Abstract

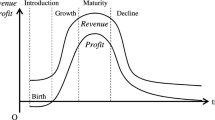

The stylized model presented is an optimal control model of technology investment decision of a single product firm. The firm’s technology investment does not have only a long-run positive effect but also a short-run adverse effect on its sales volume. We examine the case of high adverse investment effects where the firm finally leaves the market but we have observed different life cycles till this happens. Depending on the firm’s initial technology stock and sales volume, we compute different firm’s life cycles, which are driven by a trade-off between two strategies: technology versus sales focus strategy. Indifference curves, where managers are indifferent to apply initially technology or sales focus strategies, separate founding conditions of the firm to various classes distinguishable because of the firm’s life cycle.

Similar content being viewed by others

References

Abernathy WJ, Utterback JR (1978) Patterns of industrial innovation. Technol Rev 80(7): 40–47

Adda J, Cooper R (2000) The dynamics of car sales: a discrete choice approach. NBER working paper No. 7785

Agarwal R, Gort M (2002) Firm and product life cycles and firm survival. Am Econ Rev 92: 184–190. doi:10.1257/000282802320189221

Agarwal R, Sarkar M, Echambadi R (2002) The conditioning effect of time on firm survival: an industry life cycle approach. Acad Manag J 45: 971–994

Amit R, Schoemaker P (1993) Strategic assets and organizational rent. Strateg Manag J 14: 33–46

Audretsch D, Mahmood T (1994) The rate of hazard confronting new firms and plants in US manufacturing. Rev Ind Organ 9: 41–56

Caulkins JP, Feichtinger G, Haunschmied JL, Tragler G (2006) Quality cycles and the strategic manipulation of value. Oper Res 54(4): 666–677. doi:10.1287/opre.1060.0294

Caves R (1998) Industrial organization and new findings on the turnover and mobility of firms. J Econ Lit 36: 1947–1982

Cooper A, Gimeno-Gascon F, Woo C (1994) Initial human and financial capital as predictors of new venture performance. J Bus Ventur 9: 371–395

Dixit A, Pindyck R (1994) Investment under uncertainty. Princeton University Press, NJ

Doms M, Dunne T, Roberts MJ (1995) The role of technology use in the survival and growth of manufacturing plants. Int J Ind Organ 13: 523–542

Dunne T, Roberts M, Samuelson L (1988) Patterns of firm entry and exit in US manufacturing plants. Rand J Econ 19: 495–515

Dunne T, Roberts M, Samuelson L (1989) The growth and failure of US manufacturing plants. Q J Econ 104: 671–698

Dunne P, Hughes A (1994) Age, size, growth and survival: UK companies in the 1980s. J Ind Econ 42(2): 115–141

Evans DS (1987) Tests of alternative theories of firm growth. J Polit Econ 95(4): 657–674

Evans DS (1987) The relationship between firm growth, size, and age—estimates for 100 manufacturing industries. J Ind Econ 35(4): 567–581

Fichman M, Levinthal D (1991) Honeymoons and the liability of adolescence: a new perspective on duration dependence in social and organizational relationships. Acad Manag Rev 16: 442–468

Frank M (1988) An intertemporal model of industrial exit. Q J Econ 103: 333–344

Freeman J, Carroll G, Hannan M (1983) The liability of newness: age dependence in organization death rates. Am Sociol Rev 48: 692–710

Geroski PA (1995) What do we know about entry? Int J Ind Organ 13: 421–440

Geroski PA, Mata J, Portugal P (2003) Founding conditions and the survival of new firms. Banco de Portugal, Economic Research Department, Working papers No. 1–03

Grass D, Caulkins JP, Feichtinger G, Tragler G, Behrens G (2008) Optimal control of nonlinear processes. Springer Verlag, Berlin

Hall B (1987) The relationship between firm size and firm growth in the US manufacturing sector. J Ind Econ 35(4): 583–606

Hall B, Khan B (2003) Adoption of new technology. NBER Working paper No. 9730

Hannan M, Freeman J (1984) Structural inertia and organizational change. Am Sociol Rev 49: 149–164

Haunschmied JL, Kort PM, Hartl RF, Feichtinger G (2003) A DNS-curve in a two-state capital accumulation model: a numerical analysis. J Econ Dyn Control 27: 701–716. doi:10.1016/S0165-1889(01)00070-7

Haunschmied JL, Feichtinger G, Hartl RF, Kort PM (2005) Keeping up with the technology pace: a DNS-curve and a limit cycle in a technology investment decision problem. J Econ Behav Organ 57: 509–529. doi:10.1016/j.jebo.2005.04.003

Jovanovic B (1982) Selection and the evolution of industry. Econometrica 50: 649–670

Jovanovic B, MacDonald G (1994) The life cycle of a competitive industry. J Polit Econ 102: 322–347

Kimberly J (1979) Issues in the creation of organisations: initiation, innovation, and institutionalisation. Acad Manag J 22: 437–457

Levinthal D (1991) Random walks and organizational mortality. Adm Sci Q 36: 397–420

Mansfield E (1968) Industrial research and technological innovation: an econometric analysis. Longmans, London

Mata J, Portugal P (1994) Life duration of new firms. J Ind Econ 42: 227–246

Pegels C (1991) Research and development intensity and performance. In: Kocaoglu DF, Niwa K (eds) Technology management: the new international language, Portland OR, 27–31 Oct 1991. Proceedings of PICMET 91, ISBN 0-7803-0161-7, IEEE, NY, pp 166–169

Romanelli E (1989) Environments and strategies at start-up: effects on early survival. Adm Sci Q 34: 369–387

Schumpeter JA (1942) Capitalism, socialism, and democracy. Harper and Brothers, New York

Sharma A, Kesner I (1996) Diversifying entry: some ex ante explanations for post-entry survival and growth. Acad Manag J 39: 635–677

Spence M (1977) Entry, capacity, investment, and oligopolistic pricing. Bell J Econ 8: 534–544

Spence M (1979) Investment strategy and growth in a new market. Bell J Econ 10: 1–19

Spence M (1981) The learning curve and competition. Bell J Econ 12: 49–70

Stinchcombe AL (1965) Organizations and social structure. In: March JG (ed) Handbook of organizations. Rand-McNally, Chicago, pp 142–193

Utterback JM (1996) Mastering the dynamics of innovation. Harvard Business School Press, Boston

Verspagen B (1993) Uneven growth between interdependent economies: an evolutionary view on technology gaps, trade and growth. Aldershot, Avebury (published from of PhD dissertation)

Wernerfelt B (1985) The dynamics of prices and market shares over the product life cycle. Manag Sci 31: 928–939

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was financed by the Austrian National Bank under Grant Jubilaeumsfonds No. 11260. Any opinions, findings, and conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of the Austrian National Bank.

Rights and permissions

About this article

Cite this article

Fortune-Devlaminckx, E., Haunschmied, J.L. Diversity of firm’s life cycle adapted from the firm’s technology investment decision. Cent Eur J Oper Res 18, 477–489 (2010). https://doi.org/10.1007/s10100-010-0171-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-010-0171-6

Keywords

- Technology investment

- Firm’s life cycle

- Optimal control

- Non linear economic dynamics

- Indifference curves

- Computational economics