Abstract

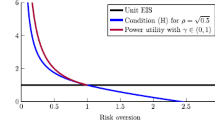

In an incomplete market, we study the optimal consumption-portfolio decision of an investor with recursive preferences of Epstein–Zin type. Applying a classical dynamic programming approach, we formulate the associated Hamilton–Jacobi–Bellman equation and provide a suitable verification theorem. The proof of this verification theorem is complicated by the fact that the Epstein–Zin aggregator is non-Lipschitz, so standard verification results (e.g. in Duffie and Epstein, Econometrica 60, 393–394, 1992) are not applicable. We provide new explicit solutions to the Bellman equation with Epstein–Zin preferences in an incomplete market for non-unit elasticity of intertemporal substitution (EIS) and apply our verification result to prove that they solve the consumption-investment problem. We also compare our exact solutions to the Campbell–Shiller approximation and assess its accuracy.

Similar content being viewed by others

Notes

See e.g. [19].

\(\mathbb {E}_{t}[\cdot]\) is short for \(\mathbb {E}[\cdot|{\mathfrak {F}}_{t}]\). Note that while c t is a consumption rate for t∈[0,T), c T represents lump sum consumption at the terminal time T.

The power set of R m×C is denoted by \(2^{\mathbf {R}^{m}\times \mathsf {C}}\).

The transpose of b is denoted by \(b^{\mathfrak {t}}\).

A Borel function χ:[0,T]×Ξ→R m×C is an admissible feedback control if

$$\mathrm {d}{X}_t = b \bigl(t,X_t,\chi (t,X_t) \bigr)\,\mathrm {d}{t} + a \bigl(t,X_t,\chi (t,X_t) \bigr) \,\mathrm {d}{W}_t,\qquad X_0=x, $$has a unique solution X x,χ such that \(u=\{u_{t}\}_{\in [0,T]}:=\{\chi (t,X^{x,\chi }_{t})\}_{t\in[0,T]}\in \mathcal {A}(x)\).

See in particular Sect. 5.6 in [28]. Note that the authors use a different normalization of utility (certainty equivalent form).

See e.g. [19] for counterexamples in a power utility setting.

This is because the Campbell–Shiller approximation is essentially a log-linear first-order expansion around the long-run stationary value of the consumption–wealth ratio. A generalization to settings with a finite horizon is possible, but beyond the scope of this paper.

Notice that [8] uses a slightly different separation where the exponent of g is unity.

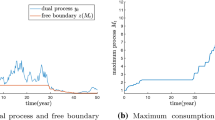

Figure 8 depicts results for different values of κ.

Recall that we are not assuming that \(\mathfrak {F}_{0}\) is trivial.

Note that \(\tilde{b}_{q}\to \tilde{b}\) as q→2.

References

Bansal, R.: Long-run risks and financial markets. Fed. Reserve Bank St. Louis Rev. 89, 1–17 (2007)

Bansal, R., Yaron, A.: Risks for the long run: A potential resolution of asset pricing puzzles. J. Finance 59, 1481–1509 (2004)

Barberis, N.: Investing for the long run when returns are predictable. J. Finance 55, 225–264 (2000)

Benzoni, L., Collin-Dufresne, P., Goldstein, R.S.: Can standard preferences explain the prices of out-of-the-money S&P 500 put options? Tech. Rep. W11861, NBER (2005)

Bhamra, H.S., Kuehn, L.A., Strebulaev, I.A.: The levered equity risk premium and credit spreads: A unified framework. Rev. Financ. Stud. 23, 645–703 (2010)

Campbell, J.Y.: Asset prices, consumption, and the business cycle. In: Taylor, J.B., Woodford, M. (eds.) Handbook of Macroeconomics, vol. 1. Elsevier North-Holland, Amsterdam (1999)

Campbell, J.Y., Viceira, L.M.: Strategic Asset Allocation. Oxford University Press, Oxford (2002)

Chacko, G., Viceira, L.M.: Dynamic consumption and portfolio choice with stochastic volatility in incomplete markets. Rev. Financ. Stud. 18, 1369–1402 (2005)

Chew, S.H., Epstein, L.G.: Recursive utility under uncertainty. In: Khan, A., Yannelis, N.C. (eds.) Equilibrium Theory with an Infinite Number of Commodities. Springer, Berlin (1990)

Duffie, D., Epstein, L.G.: Asset pricing with stochastic differential utility. Rev. Financ. Stud. 5, 411–436 (1992)

