Abstract

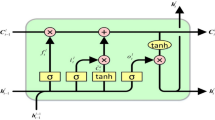

The prediction of a volatile stock market is a challenging task. While various neural networks are integrated to address stock trend prediction problems, the weight initialization of such networks plays a crucial role. In this article, we adopt feed-forward Vanilla Neural Network (VNN) and propose a novel application of Pearson Correlation Coefficient (PCC) for weight initialization of VNN model. VNN consists of an input layer, a single hidden layer, and an output layer; the edges connecting neurons in the input layer and the hidden layer are generally initialized with random weights. While PCC is primarily used to find the correlation between two variables, we propose to apply PCC for weight initialization instead of random initialization (RI) for a VNN model to enhance the prediction performance. We also introduce the application of Absolute PCC (APCC) for weight initialization and analyze the effects of RI, PCC, and APCC values as weights for a VNN model. We conduct an empirical study using these concepts to predict the stock trend and evaluate these three weight initialization techniques on ten years of stock trading archival data of Reliance Industries, Infosys Ltd, HDFC Bank, and Dr. Reddy’s Laboratories for the duration of years 2008 to 2017 for continuous as well as discrete data representations. We further evaluate the applicability of these weight initialization techniques using an ablation study on the considered features and analyze the prediction performance. The results demonstrate that the proposed weight initialization techniques, PCC and APCC, provide higher or comparable results as compared to RI, and the statistical significance of the same is carried out.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.References

Thakkar A, Chaudhari K (2020) A comprehensive survey on portfolio optimization, stock price and trend prediction using particle swarm optimization. Archiv Comput Methods Eng 28:1–32

Schumaker RP, Chen H (2009) Textual analysis of stock market prediction using breaking financial news: the AZFin text system. ACM Trans Inf Syst (TOIS) 27(2):12

Thakkar A, Chaudhari K (2020) CREST: cross-reference to exchange-based stock trend prediction using long short-term memory. Procedia Comput Sci 167:616

Ni LP, Ni ZW, Gao YZ (2011) Stock trend prediction based on fractal feature selection and support vector machine. Expert Syst Appl 38(5):5569

Zhang G, Patuwo BE, Hu MY (1998) Forecasting with artificial neural networks: the state of the art. Int J Forecast 14(1):35

Yoo PD, Kim MH, Jan T (2005) Financial forecasting: advanced machine learning techniques in stock market analysis. In: 2005 Pakistan Section Multitopic Conference, 2005, pp 1–7. https://doi.org/10.1109/INMIC.2005.334420

Chang PC, Liu CH, Lin JL, Fan CY, Ng CS (2009) A neural network with a case based dynamic window for stock trading prediction. Expert Syst Appl 36(3):6889

Tsai CF, Chiou YJ (2009) Earnings management prediction: a pilot study of combining neural networks and decision trees. Expert Syst Appl 36(3):7183

de Oliveira FA, Zárate LE, de Azevedo Reis M, Nobre CN (2011) The use of artificial neural networks in the analysis and prediction of stock prices. In: 2011 IEEE international conference on (IEEE) systems, man, and cybernetics (SMC), pp 2151–2155

Cai X, Lai G, Lin X (2013) Forecasting large scale conditional volatility and covariance using neural network on GPU. J Supercomput 63(2):490

Guresen E, Kayakutlu G, Daim TU (2011) Using artificial neural network models in stock market index prediction. Expert Syst Appl 38(8):10389

Thakkar A, Lohiya R (2020) A review on machine learning and deep learning perspectives of IDS for IoT: recent updates, security issues, and challenges. Archiv Comput Methods Eng 28:1–33

Pareek P, Thakkar A (2020) A survey on video-based human action recognition: recent updates, datasets, challenges, and applications. Artif Intell Rev 54:1–64

Thakkar A, Mungra D, Agrawal A (2020) Sentiment analysis: an empirical comparison between various training algorithms for artificial neural network. Int J Innov Comput Appl 11(1):9

Mungra D, Agrawal A, Thakkar A (2020) A voting-based sentiment classification model. In: Intelligent communication, control and devices. Springer, pp 551–558

Chaudhari K, Thakkar A (2020) A comprehensive survey on travel recommender systems. Archiv Comput Methods Eng 27:1545–1571

Chaudhari K, Thakkar A (2019) Survey on handwriting-based personality trait identification. Expert Syst Appl 124:282

Sharma R, Rajvaidya H, Pareek P, Thakkar A (2019) A comparative study of machine learning techniques for emotion recognition. In: Emerging research in computing. information, communication and applications. Springer, 906, pp 459–464

Thakkar A, Jivani N, Padasumbiya J, Patel CI (2013) A new hybrid method for face recognition. In: 2013 Nirma University international conference on engineering (NUiCONE). IEEE, pp 1–9

Patel R, Patel CI, Thakkar A (2012) Aggregate features approach for texture analysis. In: 2012 Nirma University international conference on engineering (NUiCONE). IEEE, pp 1–5

