Abstract

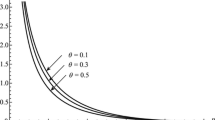

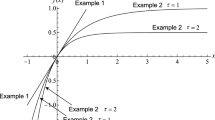

A portfolio optimization problem with fuzzy random variables is discussed using coherent risk measures, which are characterized by weighted average value-at-risks with risk spectra. By perception-based approach, coherent risk measures and weighted average value-at-risks are extended for fuzzy random variables. Coherent risk measures derived from risk averse utility functions are introduced to discuss the portfolio optimization with randomness and fuzziness. The randomness is estimated by probability, and the fuzziness is evaluated by lambda-mean functions and evaluation weights. By mathematical programming approaches, a solution is derived for the risk-minimizing portfolio optimization problem. Numerical examples are given to compare coherent risk measures. It is made clear that coherent risk measures derived from risk averse utility functions have excellent properties as risk criteria for these optimization problems. Not only pessimistic and necessity case but also optimistic and possibility case are calculated numerically to deal with uncertain information.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Abbreviations

- \({\mathrm{VaR}}, {\mathrm{AVaR}}\) :

-

Value-at-risk and average value-at-risk

- \({\mathrm{AVaR}}^{\nu }\,(\widetilde{{\mathrm{AVaR}}^{\nu }})\) :

-

(Extended) Weighted average value-at-risk with \(\nu\)

- \(\rho \,({\tilde{\rho }})\) :

-

(Extended) Coherent risk measure

- \(\nu , C\) :

-

Risk spectrum and its component function

- \({{\mathcal {N}}}\) :

-

The set of all fuzzy numbers

- \({\tilde{n}}, {\tilde{n}}_{\alpha } = {[}{\tilde{n}}_{\alpha }^{-}, {\tilde{n}}_{\alpha }^{+}{]}\) :

-

Fuzzy number and its \(\alpha\)-cut

- \({\tilde{X}}, {{\tilde{X}}}_{\alpha }={[}{\tilde{X}}_{\alpha }^{-},{\tilde{X}}_{\alpha }^{+}{]}\) :

-

Fuzzy random variable and its \(\alpha\)-cut

- \({{\mathcal {X}}}\,(\tilde{{\mathcal {X}}})\) :

-

The family of all integrable real-valued (fuzzy-valued) random variables

- \(E, {\tilde{E}}\) :

-

Expectation and perception-based expectation

- \(E^{\lambda }\) :

-

Mean of fuzzy numbers

- \(\lambda\) :

-

Optimistic/pessimistic index

- \(w(\alpha )\) :

-

Possibility/necessity evaluation weight

- f :

-

Utility function

- \(S^{i}_{t}\,({\tilde{S}}^{i}_{t})\) :

-

(Fuzzy-valued) Stock price for asset i at time t

- \(R^{i}_{t}\,({\tilde{R}}^{i}_{t})\) :

-

(Fuzzy-valued) Rate of return for asset i at time t

- \(w_t = (w_t^{1},\ldots , w_t^{n})\) :

-

Portfolio weight vector

- \({{\mathcal {W}}}_t\) :

-

The set of all portfolio weight vectors

- \(\mu _{t} = {[}\mu _{t}^{i} {]}\) :

-

Vector of expected rates of return

- \(\varSigma _{t} = {[}\sigma _{t}^{ij}{]}\) :

-

Variance–covariance matrix for rates of return

- \(\gamma _t^*\) :

-

The optimal expected rate of return

- \(\rho _t^*\) :

-

The optimal risk value

References

Acerbi C (2002) Spectral measures of risk: a coherent representation of subjective risk aversion. J Bank Finance 26:1505–1518

Adam A, Houkari H, Laurent JP (2008) Spectral risk measures and portfolio selection. J Bank Finance 32:1870–1882

Arrow KL (1971) Essays in the theory of risk-bearing. Markham, Chicago

Artzner P, Delbaen F, Eber JM, Heath D (1999) Coherent measures of risk. Math Finance 9:203–228

Bellman RE, Zadeh LA (1970) Decision-making in a fuzzy environment. Manage Sci Ser B 17:141–164

Drago GP, Ridella S (1999) Possibility and necessity pattern classification using an interval arithmetic perceptron. Neural Comput Appl 8:40–52

Emmer S, Kratz M, Tasche D (2015) What is the best risk measure in practice? A comparison of standard measures. J Risk 18:31–60

Fang Y, Lai KK, Wang S (2008) Fuzzy portfolio optimization. Lecture Notes in Economics and Mathematical Systems, vol 609. Springer, Heidelberg

Fortemps P, Roubens M (1996) Ranking and defuzzification methods based on area compensation. Fuzzy Sets Syst 82:319–330

