Abstract

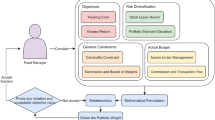

Index tracking belongs to one of the most important types of problems in portfolio management. In contrast to classical (active) portfolio management and optimization, passive portfolio management usually seeks to replicate a given index for a financial market. Due to transaction costs or legal or other practical limitation on the tradability of the respective assets, such indexes are often not fully replicated by a respective portfolio. Instead, one seeks to use a subset of the index assets (or other types of assets) to obtain a portfolio most similar to the index. This index tracking problem can be formulated as an optimization problem with respect to the minimization of the tracking error. In this article, we explore possibilities to solve the index tracking problem with invasive weed optimization (IWO), a rather new population-based metaheuristics algorithm. The complexity of this real-life problem and especially its solution space and restrictions require substantial adaptation of the original IWO algorithm. We explore different possibilities to adapt IWO to the considered type of problem. The adapted IWO method is tested using MSCI USA Value data, and systematic studies to find suitable parameter values are conducted. Although the method basically works well, the obtained results do not fully reach our intended benchmark. Reasons for that and possibilities for further improvement of the methodology are discussed.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Affolter K (2011) Financial portfolio engineering with invasive weed optimisation (IWO). BSc Thesis, University of Applied Sciences and Arts Northwestern Switzerland, Olten

Aiello S, Chieffe N (1999) International index funds and the investment portfolio. Financ Serv Rev 8:27–35

Beasley JE, Meade N, Chang TJ (2003) An evolutionary heuristic for the index tracking problem. Eur J Oper Res 148(3):621–643

Beyer HG (2001) The theory of evolution strategies. [online] Natural computer series, Springer. http://books.google.ch/books/?id=8tblnlufktmc

Callsen-Bracker H-M, Grädler M (2011) Finance—Risikomanagement und Kapitalmarkt, Chapter 2: Harry Markowitz und die Grundlagen der modernen Portfoliotheorie. http://hans-markus.de/finance/195/gliederung_finance/

Coleman TF, Li Y, Henniger J (2006) Minimizing tracking error while restricting the number of assets. J Risk 8(4):33

Derigs U, Nickel NH (2003) Meta-heuristic based decision support for portfolio optimization with a case study on tracking error minimization in passive portfolio management. OR Spectr 25(3):345–378

Gilli M, Këllezi E (2001) Threshold accepting for index tracking. Working Paper, Department of Econometrics, University of Geneva. http://www.unige.ch/ses/dsec/static/gilli/portfolio/Yale-2001-IT.pdf

Guastaroba G, Speranza MG (2012) Kernel search: an application to the index tracking problem. Eur J Oper Res 217(1):54–68

Jeurissen R, van den Berg J (2008) Optimized index tracking using a hybrid genetic algorithm. In: IEEE Congress on Evolutionary Computation, 2008. CEC 2008. (IEEE World Congress on Computational Intelligence), IEEE, pp 2327–2334

Krink T, Mittnik S, Paterlini S (2009) Differential evolution and combinatorial search for constrained index-tracking. Ann Oper Res 172(1):153–176

Kunz RM (2009) Advanced Technologies Supporting Business Areas, Lecture slides, University of Basel, Corporate Finance Department., 13-19. http://wwz.unibas.ch/fileadmin/wwz/redaktion/cofi/A._Lehre/C._HS09/applied_financial_management/AFM12_PerformanceMessung.pdf

Maringer D, Di Tollo G (2009) Metaheuristics for the index tracking problem. In: Geiger MJ, Habenicht W, Sevaux M, Sörensen K (eds) Metaheuristics in the service industry. Springer, Berlin, pp 127–154

Mathworks (2011). Matlab documentation, Release 2011a

Mehrabian AR, Lucas C (2006) A novel numerical optimization algorithm inspired from weed colonization. Ecol Inf 1(4):355–366

Nikoofard AH et al (2012) Multiobjective invasive weed optimization: application to analysis of Pareto improvement models in electricity markets. Appl Soft Comput 12:100–112

Oh K, Tim K, Min S (2005) Using genetic algorithm to support portfolio optimization for index fund management. Expert Syst Appl 28(2):371–379

Ruiz-Torrubiano R, Suárez A (2009) A hybrid optimization approach to index tracking. Ann Oper Res 166(1):57–71

Shapcott J (1992) Index Tracking: genetic algorithms for investment portfolio selection. Edinburgh Parallel Computing Centre, The University of Edinburgh, 1992. http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.66.6530

Stratman M (1987) How many stocks make a diversified portfolio. J Financ Quant Anal 22:353–363

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by S. Deb, T. Hanne and S. Fong.

Rights and permissions

About this article

Cite this article

Affolter, K., Hanne, T., Schweizer, D. et al. Invasive weed optimization for solving index tracking problems. Soft Comput 20, 3393–3401 (2016). https://doi.org/10.1007/s00500-015-1799-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-015-1799-x