Abstract

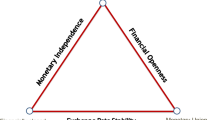

The development of financial integration makes a country’s economic links difficult. This is especially so for emerging market countries, which are more vulnerable to economic shocks. The objective of this paper is to explore whether the emerging market countries which adopt floating exchange rate system have realized, at the same time, in the aftermath of a crisis, free movement of capital flow and independence of monetary policy. This is done by introducing foreign exchange reserves into Mundell–Fleming model to do derivation. The approach is supported by empirical research based on 20 emerging countries including China, Brazil, Poland and South Africa and others. It was found that: (1) after the crisis, the emerging market countries that implemented floating exchange rate system did not achieve monetary policy independence. Rapid accumulation of foreign exchange reserves weakened the positive effect of the increase in money supply on output; (2) As a result of holding foreign exchange reserves, the independence of monetary policy in emerging market countries has been challenged, independently of the type of exchange rate system adopted, which proves the existence of dilemma phenomenon. Finally, this study puts forward policy recommendations on the exchange rate system and capital account convertibility for China.

Similar content being viewed by others

References

Borio CE, McCauley RN, McGuire P (2011) Global credit and domestic credit booms. BIS Q Rev 9:43–57

Bruno V, Shin HS (2015) Capital flows and the risk-taking channel of monetary policy. J Monet Econ 71:119–132

Fan X, Chen L, Zhu Z (2015) Sanyuan paradox or dualistic paradox: optimal exchange rate system based on the independence of monetary policy. Econ Trends 1:56–65

Gertler M, Karadi P (2011) A model of unconventional monetary policy. J Monet Econ 58(1):17–34

He D, McCauley RN (2013) Transmitting global liquidity to east asia: policy rates, bond yields, currencies and dollar credit. BIS Working Papers No. 431

Lu J (2017) Risk aversion, currency multiplier and binary paradox. Financ Res 6:3–12

Obstfeld M (2015) Trilemmas and trade-offs: living with financial globalisation. BIS Working Papers No. 480

Obstfeld M, Shambaugh JC, Taylor AM (2010) Financial stability, the trilemma, and international reserves. Am Econ J Macroecon 2(2):57–94

Philip T (2014) The global long-term interest rate, financial risks and policy choices in emes. BIS Working Papers

Rey H (2015) Dilemma not trilemma: the global financial cycle and monetary policy independence. Technical report, National Bureau of Economic Research

Wu G, Lu J (2016) Global risk aversion and capital flow: an analysis of the causes of “dual paradox”. Financ Res 11:1–14

Acknowledgements

The contribution of the first two authors (Yu Mei and Zhang Kun) to this research was partially supported by the Beijing Municipal Social Sciences Key Project (15ZDA46) and the Ministry of Education Humanities and Social Sciences Planning Fund Project (14YJA790075).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The Authors declare that they have no conflict of interest.

Human and animal rights

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by X. Li.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mei, Y., Kun, Z. & Ralescu, A.L. The dilemma phenomenon, logistics for monetary independence policy and foreign exchange reserves. Soft Comput 24, 6457–6466 (2020). https://doi.org/10.1007/s00500-019-04587-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-019-04587-y