Abstract

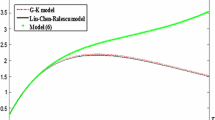

There exist some non-stochastic factors in the financial market, so the dynamics of the exchange rate highly depends on human uncertainty. This paper investigates the pricing problems of foreign currency options under the uncertain environment. First, we propose an currency model under the assumption that exchange rate, volatility, domestic interest rate and foreign interest rate are all driven by uncertain differential equations; especially, the exchange rate exhibits mean reversion. Since the analytical solutions of nested uncertain differential equations cannot always be obtained, we design a new numerical method, Runge–Kutta-99 hybrid method, for solving nested uncertain differential equations. The accuracy of the designed numerical method is investigated by comparison with the analytical solution. Subsequently, the quasi-closed-form solutions are derived for the prices of both European and American foreign currency options. Finally, in order to illustrate the rationality and the practicability of the proposed currency model, we design several numerical algorithms to calculate the option prices and analyze the price behaviors of foreign currency options across strike price and maturity.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Notes

Our paper completed the writing of original manuscript in 2016, and we submitted it to journal in January 2017. As far as we know, there was no uncertain currency model considering both mean-reversion and floating interest rates at that time. It was not until we recently received comments from the editorial board that we noticed that the work of Wang and Chen (2019) had studied the mean-reversion uncertain currency model with floating rates. Nevertheless, our proposed model can still be regarded as an extended version of them.

In general, it is difficult to obtain the analytic solution of uncertain differential equation, let alone the nested uncertain differential equation. So far, many studies have proposed different types of numerical methods to solve this problem, see, for example, Yang and Ralescu (2015), Yang and Shen (2015), Wang et al. (2015), Gao (2016), Zhang et al. (2017), Ji and Zhou (2018) and among others. However, the widely used Runge–Kutta method is very simple and has high accuracy for solving uncertain differential equations. Additionally, this paper mainly focuses on proposing a new dynamic model for exchange rate and giving the quasi-closed-form solutions of the prices of European and American foreign currency options. Thus, this paper only presents a numerical method for calculating the inverse uncertainty distribution of the solution of nested uncertain differential equations based on Runge–Kutta method and does not consider the applicability of other numerical methods. One can explore the capabilities of other numerical methods, such as Adams method, Milne method and Hamming method.

References

Bakshia G, Carrb P, Wu LR (2008) Stochastic risk premiums, stochastic skewness in currency options, and stochastic discount factors in international economies. J Financ Econ 87(1):132–156

Baldeauxa J, Grasselli M, Platene E (2015) Pricing currency derivatives under the benchmark approach. J Bank Finance 53:34–48

Black F, Scholes M (1973) The pricing of option and corporate liabilities. J Polit Econ 81(3):637–654

Bollen NP, Gray SF, Whaley RE (2000) Regime-switching in foreign exchange rates: evidence from currency option prices. J Economet 94(1–2):239–276

Chen X (2011) American option pricing formula for uncertain financial market. Int J Oper Res 8(2):32–37

Chen X, Gao J (2018) Two-factor term structure model with uncertain volatility risk. Soft Comput 22(17):5835–5841

Chen X, Liu B (2010) Existence and uniqueness theorem for uncertain differential equations. Fuzzy Optim Decis Mak 9(1):69–81

Du D (2013) General equilibrium pricing of currency and currency options. J Financ Econ 110(3):730–751

Ekvalla N, Jennergren LP, Näslund B (1997) Currency option pricing with mean reversion and uncovered interest parity: a revision of the Garman–Kohlhagen model. Eur J Oper Res 100(1):41–59

Gao R (2016) Milne method for solving uncertain differential equations. Appl Math Comput 274:774–785

Gao Y, Yang L, Li S (2016) Uncertain models on railway transportation planning problem. Appl Math Model 40(7–8):4921–4934

Garman MB, Kohlhagen SW (1983) Foreign currency option values. J Int Money Finance 2(3):231–237

