Abstract

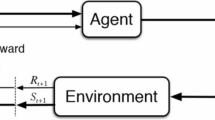

Stock markets play an essential role in the economy and offer companies opportunities to grow, and insightful investors to make profits. Many tools and techniques have been proposed and applied to analyze the overall market behavior to seize such opportunities. However, understanding the stock exchange’s intrinsic rules and taking opportunities are not trivial tasks. With that in mind, this work proposes AURORA: a new hybrid service to trade equities in the stock market, using an autonomous agent-based approach. The goal is to offer a reliable service based on technical and fundamental analysis with precision and stability in the decision-making process. For this, AURORA’s intelligence is modeled using a rational agent capable of perceiving the market and acting upon its perception autonomously. When compared with other solutions in the literature, the proposed service shows that it can predict the gain or loss of value at the price of a stock with an accuracy higher than 82.86% in the worst case and 89.23% in the best case. Furthermore, the proposed service can achieve a profitability of 11.74%, overcoming fixed-income investments, and portfolios built with the Markowitz Mean-Variance model.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Notes

Available at https://github.com/EmpyreanAI/AURORA.

Available at: https://spinningup.openai.com.

Available at: https://gym.openai.com.

Available at http://www.b3.com.br/.

Available at https://github.com/hyperopt/hyperopt.

Parameterized with \(C=0.1\) and \(\gamma =1\).

Parameterized using the DTW metric.

Values from: http://www.yahii.com.br/poupanca.html.

Values from: http://www.yahii.com.br/cetip13a21.html.

Strategy used by investors who decide to buy an asset for the long term.

It is worth emphasizing that not all selected actions are performed. If a purchase action is required, and the agent does not have the amount of money to buy the asset, it will not be performed. With this, the agent receives punishment for the action performed incorrectly. The same logic applies similarly to sales.

References

Araújo R.d.A, Nedjah N, Oliveira A.L, Silvio R.d.L (2019) A deep increasing-decreasing-linear neural network for financial time series prediction. Neurocomputing 347:59–81

Barra S, Carta SM, Corriga A, Podda AS, Recupero DR (2020) Deep learning and time series-to-image encoding for financial forecasting. IEEE/CAA J Automat Sinica 7(3):683–692

Cesarone F, Scozzari A, Tardella F (2011) Portfolio selection problems in practice: a comparison between linear and quadratic optimization models. arXiv preprint arXiv:1105.3594

Chandrinos SK, Sakkas G, Lagaros ND (2018) Airms: a risk management tool using machine learning. Expert Syst Appl 105:34–48

Chen W, Jiang M, Zhang WG, Chen Z (2021) A novel graph convolutional feature based convolutional neural network for stock trend prediction. Inf Sci 556:67–94

Chung H, Shin KS (2018) Genetic algorithm-optimized long short-term memory network for stock market prediction. Sustainability 10(10):3765

Cocco L, Concas G, Marchesi M (2017) Using an artificial financial market for studying a cryptocurrency market. J Econ Inter Coord 12(2):345–365

Dixon M, Klabjan D, Bang JH (2017) Classification-based financial markets prediction using deep neural networks. Alg Fin 6(3–4):67–77

Enke D, Thawornwong S (2005) The use of data mining and neural networks for forecasting stock market returns. Expert Syst Appl 29(4):927–940

Goodfellow I, Bengio Y, Courville A (2016) Deep learning. MIT press, USA

Hochreiter S, Schmidhuber J (1997) Long short-term memory. Neural Comput. 9(8):1735–1780

Hou X, Wang K, Zhong C, Wei Z (2021) St-trader: a spatial-temporal deep neural network for modeling stock market movement. IEEE/CAA J Automat Sinica 8(5):1015–1024

Huang CY (2018) Financial trading as a game: a deep reinforcement learning approach arXiv preprint arXiv:1807.02787

Jain R (1990) The art of computer systems performance analysis: techniques for experimental design, measurement, simulation, and modeling. Wiley, USA

Lam M (2004) Neural network techniques for financial performance prediction: integrating fundamental and technical analysis. Decision Support Syst 37(4):567–581

Lillicrap T.P, Hunt J.J, Pritzel A, Heess N, Erez T, Tassa Y, Silver D, Wierstra D (2015) Continuous control with deep reinforcement learning. arXiv preprint arXiv:1509.02971

Malagrino LS, Roman NT, Monteiro AM (2018) Forecasting stock market index daily direction: a bayesian network approach. Expert Syst Appl 105:11–22

Markowitz H (1952) Portfolio selection, journal of finance. Markowitz HM–1952 77–91

Mnih V, Kavukcuoglu K, Silver D, Graves A, Antonoglou I, Wierstra D, Riedmiller M (2013) Playing atari with deep reinforcement learning. arXiv preprint arXiv:1312.5602

Moghar A, Hamiche M (2020) Stock market prediction using lstm recurrent neural network. Procedia Comput Sci 170:1168–1173

Nti IK, Adekoya AF, Weyori BA (2019) A systematic review of fundamental and technical analysis of stock market predictions. Artificial Intelligence Review 1–51

Nti KO, Adekoya A, Weyori B (2019) Random forest based feature selection of macroeconomic variables for stock market prediction. Am J Appl Sci 16(7):200–212

Paiva FD, Cardoso RTN, Hanaoka GP, Duarte WM (2019) Decision-making for financial trading: A fusion approach of machine learning and portfolio selection. Expert Syst with Appl 115:635–655

Preis T, Moat HS, Stanley HE (2013) Quantifying trading behavior in financial markets using google trends. Sci Rep 3:1684

Russell SJ, Norvig P (2016) Artificial intelligence: a modern approach. Pearson Education Limited, Malaysia

Sharpe WF (1966) Mutual fund performance. J Bus 39(1):119–138

Silver D, Lever G, Heess N, Degris T, Wierstra D, Riedmiller M (2014) Deterministic policy gradient algorithms

Sutton RS, Barto AG (2018) Reinforcement learning: an introduction. MIT press, USA

Thakkar A, Chaudhari K (2021) A comprehensive survey on deep neural networks for stock market: The need, challenges, and future directions. Expert Systems with Applications. p 114800

Wang J, Zhou M, Guo X, Qi L (2018) Multiperiod asset allocation considering dynamic loss aversion behavior of investors. IEEE Trans Comput Soc Syst 6(1):73–81

Watkins CJ, Dayan P (1992) Machine learning. Q Learn 8(3–4):279–292

Acknowledgements

The authors thank the Coordination for the Improvement of Higher Education Personnel (CAPES) and the São Paulo Research Foundation (FAPESP) grants 19/14429-5, 15/50122-0 for the financial support to develop this research.

Funding

Not applicable

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest/Competing interests

The authors (Renato A. Nobre, Khalil C. do Nascimento, Patricia A. Vargas, Alan D. B. Valejo, Gustavo Pessin, Leandro A. Villas and Geraldo P. Rocha Filho) declare that there is no conflict of interest.

Availability of data and material

All used data are public available on the B3 stock market website: http://www.b3.com.br/.

Code availability

Every code developed is public available on Github: https://github.com/EmpyreanAI.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nobre, R.A., Nascimento, K.C.d., Vargas, P.A. et al. AURORA: an autonomous agent-oriented hybrid trading service. Neural Comput & Applic 34, 2217–2232 (2022). https://doi.org/10.1007/s00521-021-06508-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-021-06508-3