Abstract

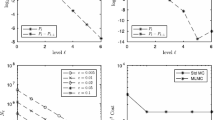

We present a fast and accurate method to compute exponential moments of the discretely observed maximum of a Lévy process. The method involves a sequential evaluation of Hilbert transforms of expressions involving the characteristic function of the (Esscher-transformed) Lévy process. It can be discretized with exponentially decaying errors of the form O(exp (−aM b)) for some a,b>0, where M is the number of discrete points used to compute the Hilbert transform. The discrete approximation can be efficiently implemented using the Toeplitz matrix–vector multiplication algorithm based on the fast Fourier transform, with total computational cost of O(NMlog (M)), where N is the number of observations of the maximum. The method is applied to the valuation of European-style discretely monitored floating strike, fixed strike, forward start and partial lookback options (both newly written and seasoned) in exponential Lévy models.

Similar content being viewed by others

References

Aitsahlia, F., Lai, T.L.: Random walk duality and the valuation of discrete lookback options. Appl. Math. Finance 5, 277–340 (1998)

Andreasen, J.: The pricing of discretely sampled Asian and lookback options: A change of numeraire approach. J. Comput. Finance 2(1), 5–30 (1998)

Asmussen, S., Glynn, P., Pitman, J.: Discretization error in simulation of one-dimensional reflecting Brownian motion. Ann. Appl. Probab. 5, 875–896 (1995)

Atkinson, C., Fusai, G.: Discrete extrema of Brownian motion and pricing of exotic options. J. Comput. Finance 10, 1–44 (2007)

Babbs, S.: Binomial valuation of lookback options. J. Econ. Dyn. Control 24, 1499–1525 (2000)

Barndorff-Nielsen, O.: Process of normal inverse Gaussian type. Finance Stoch. 2, 41–68 (1998)

Barndorff-Nielsen, O.E., Mikosch, T., Resnick, S.I.: Lévy Processes: Theory and Applications. Birkhäuser, Boston (2001)

Borovkov, K., Novikov, A.: On a new approach to calculating expectations for option pricing. J. Appl. Probab. 39, 889–895 (2002)

Boyarchenko, S.I., Levendorskiǐ, S.Z.: Non-Gaussian Merton–Black–Scholes Theory. World Scientific, Singapore (2002)

Broadie, M., Glasserman, P., Kou, S.: Connecting discrete and continuous path-dependent options. Finance Stoch. 3, 55–82 (1999)

Broadie, M., Yamamoto, Y.: A double-exponential fast Gauss transform algorithm for pricing discrete path-dependent options. Oper. Res. 53, 764–779 (2005)

Carr, P., Geman, H., Madan, D.B., Yor, M.: The fine structure of asset returns: An empirical investigation. J. Bus. 75, 305–332 (2002)

Carr, P., Madan, D.B.: Option valuation using the fast Fourier transform. J. Comput. Finance 2(4), 61–73 (1999)

Cheuk, T.H.F., Vorst, T.C.F.: Currency lookback options and observation frequency: A binomial approach. J. Int. Money Finance 16, 173–187 (1997)

Cont, R., Tankov, P.: Financial Modeling with Jump Processes. Chapman & Hall/CRC, Boca Raton (2004)

Conze, A., Viswanathan, R.: Path-dependent options: The case of lookback options. J. Finance 46, 1893–1907 (1991)

Eberlein, E., Keller, U., Prause, K.: New insights into smile, mispricing, and value at risk: The hyperbolic model. J. Bus. 71, 371–405 (1998)

Eberlein, E., Papapantoleon, A.: Equivalence of floating and fixed strike Asian and lookback options. Stoch. Process. Their Appl. 115, 31–40 (2005)

Feng, L., Linetsky, V.: Pricing options in jump-diffusion models: An extrapolation approach. Oper. Res. 56, 304–325 (2008)

Feng, L., Linetsky, V.: Pricing discretely monitored barrier options and defaultable bonds in Lévy process models: A fast Hilbert transform approach. Math. Finance 18, 337–384 (2008)