Grabbe JO (1983) The pricing of call and put options on foreign exchange. J Int Money Finance 2(3):239–253

Heston SL (1993) A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev Financ Stud 6(2):327–343

Hilliard JE, Madura J, Tucker AL (1991) Currency option pricing with stochastic domestic and foreign interest rates. J Financ Quant Anal 26(2):139–151

Ji X, Zhou J (2018) Solving high-order uncertain differential equations via Runge–Kutta method. IEEE Trans Fuzzy Syst 26(3):1379–1386

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2008) Fuzzy process, hybrid process and uncertain process. J Uncertain Syst 2(1):3–16

Liu B (2009) Some research problems in uncertainty theory. J Uncertain Syst 3(1):3–10

Liu B (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu Y, Chen X, Ralescu DA (2015) Uncetain currency model and currency option pricing. Int J Intell Syst 30(1):40–51

Medvedeva A, Scaillet O (2010) Pricing American options under stochastic volatility and stochastic interest rates. J Financ Econ 98(1):145–159

Shen Y, Yao K (2016) A mean-reverting currency model in an uncertain environment. Soft Comput 20(10):4131–4138

Sun J, Chen X (2015) Asian option pricing formula for uncertain financial market. J Uncertain Anal Appl 3:1–11

Vasicek O (1977) An equilibrium characterization of the term structure. J Financ Econ 5(2):177–188

Wang W, Chen P (2019) A mean-reverting currency model with floating interest rates in uncertain environment. J Ind Manag Optim 15(4):1921–1936

Wang X, Ning Y (2017) An uncertain currency model with floating interest rates. Soft Comput 21(22):6739–6754

Wang X, Ning Y, Moughal TA, Chen X (2015) Adams–Simpson method for solving uncertain differential equation. Appl Math Comput 271:209–219

Wong HY, Lo YW (2009) Option pricing with mean reversion and stochastic volatility. Eur J Oper Res 197(1):179–187

Yan H, Zhu Y (2015) Bang–bang control model for uncertain switched systems. Appl Math Model 39(10–11):2994–3002

Yang X, Gao J (2016) Linear-quadratic uncertain differential game with application to resource extraction problem. IEEE Trans Fuzzy Syst 24(4):819–826

Yang X, Ralescu DA (2015) Adams method for solving uncertain differential equations. Appl Math Comput 270:993–1003

Yang X, Shen Y (2015) Runge–Kutta method for solving uncertain differential equations. J Uncertain Anal Appl 3:17

Yang X, Gao J, Kar S (2016) Uncertain calculus with Yao process. IEEE Trans Fuzzy Syst 24(6):1578–1585

Yao K (2012) No-arbitrage determinant theorems on mean-reverting stock model in uncertain market. Knowl Based Syst 35:259–263

Yao K (2015a) Uncertain contour process and its application in stock model with floating interest rate. Fuzzy Optim Decis Mak 14(4):399–424

Yao K (2015b) Uncertain differential equation with jumps. Soft Comput 19(7):2063–2069

Yao K, Chen X (2013) A numerical method for solving uncertain differential equations. J Intell Fuzzy Syst 25(3):825–832

Zhang Z, Liu W, Sheng Y (2016) Valuation of power option for uncertain financial market. Appl Math Comput 286:257–264

Zhang Y, Gao J, Huang Z (2017) Hamming method for solving uncertain differential equations. Appl Math Comput 313:331–341

Acknowledgements

This work was supported by the National Natural Science Foundation of China (Grant Nos. 71901124, U1901223 and 71720107002), the Natural Science Foundation of Jiangsu Province (Grant No. BK20190695) and the Fundamental Research Funds for the Central Universities (Grant No. 2019ZD13). The authors would also like to thank the Editor and anonymous reviewers for their constructive comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Li, Z., Liu, YJ. & Zhang, WG. Quasi-closed-form solution and numerical method for currency option with uncertain volatility model. Soft Comput 24, 15041–15057 (2020). https://doi.org/10.1007/s00500-020-04854-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-020-04854-3