Abstract

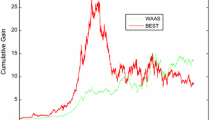

Online portfolio selection is an important fundamental problem in computational finance, which has been further developed in recent years. As the financial market changes rapidly, investors need to dynamically adjust asset positions according to various financial market information. However, existing online portfolio strategies are always designed without considering this information, which limits their practicability to some extent. To overcome this limitation, this paper exploits the available side information and presents a novel online portfolio strategy named “WAACS”. Specifically, all the constant rebalanced portfolio strategies are considered as experts and the weak aggregating algorithm is applied to aggregate all the expert advice according to their previous cumulative returns under the same side information state as the current period. Furthermore, WAACS is theoretically proved to be a universal portfolio, i.e., its growth rate is asymptotically the same as that of the best state constant rebalanced portfolio, which is a benchmark strategy considering side information. Numerical experiments show that WAACS achieves significant performance and demonstrate that considering side information improves the performance of the proposed strategy.

Similar content being viewed by others

References

Albeverio S, Lao LJ, Zhao XL (2001) On-line portfolio selection strategy with prediction in the presence of transaction costs. Math Methods Oper Res 54:133–161

Blum A, Kalai A (1999) Universal portfolios with and without transaction costs. Mach Learn 35:193–205

Borodin A, El-Yaniv R, Gogan V (2004) Can we learn to beat the best stock. J Artif Intell Res 21:579–594

Cover TM (1991) Universal portfolios. Math Finance 1:1–29

Cover TM, Ordentlich E (1996) Universal portfolio with side information. IEEE Trans Inf Theory 42:348–363

Cui XY, Li D, Wang SY, Zhu SS (2012) Better than dynamic mean-variance: time inconsistency and free cash flow stream. Math Finance 22:346–378

Fagiuoli E, Stella F, Ventura A (2007) Constant rebalanced portfolios and side-information. Quant Finance 7:161–173

Gaivoronski AA, Stella F (2000) Stochastic nonstationary optimization for finding universal portfolios. Ann Oper Res 100:165–188

Györfi L, Vajda I (2008) Growth optimal investment with transaction costs. In: International conference on algorithmic learning theory, pp 108–122

Hazan E, Kale S (2015) An online portfolio selection algorithm with regret logarithmic in price variation. Math Finance 25:288–310

Helmbold DP, Schapire RE, Singer Y, Warmuth MK (1998) On-line portfolio selection using multiplicative updates. Math Finance 8:325–347

Huang DJ, Zhou JL, Li B, Hoi SCH, Zhou SG (2016) Robust median reversion strategy for on-line portfolio selection. IEEE Trans Knowl Data Eng 28:2480–2493

Huang DJ, Yu SC, Li B, Hoi SCH, Zhou SG (2018) Combination forecasting reversion strategy for online portfolio selection. ACM Trans Intell Syst Technol. https://doi.org/10.1145/3200692

Hwang I, Xu S, In F (2018) Naive versus optimal diversification: tail risk and performance. Eur J Oper Res 265:372–388

Kalnishkan Y, Vyugin MV (2008) The weak aggregating algorithm and weak mixability. J Comput Syst Sci 74:1228–1244

Levina T, Levin Y, Mcgill J, Nediak M, Vovk V (2010) Weak aggregating algorithm for the distribution-free perishable inventory problem. Oper Res Lett 38:516–521

Li B, Zhao PL, Hoi SCH, Gopalkrishnan V (2012) PAMR: passive aggressive mean reversion strategy for portfolio selection. Mach Learn 87:221–258

Li B, Hoi SCH, Sahoo D, Liu ZY (2015) Moving average reversion strategy for on-line portfolio selection. Artif Intell 222:104–123

Li B, Wang JL, Huang DJ, Hoi SCH (2018) Transaction cost optimization for online portfolio selection. Quant Finance 18:1411–1424

Li B, Zhang D, Tang SH (2018) Universal portfolio selection strategy based on sub-gradient projection. J Manag Sci China 21:94–104

Lin X, Zhang M, Zhang YF, Gu ZQ, Liu YQ (2017) Boosting moving average reversion strategy for online portfolio selection: a meta-learning approach. In: International conference on database systems for advanced applications, pp 494–510

Markowitz HM (1952) Portfolio selection. J Finance 7:77–91

Nazemi A, Tahmasbi N (2014) A computational intelligence method for solving a class of portfolio optimization problems. Soft Comput 18:2101–2117

O’Sullivan P, Edelman D (2015) Adaptive universal portfolios. Eur J Finance 21:337–351

Singer Y (1997) Switching portfolios. Int J Neural Syst 8:445–455

Yang XY, Li HP, Zhang Y, He JA (2018) Reversion strategy for online portfolio selection with transaction costs. Int J Appl Decis Sci 11:79–99

Zhang Y, Yang XY (2017) Online portfolio selection strategy based on combining experts’ advice. Comput Econ 50:141–159

Zhang WG, Xiao WL, Wang YL (2009) A fuzzy portfolio selection method based on possibilistic mean and variance. Soft Comput 13:627–633

Zhang WG, Zhang Y, Yang XY, Xu WJ (2012) A class of on-line portfolio selection algorithms based on linear learning. Appl Math Comput 218:11832–11841

Acknowledgements

This work was supported by the National Natural Science Foundation of China (Nos. 71301029, 71501049, 71401157), the Humanities and Social Science Foundation of the Ministry of Education of China (18YJA630132), and Guangdong Province Universities and Colleges Pearl River Scholar Funded Scheme (2016).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yang, X., He, J., Xian, J. et al. Aggregating expert advice strategy for online portfolio selection with side information. Soft Comput 24, 2067–2081 (2020). https://doi.org/10.1007/s00500-019-04039-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-019-04039-7