Abstract

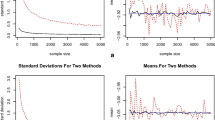

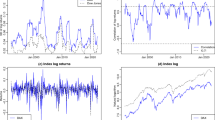

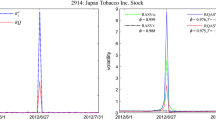

Volatility plays a key role in microstructure issues in the study of financial markets. Stochastic volatility (SV) models have been applied to the study of the behavior of financial variables. Two stock markets exist in China: Shanghai Stock Exchange and Shenzhen Stock Exchange. As emerging stock markets, investors are increasingly concerned about the volatilities of these two stock markets. We briefly introduce how to estimate SV models using the Markov chain Monte Carlo (MCMC) method. In order to do full and comprehensive analyses of the volatilities of stock returns, we estimated SV models using most of the historical data and the different data frequencies of the two Chinese markets. We found that estimated values of volatility parameters are very high for all data frequencies. This suggests that stock returns are extremely volatile even at long-term intervals in Chinese markets.

Similar content being viewed by others

References

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econometrics 31:307–327

Jacquier E, Polson NG, Rossi PE (1993) Priors and models for multivariate stochastic volatility. Unpublished manuscript, Graduate School of Business, University of Chicago

Jacquier E, Polson NG, Rossi PE (1994) Bayesian analysis of stochastic volatility models. J Business Econ Stat 12(4):69–87

Tsay RS (2005) Analysis of financial time series. 2nd edn. Wiley, New York

Lu SQ, Ito T (2008) Structural breaks and time-varying parameter: a survey with application. 10th International Business Information Management Association Conference. Innovation and Knowledge Management in Business Globalization, Theory and Practice. Malaysia, pp 422–428

Lu SQ, Ito T (2009) An empirical investigation of Chinese stock markets with feed-back models. 11th International Business Information Management Association Conference. Innovation and Knowledge Management in Twin Track Economies: Challenges and Solutions. Egypt, pp 257–262

Lu SQ, Ito T, Voges K (2008) An analysis of long memory in the SSE’s component index. 9th International Business Information Management Association Conference. Information Management in Modern Organizations: Trends and Challenges. Morocco, pp 924–929

Author information

Authors and Affiliations

Corresponding author

Additional information

This work was presented in part at the 15th International Symposium on Artificial Life and Robotics, Oita, Japan, February 4–6, 2010

About this article

Cite this article

Lu, S.Q., Xie, S. & Ito, T. Estimating stochastic volatility models of stock returns in Chinese markets. Artif Life Robotics 15, 400–402 (2010). https://doi.org/10.1007/s10015-010-0829-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10015-010-0829-0