contribution amount \(C\in [0,1]\) if \(\alpha (C^*)\ge \frac{1}{2}\). \(\square\)

Proof for Proposition 3

Suppose that \({\bar{\alpha }}<1/2\).

-

(a)

We can anticipate from our discussion in Sect. 4 that banning contributions is welfare-improving for always-abstainers (those who abstain from voting when \(C=C^*\) and \(C=0\)), and for contractors 3 to n—their expected payoff increases from zero to \(\mu /n>0\). The effect of banning contributions on the payoffs for contractors 1 and 2 is ambiguous, and depends not only on \(\delta\), but also on n—their payoffs go from \(\frac{1}{2}(\mu -C^*)\) to \(\mu /n\).

Consider always-voters and switchers. The change in the payoff for always-voters as contributions are banned is given by \(1-\delta q(I^0-C^*)-\alpha (C^*)\). Therefore, banning contributions is welfare-improving for always-voters if and only if \(1-\delta q(I^0-C^*)>\alpha (C^*)\); otherwise, it is not. The change in the payoff for switcher as contributions are banned is given by \(1-\delta q(I^0-C^*)-\alpha (C^*)+e\left| \frac{1}{2}-\gamma \right| -x\). Since they end up not voting in this case, it follows that \(e\left| \frac{1}{2}-\gamma \right| -x<0\). Hence, banning contributions is also welfare-improving for switchers if and only if \(1-\delta q(I^0-C^*)>\alpha (C^*)\); otherwise, it is not. The first statement in Proposition 3(a) follows from the fact that \({\bar{\alpha }}>\alpha (C^*)\).

-

(b)

The properties of q(.) and \(\alpha (.)\) and the assumption that \({\bar{\alpha }}<1/2\) ensure that there always exist a \(C^E\in (0,C^*)\) such that \(\frac{\partial \alpha (C^E)}{\partial C}=\delta \frac{\partial q(I^0-C^E)}{\partial I}\). Combining this with the result in Proposition 2(a), it follows that reducing contributions from \(C^*\) to any \({\bar{C}}\in [C^E,C^*)\) Pareto dominates unrestricted contributions. Furthermore, \(C^E\) Pareto dominates any other limit in the interval \([C^E,C^*)\).

\(\square\)

Proof for Proposition 4

Suppose that \({\bar{\alpha }}<1/2\).

a) Consider funding campaigns with public resources \(\beta \in (0,C^*)\), while simultaneously banning contributions. We already know that banning contributions is welfare-improving for contractors 3 through n, and has an ambiguous effect on the payoffs for contractors 1 and 2. Furthermore, subsidizing campaigns while simultaneously banning contributions is welfare-improving for always-abstainers if and only if \(\beta <C^*\).

Computing the change in the payoffs for always-voters as we move away from unrestricted campaign contributions towards this policy, it follows that doing so is welfare-improving for them if and only if \(\delta [q(I^0-\beta )-q(I^0-C^*)]>\alpha (C^*)-\alpha (\beta /2)\); otherwise, it is not. Using the same arguments used in the proof for Proposition 3(a), it can be shown that this policy is also welfare-improving for switchers if this inequality holds; otherwise, it is not. The first statement in Proposition 4(a) follows from the fact that \({\bar{\alpha }}>\alpha (C^*)\).

Whether or not there exist at least one \(\beta <C^*\) such that \({\bar{\alpha }}<\delta [q(I^0-\beta )-q(I^0-C^*)]+\alpha (\beta /2)\), critically depends on the specific form of both, \(\alpha (.)\) and q(.). The value of \(\beta\) that maximizes the payoff for always-voters under this policy, \(\beta ^*\), is implicitly given by \(\delta \frac{\partial q(I^0-\beta ^*)}{\partial I}=\frac{1}{2}\frac{\partial \alpha (\beta ^*/2)}{\partial C}\). The condition \(\frac{1}{2}\frac{\partial \alpha (C/2)}{\partial C}<\frac{\partial \alpha (C)}{\partial C}\) guarantees that \(\beta ^*<C^*\). If this happens, then \(\frac{1}{2}\frac{\partial \alpha (C^*/2)}{\partial C}<\frac{1}{2\alpha (C^*)}\frac{\partial \alpha (C^*)}{\partial C}\). Using the equilibrium condition in Eq. (14), it follows that \(\frac{1}{2}\frac{\partial \alpha (C^*/2)}{\partial C}<\delta \frac{\partial q(I^0-C^*)}{\partial I}\). Since \(\beta ^*\) equalizes these two terms, it must be the case that \(\beta ^*<C^*\). This guarantees that implementing \(\beta ^*\) is welfare-improving for always-abstainers. Furthermore, at least \(\beta ^*\) is welfare-improving for always-voters and switchers if \({\bar{\alpha }}<\delta [q(I^0-\beta ^*)-q(I^0-C^*)]+\alpha (\beta ^*/2)\).

b) Consider funding campaigns with public resources \({\tilde{\beta }}\in (0,1]\), while simultaneously imposing a contribution limit \({\tilde{C}}\in (0,C^*)\), with \({\tilde{\beta }}+{\tilde{C}}<C^*\). We already know that limiting contributions is welfare-improving for contractors 1 and 2, and does not affect the payoffs of contractors 3 through n. Subsidizing campaigns while simultaneously limiting contributions is welfare-improving for always-abstainers if and only if \({\tilde{C}}+\beta <C^*\).

