Abstract

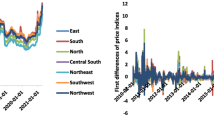

Projections of commodity prices have long been a significant source of dependence for investors and the government. This study investigates the challenging topic of forecasting the daily regional steel price index in the northeast Chinese market from January 1, 2010, to April 15, 2021. The projection of this significant commodity price indication has not received enough attention in the literature. The forecasting model that is used is Gaussian process regressions, which are trained using a mix of cross-validation and Bayesian optimizations. The models that were built precisely predicted the price indices between January 8, 2019, and April 15, 2021, with an out-of-sample relative root mean square error of 0.5432%. Investors and government officials can use the established models to study pricing and make judgments. Forecasting results can help create comparable commodity price indices when reference data on the price trends suggested by these models are used.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Data availability

Data are available upon request.

References

Liu Z, Wang Y, Zhu S, Zhang B, Wei L (2015) Steel prices index prediction in china based on bp neural network, In: LISS 2014: Proceedings of 4th International Conference on Logistics, Informatics and Service Science, Springer, pp. 603–608. https://doi.org/10.1007/978-3-662-43871-8_87

Xu Z, Deng H, Wu Q (2021) Prediction of soybean price trend via a synthesis method with multistage model. Int J Agric Environ Inf Syst (IJAEIS) 12:1–13. https://doi.org/10.4018/IJAEIS.20211001.oa1

Ganokratanaa T, Ketcham M (2021) Deep index price forecasting in steel industry, In: 2021 18th International Joint Conference on Computer Science and Software Engineering (JCSSE), IEEE, pp. 1–6. https://doi.org/10.1109/JCSSE53117.2021.9493843

Xu X, Zhang Y (2022) Thermal coal price forecasting via the neural network. Intell Syst Appl 14:200084. https://doi.org/10.1016/j.iswa.2022.200084

Zhang Q, Liu D, Wang X, Ye Z, Jiang H, Wei W (2023) Research on the improved combinatorial prediction model of steel price based on time series. Tehnički vjesnik 30:2018–2025. https://doi.org/10.17559/TV-20230426000569

Xu X, Zhang Y (2023) Coking coal futures price index forecasting with the neural network. Miner Econ 36:349–359. https://doi.org/10.1007/s13563-022-00311-9

Jin B, Xu X (2024) Machine learning predictions of regional steel price indices for east china. Ironmak Steelmak. https://doi.org/10.1177/03019233241254891

R. R. R. Palvai, A. Kaur, Steel price forecasting for better procurement decisions: Comparing tree-based decision learning methods, In: International Conference on Data Analytics in Public Procurement and Supply Chain, Springer, (2022), pp. 139–147. https://doi.org/10.1007/978-981-99-1019-9_14

K. Çetin, S. Aksoy, İ. İşeri, Steel price forcasting using long short-term memory network model, In: 2019 4th International Conference on Computer Science and Engineering (UBMK), IEEE, (2019), pp. 612–617. https://doi.org/10.1109/UBMK.2019.8907015

A. Firdaus, U. Amrina, Modelling the price forecast for construction steel: A case study in epc company, In: E3S Web of Conferences, volume 399, EDP Sciences, (2023), p. 03020. https://doi.org/10.1051/e3sconf/202339903020

Ilmark S (2013) Market forecast for stainless steel. Metallurgist 56:883–887. https://doi.org/10.1007/s11015-013-9668-2

Jin B, Xu X (2024) Price forecasting through neural networks for crude oil, heating oil, and natural gas. Meas Energy 1:100001. https://doi.org/10.1016/j.meaene.2024.100001

Gligorić Z, Gligorić M, Halilović D, Beljić Č, Urošević K (2020) Hybrid stochastic-grey model to forecast the behavior of metal price in the mining industry. Sustainability 12:6533. https://doi.org/10.3390/su12166533

Ou T-Y, Cheng C-Y, Chen P-J, Perng C (2016) Dynamic cost forecasting model based on extreme learning machine-a case study in steel plant. Comput Ind Eng 101:544–553. https://doi.org/10.1016/j.cie.2016.09.012

Chou M-T (2012) Prediction of asian steel price index using fuzzy time series, In: 2012 Third International Conference on Innovations in Bio-Inspired Computing and Applications, IEEE, pp. 185–188. DOIurlhttps://doi.org/10.1109/IBICA.2012.26

Kapl M, Müller WG (2010) Prediction of steel prices: a comparison between a conventional regression model and MSSA. Statist Interface 3:369–375. https://doi.org/10.4310/SII.2010.v3.n3.a10

Saufnay L, Demonceau J-F (2023) Establishment of reliable relative price predictions for high-strength steel members. Steel Constr. https://doi.org/10.1002/stco.202300013

Xu X, Zhang Y (2022) Commodity price forecasting via neural networks for coffee, corn, cotton, oats, soybeans, soybean oil, sugar, and wheat. Intell Syst Acco Financ Manag 29:169–181. https://doi.org/10.1002/isaf.1519

Siddique M, Mohanty S, Panda D (2018) A hybrid forecasting model for prediction of stock value of tata steel using support vector regression and particle swarm optimization. Int J Pure Appl Math 119:1719–1727

Xu X, Zhang Y (2023) Edible oil wholesale price forecasts via the neural network. Energy Nexus 12:100250. https://doi.org/10.1016/j.nexus.2023.100250

Alcalde R, Urda D, de Armiño CA, García S, Manzanedo M, Herrero Á (2022) Non-linear neural models to predict hrc steel price in Spain, In: International Workshop on Soft Computing Models in Industrial and Environmental Applications, Springer, pp. 186–194. https://doi.org/10.1007/978-3-031-18050-7_18

Tcha M, Kim PJ (2019) Steel price projections. The economics of the East Asia steel industries. Routledge, London, pp 225–256

Yin Y, Wu B, Zhu Q (2012) Compare with three models for price forecasting on steel market, in: 2012 International Conference on Computer Science and Service System, IEEE, pp 1844–1847. https://doi.org/10.1109/CSSS.2012.459

Shyu Y-W, Chang C-C (2022) A hybrid model of memd and pso-lssvr for steel price forecasting. Int J Eng Manag Res 12:30–40. https://doi.org/10.31033/ijemr.12.1.5

Al-Hammad IA (2006) Treatment of reinforcing steel bars prices fluctuations. J King Saud Univ Eng Sci 19:43–62. https://doi.org/10.1016/S1018-3639(18)30847-X

Malanichev A, Vorobyev P (2011) Forecast of global steel prices. Stud Russ Econ Dev 22:304–311. https://doi.org/10.1134/S1075700711030105

Guo Y, Zhao C, Qin X, Zhang J (2022) Prediction and analysis of wuxi stainless steel market price based on arima-bp neural network combination model. Int J Manag Stud Res (IJMSR) 10:40–52. https://doi.org/10.20431/2349-0349.1007005

Jerrett D, Cuddington JT (2008) Broadening the statistical search for metal price super cycles to steel and related metals. Resour Policy 33:188–195. https://doi.org/10.1016/j.resourpol.2008.08.001

Jin B, Xu X (2024) Contemporaneous causality among price indices of ten major steel products. Ironmak Steelmak. https://doi.org/10.1177/03019233241249361

Faghih SAM, Kashani H (2018) Forecasting construction material prices using vector error correction model. J Constr Eng Manag 144:04018075. https://doi.org/10.1061/(ASCE)CO.1943-7862.0001528

Adli KA(2020) Forecasting steel prices using arimax model: a case study of turkey, Int J Bus Manag Technol

Lin Y-H, Wu Y-W (2006) Dynamic relationship of steel prices between two different markets: Taiwan and mainland china. J Mar Sci Technol 14:7. https://doi.org/10.51400/2709-6998.2086

Chou M-T (2016) Dynamic economic relations among steel price indices. J Mar Sci Technol 24:3. https://doi.org/10.6119/JMST-016-0504-1

Jin B, Xu X (2024) Carbon emission allowance price forecasting for China Guangdong carbon emission exchange via the neural network. Global Financ Rev 6(1):3491–3491

Xu X (2015) Cointegration among regional corn cash prices. Econ Bull 35:2581–2594

Bessler DA, Chamberlain PJ (1988) Composite forecasting with Dirichlet priors. Decis Sci 19:771–781. https://doi.org/10.1111/j.1540-5915.1988.tb00302.x

Xu X (2017) Short-run price forecast performance of individual and composite models for 496 corn cash markets. J Appl Stat 44:2593–2620. https://doi.org/10.1080/02664763.2016.1259399

Bessler DA, Brandt JA (1981) Forecasting livestock prices with individual and composite methods. Appl Econ 13:513–522. https://doi.org/10.1080/00036848100000016

Xu X (2017) Contemporaneous causal orderings of us corn cash prices through directed acyclic graphs. Empir Econ 52:731–758. https://doi.org/10.1007/s00181-016-1094-4

Bessler DA (1990) Forecasting multiple time series with little prior information. Am J Agr Econ 72:788–792. https://doi.org/10.2307/1243059

