Abstract

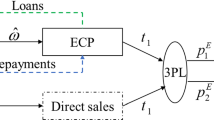

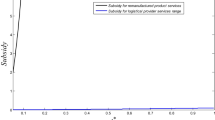

In a supply chain finance (SCF) system composed of a manufacturer, a retailer and a third-party logistics (3PL) enterprise, the market demand is dependent on the logistics service level and the retail price. This paper investigates the optimal operational strategies for the SCF system with the 3PL financing service when the retailer or the manufacturer is stuck with capital constraint, respectively. By constructing and solving Stackelberg game models, we obtain the optimal operational strategies of the above two scenarios, and combined with the sensitivity analysis of relevant parameters, we obtain the following conclusions. (1) For the SCF system with a capital-constrained retailer, except the manufacturer’s optimal wholesale price remains unchanged, other participants’ optimal decisions and the optimal profits of each participant increase with the logistics service sensitivity coefficient; except the manufacturer’s optimal wholesale price remains unchanged, other participants’ optimal decisions and the optimal profits of each participant decrease with the logistics service cost efficiency. (2) For the SCF system with a capital-constrained manufacturer, the optimal decisions and profits of supply chain participants increase with the logistics service sensitivity coefficient; the optimal decisions and profits of supply chain participants decrease with the logistics service cost efficiency. Our analysis suggests that the retailer and manufacturer must take into account 3PL enterprise’s decisions (logistics service level and logistics service price) under the 3PL financing service mode before making decisions.

Similar content being viewed by others

Change history

26 November 2019

The text <Emphasis Type="Italic">c</Emphasis><Subscript>1</Subscript> should read as <Emphasis Type="Italic">C</Emphasis><Subscript><Emphasis Type="BoldItalic">l</Emphasis></Subscript>.

References

Alavi SH, Jabbarzadeh A (2018) Supply chain network design using trade credit and bank credit: a robust optimization model with real world application. Comput Ind Eng 125:69–86. https://doi.org/10.1016/j.cie.2018.08.005

Buzacott JA, Zhang RQ (2004) Inventory management with asset-based financing. Manag Sci 50(9):1274–1292. https://doi.org/10.1287/mnsc.1040.0278

Cai GG, Chen X, Xiao Z (2014) The roles of bank and trade credits: theoretical analysis and empirical evidence. Prod Oper Manag 23(4):583–598. https://doi.org/10.1111/poms.12035

Cao E, Du L, Ruan J (2019) Financing preferences and performance for an emission-dependent supply chain: supplier vs. bank. Int J Prod Econ 208:383–399. https://doi.org/10.1016/j.ijpe.2018.08.001

Chen D, Han C (2012) A comparative study of online P2P lending in the USA and China. J Internet Bank Commer 17(2):1–15

Chen X, Cai G, Song J-S (2019) The cash flow advantages of 3PLs as supply chain orchestrators. Manuf Serv Oper Manag 21(2):435–451. https://doi.org/10.1287/msom.2017.0667

Chung K-J (1998) A theorem on the determination of economic order quantity under conditions of permissible delay in payments. Comput Oper Res 25(1):49–52. https://doi.org/10.1016/S0305-0548(98)80007-5

Dada M, Hu Q (2008) Financing newsvendor inventory. Oper Res Lett 36(5):569–573. https://doi.org/10.1016/j.orl.2008.06.004

Deng S, Gu C, Cai G, Li Y (2018) Financing multiple heterogeneous suppliers in assembly systems: buyer finance vs. bank finance. Manuf Serv Oper Manag 20(1):53–69. https://doi.org/10.1287/msom.2017.0677

Gao G-X, Fan Z-P, Fang X, Lim YF (2018) Optimal Stackelberg strategies for financing a supply chain through online peer-to-peer lending. Eur J Oper Res 267(2):585–597. https://doi.org/10.1016/j.ejor.2017.12.006

Goyal SK (1985) Economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 36(4):335–338. https://doi.org/10.1057/jors.1985.56

Hua S, Liu J, Cheng TCE, Zhai X (2019) Financing and ordering strategies for a supply chain under the option contract. Int J Prod Econ 208:100–121. https://doi.org/10.1016/j.ijpe.2018.10.008

