Abstract

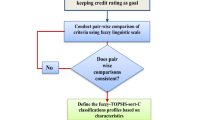

Credit score is a creditworthiness index, which enables the lender (bank and credit card companies) to evaluate its own risk exposure toward a particular potential customer. There are several credit scoring methods available in the literature, but one that is widely used is the FICO method. This method provides a score ranging from 300 to 850 as a fast filter for high-volume complex credit decisions. However, it falls short in the aspect of a decision support system where revised scoring can be achieved to reflect the borrower’s strength and weakness in each scoring dimension, as well as the possible trade-offs made to maintain one’s lending risk. Hence, this study discusses and develops a decision support tool for credit score model based on multi-criteria decision-making principles. In the proposed methodology, criteria weights are generated by fuzzy AHP. Fuzzy linguistic theory is applied in AHP to describe the uncertainties and vagueness arising from human subjectivity in decision making. Finally, drawing from the risk distance function, TOPSIS is used to rank the alternatives based on the least risk exposure. A sensitivity analysis is also demonstrated by the proposed fuzzy AHP-TOPSIS method.

Similar content being viewed by others

Notes

See http://www.fico.com/en/about-us/history/ for the history of FICO.

References

Arya S, Eckel C, Wichman C (2013) Anatomy of the credit score. J Econ Behav Organ 95(11):175–185

Baesens B, Setiono R, Mues C, Vanthienen J (2003) Using neural network rule extraction and decision tables for credit-risk evaluation. Manag Sci 49(3):312–329

Behzadian M, Hosseini-Motlagh SM, Ignatius J, Goh M, Sepehri MM (2013) PROMETHEE group decision support system and the house of quality. Group Decis Negot 22(2):189–205

Behzadian M, Kazemzadeh RB, Albadvi A, Aghdasi M (2010) PROMETHEE: a comprehensive literature review on methodologies and applications. Eur J Oper Res 200(1):198–215

Behzadian M, Khanmohammadi Otaghsara S, Yazdani M, Ignatius J (2012) A state-of the-art survey of TOPSIS applications. Expert Syst Appl 39(17):13051–13069

Bernanke BS (2007) The Community Reinvestment Act: its evolution and new challenges. Paper presented at the Community Affairs Research Conference, Washington, DC. http://www.federalreserve.gov/newsevents/speech/Bernanke20070330a.htm#f6

Bilbao-Terol A, Arenas-Parra M, Cañal-Fernández V, Antomil-Ibias J (2014) Using TOPSIS for assessing the sustainability of government bond funds. OMEGA 16(5):469–480

Burrell PR, Folarin BO (1997) The impact of neural networks in finance. Neural Comput Appl 6(4):193–200

Calantone RJ, Di Benedetto CA, Errunza VR (1988) The use of discrete variable selections for credit evaluations. OMEGA 16(5):469–480

Capotorti A, Barbanera E (2012) Credit scoring analysis using a fuzzy probabilistic rough set model. Comput Stat Data Anal 56(4):981–994

Celik M, Deha Er I, Ozok AF (2009) Application of fuzzy extended AHP methodology on shipping registry selection: the case of Turkish maritime industry. Expert Syst Appl 36(1):190–198

Chang D-Y (1992) Extent analysis and synthetic decision. Optim Tech Appl 1:352

Chang D-Y (1996) Applications of the extent analysis method on fuzzy AHP. Eur J Oper Res 95(3):649–655

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2(6):429–444

Cheng EWL, Chiang YH, Tang BS (2007) Alternative approach to credit scoring by DEA: evaluating borrowers with respect to PFI projects. Build Environ 42(4):1752–1760

Desai VS, Crook JN, Overstreet GA Jr (1996) A comparison of neural networks and linear scoring models in the credit union environment. Eur J Oper Res 95(1):24–37

Dubois D, Prade H (1980) Systems of linear fuzzy constraints. Fuzzy Sets Syst 3:37–48

Emel AB, Oral M, Reisman A, Yolalan R (2003) A credit scoring approach for the commercial banking sector. Socio Econ Plan Sci 37(2):103–123

Fahner G (2012) Estimating causal effects of credit decisions. Int J Forecast 28(1):248–260

Falbo P (1991) Credit-scoring by enlarged discriminant models. OMEGA 19(4):275–289

Giesecke K, Kim B (2011) Systemic risk: what defaults are telling us. Manag Sci 57(8):1387–1405