Xu X (2017) The rolling causal structure between the Chinese stock index and futures. Fin Markets Portfolio Mgmt 31:491–509. https://doi.org/10.1007/s11408-017-0299-7

Bessler DA, Babula RA (1987) Forecasting wheat exports: do exchange rates matter? J Bus Econ Statist 5:397–406. https://doi.org/10.2307/1391615

Xu X (2018) Intraday price information flows between the csi300 and futures market: an application of wavelet analysis. Empir Econ 54:1267–1295. https://doi.org/10.1007/s00181-017-1245-2

Yang J, Haigh MS, Leatham DJ (2001) Agricultural liberalization policy and commodity price volatility: a Garch application. Appl Econ Lett 8:593–598. https://doi.org/10.1080/13504850010018734

Xu X (2018) Using local information to improve short-run corn price forecasts. Journal of Agricultural & Food Industrial Organization 16:4

Bessler DA, Yang J, Wongcharupan M (2003) Price dynamics in the international wheat market: modeling with error correction and directed acyclic graphs. J Reg Sci 43:1–33

Xu X (2018) Causal structure among us corn futures and regional cash prices in the time and frequency domain. J Appl Stat 45:2455–2480. https://doi.org/10.1080/02664763.2017.1423044

Bessler DA, Brandt JA (1992) An analysis of forecasts of livestock prices. J Econ Behav Organ 18:249–263. https://doi.org/10.1016/0167-2681(92)90030-F

Xu X (2019) Price dynamics in corn cash and futures markets: cointegration, causality, and forecasting through a rolling window approach. Fin Markets Portfolio Mgmt 33:155–181. https://doi.org/10.1007/s11408-019-00330-7

Bessler DA, Hopkins JC (1986) Forecasting an agricultural system with random walk priors. Agric Syst 21:59–67. https://doi.org/10.1016/0308-521X(86)90029-6

Xu X (2019) Contemporaneous and granger causality among us corn cash and futures prices. Eur Rev Agric Econ 46:663–695. https://doi.org/10.1093/erae/jby036

Chen DT, Bessler DA (1990) Forecasting monthly cotton price: structural and time series approaches. Int J Forecast 6:103–113. https://doi.org/10.1016/0169-2070(90)90101-G

Xu X (2019) Contemporaneous causal orderings of csi300 and futures prices through directed acyclic graphs. Econ Bull 39:2052–2077

Wang Z, Bessler DA (2004) Forecasting performance of multivariate time series models with full and reduced rank: an empirical examination. Int J Forecast 20:683–695. https://doi.org/10.1016/j.ijforecast.2004.01.002

Xu X (2020) Corn cash price forecasting. Am J Agr Econ 102:1297–1320. https://doi.org/10.1002/ajae.12041

Chen DT, Bessler DA (1987) Forecasting the us cotton industry: Structural and time series approaches, In: Proceedings of the NCR-134 Conference on Applied Commodity Price Analysis. Forecasting, and Market Risk Management, Chicago Mercantile Exchange, Chicago, https://doi.org/10.22004/ag.econ.285463

Xu X, Zhang Y (2021) Individual time series and composite forecasting of the Chinese stock index. Mach Learn Appl 5:100035. https://doi.org/10.1016/j.mlwa.2021.100035

Bessler DA, Kling JL (1986) Forecasting vector autoregressions with Bayesian priors. Am J Agr Econ 68:144–151. https://doi.org/10.2307/1241659

Xu X, Zhang Y (2022) Contemporaneous causality among one hundred Chinese cities. Empir Econ 63:2315–2329. https://doi.org/10.1007/s00181-021-02190-5

Babula RA, Bessler DA, Reeder J, Somwaru A (2004) Modeling us soy-based markets with directed acyclic graphs and Bernanke structural Var methods: the impacts of high soy meal and soybean prices. J Food Distrib Res 35:29–52. https://doi.org/10.22004/ag.econ.27559

Xu X, Zhang Y (2023) Contemporaneous causality among residential housing prices of ten major Chinese cities. Int J Hous Mark Anal 16:792–811. https://doi.org/10.1108/IJHMA-03-2022-0039

Yang J, Zhang J, Leatham DJ (2003) Price and volatility transmission in international wheat futures markets. Ann Econ Financ 4:37–50

Xu X, Zhang Y (2023) Cointegration between housing prices: evidence from one hundred Chinese cities. J Prop Res 40:53–75. https://doi.org/10.1080/09599916.2022.2114926

Awokuse TO, Yang J (2003) The informational role of commodity prices in formulating monetary policy: a reexamination. Econ Lett 79:219–224. https://doi.org/10.1016/S0165-1765(02)00331-2

Xu X, Zhang Y (2023) An integrated vector error correction and directed acyclic graph method for investigating contemporaneous causalities. Decis Anal J 7:100229. https://doi.org/10.1016/j.dajour.2023.100229

Yang J, Awokuse TO (2003) Asset storability and hedging effectiveness in commodity futures markets. Appl Econ Lett 10:487–491. https://doi.org/10.1080/1350485032000095366

Xu X, Zhang Y (2023) Dynamic relationships among composite property prices of major Chinese cities: contemporaneous causality through vector error corrections and directed acyclic graphs. Int J Real Estate Stud 17:148–157. https://doi.org/10.11113/intrest.v17n1.294

Yang J, Leatham DJ (1998) Market efficiency of us grain markets: application of cointegration tests. Agribus Int J 14:107–112

Xu X, Zhang Y (2024) Contemporaneous causality among regional steel price indices of east, south, north, central south, northeast, southwest, and northwest china. Miner Econ 37:1–14. https://doi.org/10.1007/s13563-023-00380-4

Yang J, Li Z, Wang T (2021) Price discovery in Chinese agricultural futures markets: a comprehensive look. J Futur Mark 41:536–555. https://doi.org/10.1002/fut.22179

Xu X, Zhang Y (2023) Spatial-temporal analysis of residential housing, office property, and retail property price index correlations: evidence from ten Chinese cities. Int J Real Estate Stud 17:1–13. https://doi.org/10.11113/intrest.v17n2.274

Khorram AM, Nourollahzadeh N, Hamidian M (2023) Steel price volatility forecasting; application of the artificial neural network approach and Garch family models. Int J Nonlinear Anal Appl. https://doi.org/10.22075/IJNAA.2023.30006.4310

Xu X, Zhang Y (2023) Contemporaneous causality among office property prices of major Chinese cities with vector error correction modeling and directed acyclic graphs. J Model Manag. https://doi.org/10.1108/JM2-08-2023-0171

Zola P, Carpita M (2016) Forecasting the steel product prices with the arima model. Statist Appl 14:1

Payne ND, Karali B, Dorfman JH (2019) Can cattle basis forecasts be improved? A Bayesian model averaging approach. J Agric Appl Econ 51:249–266. https://doi.org/10.1017/aae.2018.35

Shimizu S, Hoyer PO, Hyvärinen A, Kerminen A, Jordan M (2006) A linear non-gaussian acyclic model for causal discovery. J Mach Learn Res 7:2003

Kunst RM, Franses PH (2015) Asymmetric time aggregation and its potential benefits for forecasting annual data. Empir Econ 49:363–387. https://doi.org/10.1007/s00181-014-0864-0

Coad A, Janzing D, Nightingale P (2018) Tools for causal inference from cross-sectional innovation surveys with continuous or discrete variables: theory and applications. Cuadernos de Economía 37:779–807. https://doi.org/10.15446/cuad.econ.v37n75.69832

Xu X, Zhang Y (2021) Network analysis of corn cash price comovements. Mach Learn Appl 6:100140. https://doi.org/10.1016/j.mlwa.2021.100140

Dorfman JH (1998) Bayesian composite qualitative forecasting: hog prices again. Am J Agr Econ 80:543–551. https://doi.org/10.2307/1244556

Hyvärinen A, Zhang K, Shimizu S, Hoyer PO (2010) Estimation of a structural vector autoregression model using non-gaussianity. J Mach Learn Res 11:1709

Jumah A, Kunst RM (2008) Seasonal prediction of European cereal prices: good forecasts using bad models? J Forecast 27:391–406. https://doi.org/10.1002/for.1062

Coad A, Binder M (2014) Causal linkages between work and life satisfaction and their determinants in a structural var approach. Econ Lett 124:263–268. https://doi.org/10.1016/j.econlet.2014.05.021

Xu X, Zhang Y (2024) Network analysis of comovements among newly-built residential house price indices of seventy Chinese cities. Int J Hous Mark Anal 17:726–749. https://doi.org/10.1108/IJHMA-09-2022-0134

Dorfman JH, McIntosh CS (1997) Economic criteria for evaluating commodity price forecasts. J Agric Appl Econ 29:337–345. https://doi.org/10.1017/S1074070800007835

Kawahara Y, Shimizu S, Washio T (2011) Analyzing relationships among arma processes based on non-gaussianity of external influences. Neurocomputing 74:2212–2221. https://doi.org/10.1016/j.neucom.2011.02.008