Huang S, Fan Z-P, Wang X (2019a) Optimal operational strategies of supply chain under financing service by a 3PL firm. Int J Prod Res 57(11):3405–3420. https://doi.org/10.1080/00207543.2018.1534017

Huang S, Fan ZP, Wang X (2019b) The impact of transportation fee on the performance of capital-constrained supply chain under 3PL financing service. Comput Ind Eng 130:358–369. https://doi.org/10.1016/j.cie.2019.02.048

Jaggi CK, Gupta M, Kausar A, Tiwari S (2019) Inventory and credit decisions for deteriorating items with displayed stock dependent demand in two-echelon supply chain using Stackelberg and Nash equilibrium solution. Ann Oper Res 274(1–2):309–329. https://doi.org/10.1007/s10479-018-2925-9

Khouja MJ (2000) Optimal ordering, discounting, and pricing in the single-period problem. Int J Prod Econ 65(2):201–216. https://doi.org/10.1016/S0925-5273(99)00027-4

Kouvelis P, Zhao W (2012) Financing the newsvendor: supplier vs. bank, and the structure of optimal trade credit contracts. Oper Res 60(3):566–580. https://doi.org/10.1287/opre.1120.1040

Kouvelis P, Zhao W (2018) Who should finance the supply chain? Impact of credit ratings on supply chain decisions. Manuf Serv Oper Manag 20(1):19–35. https://doi.org/10.1287/msom.2017.0669

Lin Q, Xiao Y (2018) Retailer credit guarantee in a supply chain with capital constraint under push & pull contract. Comput Ind Eng 125:245–257. https://doi.org/10.1016/j.cie.2018.08.029

Liu B, Cai GG, Tsay AA (2014) Advertising in asymmetric competing supply chains. Prod Oper Manag 23(11):1845–1858. https://doi.org/10.1111/poms.12090

Seifbarghy M, Nouhi K, Mahmoudi A (2015) Contract design in a supply chain considering price and quality dependent demand with customer segmentation. Int J Prod Econ 167:108–118. https://doi.org/10.1016/j.ijpe.2015.05.004

Veldman J, Klingenberg W, Gaalman GJC, Teunter RH (2014) Getting what you pay for-strategic process improvement compensation and profitability impact. Prod Oper Manag 23(8):1387–1400. https://doi.org/10.1111/poms.12207

Wang Y, Sun X, Meng F (2016) On the conditional and partial trade credit policy with capital constraints: a Stackelberg model. Appl Math Model 40(1):1–18. https://doi.org/10.1016/j.apm.2015.04.036

Wang C, Fan X, Yin Z (2019) Financing online retailers: bank vs electronic business platform, equilibrium, and coordinating strategy. Eur J Oper Res 276(1):343–356. https://doi.org/10.1016/j.ejor.2019.01.009

Whitin TM (1955) Inventory control and price theory. Manag Sci 2(1):61–68. https://doi.org/10.1287/mnsc.2.1.61

Wu Q, Mu Y, Feng Y (2015) Coordinating contracts for fresh product outsourcing logistics channels with power structures. Int J Prod Econ 160:94–105. https://doi.org/10.1016/j.ijpe.2014.10.007

Yan N, Sun B, Zhang H, Liu C (2016) A partial credit guarantee contract in a capital-constrained supply chain: financing equilibrium and coordinating strategy. Int J Prod Econ 173:122–133. https://doi.org/10.1016/j.ijpe.2015.12.005

Yu Y, Xiao T (2017) Pricing and cold-chain service level decisions in a fresh agri-products supply chain with logistics outsourcing. Comput Ind Eng 111:56–66. https://doi.org/10.1016/j.cie.2017.07.001

Zhan J, Chen X, Hu Q (2019) The value of trade credit with rebate contract in a capital-constrained supply chain. Int J Prod Res 57(2):379–396. https://doi.org/10.1080/00207543.2018.1442946

Zhang C, Fan L-W, Tian Y-X, Yang S-M (2018) Optimal credit period and lot size policies for a retailer at risk of customer default under two-echelon partial trade credit. IEEE Access 6:54295–54309. https://doi.org/10.1109/ACCESS.2018.2871838

Zhu X, Cetinkaya S (2015) A stochastic inventory model for an immediate liquidation and price-promotion decision under price-dependent demand. Int J Prod Res 53(12):3789–3809. https://doi.org/10.1080/00207543.2014.990233

Acknowledgements

This study was funded by the National Social Science Fund of China (19BGL229).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Communicated by Y. Ni.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original version of this article was revised: Due to Table 1 update.

