Abstract

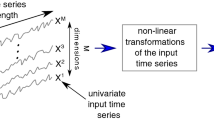

Properly comprehending and modeling the dynamics of financial data has indispensable practical importance. The prime goal of a financial time series model is to provide reliable future forecasts which are crucial for investment planning, fiscal risk hedging, governmental policy making, etc. These time series often exhibit notoriously haphazard movements which make the task of modeling and forecasting extremely difficult. As per the research evidence, the random walk (RW) is so far the best linear model for forecasting financial data. Artificial neural network (ANN) is another promising alternative with the unique capability of nonlinear self-adaptive modeling. Numerous comparisons of the performances of RW and ANN models have also been carried out in the literature with mixed conclusions. In this paper, we propose a combination methodology which attempts to benefit from the strengths of both RW and ANN models. In our proposed approach, the linear part of a financial dataset is processed through the RW model, and the remaining nonlinear residuals are processed using an ensemble of feedforward ANN (FANN) and Elman ANN (EANN) models. The forecasting ability of the proposed scheme is examined on four real-world financial time series in terms of three popular error statistics. The obtained results clearly demonstrate that our combination method achieves reasonably better forecasting accuracies than each of RW, FANN and EANN models in isolation for all four financial time series.

Similar content being viewed by others

References

Sun Y (2005) Exchange rate forecasting with an artificial neural network model: can we beat a random walk model? Master of Commerce and Management (MCM) thesis, Lincoln University, New Zealand

Tyree AW, Long JA (1995) Forecasting currency exchange rates: neural networks and the random walk model. In: Proceedings of the third international conference on artificial intelligence applications, Wall Street, New York

Hussain AJ, Knowles A, Lisoba PJG, El-Deredy W (2008) Financial time series prediction using polynomial pipelined neural networks. J Expert Syst Appl 35:1186–1199

Sewell MV (2009) The application of intelligent systems to financial time series analysis. PhD thesis, Department of Computer Science, UCL, London

Sewell M (2011) Characterization of financial time series. Research Note RN/11/01, Dept of Computer Science, UCL, London

Lemke C, Gabrys B (2010) Meta-learning for time series forecasting and forecast combination. J Neurocomputing 73:2006–2016

Box GEP, Jenkins GM (1970) Time series analysis, forecasting and control, 3rd edn. Holden-Day, CA

Meese RA, Rogoff K (1983) Empirical exchange rate models of the seventies: do they fit out of sample? J Int Econ 14:3–24

Zhang GP (2003) Time series forecasting using a hybrid ARIMA and neural network model. J Neurocomputing 50:159–175

Ghazali R, Hussain AJ, Nawi NM, Mohamad B (2009) Non-stationary and stationary prediction of financial time series using dynamic ridge polynomial neural network. J Neurocomputing 72:2359–2367

Dunis CL, Williams M (2005) Modelling and trading the EUR/USD exchange rate: do neural network models perform better? J Deriv Use Trading Regul 8:211–239

Khashei M, Bijari M (2010) An artificial neural network (p, d, q) model for time series forecasting. J Expert Syst Appl 37:479–489

Zhang GP (2007) A neural network ensemble method with jittered training data for time series forecasting. J Inf Sci 177:5329–5346

Bellgard C, Goldschmidt P (1999) Forecasting across frequencies: linearity and non-linearity. In: Proceedings of the conference on advanced investment technology, Gold Coast, Australia, pp 41–48

Versace M, Bhatt R, Hinds O, Shiffer M (2004) Predicting the exchange traded fund DIA with a combination of genetic algorithms and neural networks. J Expert Syst Appl 27:417–425

Sermpinis G, Dunis C, Laws J, Stasinakis C (2012) Forecasting and trading the EUR/USD exchange rate with stochastic neural network combination and time-varying leverage. J Decis Support Syst 54:316–329

Dunis CL, Laws J, Sermpinis G (2011) Higher order and recurrent neural architectures for trading the EUR/USD exchange rate. J Quant Financ 11:615–629

Hann TH, Steurer E (1996) Much ado about nothing? Exchange rate forecasting: neural networks vs. linear models using monthly and weekly data. J Neurocomputing 10:323–339

Khashei M, Bijari M (2011) A novel hybridization of artificial neural networks and ARIMA models for time series forecasting. J Appl Soft Comput 11:2664–2675

Timmermann A, Granger CWJ (2004) Efficient market hypothesis and forecasting. Int J Forecast 20:15–27

Hamzaçebi C, Akay D, Kutay F (2009) Comparison of direct and iterative artificial neural network forecast approaches in multi-periodic time series forecasting. J Expert Syst Appl 36:3839–3844

Kihoro JM, Otieno RO, Wafula C (2004) Seasonal time series forecasting: a comparative study of ARIMA and ANN models. Afr J Sci Technol 5:41–49

Faraway J, Chatfield C (1998) Time series forecasting with neural networks: a comparative study using the airline data. J Appl Stat 47(2):231–250

Hagan M, Menhaj M (1994) Training feedforward networks with the Marquardt algorithm. IEEE Trans Neural Netw 5:989–993

Elman JL (1990) Finding structure in time. J Cogn Sci 14(2):179–211

Lim CP, Goh WY (2005) The application of an ensemble of boosted Elman networks to time series prediction: a benchmark study. J Comput Intell 3:119–126

Demuth H, Beale M, Hagan M (2010) Neural network toolbox user’s guide. The MathWorks, Natic

Adhikari R, Agrawal RK (2012) Performance evaluation of weights selection schemes for linear combination of multiple forecasts. J Artif Intell Rev. doi:10.1007/s10462-012-9361-z

Pacific FX database (2012) http://fx.sauder.ubc.ca/data.html

Federal Reserve Bank of St. Louis (2012) http://wikiposit.org/uid?FRED.DEXUSUK

Yahoo! Finance (2012) http://finance.yahoo.com

Acknowledgments

The authors are thankful to the reviewers for their innovative suggestions which facilitated the quality enhancement of this paper. Moreover, the first author also expresses his gratefulness to the Council of Scientific and Industrial Research (CSIR), India, for the obtained financial support, which provided significant help in performing the present work.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Adhikari, R., Agrawal, R.K. A combination of artificial neural network and random walk models for financial time series forecasting. Neural Comput & Applic 24, 1441–1449 (2014). https://doi.org/10.1007/s00521-013-1386-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-013-1386-y