Hauser MA, Kunst RM (2001) Forecasting high-frequency financial data with the arfima-arch model. J Forecast 20:501–518. https://doi.org/10.1002/for.803

Moneta A, Entner D, Hoyer PO, Coad A (2013) Causal inference by independent component analysis: theory and applications. Oxford Bull Econ Stat 75:705–730. https://doi.org/10.1111/j.1468-0084.2012.00710.x

Xu X, Zhang Y (2022) Network analysis of price comovements among corn futures and cash prices. J Agric Food Ind Organ. https://doi.org/10.1515/jafio-2022-0009

McIntosh CS, Dorfman JH (1992) Qualitative forecast evaluation: a comparison of two performance measures. Am J Agr Econ 74:209–214. https://doi.org/10.2307/1243005

Jumah A, Kunst RM (2001) The effects of dollar/sterling exchange rate volatility on futures markets for coffee and cocoa. Eur Rev Agric Econ 28:307–328. https://doi.org/10.1093/erae/28.3.307

Costantini M, Kunst RM (2021) On using predictive-ability tests in the selection of time-series prediction models: A monte carlo evaluation. Int J Forecast 37:445–460. https://doi.org/10.1016/j.ijforecast.2020.06.010

Xu X, Zhang Y (2023) Network analysis of housing price comovements of a hundred chinese cities. Natl Inst Econ Rev 264:110–128. https://doi.org/10.1017/nie.2021.34

Jumah A, Kunst RM (2016) Optimizing time-series forecasts for inflation and interest rates using simulation and model averaging. Appl Econ 48:4366–4378. https://doi.org/10.1080/00036846.2016.1158915

Dorfman JH, McIntosh CS (1990) Results of a price forecasting competition. Am J Agr Econ 72:804–808. https://doi.org/10.2307/1243062

Ciarli T, Coad A, Moneta A (2023) Does exporting cause productivity growth? evidence from Chilean firms. Struct Chang Econ Dyn 66:228–239. https://doi.org/10.1016/j.strueco.2023.04.015

Alade IO, Zhang Y, Xu X (2021) Modeling and prediction of lattice parameters of binary spinel compounds (\(\text{ am}_{{2}}\text{ x}_{{4}}\)) using support vector regression with bayesian optimization. New J Chem 45:15255–15266. https://doi.org/10.1039/d1nj01523k

Alade IO, Oyedeji MO, Rahman MAA, Saleh TA (2022) Prediction of the lattice constants of pyrochlore compounds using machine learning. Soft Comput 26:8307–8315. https://doi.org/10.1007/s00500-022-07218-1

Alade IO, Rahman MAA, Hassan A, Saleh TA (2020) Modeling the viscosity of nanofluids using artificial neural network and Bayesian support vector regression. J Appl Phys. https://doi.org/10.1063/5.0008977

Adewumi AA, Owolabi TO, Alade IO, Olatunji SO (2016) Estimation of physical, mechanical and hydrological properties of permeable concrete using computational intelligence approach. Appl Soft Comput 42:342–350. https://doi.org/10.1016/j.asoc.2016.02.009

Tang B-Q, Han J, Guo G-F, Chen Y, Zhang S (2019) Building material prices forecasting based on least square support vector machine and improved particle swarm optimization. Archit Eng Des Manag 15:196–212. https://doi.org/10.1080/17452007.2018.1556577

Eroglu Y, Sakar IK (2013) Price modeling for steel industry: a case for Turkey, In: Proceedings of 10th International Symposium on Intelligent Manufacturing and Service Systems, pp 232–238

Wu B, Zhu Q (2012) Week-ahead price forecasting for steel market based on rbf nn and asw, in: 2012 IEEE International Conference on Computer Science and Automation Engineering, IEEE, pp 729–732. https://doi.org/10.1109/ICSESS.2012.6269570

Terregrossa SJ, Şener U (2023) Employing a generalized reduced gradient algorithm method to form combinations of steel price forecasts generated separately by arima-tf and ann models. Cogent Econ Financ 11:2169997. https://doi.org/10.1080/23322039.2023.2169997

Chiu C-Y, Fan S-KS, Shih P-C, Weng Y-H (2014) Applying HBMO-based SOM in predicting the Taiwan steel price fluctuation. Int J Electron Bus Manag 12:1

Mahto AK, Alam MA, Biswas R, Ahmad J, Alam SI (2021) Short-term forecasting of agriculture commodities in context of Indian market for sustainable agriculture by using the artificial neural network. J Food Qual 2021:1–13. https://doi.org/10.1155/2021/9939906

Luo R, Liu J, Wang P, Tao Z, Chen H (2023) A multisource data-driven combined forecasting model based on internet search keyword screening method for interval soybean futures price. J Forecast. https://doi.org/10.1002/for.3035

Xiong T, Forecasting soybean futures price using dynamic model averaging and particle swarm optimization, In: Proceedings of the Genetic and Evolutionary Computation Conference Companion, (2018), pp 75–76. https://doi.org/10.1145/3205651.3208761

Yin T, Wang Y (2021) Nonlinear analysis and prediction of soybean futures. Agric Econ Zemedelska Ekonomika. https://doi.org/10.17221/480/2020-AGRICECON

Abraham ER, dos Reis JGM, Vendrametto O, Costa-Neto PLDO, Carlo-Toloi R, Souza AED, Oliveira-Morais MD (2020) Time series prediction with artificial neural networks: an analysis using Brazilian soybean production. Agriculture 10:475. https://doi.org/10.3390/agriculture10100475

Luo Y (2023) Soybean futures price prediction based on CNN-LSTM model of Bayesian optimization algorithm. Highlights Bus Econ Manag 16:6–17

Yuan CZ, San WW, Leong TW, Determining optimal lag time selection function with novel machine learning strategies for better agricultural commodity prices forecasting in malaysia, In: Proceedings of the 2020 2nd International Conference on Information Technology and Computer Communications, (2020), pp. 37–42. https://doi.org/10.1145/3417473.3417480

Rl M, Mishra AK (2021) Forecasting spot prices of agricultural commodities in India: application of deep-learning models. Intell Syst Acc Financ Manag 28:72–83. https://doi.org/10.1002/isaf.1487

Bayona-Oré S, Cerna R, Hinojoza ET (2021) Machine learning for price prediction for agricultural products. WSEAS Trans Bus Econ 18:969–977. https://doi.org/10.37394/23207.2021.18.92

Storm H, Baylis K, Heckelei T (2020) Machine learning in agricultural and applied economics. Eur Rev Agric Econ 47:849–892. https://doi.org/10.1093/erae/jbz033

Kouadio L, Deo RC, Byrareddy V, Adamowski JF, Mushtaq S et al (2018) Artificial intelligence approach for the prediction of robusta coffee yield using soil fertility properties. Comput Electron Agric 155:324–338. https://doi.org/10.1016/j.compag.2018.10.014

Abreham Y (2019) Coffee price pridiction using machine-learning techniques, Ph.D. thesis, ASTU

Huy HT, Thac HN, Thu HNT, Nhat AN, Ngoc VH (2019) Econometric combined with neural network for coffee price forecasting. J Appl Econ Sci 14(64):378–392

Degife WA, Sinamo A (2019) Efficient predictive model for determining critical factors affecting commodity price: the case of coffee in Ethiopian commodity exchange (ECX). Int J Inf Eng Electron Bus 11:32–36. https://doi.org/10.5815/ijieeb.2019.06.05

Naveena K, Subedar S et al (2017) Hybrid time series modelling for forecasting the price of washed coffee (Arabica plantation coffee) in India. Int J Agric Sci 9:4004

Lopes LP (2018) Prediction of the Brazilian natural coffee price through statistical machine learning models. Sigmae 7:1–16

Mayabi TW (2019) An artificial neural network model for predicting retail maize prices in Kenya, Ph.D. thesis, University of Nairobi

Moreno RS, Salazar OZ et al (2018) An artificial neural network model to analyze maize price behavior in Mexico. Appl Math 9:473. https://doi.org/10.4236/am.2018.95034

Zelingher R, Makowski D, Brunelle T (2021) Assessing the sensitivity of global maize price to regional productions using statistical and machine learning methods. Front Sustain Food Syst 5:171. https://doi.org/10.3389/fsufs.2021.655206

Shahhosseini M, Hu G, Huber I, Archontoulis SV (2021) Coupling machine learning and crop modeling improves crop yield prediction in the us corn belt. Sci Rep 11:1–15. https://doi.org/10.1038/s41598-020-80820-1

Shahhosseini M, Hu G, Archontoulis S (2020) Forecasting corn yield with machine learning ensembles. Front Plant Sci 11:1120. https://doi.org/10.3389/fpls.2020.01120

dos Reis Filho IJ, Correa GB, Freire GM, Rezende SO(2020) Forecasting future corn and soybean prices: an analysis of the use of textual information to enrich time-series., In: Anais do VIII Symposium on Knowledge Discovery, Mining and Learning, SBC, pp 113–120

Zelingher R, Makowski D, Brunelle T (2020) Forecasting impacts of agricultural production on global maize price