Appendix

Appendix

Proof of Proposition 1

Taking the first-order and the second-order derivative of \( \pi_{\text{r}} \) w.r.t. p in Eq. (1), we have

where \( Q = d - bp + \theta \zeta \).

From Eq. (A.2), we have \( \frac{{{\text{d}}^{2} \pi_{\text{r}} }}{{{\text{d}}p^{2} }} = - 2b < 0 \), which means that the retailer’s profit function is concave and that there exists a unique \( p^{ * } \). From the first-order condition, i.e., \( \frac{{{\text{d}}\pi_{\text{r}} }}{{{\text{d}}p}} = 0 \), we can obtain the retailer’s optimal retail price, i.e., \( p^{ * } = \frac{1}{2b}\left[ {b\left( {i_{\text{r}} w + l + w} \right) + d + \theta \zeta } \right] \). Then, substituting \( p^{ * } \) in \( Q = d - bp^{ * } + \theta \zeta \), we have \( Q^{*} = - \frac{b}{2}\left( {i_{\text{r}} w + l + w} \right) + \frac{d}{2} + \frac{\theta \zeta }{2} \).

Proof of Corollary 1

Differentiating the optimal retail price \( p^{ * } \) w.r.t. w, we have \( \frac{{{\text{d}}p^{ * } }}{{{\text{d}}w}} = \frac{{i_{\text{r}} }}{2} + \frac{1}{2} \). Since \( i_{\text{r}} > 0 \) in Table 1, we can obtain \( \frac{{dp^{ * } }}{dw} = \frac{{i_{r} }}{2} + \frac{1}{2} > 0 \). Furthermore, differentiating the optimal order quantity \( Q^{ * } \) w.r.t. w, we have \( \frac{{{\text{d}}Q^{ * } }}{{{\text{d}}w}} = - \frac{b}{2}\left( {i_{\text{r}} + 1} \right) \). Since \( b,i_{\text{r}} > 0 \), we can derive \( \frac{{{\text{d}}Q^{ * } }}{{{\text{d}}w}} = - \frac{b}{2}\left( {i_{\text{r}} + 1} \right) < 0 \).

Proof of Corollary 2

Differentiating the optimal retail price \( p^{ * } \) w.r.t. the financing interest rate ir, we have \( \frac{{{\text{d}}p^{ * } }}{{{\text{d}}i_{\text{r}} }} = \frac{w}{2} \). Since \( w > 0 \), we can obtain \( \frac{{{\text{d}}p^{ * } }}{{{\text{d}}i_{\text{r}} }} = \frac{w}{2} > 0 \). Furthermore, differentiating the optimal order quantity \( Q^{ * } \) w.r.t. the financing interest rate ir, we have \( \frac{{{\text{d}}Q^{ * } }}{{{\text{d}}i_{\text{r}} }} = - \frac{bw}{2} \). Since \( b,w > 0 \), we can derive \( \frac{{{\text{d}}Q^{ * } }}{{{\text{d}}i_{\text{r}} }} = - \frac{bw}{2} < 0 \).