Duffie, D., Epstein, L.G.: Stochastic differential utility. Econometrica 60, 353–394 (1992)

Duffie, D., Lions, P.L.: PDE solutions of stochastic differential utility. J. Math. Econ. 21, 577–606 (1992)

Duffie, D., Skiadas, C.: Continuous-time security pricing: A utility gradient approach. J. Math. Econ. 23, 107–131 (1994)

Epstein, L.G., Zin, S.E.: Substitution, risk aversion and the temporal behavior of consumption and asset returns: A theoretical framework. Econometrica 57, 937–969 (1989)

Fisher, M., Gilles, C.: Consumption and asset prices with recursive preferences. Tech. Rep. 1998-40, Federal Reserve Board (1998)

Hall, R.E.: Intertemporal substitution in consumption. J. Polit. Econ. 96, 339–357 (1988)

Heath, D., Schweizer, M.: Martingales versus PDEs in finance: An equivalence result with examples. J. Appl. Probab. 37, 947–957 (2000)

Heston, S.L.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327–343 (1993)

Korn, R., Kraft, H.: On the stability of continuous-time portfolio problems with stochastic opportunity set. Math. Finance 14, 403–414 (2004)

Kraft, H., Seifried, F.T.: Foundations of continuous-time recursive utility: Differentiability and normalization of certainty equivalents. Math. Financ. Econ. 3, 115–138 (2010)

Kreps, D.M., Porteus, E.L.: Temporal resolution of uncertainty and dynamic choice theory. Econometrica 46, 185–200 (1978)

Liu, J.: Portfolio selection in stochastic environments. Rev. Financ. Stud. 20, 1–39 (2007)

Liu, J., Pan, J.: Dynamic derivative strategies. J. Financ. Econ. 69, 401–430 (2003)

Ma, C.: An existence theorem of intertemporal recursive utility in the presence of Lévy jumps. J. Math. Econ. 34, 509–526 (2000)

Pitman, J.W., Yor, M.: A decomposition of Bessel bridges. Probab. Theory Relat. Fields 59, 425–457 (1982)

Rogers, L.C.G., Williams, D.: Diffusions, Markov Processes and Martingales. Volume 2: Itô Calculus, 2nd edn. Cambridge University Press, Cambridge (2000)

Schroder, M., Skiadas, C.: Optimal consumption and portfolio selection with stochastic differential utility. J. Econ. Theory 89, 68–126 (1999)

Schroder, M., Skiadas, C.: Optimal lifetime consumption-portfolio strategies under trading constraints and generalized recursive preferences. Stoch. Process. Appl. 108, 155–202 (2003)

Schroder, M., Skiadas, C.: Lifetime consumption-portfolio choice under trading constraints, recursive preferences, and nontradeable income. Stoch. Process. Appl. 115, 1–30 (2005)

Schroder, M., Skiadas, C.: Optimality and state pricing in constrained financial markets with recursive utility under continuous and discontinuous information. Math. Finance 18, 199–238 (2008)

Skiadas, C.: Recursive utility and preferences for information. Econ. Theory 12, 293–312 (1998)

Skiadas, C.: Dynamic portfolio theory and risk aversion. In: Birge, J.R., Linetsky, V. (eds.) Handbooks in Operations Research and Management Science: Financial Engineering, vol. 15. Elsevier North-Holland, Amsterdam (2008)

Tiu, C.: On the Merton problem in incomplete markets. Ph.D. Thesis, University of Texas, Austin (2002)

Vissin-Jorgensen, A.: Limited asset market participation and the elasticity of intertemporal substitution. J. Polit. Econ. 110, 825–853 (2002)

Wachter, J.A.: Portfolio and consumption decisions under mean-reverting returns: An exact solution for complete markets. J. Financ. Quant. Anal. 37, 63–91 (2002)

Wachter, J.A.: Can time-varying risk of rare disasters explain aggregate stock market volatility? Working Paper, University of Pennsylvania (2011). Available at http://finance.wharton.upenn.edu/~jwachter/

Acknowledgements

We thank Jakša Cvitanić (editor), Tomas Björk, and two anonymous referees for very helpful comments. We thank seminar participants at Aarhus University, the University of Copenhagen and the University of Bonn for valuable discussions and suggestions. All errors are of course our own. Holger Kraft gratefully acknowledges financial support by Deutsche Forschungsgemeinschaft.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Generalization of Skiadas’ lemma

In this part of the appendix, we establish the key auxiliary result required in the proof of Theorem 3.1. Throughout Appendix A, we assume as given a probability space \((\varOmega,\mathfrak {F},\mathbb {P})\) endowed with an arbitrary filtration \(\{\mathfrak {F}_{t}\}_{t\in[0,T]}\) satisfying the usual conditions of right-continuity and completeness; however, \(\mathfrak {F}_{0}\) does not have to be trivial. First, recall

Theorem A.1

(Stochastic Gronwall–Bellman inequality)

Let Y={Y t } t∈[0,T] be a right-continuous adapted process with \(\mathbb {E}[\sup_{s\in [0,T]}|Y_{s}|]<\infty\) and suppose that for some k∈(0,∞),

Then Y t ≥0 for all t∈[0,T] a.s.