Goldman, M.B., Sosin, H.B., Gatto, M.A.: Path-dependent options: Buy at the low, sell at the high. J. Finance 34, 1111–1127 (1979)

Heynen, R.C., Kat, H.M.: Lookback options with discrete and partial monitoring of the underlying price. Appl. Math. Finance 2, 273–284 (1995)

Kou, S.G.: A jump-diffusion model for option pricing. Manag. Sci. 48, 1086–1101 (2002)

Kou, S.G., Wang, H.: Option pricing under a double exponential jump-diffusion model. Manag. Sci. 50, 1178–1192 (2004)

Kou, S.G.: Discrete barrier and lookback options. In: Birge, J.R., Linetsky, V. (eds.) Financial Engineering. Handbooks in Operations Research and Management Science, vol. 15, pp. 343–373. Elsevier, Amsterdam (2008)

Kyprianou, A., Schoutens, W., Wilmott, P.: Exotic Option Pricing and Advanced Lévy Models. Wiley, New York (2005)

Lee, R.: Option pricing by transform methods: Extensions, unification, and error control. J. Comput. Finance 7(3), 51–86 (2004)

Lewis, A.: A simple option formula for general jump-diffusion and other exponential Lévy processes. Working Paper. http://ssrn.com/abstract=282110 (2001)

Linetsky, V.: Lookback options and diffusion hitting times: A spectral expansion approach. Finance Stoch. 8, 373–398 (2004)

Madan, D.B., Carr, P., Chang, E.: The variance gamma process and option pricing. Eur. Finance Rev. 2, 79–105 (1998)

Madan, D.B., Milne, F.: Option pricing with V.G. martingale components. Math. Finance 1(4), 39–55 (1991)

Madan, D.B., Seneta, E.: The variance gamma (V.G.) model for share market returns. J. Bus. 63, 511–524 (1990)

Merton, R.: Option pricing when underlying stock returns are discontinuous. J. Financ. Econ. 3, 125–144 (1976)

Nguyen-Ngoc, L., Yor, M.: Exotic options and Lévy processes. In: Ait-Sahalia, Y., Hansen, L. (eds.) Handbook of Financial Econometrics. Elsevier, Amsterdam (2002, to appear)

Petrella, G., Kou, S.G.: Numerical pricing of discrete barrier and lookback options via Laplace transforms. J. Comput. Finance 8, 1–37 (2004)

Protter, P.: Stochastic Integration and Differential Equations, 2nd edn. Springer, Berlin (2005)

Raible, S.: Lévy processes in finance: theory, numerics and empirical facts. Ph.D. Thesis, University of Freiburg. http://www.freidok.uni-freiburg.de/volltexte/51/pdf/51_1.pdf (2000)

Sato, K.: Lévy Processes and Infinitely Divisible Distributions. Cambridge University Press, Cambridge (1999)

Schoutens, W.: Lévy Processes in Finance: Pricing Financial Derivatives. Wiley, New York (2003)

Schoutens, W.: Exotic options under Lévy models: An overview. J. Comput. Appl. Math. 189, 526–538 (2006)

Stenger, F.: Numerical Methods Based on Sinc and Analytic Functions. Springer, New York (1993)

Tse, W.M., Li, L.K., Ng, K.W.: Pricing discrete barrier and hindsight options with the tridiagonal probability algorithm. Manag. Sci. 47, 383–393 (2001)

Yamamoto, Y.: Double-exponential fast Gauss transform algorithms for pricing discrete lookback options. Publ. Res. Inst. Math. Sci., Kyoto Univ. 41, 989–1006 (2005)

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Science Foundation under grant DMI-0422937.

Rights and permissions

About this article

Cite this article

Feng, L., Linetsky, V. Computing exponential moments of the discrete maximum of a Lévy process and lookback options. Finance Stoch 13, 501–529 (2009). https://doi.org/10.1007/s00780-009-0096-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-009-0096-x

Keywords

- Lévy processes

- Discrete maximum

- Exponential moments

- Esscher transform

- Discrete lookback options

- Fourier transform

- Hilbert transform

- Sinc expansion