Proof of Corollary 3

Differentiating the optimal retail price \( p^{ * } \) and the optimal order quantity \( Q^{ * } \) w.r.t. the price sensitivity coefficient b, we have \( \frac{{ {\text{d}}p^{ * } }}{ {{\text{d}}b}} =\frac{1}{2b}\left( {i_{\text{r}} w + l + w} \right) - \frac{1}{{2b^{2} }}\left[ {b\left( {i_{\text{r}} w + l +w} \right) + d + \theta \zeta } \right] \) and \( \frac{{{\text{d}}Q^{ * } }}{{{\text{d}}b}} = - \frac{{i_{\text{r}} w}}{2} - \frac{l}{2} - \frac{w}{2} \). Since \( b,w,d,i_{\text{r}} ,\theta ,\zeta ,l > 0 \), we can obtain \( \frac{{ {\text{d}}p^{ * } }}{ {{\text{d}}b}} =\frac{1}{2b}\left( {i_{\text{r}} w + l + w} \right) - \frac{1}{{2b^{2} }}\left[ {b\left( {i_{\text{r}} w + l +w} \right) + d + \theta \zeta } \right] < 0 \) and \( \frac{{{\text{d}}Q^{ * } }}{{{\text{d}}b}} = - \frac{{i_{\text{r}} w}}{2} - \frac{l}{2} - \frac{w}{2} < 0 \).

Proof of Proposition 2

Taking the first-order derivative of \( \pi_{{3{\text{PL}}}} \) w.r.t. \( \zeta \) and l in Eq. (2) respectively, we have

Differentiating Eqs. (A.3) and (A.4) w.r.t. \( \zeta \) and l, respectively, we can derive the Hessian Matrix as follows:

From Eq. (A.5), the first-order sequential principal minor of the Hessian Matrix \( \left| {H_{1} \left( {\zeta ,l} \right)} \right| = \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{{\partial \zeta^{2} }} = - \eta < 0 \) and the second-order sequential principal minor of the Hessian Matrix \( \left| {H_{2} \left( {\zeta ,l} \right)} \right| = \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{{\partial \zeta^{2} }} \times \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{{\partial l^{2} }} - \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{\partial \zeta \partial l} \times \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{\partial l\partial \zeta } = - \eta \times \left( { - b} \right) - \frac{\theta }{2} \times \frac{\theta }{2} = b\eta - \frac{{\theta^{2} }}{4} > 0 \), i.e., the Hessian Matrix is negative definite. Therefore \( \pi_{{3{\text{PL}}}} \) is concave w.r.t. \( \left( {\zeta ,l} \right) \), and there exists a unique optimal solution, respectively. From the first-order condition, i.e., \( \frac{{{\text{d}}\pi_{{3{\text{PL}}}} }}{{{\text{d}}\zeta }} = 0 \) and \( \frac{{{\text{d}}\pi_{{3{\text{PL}}}} }}{{{\text{d}}l}} = 0 \), we can obtain the 3PL enterprise’s optimal logistics service level \( \zeta^{ * } \) and the optimal logistics service price \( l^{ * } \), i.e., \( \zeta^{ * } { = } - \frac{{\theta \left( {bc_{l} + bw - d} \right)}}{{4b\eta - \theta^{2} }} \) and \( l^{ * } = \frac{1}{{4b\eta - \theta^{2} }}\left[ {2\eta \left( {bc_{l} - 2bi_{\text{r}} w - bw + d} \right) - \theta^{2} \left( {c_{l} - i_{\text{r}} w} \right)} \right] \).

Proof of Proposition 3

Taking the first-order and the second-order derivative of \( \pi_{\text{m}} \) w.r.t. w in Eq. (3), we have

From Eq. (A.7), we have \( \frac{{{\text{d}}^{2} \pi_{\text{m}} }}{{{\text{d}}w^{2} }} = - \frac{{8b^{2} \eta }}{{16b\eta - 4\theta^{2} }} < 0 \), which means that the manufacturer’s profit function is concave and that there exists a unique \( w^{ * } \). From the first-order condition, i.e., \( \frac{{{\text{d}}\pi_{\text{m}} }}{{{\text{d}}w}} = 0 \), we can obtain the manufacturer’s optimal wholesale price, i.e., \( w^{ * } = \frac{1}{2b}\left( {bc - bc_{l} + d} \right) \).

Proof of Proposition 4

Taking the first-order and the second-order derivative of \( \pi_{\text{r}} \) w.r.t. p in Eq. (4), we have

where \( Q = d - bp + \theta \zeta \).

