Abstract

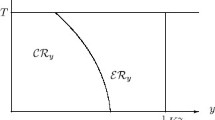

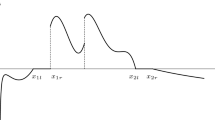

This article studies an optimal stopping problem with an endogenous constraint on the set of admissible stopping times. The constraint stipulates that continuation is permitted, at any given date t, only if the endogenous reward achieved exceeds a prespecified threshold. Characterizations of the value function and the optimal stopping time are presented. An application to the pricing of corporate claims, when the capital structure of the firm includes equity-trigger debt, is carried out.

Similar content being viewed by others

References

Artzner, P., Delbaen, F., Eber, J.-M., Heath, D., Ku, H.: Coherent multiperiod risk adjusted values and Bellman’s principle. Ann. Oper. Res. 152, 5–22 (2007)

Bensoussan, A.: On the theory of option pricing. Acta Appl. Math. 2, 139–158 (1984)

Bhanot, K., Mello, A.S.: Should corporate debt include a rating trigger? J. Financ. Econ. 79, 69–98 (2006)

Black, F., Cox, J.C.: Valuing corporate securities: some effects of bond indenture provisions. J. Finance 31, 351–367 (1976)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–659 (1973)

Brennan, M.J., Schwartz, E.: Evaluating natural resource investments. J. Bus. 58, 135–157 (1985)

Dayanik, S., Karatzas, I.: On the optimal stopping problem for one-dimensional diffusions. Stoch. Process. Appl. 107, 173–212 (2003)

Detlefsen, K., Scandolo, G.: Conditional and dynamic convex risk measures. Finance Stoch. 9, 539–561 (2005)

Dorobantu, D.: Optimal strategies in a risky debt context. Stochastics 81, 269–277 (2009)

Dynkin, E.: Optimal choices of the stopping moment of a Markov process. Dokl. Akad. Nauk SSSR 150, 238–240 (1963)

Dynkin, E., Yushkevich, A.: Markov Processes: Theorems and Problems. Plenum, New York (1969)

Jacka, S.: Optimal stopping and the American put. Math. Finance 1(2), 1–14 (1991)

Karatzas, I.: On the pricing of American options. Appl. Math. Optim. 17, 37–60 (1988)

Karatzas, I., Shreve, S.: Brownian Motion and Stochastic Calculus, 2nd edn. Springer, New York (1991)

Karatzas, I., Shreve, S.: Methods of Mathematical Finance. Applications of Mathematics, vol. 39. Springer, Berlin (1998)

Kifer, Y.: Game options. Finance Stoch. 4, 443–463 (2000)

Leland, H.: Corporate debt value, bond covenants, and optimal capital structure. J. Finance 49, 1213–1252 (1994)

Leland, H., Toft, K.: Optimal capital structure, endogenous bankruptcy, and the structure of credit spreads. J. Finance 51, 987–1019 (1996)

McDonald, R., Siegel, D.: The value of waiting to invest. Q. J. Econ. 101, 707–727 (1986)

Merton, R.: On the pricing of corporate debt: the risk structure of interest rates. J. Finance 29, 449–470 (1974)

Peskir, G., Shiryaev, A.N.: Optimal Stopping and Free-Boundary Problems. Birkhäuser, Basel (2006)

Powers, W.: Report of Investigation by the Special Investigation Committee of the Board of Directors of Enron Corp, William Powers Committee Report (2002). Available from http://news.findlaw.com/wsj/docs/enron/sicreport/index.html

Riedel, F.: Optimal stopping with multiple priors. Econometrica 77, 857–908 (2009)

Snell, J.L.: Application of martingale system theorems. Trans. Am. Math. Soc. 73, 293–312 (1952)

Shreve, S., Sîrbu, M.: A two-person game for pricing convertible bonds. SIAM J. Control Optim. 45, 1508–1539 (2006)

Villeneuve, S.: On threshold strategies and the smooth-fit principle for optimal stopping problems. J. Appl. Probab. 44, 181–198 (2007)

Acknowledgements

We would like to thank the editor, the co-editor, the associate editor and two anonymous referees for their constructive comments and insightful suggestions that improved the paper. Jie Xiong gratefully acknowledges research support from National Science Foundation grant DMS-0906907. Address correspondence to Weidong Tian, Belk College of Business, University of North Carolina at Charlotte, NC, 28223, USA.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Detemple, J., Tian, W. & Xiong, J. An optimal stopping problem with a reward constraint. Finance Stoch 16, 423–448 (2012). https://doi.org/10.1007/s00780-012-0173-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-012-0173-4