Guo H, Pedrycz W, Liu X (2018) Fuzzy time series forecasting based on axiomatic fuzzy set theory. Neural Comput Appl. https://doi.org/10.1007/s00521-017-3325-9

Hasuike T, Katagiri H, Ishii H (2009) Portfolio selection problems with random fuzzy variable returns. Fuzzy Sets Syst 160:2579–2596

Jorion P (2006) Value at risk: the new benchmark for managing financial risk. McGraw-Hill, New York

Katagiri H, Sakawa M, Kato K, Nishizaki I (2008) Interactive multiobjective fuzzy random linear programming: maximization of possibility and probability. Eur J Oper Res 188:530–539

Kodogiannis V, Lolis A (2002) Forecasting financial time series using neural network and fuzzy system-based techniques. Neural Comput Appl 11:90–102

Kruse R, Meyer KD (1987) Statistics with vague data. Reidel Publishing Company, Dortrecht

Kusuoka S (2001) On law-invariant coherent risk measures. Adv Math Econ 3:83–95

Kwakernaak H (1978) Fuzzy random variables: I. Definitions and theorem. Inf Sci 15:1–29

Li J, Xu J (2013) Multi-objective portfolio selection model with fuzzy random returns and a compromise approach-based genetic algorithm. Inf Sci 220:507–521

Markowitz H (1990) Mean–variance analysis in portfolio choice and capital markets. Blackwell, Oxford

Moussa AM, Kamdem JS, Terraza M (2014) Fuzzy value-at-risk and expected shortfall for portfolios with heavy-tailed returns. Econ Model 39:247–256

Pliska SR (1997) Introduction to mathematical finance: discrete-time models. Blackwell, New York

Puri ML, Ralescu DA (1986) Fuzzy random variables. J Math Anal Appl 114:409–422

Rockafellar RT, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2:21–41

Ross SM (1999) An introduction to mathematical finance. Cambridge University Press, Cambridge

Sadati MEH, Doniavi A (2014) Optimization of fuzzy random portfolio selection by implementation of harmony search algorithm. Int J Eng Trends Technol 8:60–64

Sadati MEH, Nematian J (2013) Two-level linear programming for fuzzy random portfolio optimization through possibility and necessity-based model. Proc Econ Finance 5:657–666

Tanaka H, Guo P (1999) Portfolio selection based on upper and lower exponential possibility distributions. Eur J Oper Res 114:115–126

Tanaka H, Guo P, Turksen IB (2000) Portfolio selection based on fuzzy probabilities and possibility distributions. Fuzzy Sets Syst 111:387–397

Tasche D (2002) Expected shortfall and beyond. J Bank Finance 26:1519–1533

Wang B, Wang S, Watada J (2011) Fuzzy portfolio selection models with value-at-risk. IEEE Trans Fuzzy Syst 19:758–769

Watada J (2001) Fuzzy portfolio model for decision making in investment. In: Yoshida Y (ed) Dynamical aspects in fuzzy decision making. Physica, Heidelberg, pp 141–162

Yoshida Y (2006) Mean values, measurement of fuzziness and variance of fuzzy random variables for fuzzy optimization. In: Proceedings of SCIS and ISIS 2006, Tokyo, pp 2277–2282

Yoshida Y (2007) Fuzzy extension of estimations with randomness: the perception-based approach. In: Proceedings of MDAI 2007, LNAI 4529, Springer, pp 295–306

Yoshida Y (2008) Perception-based estimations of fuzzy random variables: linearity and convexity. Int J Uncertain Fuzziness Knowl Based Syst 16(suppl):71–87

Yoshida Y (2009) An estimation model of value-at-risk portfolio under uncertainty. Fuzzy Sets Syst 160:3250–3262

Yoshida Y (2011) Risk analysis of portfolios under uncertainty: minimizing average rates of falling. J Adv Comput Intell Intell Inform 15:56–62

Yoshida Y (2013) Ordered weighted averages on intervals and the sub/super-additivity. J Adv Comput Intell Intell Inform 17(4):520–525

Yoshida Y (2017) Portfolios optimization with coherent risk measures in fuzzy asset management. In: Proceedings of ISCBI2017, Dubai, pp 100–104

Yoshida Y (2018) Coherent risk measures derived from utility functions. In: Proceedings of MDAI 2018, LNAI, vol 11144. Springer (to appear)

Zadeh LA (1965) Fuzzy sets. Inf Control 8:338–353

Acknowledgements

This research is supported from JSPS KAKENHI Grant Number JP 16K05282.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yoshida, Y. Portfolio optimization in fuzzy asset management with coherent risk measures derived from risk averse utility. Neural Comput & Applic 32, 10847–10857 (2020). https://doi.org/10.1007/s00521-018-3683-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-018-3683-y