From Eq. (A.9), we have \( \frac{{{\text{d}}^{2} \pi_{\text{r}} }}{{{\text{d}}p^{2} }} = - 2b < 0 \), which means that the retailer’s profit function is concave and that there exists a unique \( p^{ * } \). From the first-order condition, i.e., \( \frac{{{\text{d}}\pi_{\text{r}} }}{{{\text{d}}p}} = 0 \), we can obtain the retailer’s optimal retail price, i.e., \( p^{ * } = \frac{1}{2b}\left( {bw + d + \theta \zeta } \right) \). Then, substituting \( p^{ * } \) in \( Q = d - bp^{ * } + \theta \zeta \), we have \( Q^{*} { = } - \frac{bw}{2} + \frac{d}{2} + \frac{\theta \zeta }{2} \).

Proof of Proposition 5

Taking the first-order and the second-order derivative of \( \pi_{\text{m}} \) w.r.t. w in Eq. (5), we have

From Eq. (A.11), we have \( \frac{{{\text{d}}^{2} \pi_{\text{m}} }}{{{\text{d}}w^{2} }} = - b < 0 \), which means that the manufacturer’s profit function is concave and that there exists a unique \( w^{ * } \). From the first-order condition, i.e., \( \frac{{{\text{d}}\pi_{\text{m}} }}{{{\text{d}}w}} = 0 \), we can obtain the manufacturer’s optimal wholesale price, i.e., \( w^{ * } = \frac{1}{2b}\left( {bci_{\text{m}} + bc + bl + d + \theta \zeta } \right) \).

Proof of Proposition 6

Taking the first-order derivative of \( \pi_{{3{\text{PL}}}} \) w.r.t. \( \zeta \) and l in Eq. (6), respectively, we have

Differentiating Eqs. (A.12) and (A.13) w.r.t. \( \zeta \) and l, respectively, we can derive the Hessian Matrix as follows:

From Eq. (A.14), the first-order sequential principal minor of the Hessian Matrix \( \left| {H_{1} \left( {\zeta ,l} \right)} \right| = \frac{{\partial^{2} \pi_{3PL} }}{{\partial \zeta^{2} }} = - \eta < 0 \) and the second-order sequential principal minor of the Hessian Matrix \( \left| {H_{2} \left( {\zeta ,l} \right)} \right| = \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{{\partial \zeta^{2} }} \times \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{{\partial l^{2} }} - \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{\partial \zeta \partial l} \times \frac{{\partial^{2} \pi_{{3{\text{PL}}}} }}{\partial l\partial \zeta } = - \eta \times \left( { - \frac{b}{2}} \right) - \frac{\theta }{4} \times \frac{\theta }{4} = \frac{1}{2}b\eta - \frac{{\theta^{2} }}{16} > 0 \), i.e., the Hessian Matrix is negative definite. Therefore \( \pi_{{3{\text{PL}}}} \) is concave w.r.t. \( \left( {\zeta ,l} \right) \), and there exists a unique optimal solution, respectively. From the first-order condition, i.e., \( \frac{{{\text{d}}\pi_{{3{\text{PL}}}} }}{{{\text{d}}\zeta }} = 0 \) and \( \frac{{{\text{d}}\pi_{{3{\text{PL}}}} }}{{{\text{d}}l}} = 0 \), we can obtain the 3PL enterprise’s optimal logistics service level \( \zeta^{ * } \) and the optimal logistics service price \( l^{ * } \), i.e., \( \zeta^{ * } { = } - \frac{{\theta \left( {bc + bc_{l} - d} \right)}}{{8b\eta - \theta^{2} }} \) and \( l^{ * } = \frac{1}{{8b\eta - \theta^{2} }}\left[ { - 4\eta \left( {2bci_{\text{m}} + bc - bc_{l} - d} \right) + \theta^{2} \left( {ci_{\text{m}} - c_{l} } \right)} \right] \).

Rights and permissions

About this article

Cite this article

Zhang, C., Fan, LW. & Tian, YX. Optimal operational strategies of capital-constrained supply chain with logistics service and price dependent demand under 3PL financing service. Soft Comput 24, 2793–2806 (2020). https://doi.org/10.1007/s00500-019-04500-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-019-04500-7