Ribeiro MHDM, Ribeiro VHA, Reynoso-Meza G, dos Santos Coelho L (2019) Multi-objective ensemble model for short-term price forecasting in corn price time series, In: 2019 International Joint Conference on Neural Networks (IJCNN), IEEE, pp 1–8. https://doi.org/10.1109/IJCNN.2019.8851880

Surjandari I, Naffisah MS, Prawiradinata MI (2015) Text mining of twitter data for public sentiment analysis of staple foods price changes. J Ind Intell Inf. https://doi.org/10.12720/jiii.3.3.253-257

Ayankoya K, Calitz AP, Greyling JH (2016) Using neural networks for predicting futures contract prices of white maize in south africa, In: Proceedings of the Annual Conference of the South African Institute of Computer Scientists and Information Technologists, pp 1–10. https://doi.org/10.1145/2987491.2987508

Ali M, Deo RC, Downs NJ, Maraseni T (2018) Cotton yield prediction with Markov Chain Monte Carlo-based simulation model integrated with genetic programing algorithm: a new hybrid copula-driven approach. Agric For Meteorol 263:428–448. https://doi.org/10.1016/j.agrformet.2018.09.002

Fang Y, Guan B, Wu S, Heravi S (2020) Optimal forecast combination based on ensemble empirical mode decomposition for agricultural commodity futures prices. J Forecast 39:877–886. https://doi.org/10.1002/for.2665

Harris JJ (2017) A machine learning approach to forecasting consumer food prices

Li J, Li G, Liu M, Zhu X, Wei L (2020) A novel text-based framework for forecasting agricultural futures using massive online news headlines. Int J Forecast. https://doi.org/10.1016/j.ijforecast.2020.02.002

Yoosefzadeh-Najafabadi M, Earl HJ, Tulpan D, Sulik J, Eskandari M (2021) Application of machine learning algorithms in plant breeding: predicting yield from hyperspectral reflectance in soybean. Front Plant Sci 11:2169. https://doi.org/10.3389/fpls.2020.624273

Ribeiro MHDM, dos Santos Coelho L (2020) Ensemble approach based on bagging, boosting and stacking for short-term prediction in agribusiness time series. Appl Soft Comput 86:105837. https://doi.org/10.1016/j.asoc.2019.105837

Zhao H (2021) Futures price prediction of agricultural products based on machine learning. Neural Comput Appl 33:837–850. https://doi.org/10.1007/s00521-020-05250-6

Jiang F, He J, Zeng Z (2019) Pigeon-inspired optimization and extreme learning machine via wavelet packet analysis for predicting bulk commodity futures prices. Sci China Inf Sci 62:1–19. https://doi.org/10.1007/s11432-018-9714-5

Handoyo S, Chen YP (2020) The developing of fuzzy system for multiple time series forecasting with generated rule bases and optimized consequence part. SSRG Int J Eng Trends Technol 68:118–122. https://doi.org/10.14445/22315381/IJETT-V68I12P220

Silalahi DD, et al (2013) Application of neural network model with genetic algorithm to predict the international price of crude palm oil (CPO) and soybean oil (SBO), In: 12th National Convention on Statistics (NCS), Mandaluyong City, Philippine, October, (2013), pp 1–2

Li G, Chen W, Li D, Wang D, Xu S (2020) Comparative study of short-term forecasting methods for soybean oil futures based on LSTM, SVR, ES and wavelet transformation. J Phys Conf Ser 1682:012007. https://doi.org/10.1088/1742-6596/1682/1/012007

Ribeiro CO, Oliveira SM (2011) A hybrid commodity price-forecasting model applied to the sugar-alcohol sector. Austral J Agric Resour Econ 55:180–198. https://doi.org/10.1111/j.1467-8489.2011.00534.x

Zhang J, Meng Y, Wei J, Chen J, Qin J (2021) A novel hybrid deep learning model for sugar price forecasting based on time series decomposition. Math Prob Eng. https://doi.org/10.1155/2021/6507688

Melo BD, Milioni AZ, Nascimento Júnior CL (2007) Daily and monthly sugar price forecasting using the mixture of local expert models. Pesquisa Operacional 27:235–246. https://doi.org/10.1590/S0101-74382007000200003

de Melo B, Júnior CN, Milioni AZ (2004) Daily sugar price forecasting using the mixture of local expert models. WIT Trans Inf Commun Technol. https://doi.org/10.2495/DATA040221

Kohzadi N, Boyd MS, Kermanshahi B, Kaastra I (1996) A comparison of artificial neural network and time series models for forecasting commodity prices. Neurocomputing 10:169–181. https://doi.org/10.1016/0925-2312(95)00020-8

Zou H, Xia G, Yang F, Wang H (2007) An investigation and comparison of artificial neural network and time series models for Chinese food grain price forecasting. Neurocomputing 70:2913–2923

Rasheed A, Younis MS, Ahmad F, Qadir J, Kashif M (2021) District wise price forecasting of wheat in Pakistan using deep learning, arXiv preprint arXiv:2103.04781

Khamis A, Abdullah S (2014) Forecasting wheat price using backpropagation and NARX neural network. Int J Eng Sci 3:19–26

Dias J, Rocha H (2019) Forecasting wheat prices based on past behavior: comparison of different modelling approaches, In: International Conference on Computational Science and Its Applications, Springer, pp 167–182. https://doi.org/10.1007/978-3-030-24302-9_13

Gómez D, Salvador P, Sanz J, Casanova JL (2021) Modelling wheat yield with antecedent information, satellite and climate data using machine learning methods in mexico. Agric For Meteorol 300:108317. https://doi.org/10.1016/j.agrformet.2020.108317

Silva N, Siqueira I, Okida S, Stevan SL, Siqueira H (2019) Neural networks for predicting prices of sugarcane derivatives. Sugar Tech 21:514–523. https://doi.org/10.1007/s12355-018-0648-5

Deina C, do Amaral-Prates MH, Alves CHR, Martins MSR, Trojan F, Stevan SL Jr, Siqueira HV (2021) A methodology for coffee price forecasting based on extreme learning machines. Inf Process Agric. https://doi.org/10.1016/j.inpa.2021.07.003

Filippi P, Jones EJ, Wimalathunge NS, Somarathna PD, Pozza LE, Ugbaje SU, Jephcott TG, Paterson SE, Whelan BM, Bishop TF (2019) An approach to forecast grain crop yield using multi-layered, multi-farm data sets and machine learning. Precis Agric 20:1015–1029. https://doi.org/10.1007/s11119-018-09628-4

Wen G, Ma B-L, Vanasse A, Caldwell CD, Earl HJ, Smith DL (2021) Machine learning-based canola yield prediction for site-specific nitrogen recommendations. Nutr Cycl Agroecosyst 121:241–256. https://doi.org/10.1007/s10705-021-10170-5

Xu X, Zhang Y (2021) Corn cash price forecasting with neural networks. Comput Electron Agric 184:106120. https://doi.org/10.1016/j.compag.2021.106120

Shahwan T, Odening M (2007) Forecasting agricultural commodity prices using hybrid neural networks. Computational intelligence in economics and finance. Springer, Cham, pp 63–74. https://doi.org/10.1007/978-3-540-72821-4_3

Gollou AR, Ghadimi N (2017) A new feature selection and hybrid forecast engine for day-ahead price forecasting of electricity markets. J Intell Fuzzy Syst 32:4031–4045. https://doi.org/10.3233/JIFS-152073

Saâdaoui F (2017) A seasonal feedforward neural network to forecast electricity prices. Neural Comput Appl 28:835–847. https://doi.org/10.1007/s00521-016-2356-y

Zou Y, Tu M, Teng X, Cao R, Xie W (2019) Electricity price forecast based on stacked autoencoder in spot market environment, In: 2019 9th International Conference on Power and Energy Systems (ICPES), IEEE, pp 1–6. https://doi.org/10.1109/ICPES47639.2019.9105616

Abhinav R, Pindoriya NM (2018) Electricity price forecast for optimal energy management for wind power producers: a case study in indian power market, In: IEEE Innovative Smart Grid Technologies-Asia (ISGT Asia). IEEE, pp 1233–1238. https://doi.org/10.1109/ISGT-Asia.2018.8467870

Abedinia O, Amjady N, Shafie-Khah M, Catalão JP (2015) Electricity price forecast using combinatorial neural network trained by a new stochastic search method. Energy Convers Manag 105:642–654. https://doi.org/10.1016/j.enconman.2015.08.025

Sohrabi P, Jodeiri Shokri B, Dehghani H (2021) Predicting coal price using time series methods and combination of radial basis function (RBF) neural network with time series. Miner Econ. https://doi.org/10.1007/s13563-021-00286-z

Jaipuria S (2019) Prediction of lam coke price using ANN and ANFIS model. Int J Appl Res Manag Econ 2:7–17. https://doi.org/10.33422/ijarme.v2i3.267

Matyjaszek M, Fernández PR, Krzemień A, Wodarski K, Valverde GF (2019) Forecasting coking coal prices by means of ARIMA models and neural networks, considering the transgenic time series theory. Resour Policy 61:283–292. https://doi.org/10.1016/j.resourpol.2019.02.017