Tsai CF, Hsiao YC (2010) Combining multiple feature selection methods for stock prediction: union, intersection, and multi-intersection approaches. Decis Support Syst 50(1):258

Ray R, Khandelwal P, Baranidharan B (2018) A survey on stock market prediction using artificial intelligence techniques. In: 2018 International conference on smart systems and inventive technology (ICSSIT). IEEE, pp 594–598

Ryll L, Seidens S (2019) Evaluating the performance of machine learning algorithms in financial market forecasting: a comprehensive survey. arXiv:1906.07786

Abiodun OI, Jantan A, Omolara AE, Dada KV, Mohamed NA, Arshad H (2018) State-of-the-art in artificial neural network applications: a survey. Heliyon 4(11):e00938

Nguyen D (1990) Improving the learning speed of 2-layer neural networks by choosing initial values of the adaptive weights. In: Proceedings of the international joint conference on neural networks, vol. 3. pp 21–26

Drago GP, Ridella S (1992) Statistically controlled activation weight initialization (SCAWI). IEEE Trans Neural Netw 3(4):627

Enke D, Thawornwong S (2005) The use of data mining and neural networks for forecasting stock market returns. Expert Syst Appl 29(4):927

Castillo E, Guijarro-Berdiñas B, Fontenla-Romero O, Alonso-Betanzos A (2006) A very fast learning method for neural networks based on sensitivity analysis. J Mach Learn Res 7(Jul):1159

Mingyue Q, Cheng L, Yu S (2016) Application of the artifical neural network in predicting the direction of stock market index. In: 2016 10th international conference on complex, intelligent, and software intensive systems (CISIS). IEEE, pp 219–223

Qiu M, Song Y (2016) Predicting the direction of stock market index movement using an optimized artificial neural network model. PLoS ONE 11(5):e0155133

Wang H (2018) A study on the stock market prediction based on genetic neural network. In: Proceedings of the 2018 international conference on information hiding and image processing, pp 105–108

Kim KJ, Han I (2000) Genetic algorithms approach to feature discretization in artificial neural networks for the prediction of stock price index. Expert Syst Appl 19(2):125

Abraham A, Nath B, Mahanti PK (2001) Hybrid intelligent systems for stock market analysis. In: International conference on computational science. Springer, pp 337–345

Hadavandi E, Shavandi H, Ghanbari A (2010) Integration of genetic fuzzy systems and artificial neural networks for stock price forecasting. Knowl Based Syst 23(8):800

Csáji BC et al (2001) Approximation with artificial neural networks. Faculty of Sciences, Etvs Lornd University, Hungary 24(48):7

Kara Y, Boyacioglu MA, Baykan ÖK (2011) Predicting direction of stock price index movement using artificial neural networks and support vector machines: the sample of the Istanbul Stock Exchange. Expert Syst Appl 38(5):5311

Chorowski J, Zurada JM (2015) Learning understandable neural networks with nonnegative weight constraints. IEEE Trans Neural Netw Learn Syst 26(1):62

Thakkar A, Lohiya R (2020) Attack classification using feature selection techniques: a comparative study. J Ambient Intell Humaniz Comput 12:1–18

Benesty J, Chen J, Huang Y, Cohen I (2009) Pearson correlation coefficient. In: Noise reduction in speech processing. Springer, pp 1–4

Patel J, Shah S, Thakkar P, Kotecha K (2015) Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert Syst Appl 42(1):259

NSE (1992) NSE-National Stock Exchange of India Ltd., NSE-National Stock Exchange of India Ltd. http://www.nseindia.com/. Last Accessed 31, Oct 2018

Chollet F et al (2015) Keras. https://keras.io

Kingdom S (2019) Wilcoxon signed-rank test. http://www.statskingdom.com/175wilcoxon_signed_ranks.html. Last Accessed 21 Mar 2019

Abdi H (2010) Coefficient of variation. Encycl Res Des 1:169

Thakkar A, Chaudhari K (2020) Fusion in stock market prediction: a decade survey on the necessity, recent developments, and potential future directions. Inf Fusion 65:95

Chaudhari K, Thakkar A (2021) iCREST: international cross-reference to exchange-based stock trend prediction using long short-term memory. In: International conference on applied soft computing and communication networks. Springer, pp 323–338. https://doi.org/10.1007/978-981-33-6173-7_22

Thakkar A, Chaudhari K (2021) A comprehensive survey on deep neural networks for stock market: the need, challenges, and future directions. Expert Syst Appl 177:114800. https://doi.org/10.1016/j.eswa.2021.114800

Thakkar A, Chaudhari K (2020) Predicting stock trend using an integrated term frequency-inverse document frequency-based feature weight matrix with neural networks. Appl Soft Comput 96:106684

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no potential conflict of interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Thakkar, A., Patel, D. & Shah, P. Pearson Correlation Coefficient-based performance enhancement of Vanilla Neural Network for stock trend prediction. Neural Comput & Applic 33, 16985–17000 (2021). https://doi.org/10.1007/s00521-021-06290-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-021-06290-2