For the proof of this result, we refer the reader to Appendix B in [11] or Appendix B in [20].

The main result of this appendix is the following generalization of Skiadas’ lemma.Footnote 14 We wish to stress that Condition (A.1) of Theorem A.2 is only required on the event {Y t ≤0}.

Theorem A.2

(Generalized Skiadas’ lemma)

Let Y={Y t } t∈[0,T] be a right-continuous adapted process with Y T =0 and \(\mathbb {E}[\sup_{s\in[0,T]}|Y_{s}|]<\infty \). Moreover, assume that there exist a progressive process H and a constant k∈(0,∞) such that

Then Y t ≥0 for all t∈[0,T] a.s.

Proof

Since Y is right-continuous, it suffices to prove \(Y_{t_{0}}\ge0\) a.s. for each t 0∈[0,T]. If the result is established for t 0=0, then applying it to each of the processes \(\{ Y_{t_{0}+t}\}_{t\in[0,T-t_{0}]}\) for t 0∈[0,T] yields the claim.Footnote 15 Thus it suffices to show that Y 0≥0 a.s. We define the stopping time

Note that Y τ ≥0 since Y is right-continuous and Y T =0. By (A.1) it follows that \(\{Y_{t}+\int_{0}^{t} H_{s}\,\mathrm {d}{s}\}_{t\in[0,T]}\) is a martingale. Hence the optional stopping theorem gives \(\mathbb {E}_{t}[1_{\{\tau>t\}} ( Y_{\tau} + \int_{0}^{\tau } H_{s}\,\mathrm {d}{s})] = 1_{\{\tau>t\}} (Y_{t}+\int_{0}^{t} H_{s}\,\mathrm {d}{s})\) a.s., and so

The assumption on H yields H t (ω)≥kY t (ω) for all (t,ω)∈[0,T]×Ω with 0≤t<τ(ω), i.e., with Y t (ω)≤0, and substituting this into (A.2), we get

Applying the stochastic Gronwall–Bellman inequality in Theorem A.1 to the process {1{τ>t} Y t } t∈[0,T], we find that 1{τ>0} Y 0≥0 a.s. By definition of τ, we have 1{τ=0} Y 0≥0. Hence, Y 0≥0 a.s. □

Appendix B: General verification result

In Appendix B, we prove the general verification results of Sect. 3.

Proof of Theorem 3.1

We adapt the line of argument in the proof of Proposition 9 in [11]. Let x∈Ξ and \(u=(\pi,c)\in \mathcal {A}(x)\) be an arbitrary admissible control. To shorten notation, X=X x,u and V=V c denote the controlled process and the continuation value process associated to u and c, respectively. Itô’s formula implies that

where M is a martingale. Taking conditional expectations and using the definition of V, we obtain

Hence,

The dynamic programming equation implies

and condition (L) yields

Combining (B.1) with (B.3) we find that Y={Y t } t∈[0,T]:={w(t,X t )−V t } t∈[0,T] has the representation

Thus we can apply the generalized Skiadas’ lemma in Theorem A.2 and obtain \(\mathfrak {v}(c) = V^{c}_{0} \le w(0,X^{x,u}_{0}) = w(0,x)\). Since \(u=(\pi,c)\in \mathcal {A}(x)\) is arbitrary, we have

Conversely, under the assumptions of Theorem 3.1, we have for the feedback control χ ⋆ that

instead of (B.2), where \(u^{\star}=\{ u^{\star}_{t}\}_{t\in[0,T]}:= \{\chi ^{\star}(t,X^{x,\chi ^{\star}}_{t})\}_{t\in[0,T]}\). Therefore, the preceding argument applies to both processes \(\{w(t,X^{x,u^{\star}}_{t})-V^{c^{\star}}_{t}\}_{t\in[0,T]}\) and \(\{ V^{c^{\star}}_{t}-w(t,X^{x,u^{\star}}_{t})\}_{t\in[0,T]}\). Consequently, \(\mathfrak {v}(c^{\star}) = w(0,x)\) and \(c^{\star }\in \mathcal {C}\). Hence χ ⋆ is an optimal feedback control. □

We now provide a verification result for the associated infinite-horizon problem.