Zhang K, Cao H, Thé J, Yu H (2022) A hybrid model for multi-step coal price forecasting using decomposition technique and deep learning algorithms. Appl Energy 306:118011. https://doi.org/10.1016/j.apenergy.2021.118011

Alameer Z, Fathalla A, Li K, Ye H, Jianhua Z (2020) Multistep-ahead forecasting of coal prices using a hybrid deep learning model. Resour Policy 65:101588. https://doi.org/10.1016/j.resourpol.2020.101588

Mouchtaris D, Sofianos E, Gogas P, Papadimitriou T (2021) Forecasting natural gas spot prices with machine learning. Energies 14:5782. https://doi.org/10.3390/en14185782

Wang J, Cao J, Yuan S, Cheng M (2021) Short-term forecasting of natural gas prices by using a novel hybrid method based on a combination of the CEEMDAN-SE-and the PSO-ALS-optimized GRU network. Energy. https://doi.org/10.1016/j.energy.2021.121082

Li J, Wu Q, Tian Y, Fan L (2021) Monthly henry hub natural gas spot prices forecasting using variational mode decomposition and deep belief network. Energy 227:120478. https://doi.org/10.1016/j.energy.2021.120478

Sahed A, Mekidiche M, Kahoui H (2020) Forecasting natural gas prices using nonlinear autoregressive neural network. Int J Math Sci Comput 5:37–46. https://doi.org/10.5815/ijmsc.2020.05.04

Wang C, Xu J, Xu K, Yuan K, Qi Y, Mu Y (2019) Rolling forecast nature gas spot price with back propagation neural network, In: IEEE Sustainable Power and Energy Conference (iSPEC). IEEE pp 2473–2477. https://doi.org/10.1109/iSPEC48194.2019.8974910

Mustaffa Z, Yusof Y, Kamaruddin SS (2014) An enhanced artificial bee colony optimizer for predictive analysis of heating oil prices using least squares support vector machines, In: Biologically-Inspired Techniques for Knowledge Discovery and Data Mining, IGI Global, pp 149–173. https://doi.org/10.4018/978-1-4666-6078-6.ch007

Tian L, Chen H, Zhen Z (2018) Research on the forward-looking behavior judgment of heating oil price evolution based on complex networks. PLoS ONE 13:e0202209. https://doi.org/10.1371/journal.pone.0202209

Wang B, Wang J (2019) Energy futures prices forecasting by novel DPFWR neural network and DS-CID evaluation. Neurocomputing 338:1–15. https://doi.org/10.1016/j.neucom.2019.01.092

Chiroma H, Abdul-Kareem S, Muaz SA, Khan A, Sari EN, Herawan T (2014) Neural network intelligent learning algorithm for inter-related energy products applications, in: International Conference in Swarm Intelligence, Springer, pp. 284–293. https://doi.org/10.1007/978-3-319-11857-4_32

Malliaris ME, Malliaris SG (2005) Forecasting energy product prices, In: Proceedings. 2005 IEEE International Joint Conference on Neural Networks, vol. 5, IEEE, pp 3284–3289. https://doi.org/10.1109/IJCNN.2005.1556454

Sun G, Chen T, Wei Z, Sun Y, Zang H, Chen S (2016) A carbon price forecasting model based on variational mode decomposition and spiking neural networks. Energies 9:54. https://doi.org/10.3390/en9010054

Zhou J, Wang S (2021) A carbon price prediction model based on the secondary decomposition algorithm and influencing factors. Energies 14:1328. https://doi.org/10.3390/en14051328

Hao Y, Tian C (2020) A hybrid framework for carbon trading price forecasting: the role of multiple influence factor. J Clean Prod 262:120378. https://doi.org/10.1016/j.jclepro.2020.120378

Huang Y, Dai X, Wang Q, Zhou D (2021) A hybrid model for carbon price forecasting using Garch and long short-term memory network. Appl Energy 285:116485. https://doi.org/10.1016/j.apenergy.2021.116485

Zhang J, Li D, Hao Y, Tan Z (2018) A hybrid model using signal processing technology, econometric models and neural network for carbon spot price forecasting. J Clean Prod 204:958–964. https://doi.org/10.1016/j.jclepro.2018.09.071

Xu X, Zhang Y (2023) China mainland new energy index price forecasting with the neural network. Energy Nexus 10:100210. https://doi.org/10.1016/j.nexus.2023.100210

Zhang Y, Hamori S (2020) Forecasting crude oil market crashes using machine learning technologies. Energies 13:2440. https://doi.org/10.3390/en13102440

Paul C, Nwosu I, Ezenwanyi G, Chizoba L (2021) The optimal machine learning modeling of Brent crude oil price. Quart J Economet Res 7:31–43. https://doi.org/10.18488/journal.88.2021.71.31.43

Abdollahi H, Ebrahimi SB (2020) A new hybrid model for forecasting Brent crude oil price. Energy 200:117520. https://doi.org/10.1016/j.energy.2020.117520

Jabeur SB, Khalfaoui R, Arfi WB (2021) The effect of green energy, global environmental indexes, and stock markets in predicting oil price crashes: evidence from explainable machine learning. J Environ Manag 298:113511. https://doi.org/10.1016/j.jenvman.2021.113511

Lu Q, Sun S, Duan H, Wang S (2021) Analysis and forecasting of crude oil price based on the variable selection-LSTM integrated model. Energy Inf 4:1–20. https://doi.org/10.1186/s42162-021-00166-4

Wu H, Li M, Kimhong L, Li C (2023) Forecast of steel price on ARIMA-LSTM model, In: ICEMME 2022: Proceedings of the 4th International Conference on Economic Management and Model Engineering, ICEMME 2022, November 18-20, 2022, Nanjing, China, European Alliance for Innovation, p 1. https://doi.org/10.4108/eai.18-11.2022.2326770

Mi J, Xie X, Luo Y, Zhang Q, Wang J (2023) Research on rebar futures price forecast based on VMD-EEMD-LSTM model, In: Applied Mathematics, Modeling and Computer Simulation, IOS Press, pp 54–62. https://doi.org/10.3233/ATDE230940

Wang T, Leung H, Zhao J, Wang W (2020) Multiseries featural LSTM for partial periodic time-series prediction: a case study for steel industry. IEEE Trans Instrum Meas 69:5994–6003. https://doi.org/10.1109/TIM.2020.2967247

Xu X, Zhang Y (2023) Price forecasts of ten steel products using Gaussian process regressions. Eng Appl Artif Intell 126:106870. https://doi.org/10.1016/j.engappai.2023.106870

Chou M-T (2013) An application of fuzzy time series: a long range forecasting method in the global steel price index forecast. Rev Econ Financ 3:90–98

El-Kholy AM, Tahwia AM, Elsayed MM (2022) Prediction of simulated cost contingency for steel reinforcement in building projects: ANN versus regression-based models. Int J Constr Manag 22:1675–1689. https://doi.org/10.1080/15623599.2020.1741492

Liu Z, Ma J, Wei X, Wang J, Li H (2015) A steel price index model and its empirical research, In: 2015 IEEE 12th International Conference on e-Business Engineering, IEEE, pp 209–213. https://doi.org/10.1109/ICEBE.2015.43

Liu Y, Li H, Guan J, Liu X, Guan Q, Sun Q (2019) Influence of different factors on prices of upstream, middle and downstream products in china’s whole steel industry chain: Based on adaptive neural fuzzy inference system. Resour Policy 60:134–142. https://doi.org/10.1016/j.resourpol.2018.12.009

Sadorsky P (2021) Predicting gold and silver price direction using tree-based classifiers. J Risk Financ Manag 14:198. https://doi.org/10.3390/jrfm14050198

Erkan TE, Karaçor AG (2020) On predictability of precious metals towards robust trading. Int Sci J Ind 4.0 5:87–89

Huynh TLD (2020) The effect of uncertainty on the precious metals market: new insights from transfer entropy and neural network var. Resour Policy 66:101623. https://doi.org/10.1016/j.resourpol.2020.101623

Pierdzioch C, Risse M (2020) Forecasting precious metal returns with multivariate random forests. Empir Econ 58:1167–1184. https://doi.org/10.1007/s00181-018-1558-9

Çelik U, Başarır Ç (2017) The prediction of precious metal prices via artificial neural network by using rapidminer. Alphanumer J 5:45–54. https://doi.org/10.17093/alphanumeric.290381

Aruna S, Umamaheswari P, Sujipriya J et al (2021) Prediction of potential gold prices using machine learning approach. Ann Roman Soc Cell Biol 1385–1396

Jabeur SB, Mefteh-Wali S, Viviani J-L (2021) Forecasting gold price with the xgboost algorithm and shap interaction values. Ann Oper Res. https://doi.org/10.1007/s10479-021-04187-w

Yuan F-C, Lee C-H, Chiu C (2020) Using market sentiment analysis and genetic algorithm-based least squares support vector regression to predict gold prices. Int J Comput Intell Syst 13:234–246. https://doi.org/10.2991/ijcis.d.200214.002