Computing the change in the always-voters’ payoffs as we move away from unrestricted campaign contributions towards this policy, it follows that doing so is welfare-improving for them if and only if \(\delta [q(I^0-{\tilde{\beta }}-{\tilde{C}})-q(I^0-C^*)]>\alpha (C^*)-\alpha ({\tilde{C}}+{\tilde{\beta }}/2)\); otherwise, it is not. Using the same arguments used in the proof for Proposition 3(a), it can be shown that this policy is also welfare-improving for switchers if this inequality holds; otherwise, it is not. The first statement in Proposition 4(b) follows from the fact that \({\bar{\alpha }}>\alpha (C^*)\).

Let us now assume that subsidizing campaigns with \(\beta ^*\)—defined as in Proposition 4(a)—while simultaneously banning contributions is welfare-improving for all groups of citizens. Take \({\tilde{C}}+{\tilde{\beta }}=\beta ^*<C^*\). It then follows that \(q(I^0-{\tilde{C}}-{\tilde{\beta }})+\alpha (\frac{{\tilde{C}}+{\tilde{\beta }}}{2})>\delta q(I^0-C^*)+\alpha (C^*)\). Since \(\alpha (\frac{{\tilde{C}}+{\tilde{\beta }}}{2})<\alpha ({\tilde{C}}+\frac{{\tilde{\beta }}}{2})\), and \({\bar{\alpha }}>\alpha (C^*)\), it follows that \({\bar{\alpha }}<\delta [q(I^0-{\tilde{C}}-{\tilde{\beta }})-q(I^0-C^*)]+\alpha ({\tilde{C}}+{\tilde{\beta }}/2)\). This guarantees that (\({\tilde{C}},{\tilde{\beta }}\)), with \({\tilde{C}}+{\tilde{\beta }}=\beta ^*\) is Pareto improving. Furthermore, there exists an infinite number of policies (\({\tilde{C}},{\tilde{\beta }}\)) that do the same job. \(\square\)

Proof for Proposition 5

Suppose that \({\bar{\alpha }}<\frac{1}{2}\).

-

(a)

Let us allow for unrestricted contributions, impose a lump-sum tax \(\tau \in (0,{\bar{\tau }})\) on contributions, and invest \(\tau\) in the public-works project. \({\bar{\tau }}\)—defined below—is the maximum rate where the unrestricted contributions at equilibrium are interior. Consider imposing the tax on parties. The voting subsidy is then given by \(\alpha (C_k-\tau )\), and the quality of the public-works project is given by \(\delta q(I^0-C_k+2\tau )\). Following the same steps used to compute the optimal unrestricted contributions without taxes, it follows that the contributions with taxes at equilibrium are such that \(C^{\tau }_k=C^{\tau }\), and are implicitly given by:

$$\begin{aligned} \delta \frac{\partial q\left( I^0-C^{\tau }+2\tau \right) }{\partial I}=\frac{1}{2\alpha \left( C^{\tau }-\tau \right) }\frac{\partial \alpha \left( C^{\tau }-\tau \right) }{\partial C}\quad \quad \quad \quad (\hbox {5A}) \end{aligned}$$

Following the same arguments used in the Proof for Proposition 1, one can prove that this equilibrium always exists and is unique. Using the implicit function theorem in Eq. (5A), it follows that \(\partial C^{\tau }/\partial \tau \in (1,2)\) and, consequently, that \(C^{\tau }-\tau\) also increases as \(\tau\) does. Hence, the maximum \(\tau\) that can be imposed to obtain an interior solution is implicitly defined by replacing \(C^\tau\) by \(\mu\) in Eq. (5A). Moreover, increasing \(\tau\) beyond \({\bar{\tau }}\) leaves unrestricted contributions with taxes unchanged at \(\mu\).

