Abstract.

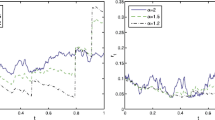

We propose a new model for pricing of bonds and their options based on the short rate when the latter exhibits a step function like behaviour. The model produces realistic looking spot rate curves, and allows one to derive explicit formulae for the yield curve and put and cap options. This model is appropriate for markets with pegged rates, such as the Australian market. We also give a general result on bond prices when the short rate is a sum of independent processes.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Manuscript received: July 2001; final version received: April 2002

The authors are grateful to the referee for careful reading of the paper, useful comments, especially Remark 4, and a number of references. The work of the second author was supported by the Australian Research Council, the work of the third author was supported by the Australian Postgraduate Research Award.

Rights and permissions

About this article

Cite this article

Borovkov, K., Klebaner, F. & Virag, E. Random step functions model for interest rates. Finance Stochast 7, 123–143 (2003). https://doi.org/10.1007/s007800200080

Issue Date:

DOI: https://doi.org/10.1007/s007800200080