Jalali MFM, Heidari H (2018) Forecasting palladium price using gm (1, 1). Glob Anal Discrete Math 3:1–9. https://doi.org/10.22128/GADM.2018.114

Pierdzioch C, Risse M, Rohloff S (2016) Are precious metals a hedge against exchange-rate movements? an empirical exploration using Bayesian additive regression trees. N Am J Econ Financ 38:27–38. https://doi.org/10.1016/j.najef.2016.06.002

Alameer Z, Abd-Elaziz M, Ewees AA, Ye H, Jianhua Z (2019) Forecasting copper prices using hybrid adaptive neuro-fuzzy inference system and genetic algorithms. Nat Resour Res 28:1385–1401. https://doi.org/10.1007/s11053-019-09473-w

Mir M, Kabir HD, Nasirzadeh F, Khosravi A (2021) Neural network-based interval forecasting of construction material prices. J Build Eng 39:102288. https://doi.org/10.1016/j.jobe.2021.102288

Wegener C, von Spreckelsen C, Basse T, von Mettenheim H-J (2016) Forecasting government bond yields with neural networks considering cointegration. J Forecast 35:86–92. https://doi.org/10.1002/for.2385

Xu X, Zhang Y (2022) Canola and soybean oil price forecasts via neural networks. Adv Comput Intell 2:32. https://doi.org/10.1007/s43674-022-00045-9

Altan A, Karasu S, Zio E (2021) A new hybrid model for wind speed forecasting combining long short-term memory neural network, decomposition methods and grey wolf optimizer. Appl Soft Comput 100:106996. https://doi.org/10.1016/j.asoc.2020.106996

Xu X, Zhang Y (2023) Steel price index forecasting through neural networks: the composite index, long products, flat products, and rolled products. Miner Econ 36:563–582. https://doi.org/10.1007/s13563-022-00357-9

Karasu S, Altan A, Saraç Z, Hacioğlu R (2017) Prediction of wind speed with non-linear autoregressive (nar) neural networks, In: 25th Signal Processing and Communications Applications Conference (SIU). IEEE pp 1–4. https://doi.org/10.1109/SIU.2017.7960507

Xu X, Zhang Y (2024) Platinum and palladium price forecasting through neural networks. Commun Statist Simul Comput. https://doi.org/10.1080/03610918.2024.2330700

Xu X, Zhang Y (2023) Yellow corn wholesale price forecasts via the neural network. Economia 24:44–67. https://doi.org/10.1108/ECON-05-2022-0026

Wang B, Wang W, Qiao Z, Meng G, Mao Z (2022) Dynamic selective gaussian process regression for forecasting temperature of molten steel in ladle furnace. Eng Appl Artif Intell 112:104892. https://doi.org/10.1016/j.engappai.2022.104892

Xu X, Zhang Y (2021) House price forecasting with neural networks. Intell Syst Appl 12:200052. https://doi.org/10.1016/j.iswa.2021.200052

Martinho AD, Goliatt L, Hippert H (2020) Gaussian process models applied for monthly forecast coal price mineral: a case study of Mozambique, In: Proceedings of the XLI Ibero-Latin-American Congress on Computational Methods in Engineering, ABMEC

Xu X, Zhang Y (2022) Residential housing price index forecasting via neural networks. Neural Comput Appl 34:14763–14776. https://doi.org/10.1007/s00521-022-07309-y

Seya H, Shiroi D (2021) A comparison of residential apartment rent price predictions using a large data set: Kriging versus deep neural network. Geogr Anal. https://doi.org/10.1111/gean.12283

Xu X, Zhang Y (2023) Scrap steel price forecasting with neural networks for east, north, south, central, northeast, and southwest china and at the national level. Ironmak Steelmak 50:1683–1697. https://doi.org/10.1080/03019233.2023.2218243

Neal RM (2012) Bayesian learning for neural networks. Springer, Cham

Xu X, Zhang Y (2022) Rent index forecasting through neural networks. J Econ Stud 49:1321–1339. https://doi.org/10.1108/JES-06-2021-0316

Jin B, Xu X (2024) Gaussian process regression based silver price forecasts. J Uncert Syst. https://doi.org/10.1142/S1752890924500132

Xu X, Zhang Y (2022) Second-hand house price index forecasting with neural networks. J Prop Res 39:215–236. https://doi.org/10.1080/09599916.2021.1996446

Jin B, Xu X (2024) Palladium price predictions via machine learning. Mater Circ Econ 6:32. https://doi.org/10.1007/s42824-024-00123-y

Xu X, Zhang Y (2024) High-frequency csi300 futures trading volume predicting through the neural network. Asian J Econ Bank 8:26–53. https://doi.org/10.1108/AJEB-05-2022-0051

Grbić R, Kurtagić D, Slišković D (2013) Stream water temperature prediction based on gaussian process regression. Expert Syst Appl 40:7407–7414. https://doi.org/10.1016/j.eswa.2013.06.077

Xu X, Zhang Y (2022) Forecasting the total market value of a shares traded in the Shenzhen stock exchange via the neural network. Econ Bull 42:1266–1279

Sharifzadeh M, Sikinioti-Lock A, Shah N (2019) Machine-learning methods for integrated renewable power generation: a comparative study of artificial neural networks, support vector regression, and gaussian process regression. Renew Sustain Energy Rev 108:513–538. https://doi.org/10.1016/j.rser.2019.03.040

Xu X, Zhang Y (2023) Neural network predictions of the high-frequency csi300 first distant futures trading volume. Fin Markets Portfolio Mgmt 37:191–207. https://doi.org/10.1007/s11408-022-00421-y

Taki M, Rohani A, Soheili-Fard F, Abdeshahi A (2018) Assessment of energy consumption and modeling of output energy for wheat production by neural network (MLP and RBF) and gaussian process regression (GPR) models. J Clean Prod 172:3028–3041. https://doi.org/10.1016/j.jclepro.2017.11.107

Xu X, Zhang Y (2023) Corn cash-futures basis forecasting via neural networks. Adv Comput Intell 3:8. https://doi.org/10.1007/s43674-023-00054-2

Williams C, Rasmussen C (1995) Gaussian processes for regression, Advances in neural information processing systems 8

Xu X, Zhang Y (2023) Retail property price index forecasting through neural networks. J Real Estate Portfolio Manag 29:1–28. https://doi.org/10.1080/10835547.2022.2110668

Yan J, Li K, Bai E, Yang Z, Foley A (2016) Time series wind power forecasting based on variant Gaussian process and TLBO. Neurocomputing 189:135–144. https://doi.org/10.1016/j.neucom.2015.12.081

Xu X, Zhang Y (2024) Office property price index forecasting using neural networks. J Financ Manag Prop Constr 29:52–82. https://doi.org/10.1108/JFMPC-08-2022-0041

Cai H, Jia X, Feng J, Li W, Hsu Y-M, Lee J (2020) Gaussian process regression for numerical wind speed prediction enhancement. Renew Energy 146:2112–2123. https://doi.org/10.1016/j.renene.2019.08.018

Xu X, Zhang Y (2023) A high-frequency trading volume prediction model using neural networks. Decis Anal J 7:100235. https://doi.org/10.1016/j.dajour.2023.100235

Neal RM (1997) Monte Carlo implementation of gaussian process models for Bayesian regression and classification, arXiv preprint physics/9701026

Yin F, Pan L, Chen T, Theodoridis S, Luo Z-QT, Zoubir AM (2020) Linear multiple low-rank kernel based stationary gaussian processes regression for time series. IEEE Trans Signal Process 68:5260–5275. https://doi.org/10.1109/TSP.2020.3023008

Brahim-Belhouari S, Vesin J-M (2001) Bayesian learning using gaussian process for time series prediction, In: Proceedings of the 11th IEEE Signal Processing Workshop on Statistical Signal Processing (Cat. No. 01TH8563), IEEE, pp 433–436. https://doi.org/10.1109/SSP.2001.955315

Brahim-Belhouari S, Bermak A (2004) Gaussian process for nonstationary time series prediction. Comput Statist Data Anal 47:705–712. https://doi.org/10.1016/j.csda.2004.02.006

Xu X, Zhang Y (2023) Regional steel price index forecasts with neural networks: evidence from east, south, north, central south, northeast, southwest, and northwest china. J Supercomput 79:13601–13619. https://doi.org/10.1007/s11227-023-05207-1

Hu J, Wang J (2015) Short-term wind speed prediction using empirical wavelet transform and Gaussian process regression. Energy 93:1456–1466. https://doi.org/10.1016/j.energy.2015.10.041

Xu X, Zhang Y (2023) Wholesale food price index forecasts with the neural network. Int J Comput Intell Appl 22:2350024. https://doi.org/10.1142/S1469026823500244

Rhode S (2020) Non-stationary gaussian process regression applied in validation of vehicle dynamics models. Eng Appl Artif Intell 93:103716. https://doi.org/10.1016/j.engappai.2020.103716

Xu X, Zhang Y (2023) Composite property price index forecasting with neural networks. Prop Manag. https://doi.org/10.1108/PM-11-2022-0086