We now prove that \(C^{\tau }-2\tau<C^*<C^{\tau }-\tau\). If this is true, then \(\alpha (C^{\tau }-\tau )>\alpha (C^*)\), and \(q(I^0-C^{\tau }+2\tau )>q(I^0-C^*)\). To do this, we use the following two facts. Fact 1: \(\alpha (C^*)=\frac{1}{2\delta }\frac{\partial \alpha (C^*)/\partial C}{\partial q(I^0-C^*)/\partial I}\), from the equilibrium condition in Eq. (14). Fact 2: \(\alpha (C^{\tau }-\tau )=\frac{1}{2\delta }\frac{\partial \alpha (C^{\tau }-\tau )/\partial C}{\partial q(I^0-C^{\tau }+2\tau )/\partial I}\), from the equilibrium condition in Eq. (5A). We first prove that \(C^*<C^{\tau }\). Assume it is not, i.e., \(C^*\ge C^{\tau }\). This assumption implies both that \(C^*>C^{\tau }-\tau\) and \(I^0 - C^*<I^0 -C^{\tau }+2\tau\). It follows from these two inequalities that \(\frac{\partial \alpha (C^*)}{\partial C}<\frac{\partial \alpha (C^{\tau }-\tau )}{\partial C}\), and \(\frac{\partial q(I^0 - C^*) }{\partial I}>\frac{\partial q(I^0 -C^{\tau }+2\tau ) }{\partial I}\). Combining these last two inequalities, and using Fact 1 and 2, it follows that \(\alpha (C^*)<\alpha (C^{\tau }-\tau )\). Nevertheless, from the initial assumption, we know that \(\alpha (C^*)>\alpha (C^{\tau }-\tau )\), which is a contradiction. Consequently, \(C^*<C^{\tau }\).

We now prove that \(C^*<C^{\tau }-\tau\). Assume that it is not, i.e., \(C^*\ge C^{\tau }-\tau\). From here, we can use the same steps used in the previous paragraph and prove that this implies that \(C^*<C^\tau -\tau\), which contradicts the initial assumption. Finally, we prove that \(C^{\tau }-2\tau <C^*\). Assume that it is not, i.e., \(C^{\tau }-2\tau \ge C^*\). It implies that \(\frac{\partial q(I^0 -C^{\tau }+2\tau ) }{\partial I}\ge \frac{\partial q(I^0 - C^*) }{\partial I}\). Moreover, since we already know that \(C^*<C^{\tau }-\tau\), it is true that \(\frac{\partial \alpha (C^{\tau }-\tau )}{\partial C}<\frac{\partial \alpha (C^*)}{\partial C}\). Combining these two inequalities and using Fact 1 and Fact 2, it follows that \(\alpha (C^{\tau }-\tau )<\alpha (C^*)\). Nevertheless, we know form the initial assumption that \(\alpha (C^{\tau }-2\tau )\ge \alpha (C^*)\), which is a contradiction. Consequently, \(C^{\tau }-2\tau <C^*\).

Consider now that the tax is imposed on contractors 1 and 2. As said in the main text, the voting subsidy is given by \(\alpha (C_k)\), while the quality of the public-works project is given by \(\delta q(I^0-C_k+\tau )\). It can be proved that the equilibrium is symmetric, always exists and is unique. Contributions at equilibrium are now implicitly given by:

The maximum \(\tau\) that can be imposed to obtain an interior solution is implicitly defined by replacing \(C^\tau\) by \(\mu -\tau\) in Eq. (6A). Using the same strategy used in the case where the tax was imposed on parties, it can be proved first that \(C^\tau -\tau <C^*\), and before that \(C^\tau >C^*\).

(b) Consider simultaneously imposing a campaign contribution limit \({\hat{C}}\in (0,C^*)\); a contribution lump-sum tax \({\hat{\tau }}\in (0,{\bar{\tau }})\), and then investing the resulting tax revenues on the public-works project. The voting subsidy and the quality of the project are now given by \(\alpha ({\hat{C}}-{\hat{\tau }})\), and \(q(I^0-{\hat{C}}+2{\hat{\tau }})\), as the tax is imposed on parties. Consider any policy \(({\hat{C}},{\hat{\tau }})\) with \({\hat{C}}-{\hat{\tau }}=C^E<C^*\), where \(C^E\) is defined as in Proposition 3. Consequently, \({\hat{C}}-2{\hat{\tau }}=C^E-{\hat{\tau }}\). It then follows that \(\alpha ({\hat{C}}-{\hat{\tau }})+q(I^0-{\hat{C}}+2{\hat{\tau }})>\alpha (C^E)+q(I^0-C^E)\). Since we already know from proposition 3(b) that \(\alpha (C^E)+q(I^0-C^E)>\alpha (C^*)+q(I^0-C^*)\), this policy is not only welfare-improving for all groups of citizens, but also gives them a greater payoff than the one obtained when just limiting contributions. Furthermore, this policy is welfare-improving for contractors 1 and 2, and does not affect the payoffs of the other contractors. Notably, there exist an infinite number of policies \(({\hat{C}},{\hat{\tau }})\) that satisfy \({\hat{C}}-{\hat{\tau }}=C^E\). The same can be proved if the tax is imposed on contractors 1 and 2, but with \({\hat{C}}=C^E\).

Rights and permissions

About this article

Cite this article

Nupia, O., Eslava, F. Campaign finance and welfare when contributions are spent on mobilizing voters. Soc Choice Welf 58, 589–618 (2022). https://doi.org/10.1007/s00355-021-01369-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-021-01369-0