Corollary B.3

In the framework of Sect. 3, suppose that all coefficients are time-homogeneous and consider the infinite-horizon stochastic control problem to

Suppose that f satisfies condition (L), that w∈C2(Ξ) is a solution of

and that for every \(u\in \mathcal {A}(x)\) the local martingale

is a uniformly integrable martingale. Further assume the transversality condition

If there is a feedback control \(\chi ^{\star}=(\chi ^{\star }_{\pi},\chi ^{\star}_{c}):\ \varXi\to \mathbf {R}^{m}\times \mathsf {C}\) with

then χ ⋆ is optimal and w is the value function of problem (3.2). In particular,

Proof

Let x∈Ξ and \(u=(\pi,c)\in \mathcal {A}(x)\). We use similar notation as in the proof of Theorem 3.1; in particular, let X=X x,u and V=V c. For fixed T>0, define

Then it follows as in the proof of Theorem 3.1 that \(w(x)\ge\bar{V}^{(T)}_{0}\). Since

the transversality condition implies that \(V_{0} - \bar{V}^{(T)}_{0} = \mathbb {E}[V_{T}] - \mathbb {E}[w(X_{T})] \to0\) as T→∞. Thus we have \(w(x)\ge V_{0} = \mathfrak {v}(c)\) and

The remainder of the proof is analogous to that of Theorem 3.1. □

Proof of Proposition 3.2

Let c∈C be arbitrary, and let v,w∈V with v≥w. From the definition of the Epstein–Zin aggregator in (2.2), we have

Since the first summand is obviously Lipschitz, it is sufficient to show that in each of the cases (a)–(d), the second summand is negative. Note that

If γ<1, i.e., 1−γ>0, then (1−γ)v≥(1−γ)w and

Thus, in this case the second summand in (B.4) is negative if

However, if ψ<1 then \(\gamma<1<\frac{1}{\psi}\) is always satisfied, and we obtain cases (c) and (d). Similarly, if γ>1, i.e., 1−γ<0, then (1−γ)v≤(1−γ)w and

Hence, the second summand in (B.4) is negative if

Now we always have \(\gamma>1>\frac{1}{\psi}\) for ψ>1, and we obtain cases (a) and (b). □

Appendix C: Verification for Heston’s model

Appendix C provides the proof of Theorem 5.1. We first establish Theorem 5.1 assuming that Propositions C.3 and C.6 hold true. Then we present the proofs of Propositions C.3 and C.6.

Proof of Theorem 5.1

The proof is divided into two steps.

Step 1: Explicit solution of (4.5). First observe that

It is then sufficient to solve the PDE (4.6) for h for every s∈[0,T]. The conjecture h(t,y;s)=eA(t,s)−B(t,s)y yields for \(A(\:\cdot \:,s)\) and \(B(\:\cdot \:,s)\) the ODEs

The solutions read

where \(\hat{\kappa } := \kappa -\frac{1-\gamma}{\gamma}\bar{\lambda }\bar{\beta}\rho\), \(b:= -\frac{1}{2}\frac{1-\gamma}{k\gamma}\bar {\lambda}^{2}\) and \(a :=\sqrt{\hat{\kappa }^{2}+2b\bar{\beta}^{2}}\).

Step 2: Verification of the integrability condition (M). Proposition C.3 implies that under the assumptions of Theorem 5.1 the integrability condition (M) holds for all \((\pi,c)\in \mathcal {A}'(x)\). Moreover, by Proposition C.6, the consumption-portfolio strategy (π ⋆,c ⋆) in (5.2) is admissible. Hence Theorem 3.1 yields the claim. □

In the remainder of this appendix, we complete the proof of Theorem 5.1 by establishing Propositions C.3 and C.6. In the following we suppose that the assumptions of Theorem 5.1 are satisfied. In particular, conditions (H) and (H1)–(H3) are assumed to hold. We also continue to use the notation introduced in Sect. 5.1 and the proof of Theorem 5.1. In particular,

Moreover, we define the processes \(\pi^{\star}=\{\pi^{\star}_{t}\}\) and \(C^{\star}=\{C^{\star}_{t}\}\) by

which are the candidates for the optimal trading strategy and the optimal consumption–wealth ratio, respectively. Slightly abusing notation, we also write \(\pi^{\star}_{t} = \pi^{\star}(t,Y_{t})\) and \(C^{\star}_{t} = C^{\star}(t,Y_{t})\) for the feedback form of these strategies. Our first result summarizes some estimates of the functions g, A, and B.

