Abstract

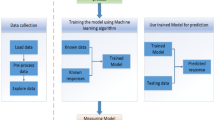

Credit scoring computation essentially involves taking into account various financial factors and the previous behavior of the credit requesting person. There is a strong degree of correlation between the compliance level and the credit score of a given entity. The concept of trust has been widely used and applied in the existing literature to determine the compliance level of an entity. However it has not been studied in the context of credit scoring literature. In order to address this shortcoming, in this paper we propose a six-step bio-inspired methodology for trust-based credit lending decisions by credit institutions. The proposed methodology makes use of an artificial neural network-based model to classify the (potential) customers into various categories. To show the applicability and superiority of the proposed algorithm, it is applied to a credit-card dataset obtained from the UCI repository. Due to the varying spectrum of trust levels, we are able to solve the problem of binary credit lending decisions. A trust-based credit scoring approach allows the financial institutions to grant credit-based on the level of trust in potential customers.

Similar content being viewed by others

References

Blochlinger A, Leippold M (2006) Economic benefit of powerful credit scoring. J Banking Finance 30(3): 851–873

Jacobson T, Roszbach K (2003) Bank lending policy, credit scoring and value-at-risk. J Banking Finance 27: 615–633

Yu L, Wang S, Lai KK, Zhou L (2008) Bio-inspired credit risk analysis: computational intelligence with support vector machines. Springer, Berlin

Kim YS, Sohn SY (2004) Managing loan customers using misclassification patterns of credit scoring model. Expert Syst Appl 26: 567–568

Chuang C, Lin R (2009) Constructing a reassigning credit scoring model. Expert Syst Appl 36: 1685–1687

Sarlija N, Bensic M, Bohacek Z (2004) Multinomial model in consumer credit scoring. 10th international conference on operational research. Trogir, Croatia

Abdou H, Pointon J, El-Marsy A (2008) Neural nets versus conventional techniques in credit scoring in Egyptian banking. Expert Syst Appl 35: 1277–1279

Islam S, Zhou L, Li F (2009) Application of artificial intelligence (artificial neural network) to assess credit risk: a predictive model for credit card scoring. MSc, School of Management Blekinge Institute of Technology

Jentzsch N (2007) Financial privacy: an international comparison of credit reporting systems (contributions to economics). Springer, Berlin

Chen M, Huang S (2003) Credit scoring and rejected instances reassigning through evolutionary computation technique. Expert Syst Appl 24: 433–434

Ferretti F (2009) The credit scoring pandemic and the European vaccine: making sense of EU data protection legislation. J Inf Law Technol 1. http://go.warwick.ac.uk/jilt/2009_1/ferretti

Bocij P, Chaffey D, Greasley A, Hickie S (2009) Business information systems: technology. Development and management for the E-business. FT Press, Upper Saddle River

Tsai C, Wu J (2008) Using neural network ensembles for bankruptcy prediction and credit scoring. Expert Syst Appl 34: 2639–2640

Lee T, Chen I (2005) A two-stage hybrid credit scoring model using artificial neural networks and multivariate adaptive regression splines. Expert Syst Appl 28(4): 743–752

Bellotti T, Crook J (2009) Support vector machines for credit scoring and discovery of significant features. Expert Syst Appl 36: 3302

Lee TS, Chiu CC, Lu CJ, Chen I (2002) Credit scoring using the hybrid neural discriminant technique. Expert Syst Appl 23(3): 245–254

Zekic-Susac M, Sarlija N, Bensic M (2004) Small business credit scoring: a comparison of logistic regression, neural networks, and decision tree models. 26th international conference on information technology interfaces, Croatia

Yang Y (2007) Adaptive credit scoring with kernel learning methods. Eur J Oper Res 183(3): 1521–1536

Leondes CT (2005) Intelligent knowledge-based systems: business and technology in the new millennium. Kluwer, Dordrecht

Timofeev R (2004) Classification and regression trees theory and applications. Master, Humboldt University, Center of Applied Statistics and Economics

Thomas LC (2000) A survey of credit scoring and behavioural scoring: forcasting financial risk of lending to customers. Int J Forecast 16: 151–152

Huang CL, Chen MC, Wang CJ (2007) Credit scoring with a data mining approach based on support vector machine. Expert Syst Appl 33(4): 847–856

Huang J, Tzeng GH, Ong CH (2006) Two stage genetic programming (2SGP) for credit scoring model. Appl Math Comput 174(2): 1039–1053

Pérez JM, Albisua I, Arbelaitz O, Gurrutxaga I, Martín J, Muguerza J, Perona I (2010) Consolidated trees versus bagging when explanation is required. Computing 89: 113–145

Sathasivam S, Wan Abdullah WA (2011) Logic mining in neural network: reverse analysis method. Computing 91: 119–133

Zhang GP (2003) Neural networks in business forecasting. Information Science Publishing, New York

Burger M, Hofinger A (2005) Regularized greedy algorithms for network training with data noise. Computing 74: 1–22

Liang Q (2003) Corporate financial distress diagnosis in China: empirical analysis using credit scoring models. Hitotsubashi J Commerce Manag 38(1): 13–28

Jabeen H, Beig AR (2010) Review of classification using genetic programming. Int J Eng Sci Technol 2(2): 94–97

Auria L, Moro RA (2008) Support vector machines as a technique for solvency analysis. German Institute for Economic Research. http://www.diw.de/english/products/publications/discussion_papers/27539.html

Hsieh NC (2005) Hybrid mining approach in the design of credit scoring model. Expert Syst Appl 28: 656–657

Martens D, Baesens B, Gestel TV, Vanthienen J (2007) Comprehensible credit scoring models using rule extraction from support vector machines. Eur J Oper Res 183: 1471–1472

Xu X, Zhou C, Wang Z (2009) Credit scoring algorithm based on link analysis ranking with support vector machine. Expert Syst Appl 36: 2627–2628

Bharadwaj K, Al-Shamri MH (2009) Fuzzy computational models for trust and reputation systems. Electr Commerce Res Appl 8: 38–39

Hussain FK, Chang E, Dillon T (2006) Trust and reputation for service-oriented environments, vol 1: Technologies for building business intelligence and consumer confidence. Wiley, West Sussex

Frank A, Asuncion A (2010) UCI machine learning repository. University of California, School of Information and Computer Science, Irvine. http://archive.ics.uci.edu/ml

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mirtalaei, M.S., Saberi, M., Hussain, O.K. et al. A trust-based bio-inspired approach for credit lending decisions. Computing 94, 541–577 (2012). https://doi.org/10.1007/s00607-012-0190-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00607-012-0190-3