Hatami-Marbini A, Tavana M (2011) An extension of the Electre I method for group decision-making under a fuzzy environment. Omega 39(4):373–386

Hatami-Marbini A, Tavana M, Hajipour V, Kangi F, Kazemi A (2013) An extended compromise ratio method for fuzzy group multi-attribute decision making with SWOT analysis. Appl Soft Comput 13(8):3459–3472

Hatami-Marbini A, Tavana M, Moradi M, Kangi F (2013) A fuzzy group Electre method for safety and health assessment in hazardous waste recycling facilities. Saf Sci 51(1):414–426

Hajialiakbari F, Gholami MH, Roshandel J, Hatami-Shirkouhi L (2013) Assessment of the effect on technical efficiency of bad loans in banking industry: a principal component analysis and neuro-fuzzy system. Neural Comput Appl 23(1):315–322

Ho W (2008) Integrated analytic hierarchy process and its applications—a literature review. Eur J Oper Res 186(1):211–228

Hwang CL, Yoon K (1981) Multiple attribute decision making. In: Lecture notes in economics and mathematical systems, vol 186. Springer, Berlin

Iç YT (2012) Development of a credit limit allocation model for banks using an integrated Fuzzy TOPSIS and linear programming. Expert Syst Appl 39(5):5309–5316

Iç YT, Yurdakul M (2009) Development of a quick credibility scoring decision support system using fuzzy TOPSIS. Expert Syst Appl 37(1):567–574

Javanbarg MB, Scawthorn C, Kiyono J, Shahbodaghkhan B (2012) Fuzzy AHP-based multicriteria decision making systems using particle swarm optimization. Expert Syst Appl 39(1):960–966

Kulak O, Kahraman C (2005) Fuzzy multi-attribute selection among transportation companies using axiomatic design and analytic hierarchy process. Inf Sci 170(2–4):191–210

Lin SJ, Hsu MF (2016) Incorporated risk metrics and hybrid AI techniques for risk management. Neural Comput Appl 1–13. doi:10.1007/s00521-016-2253-4

Malhotra R, Malhotra DK (2002) Differentiating between good credits and bad credits using neuro-fuzzy systems. Eur J Oper Res 136(1):190–211

Malhotra R, Malhotra DK (2003) Evaluating consumer loans using neural networks. Omega 31(2):83–96

Mikhailov L (2004) A fuzzy approach to deriving priorities from interval pairwise comparison judgements. Eur J Oper Res 159(3):687–704

Mikhailov L, Tsvetinov P (2004) Evaluation of services using a fuzzy analytic hierarchy process. Appl Soft Comput 5(1):23–33

Min JH, Lee Y-C (2008) A practical approach to credit scoring. Expert Syst Appl 35(4):1762–1770

Motlagh SMH, Behzadian M, Ignatius J, Goh M, Sepehri MM, Hua TK (2015) Fuzzy PROMETHEE GDSS for technical requirements ranking in HOQ. Int J Adv Manuf Technol 76(9):1993–2002

Rosenberg E, Gleit A (1994) Quantitative methods in credit management: a survey. Oper Res 42(4):589–613

Saaty TL (1980) The analytic hierarchy process. McGraw-Hill, New York

Troutt MD, Rai A, Zhang A (1996) The potential use of DEA for credit applicant acceptance systems. Comput Oper Res 23(4):405–408

West D (2000) Neural network credit scoring models. Comput Oper Res 27(11–12):1131–1152

Wiginton JC (1980) A note on the comparison of logit and discriminant models of consumer credit behavior. J Financ Quant Anal 15(03):757–770. doi:10.2307/2330408

Yu L, Wang S, Lai KK (2009) An intelligent-agent-based fuzzy group decision making model for financial multicriteria decision support: the case of credit scoring. Eur J Oper Res 195(3):942–959

Yurdakul M, İç YT (2004) AHP approach in the credit evaluation of the manufacturing firms in Turkey. Int J Prod Econ 88(3):269–289

Zadeh LA (1965) Fuzzy sets. Inf Control 8:338–353

Zimmerman HJ (1996) Fuzzy sets theory and its applications. Kluwer Academic Publishers, Boston

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ignatius, J., Hatami-Marbini, A., Rahman, A. et al. A fuzzy decision support system for credit scoring. Neural Comput & Applic 29, 921–937 (2018). https://doi.org/10.1007/s00521-016-2592-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-016-2592-1