Lemma C.4

We have

where \(\left \|{F}\right \| :=\max_{s,t\in[0,T],\, t\le s} |F(t,s)| < \infty\) for F∈{A,B}. More precisely, A and B satisfy

and we have

Proof

First note that B(t,s)≥0 for t≤s. The first inequality in (C.2) follows from

and the second is immediate. To establish (C.3), recall that \(B(\:\cdot \:,s)\) is given by

Since \(\hat{\kappa }>0\) by assumption and b>0, an elementary ODE argument yields the first part of (C.3). The second estimate follows from (C.1). To prove (C.4), recall that \(A(\:\cdot \:,s)\) is given by

Observe that \(\frac{(1-\gamma)r-\delta\theta}{k}<0\) since γ>1 and θ,k>0. Therefore, by (C.3), we obtain

Hence (C.4) follows. Finally, (C.5) follows from the definition of π ⋆ since ρ≤0 and \(\frac{g_{y}(t,y)}{g(t,y)}\le0\) as well as (C.2), (C.3). □

Next we recall a well-known result on the Laplace transform of the integrated square-root process; see [25].

Lemma C.5

(Pitman–Yor)

Consider the square-root process Y={Y t } with dynamics

where \(\bar{W}=\{\bar{W}_{t}\}\) is a standard Wiener process. Further assume that p,q∈R satisfy

Then the Laplace transform

is well-defined and

where \(\tilde{A}(\:\cdot \:,T)\) and \(\tilde{B}(\:\cdot \:,T)\) are bounded continuous functions on [0,T].

Proposition C.6

(Verification of integrability condition (M))

Under the assumptions of Theorem 5.1, the integrability condition (M) holds for all \((\pi,c)\in \mathcal {A}'(x)\).

Proof

Let \((\pi,c)\in \mathcal {A}'(x)\) be an admissible consumption-portfolio strategy. To establish (M), we have to show that

where the processes F={F t } and \(\hat{F}=\{\hat{F}_{t}\}\) are given by

As π and \(\{\frac{g_{y}(t,Y_{t})}{g(t,Y_{t})}\}\) are uniformly bounded and

it suffices to show that

Since \(\sup_{t\in[0,T]}\mathbb {E}[Y_{t}^{p}]<\infty\) for any p>1 by Lemma C.2, Hölder’s inequality implies that it is sufficient to show

By (C.2), we have \(|g(t,y)| \le\mathrm{e}^{\left \|{A}\right \|}(T-t)\). Therefore

On the other hand, the admissibility condition (M′) implies that

if q−2 is sufficiently small. Therefore we obtain

for some K>0. By (H1), k+1−γ>−1. Consequently,

and thus (C.6) holds. This completes the proof. □

The following consequence of Lemma C.2 will be required in the proof of Proposition C.6.

Corollary C.7

If |π t |≤K π for all t∈[0,T], then the Novikov condition

is satisfied for some q>2.

Proof

The claim follows immediately from Lemma C.2 and assumption (H3). □

The next result provides a crucial upper bound for the candidate optimal consumption–wealth ratio C ⋆. Note that C ⋆(t,y) increases linearly in y.

Lemma C.8

(Upper bound for consumption–wealth ratio)

We have

Proof

Let τ>0 be arbitrary and consider the auxiliary function

where \(h(0):=\frac{1}{\tau}\). Then h is continuous and a straightforward calculation shows that h′(x)≤1 for all x>0. Thus the mean value theorem yields

Using (C.3) and (C.4), we then obtain

Now (C.7) implies

and the claim follows. □

We are now in a position to establish the second main result of this appendix.

Proposition C.9

(Sufficient conditions for admissibility in the Heston model)

Suppose the assumptions of Theorem 5.1 hold. Let (π,c) be a consumption-portfolio strategy and denote by C={C t } the associated consumption–wealth ratio. If for some constant K>0 we have

then (π,c) satisfies the admissibility condition (M′). In particular, the strategy (π ⋆,c ⋆) in (5.2) is admissible.

Proof

The proof is divided into three steps. In the following, we denote by K a sufficiently large constant K>0 and by q a constant q>2. The precise magnitude of these constants may depend on the parameters of the model, but is independent of both y=Y t and t.

