Abstract

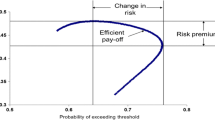

We present a single stage stochastic mixed integer linear model for determining the optimal mix of different technologies for electricity generation, ranging from coal, nuclear and combined cycle gas turbine to hydroelectric, wind and photovoltaic, taking into account the existing plants, the cost of investment in new plants, maintenance costs, purchase and sale of \({CO}_2\) emission trading certificates and green certificates, in order to satisfy regulatory requirements. The power producer is assumed to be a price-taker. Stochasticity of future fuel prices, which affect the generation variable costs, is included in the model by means of a set of scenarios. The main contribution of the paper, beyond considering stochasticity in the future fuel prices, is the introduction of CVaR risk measure in the objective function in order to limit the possibility of low profits in bad scenarios with a fixed confidence level.

Similar content being viewed by others

References

Artzner P, Delbaen F, Eber JM, Heath D (1999) Coeherent measures of risk. Math Financ 9:203–228

Bjorkvoll T, Fleten SE, Nowak MP, Tomasgard A, Wallace SW (2001) Power generation planning and risk management in a liberalized market. IEEE Power Tech Proc 1:426–431

Botterud A, Mahalik MR, Veselka TD, Ryu HS, Sohn KW (2007) Multi-agent simulation of generation expansion in electricity markets. IEEE Power Engineering Society General Meeting, Tampa, FL, USA, 24–28 June 2007. doi:10.1109/PES.2007.385566

Conejo AJ, Carrion M, Morales JM (2010) Decision making under uncertainty in electricity market. International Series in Operations Research and Management Science. Springer Science+Business Media, New York

Decree March 3 (2011) Attuazione della direttiva 2009/28/CE sulla promozione dell’uso dell’energuia da fonti rinnovabili. Gazzetta Ufficiale dell Repubblica Italiana 28

Genesi C, Marannino P, Montagna M, Rossi S, Siviero I, Desiata L, Gentile G (2009) Risk management in long term generation planning. In: 6th international conference on the European, energy market, pp 1–6

Han S, Chung K, Kim BH (2012) The development of the generation expansion planning system using multi-criteria decision making rule. J Energy Power Eng 6:126–131

Hariyanto N, Nurdin M, Haroen Y, Machbub C (2009) Decentralized and simultaneous generation and transmission expansion planning through cooperative game theory. Int J Electr Eng Inf 1(2):149–164

Moghdass-Tafreshi SM, Shayanfar HA, Rabiee A, Aghaei J (2011) Generation expansion planning in Pool market: a hybrid modified game theory and particle swarm optimization. Energ Convers Manag 52:1512–1519

Rockafellar RT, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2:21–41

Rockafellar RT, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Financ 26:1443–1471

Roh JH, Shahidehpour M, Fu Y (2007) Market-based coordination of trasmisssion and generation capacity planning. IEEE Trans Power Syst 22(4):1406–1419

Roh JH, Shahidehpour M, Wu L (2009) Market-based generation and transmission planning under uncertainties. IEEE Trans Power Syst 24(3):1587–1598

Sauma EE, Oren SS (2006) Proactive planning and valuation of transmission investments in restructured electricity markets. J Regul Econ 30:358–387

Vespucci MT, Bertocchi M, Innorta I, Zigrino S (2011) Models for the generation expansion problem in the Italian electricity market. Tecnical report DMSIA 2, University of Bergamo

Vespucci MT, Bertocchi M, Innorta I, Zigrino S (2011) A stochastic model for the single producer capacity expansion problem in the Italian electricity market. Tecnical report DIIMM 6, University of Bergamo

Vespucci MT, Bertocchi M, Innorta I, Zigrino S (2012) A stochastic model for capacity planning in the electricity production sector in the long run. Tecnical report DMSIA 3, University of Bergamo

Acknowledgments

The authors acknowledge the support from the grant by Regione Lombardia “Metodi di integrazione delle fonti energetiche rinnovabili e monitoraggio satellitare dell’impatto ambientale”, EN-17, ID 17369.10, and grants by University of Bergamo (2010, 2011) coordinated by M. Bertocchi and M.T. Vespucci. The authors thanks the anonymous referees for advices and suggestions that greatly improve the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors acknowledge the support from the grant by Regione Lombardia “Metodi di integrazione delle fonti energetiche rinnovabili e monitoraggio satellitare dell’impatto ambientale”, EN-17, ID 17369.10, and grants by University of Bergamo (2010, 2011) coordinated by M. Bertocchi and M. T. Vespucci.

Rights and permissions

About this article

Cite this article

Vespucci, M.T., Bertocchi, M., Innorta, M. et al. A stochastic model for investments in different technologies for electricity production in the long period. Cent Eur J Oper Res 22, 407–426 (2014). https://doi.org/10.1007/s10100-013-0317-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-013-0317-4