Zhang Z, Ye L, Qin H, Liu Y, Wang C, Yu X, Yin X, Li J (2019) Wind speed prediction method using shared weight long short-term memory network and gaussian process regression. Appl Energy 247:270–284. https://doi.org/10.1016/j.apenergy.2019.04.047

Frazier PI (2018) Bayesian optimization, In: Recent advances in optimization and modeling of contemporary problems, Informs, (2018), pp 255–278. https://doi.org/10.1287/educ.2018.0188

Gonzalvez J, Lezmi E, Roncalli T, Xu J (2019) Financial applications of Gaussian processes and Bayesian optimization, arXiv preprint arXiv:1903.04841

Du L, Gao R, Suganthan PN, Wang DZ (2022) Bayesian optimization based dynamic ensemble for time series forecasting. Inf Sci 591:155–175. https://doi.org/10.1016/j.ins.2022.01.010

Abbasimehr H, Paki R (2021) Prediction of covid-19 confirmed cases combining deep learning methods and Bayesian optimization. Chaos Soliton Fract 142:110511. https://doi.org/10.1016/j.chaos.2020.110511

Liu Z, Zhu S, Wang Y, Zhang B, Wei L (2015) Thread steel price index prediction in china based on arima model, In: LISS 2014, Springer, pp 609–614. https://doi.org/10.1007/978-3-662-43871-8_88

Supattana N (2014) Steel price index forecasting using arima and arimax model, National Institute of Development Administration

Brandt JA, Bessler DA (1981) Composite forecasting: an application with us hog prices. Am J Agr Econ 63:135–140. https://doi.org/10.2307/1239819

Brandt JA, Bessler DA (1983) Price forecasting and evaluation: an application in agriculture. J Forecast 2:237–248. https://doi.org/10.1002/for.3980020306

Brandt JA, Bessler DA (1982) Forecasting with a dynamic regression model: a heuristic approach, North Central. J Agric Econ 4:27–33. https://doi.org/10.2307/1349096

Brandt JA, Bessler DA (1984) Forecasting with vector autoregressions versus a univariate arima process: an empirical example with us hog prices, North Central. J Agric Econ 4:29–36. https://doi.org/10.2307/1349248

Kling JL, Bessler DA (1985) A comparison of multivariate forecasting procedures for economic time series. Int J Forecast 1:5–24. https://doi.org/10.1016/S0169-2070(85)80067-4

McIntosh CS, Bessler DA (1988) Forecasting agricultural prices using a Bayesian composite approach. J Agric Appl Econ 20:73–80. https://doi.org/10.1017/S0081305200017611

Ming-Tao C, Bo-Ching H (2010) An analysis of the relationship between forward freight agreements and steel price index: an application of the vector arma model. Afr J Bus Manage 4:1149–1154

Adli KA, Sener U (2021) Forecasting of the us steel prices with LVAR and VEC models. Bus Econ Res J 12:509–522

Xiarchos IM (2005) Steel: price Links between Primary and Scrap Market, Technical Report, https://doi.org/10.22004/ag.econ.35655

Jiang H, Xu Y, Liu C (2014) Market effects on forecasting construction prices using vector error correction models. Int J Constr Manag 14:101–112. https://doi.org/10.1080/15623599.2014.899128

Kim S, Abediniangerabi B, Shahandashti M (2021) Pipeline construction cost forecasting using multivariate time series methods. J Pipeline Syst Eng Pract 12:04021026

Bin D (2007) The empirical study on dynamic relationship between domestic and global steel price, In: 2007 International Conference on Wireless Communications, Networking and Mobile Computing, IEEE, pp 4347–4350. https://doi.org/10.1109/WICOM.2007.1072

Liu Y, Yang C, Huang K, Gui W (2020) Non-ferrous metals price forecasting based on variational mode decomposition and LSTM network. Knowl-Based Syst 188:105006. https://doi.org/10.1016/j.knosys.2019.105006

Tuo J, Zhang F (2020) Modelling the iron ore price index: a new perspective from a hybrid data reconstructed EEMD-GORU model. J Manag Sci Eng 5:212–225. https://doi.org/10.1016/j.jmse.2020.08.003

Wang Z-X, Zhao Y-F, He L-Y (2020) Forecasting the monthly iron ore import of China using a model combining empirical mode decomposition, non-linear autoregressive neural network, and autoregressive integrated moving average. Appl Soft Comput 94:106475. https://doi.org/10.1016/j.asoc.2020.106475

Wang J, Li X (2018) A combined neural network model for commodity price forecasting with SSA. Soft Comput 22:5323–5333. https://doi.org/10.1007/s00500-018-3023-2

Raju S, Sarker A, Das A, Islam M, Al-Rakhami MS, Al-Amri AM, Mohiuddin T, Albogamy FR (2022) An approach for demand forecasting in steel industries using ensemble learning. Complexity. https://doi.org/10.1155/2022/9928836

Benrhmach G, Namir K, Namir A, Bouyaghroumni J (2020) Nonlinear autoregressive neural network and extended Kalman filters for prediction of financial time series. J Appl Math. https://doi.org/10.1155/2020/5057801

Jarque CM, Bera AK (1980) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ Lett 6:255–259. https://doi.org/10.1016/0165-1765(80)90024-5

Jarque CM, Bera AK (1987) A test for normality of observations and regression residuals. Int Statist Rev/Revue Internationale de Statistique 55:163–172. https://doi.org/10.2307/1403192

Anderson TW, Darling DA (1954) A test of goodness of fit. J Am Stat Assoc 49:765–769. https://doi.org/10.2307/2281537

Jin B, Xu X (2024) Forecasting wholesale prices of yellow corn through the Gaussian process regression. Neural Comput Appl 36:8693–8710. https://doi.org/10.1007/s00521-024-09531-2

Xu X, Zhang Y (2023) A gaussian process regression machine learning model for forecasting retail property prices with Bayesian optimizations and cross-validation. Decis Anal J 8:100267. https://doi.org/10.1016/j.dajour.2023.100267

Yang J, Su X, Kolari JW (2008) Do euro exchange rates follow a martingale? Some out-of-sample evidence. J Bank Financ 32:729–740. https://doi.org/10.1016/j.jbankfin.2007.05.009

Xu X (2018) Linear and nonlinear causality between corn cash and futures prices. J Agric Food Ind Organ 16:20160006. https://doi.org/10.1515/jafio-2016-0006

Yang J, Cabrera J, Wang T (2010) Nonlinearity, data-snooping, and stock index ETF return predictability. Eur J Oper Res 200:498–507. https://doi.org/10.1016/j.ejor.2009.01.009

Xu X (2018) Cointegration and price discovery in us corn cash and futures markets. Empir Econ 55:1889–1923. https://doi.org/10.1007/s00181-017-1322-6

Wang T, Yang J (2010) Nonlinearity and intraday efficiency tests on energy futures markets. Energy Econ 32:496–503. https://doi.org/10.1016/j.eneco.2009.08.001

Xu X, Zhang Y (2023) House price information flows among some major Chinese cities: linear and nonlinear causality in time and frequency domains. Int J Hous Mark Anal 16:1168–1192. https://doi.org/10.1108/IJHMA-07-2022-0098

Karasu S, Altan A, Bekiros S, Ahmad W (2020) A new forecasting model with wrapper-based feature selection approach using multi-objective optimization technique for chaotic crude oil time series. Energy 212:118750. https://doi.org/10.1016/j.energy.2020.118750

Xu X, Zhang Y (2022) Soybean and soybean oil price forecasting through the nonlinear autoregressive neural network (narnn) and narnn with exogenous inputs (narnn-x). Intell Syst Appl 13:200061. https://doi.org/10.1016/j.iswa.2022.200061

Brock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Economet Rev 15:197–235. https://doi.org/10.1080/07474939608800353

Jin B, Xu X (2024) Wholesale price forecasts of green grams using the neural network. Asian J Econ Bank. https://doi.org/10.1108/AJEB-01-2024-0007

Zhang Y, Xu X (2020) Machine learning band gaps of doped-\(\text{ tio}_{{2}}\) photocatalysts from structural and morphological parameters. ACS Omega 5:15344–15352. https://doi.org/10.1021/acsomega.0c01438

Jin B, Xu X (2024) Pre-owned housing price index forecasts using gaussian process regressions. J Model Manag. https://doi.org/10.1108/JM2-12-2023-0315

Jin B, Xu X (2024) Forecasts of thermal coal prices through gaussian process regressions, Ironmak Steelmak

Zhang Y, Xu X (2020) Predicting the thermal conductivity enhancement of nanofluids using computational intelligence. Phys Lett A 384:126500. https://doi.org/10.1016/j.physleta.2020.126500

Jin B, Xu X (2024) Regional steel price index predictions for north china through machine learning. Int J Min Miner Eng 79:13601

Zhang Y, Xu X (2020) Yttrium barium copper oxide superconducting transition temperature modeling through gaussian process regression. Comput Mater Sci 179:109583. https://doi.org/10.1016/j.commatsci.2020.109583