Step 1: Change of measure. The investor’s wealth dynamics satisfy

so \(X_{t}^{1-\gamma}\) can be computed explicitly as

It follows that

where the processes Z={Z t } and Ψ={Ψ t } are given by

By Novikov’s condition and Corollary C.4, Z={Z t } is a martingale. Hence, under the equivalent measure \(\tilde {\mathbb {P}}\) given by \(\frac{\mathrm {d}\tilde {\mathbb {P}}}{\mathrm {d}\mathbb {P}} = Z_{t}\) on \(\mathfrak {F}_{t}\), the process \(\tilde {W}=\{\tilde{W}_{t}\}\) defined by

is a standard Wiener process. With \(\tilde {\mathbb {E}}\) denoting the expectation operator associated to \(\tilde {\mathbb {P}}\), we thus have

Step 2: Dynamics of Y under \(\tilde {\mathbb {P}}\). Observe that Y has the \(\tilde {\mathbb {P}}\)-dynamics

where \(\tilde{W}\) and \(\hat{W}\) are independent standard \(\tilde {\mathbb {P}}\)-Wiener processes and

Assumption (H3) implies that

provided q−2 is sufficiently small. By (C.8), we have \(\tilde{\kappa }_{t}\ge\underline {\kappa }\). It follows that \(\vartheta-\tilde{\kappa }_{t} y\le \vartheta-\underline{\kappa }y\) for all t∈[0,T] and y∈[0,∞). Thus, by a ramification of a classical comparison result of Yamada and Watanabe, see e.g. Theorem V.43.1 in [26],

where \(\tilde{Y}=\{\tilde{Y}_{t}\}\) follows a square-root process

Step 3: Verification of (M′). The quantity Ψ t defined before (C.9) can be interpreted as a convex parabola in π=π t with vertex at π=0. Therefore,

and in combination with the assumption (C.8) on C t , we obtain

where \(\tilde{b}_{q} := b + \frac{1-q+q\gamma}{2} K_{\pi}^{2}\). Hence, by (C.10), we get

where the third line follows from (C.11). Now, by (C.12), \(\tilde{Y}\) is a square-root process under \(\tilde {\mathbb {P}}\), and assumption (H3) ensures that

if q−2 is sufficiently small.Footnote 16 Hence Lemma C.2 yields

and thus

Consequently (M′) is satisfied with ℓ=q(γ−1)>2(γ−1). The last part of the assertion follows immediately from (C.5) and Lemma C.5. □

Remark

Note that Proposition C.6 implies in particular that there exists a continuation value process \(V^{\star}=\{V^{\star}_{t}\}\) corresponding to (π ⋆,c ⋆); see the discussion following Theorem 3.1. In fact, we have \(V^{\star}_{t}=w(t,X^{\star}_{t},Y_{t})\) for t∈[0,T].

Appendix D: Proofs of Propositions 5.2 and 5.3

Proof of Proposition 5.2

Since the PDEs (4.5) for g in the Heston and the inverse Heston model are identical, the claim follows from the first part of the proof of Theorem 5.1. □

Proof of Proposition 5.3

Note that in terms of the notation of Sect. 5.2,

and as in the first part of the proof of Theorem 5.1, it suffices to solve (4.6). The conjecture \(h(t,y;s)=\mathrm {e}^{A(t,s)-B(t,s)y-C(t,s)y^{2}}\), (t,y)∈[0,s]×R, yields for \(A(\:\cdot \:,s)\), \(B(\:\cdot \:,s)\) and \(C(\:\cdot \:,s)\) the ODEs

Therefore,

where \(\hat{\kappa } := \kappa -\frac{1-\gamma}{\gamma}\beta\rho\), \(b := -\frac{1}{2}\frac{1-\gamma}{k\gamma}\) and \(a := 2\sqrt{\hat{\kappa }^{2}+2b\beta^{2}}\). The function \(A(\:\cdot \:,s)\) can then be found by integrating the corresponding trivial ODE. □

Rights and permissions

About this article

Cite this article

Kraft, H., Seifried, F.T. & Steffensen, M. Consumption-portfolio optimization with recursive utility in incomplete markets. Finance Stoch 17, 161–196 (2013). https://doi.org/10.1007/s00780-012-0184-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-012-0184-1

Keywords

- Consumption-portfolio optimization

- Recursive utility

- Stochastic control approach

- Stochastic volatility

- Unspanned state process

- Campbell–Shiller approximation