Mojaddady M, Nabi M, Khadivi S (2011) Stock market prediction using twin gaussian process regression, Int J Adv Comput Res (JACR) preprint

Zhang Y, Xu X (2020) Machine learning decomposition onset temperature of lubricant additives. J Mater Eng Perform 29:6605–6616. https://doi.org/10.1007/s11665-020-05146-5

Han J, Zhang X-P, Wang F (2016) Gaussian process regression stochastic volatility model for financial time series. IEEE J Sel Topics Signal Process 10:1015–1028. https://doi.org/10.1109/JSTSP.2016.2570738

Zhang Y, Xu X (2020) Machine learning lattice constants for cubic perovskite \(a_{2}xy_{6}\) compounds. J Solid State Chem 291:121558. https://doi.org/10.1016/j.jssc.2020.121558

Liu S, Ma J (2016) Stock price prediction through the mixture of gaussian processes via the precise hard-cut em algorithm, In: Intelligent Computing Methodologies: 12th International Conference, ICIC 2016, Lanzhou, China, August 2-5, 2016, Proceedings, Part III 12, Springer, pp 282–293. https://doi.org/10.1007/978-3-319-42297-8_27

Zhang Y, Xu X (2021) Machine learning glass transition temperature of polyacrylamides using quantum chemical descriptors. Polym Chem 12:843–851. https://doi.org/10.1039/d0py01581d

Zhang Y, Xu X (2020) Machine learning properties of electrolyte additives: a focus on redox potentials. Ind Eng Chem Res 60:343–354. https://doi.org/10.1021/acs.iecr.0c05055

Zhang Y, Xu X (2021) Machine learning tensile strength and impact toughness of wheat straw reinforced composites. Mach Learn Appl 6:100188. https://doi.org/10.1016/j.mlwa.2021.100188

Xu X, Zhang Y, Li Y, Li Y (2022) Machine learning cutting forces in milling processes of functionally graded materials. Adv Comput Intell 2:25. https://doi.org/10.1007/s43674-022-00036-w

Zhang Y, Xu X (2021) Predicting multiple properties of pervious concrete through the gaussian process regression. Adv Civ Eng Mater 10:56–73. https://doi.org/10.1520/ACEM20200134

Zhang Y, Xu X (2021) Machine learning the lattice constant of cubic pyrochlore compounds. Int J Appl Ceram Technol 18:661–676. https://doi.org/10.1111/ijac.13709

Williams CK, Rasmussen CE (2006) Gaussian processes for machine learning, vol 2. MIT press, Cambridge

Zhang Y, Xu X (2021) Machine learning F-doped Bi (Pb)-Sr-Ca-Cu-O superconducting transition temperature. J Supercond Novel Magn 34:63–73. https://doi.org/10.1007/s10948-020-05682-0

Zhang Y, Xu X (2021) Predicting doped Fe-based superconductor critical temperature from structural and topological parameters using machine learning. Int J Mater Res 112:2–9. https://doi.org/10.1515/ijmr-2020-7986

Zhang Y, Xu X (2022) Modulus of elasticity predictions through lsboost for concrete of normal and high strength. Mater Chem Phys 283:126007. https://doi.org/10.1016/j.matchemphys.2022.126007

Zhang Y, Xu X (2020) Machine learning optical band gaps of doped-ZnO films. Optik 217:164808. https://doi.org/10.1016/j.ijleo.2020.164808

Zhang Y, Xu X (2021) Modeling of lattice parameters of cubic perovskite oxides and halides. Heliyon 7:e07601. https://doi.org/10.1016/j.heliyon.2021.e07601

Zhang Y, Xu X (2020) Curie temperature modeling of magnetocaloric lanthanum manganites using gaussian process regression. J Magn Magn Mater 512:166998. https://doi.org/10.1016/j.jmmm.2020.166998

Zhang Y, Xu X (2021) Machine learning lattice constants of zircon-group minerals \(\text{ mxo}_{{4}}\). Struct Chem 32:1311–1326. https://doi.org/10.1007/s11224-020-01699-2

Zhang Y, Xu X (2021) Machine learning bioactive compound solubilities in supercritical carbon dioxide. Chem Phys 550:111299. https://doi.org/10.1016/j.chemphys.2021.111299

Zhang Y, Xu X (2020) Machine learning modeling of lattice constants for Half-Heusler alloys. AIP Adv 10:045121. https://doi.org/10.1063/5.0002448

Zhang Y, Xu X (2022) Machine learning surface roughnesses in turning processes of brass metals. Int J Adv Manuf Technol 121:2437–2444. https://doi.org/10.1007/s00170-022-09498-1

Zhang Y, Xu X (2020) Machine learning lattice constants for cubic perovskite \(\text{ a}_{{2}}^{2+}\text{ bb}^{\prime }\text{ o}_{{6}}\) compounds. CrystEngComm 22:6385–6397. https://doi.org/10.1039/D0CE00928H

Zhang Y, Xu X (2021) Machine learning steel \(m_{s}\) temperature. Simulation 97:383–425. https://doi.org/10.1177/0037549721995574

Zhang Y, Xu X (2021) Predictions of adsorption energies of methane-related species on cu-based alloys through machine learning. Mach Learn Appl 3:100010. https://doi.org/10.1016/j.mlwa.2020.100010

Bull AD (2011) Convergence rates of efficient global optimization algorithms. J Mach Learn Res 12:2879

Xu X, Zhang Y (2022) Machine learning the concrete compressive strength from mixture proportions. ASME Open J Eng 1:011037. https://doi.org/10.1115/1.4055194

Zhang Y, Xu X (2021) Machine learning glass transition temperature of polymethacrylates. Mol Cryst Liq Cryst 730:9–22. https://doi.org/10.1080/15421406.2021.1946348

Zhang Y, Xu X (2021) Predicting lattice parameters for orthorhombic distorted-perovskite oxides via machine learning. Solid State Sci 113:106541. https://doi.org/10.1016/j.solidstatesciences.2021.106541

Zhang Y, Xu X (2022) Predicting thrust force during drilling of composite laminates with step drills through the Gaussian process regression. Multidiscip Model Mater Struct 18:845–855. https://doi.org/10.1108/MMMS-07-2022-0123

Jamieson P, Porter J, Wilson D (1991) A test of the computer simulation model arcwheat1 on wheat crops grown in New Zealand. Field Crop Res 27:337–350. https://doi.org/10.1016/0378-4290(91)90040-3

Heinemann AB, Van Oort PA, Fernandes DS, Maia AdHN (2012) Sensitivity of apsim/oryza model due to estimation errors in solar radiation. Bragantia 71:572–582. https://doi.org/10.1590/S0006-87052012000400016

Li M-F, Tang X-P, Wu W, Liu H-B (2013) General models for estimating daily global solar radiation for different solar radiation zones in mainland china. Energy Convers Manage 70:139–148. https://doi.org/10.1016/j.enconman.2013.03.004

Despotovic M, Nedic V, Despotovic D, Cvetanovic S (2016) Evaluation of empirical models for predicting monthly mean horizontal diffuse solar radiation. Renew Sustain Energy Rev 56:246–260. https://doi.org/10.1016/j.rser.2015.11.058

Timmermann A (2006) Forecast combinations. Handbook of Economic Forecasting, vol 1. Elsevier, New york, pp 135–196. https://doi.org/10.1016/S1574-0706(05)01004-9

Costantini M, Gunter U, Kunst RM (2017) Forecast combinations in a DSGE-VAR lab. J Forecast 36:305–324. https://doi.org/10.1002/for.2427

Ou P, Wang H (2011) Volatility prediction by treed gaussian process with limiting linear model. Int J Model Simul 31:166–174. https://doi.org/10.2316/Journal.205.2011.2.205-5498

Ou P, Wang H (2011) Forecasting volatility switching arch by treed gaussian process with jumps to the limiting linear model. Int J Comput Appl 33:355–361. https://doi.org/10.2316/Journal.202.2011.4.202-3260

Ou P, Wang H (2011c) Modeling and forecasting stock market volatility by gaussian processes based on garch, egarch and gjr models, In: Proceedings of the World Congress on Engineering, vol 1, pp 1–5

Han J, Zhang X-P (2015) Financial time series volatility analysis using gaussian process state-space models, In: 2015 IEEE Global Conference on Signal and Information Processing (GlobalSIP), IEEE, pp 358–362. https://doi.org/10.1109/GlobalSIP.2015.7418217

Diebold FX, Mariano RS (2002) Comparing predictive accuracy. J Bus Econ Statist 20:134–144. https://doi.org/10.2307/1392185

Harvey D, Leybourne S, Newbold P (1997) Testing the equality of prediction mean squared errors. Int J Forecast 13:281–291. https://doi.org/10.1016/S0169-2070(96)00719-4

Breiman L (2017) Classification and regression trees. Routledge

Funding

There is no funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jin, B., Xu, X. Predictions of steel price indices through machine learning for the regional northeast Chinese market. Neural Comput & Applic 36, 20863–20882 (2024). https://doi.org/10.1007/s00521-024-10270-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-024-10270-7