Abstract

New Institutions for Occupational Retirement Provision Directive, effective since 2019, lays down new information requirements for all pension providers across the EU. The directive requires providers to supply their members and savers with a Pension Benefit Statement on a regular basis. The Pension Benefit Statement should inter alia contain the projections of future pension benefits that can reasonably be expected at the moment of retirement. However, the directive does not provide any further technical specification on the methods and processes of pension benefit projections. Our motivation is to contribute to this issue and present possible approaches on pension benefit projections. The complexity of pension benefit projections requires consideration of not only expected returns on various asset categories, but also the correlation between other variables such as expected life-cycle income or decisions on the default saving strategy. Our results provide indications on the possible solutions and compare the projected pension benefits using three simulation methods with back-tested results using real supplementary pension funds operating in Slovakia.

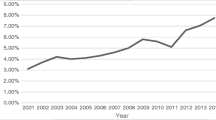

Source: Author’s calculation 2018

Source: Author’s calculation 2018

Source: Author’s calculation 2018

Source: Author’s calculation 2018

Source: Author’s calculation 2018

Source: Author’s calculation 2018

Source: Author’s calculation 2018

Source: Author’s calculation 2018

Source: Author’s calculation 2018

Similar content being viewed by others

References

Act No. 650/2004 Coll. on supplementary retirement savings and on amendments to certain laws

American Community Survey (2014) American Community Survey data on educational attainment, public database

Anderson C et al (2018) Pension savings: the real return (2018 edition). A research report by Better Finance

Autenne A (2017) Occupational pension funds: governance issues at the international and European levels. Eur J Soc Secur 19(2):158–171

Balco M, Šebo J, Mešťan M, Šebová L (2018) Application of the lifecycle theory in Slovak pension system. Ekonomický časopis 66(1):64–80

Barr N, Diamond P (2006) The economics of pensions. Oxf Rev Econ Policy 22(1):15–39

Chybalski F, Marcinkiewicz E (2016) The replacement rate: an imperfect indicator of pension adequacy in cross-country analyses. Soc Indic Res 2016(126):99–117

EIOPA (2018) Implementation of IORP II: Update on the Pension Benefit Statement (PBS). EIOPA Occupational Pensions Stakeholder Group meeting, Frankfurt, 3 May 2018

Grech A (2013) How best to measure pension adequacy. Centre for Analysis of Social Exclusion, London School of Economics, CASE/172

Guvenen F (2009) An empirical investigation of labor income processes. Rev Econ Dyn 12(1):58–79

Guvenen F, Smith AA (2014) Inferring labor income risk and partial insurance from economic choices. Econometrica 82(6):2085–2129

Hamdani A et al (2017) Incentive fees and competition in pension funds: evidence from a regulatory experiment. J Law Financ Account 2(1):49–86

Hurd MD, Rohwedder S (2015) Measuring economics preparation for retirement: income versus consumption. Michigan Retirement Research Center, working paper 2015-332, www.mrrc.isr.umich.edu/publications/papers/pdf/wp332.pdf. Accessed 03 Nov 2018

Institute of Savings and Investments (2018) Data source: www.ManazerUspor.sk. Accessed 03 Nov 2018

Killianová S, Meilcherčík I, Ševčovič D (2006) A dynamic accumulation model for the second pillar of the Slovak pension system. Czech J Econ Financ 56(11–12):506–521

Kopa M, Moriggia V, Vitali S (2018) Individual optimal pension allocation under stochastic dominance constraints. Ann Oper Res 260(1–2):255–291

Lee R, Carter L (1992) Modeling and forecasting the time series of U.S. mortality. J Am Stat Assoc 87(419):659–671

Melichercik I, Szücz G, Vilček I (2015) Investment strategies in the funded pillar of the Slovak pension system. Ekonomický časopis 63(2):133–151

Mešarová N, Šebo J, Balco M (2015) Fee policy analysis of private pension schemes of selected countries. In: Central European conference in finance and economic (CEFE2015). Technical University in Košice, pp 413–427

Mešťan M, Králik I, Žofaj M, Karkošiaková N (2018) Projections of DC scheme pension benefits—the case of Slovakia. In: Central European conference in finance and economics (CEFE2018). Technical University in Košice, pp 170–182

Moriggia V, Kopa M, Vitali S (2019) Pension fund management with hedging derivatives, stochastic dominance and nodal contamination. Omega 87:127–141

Rubinstein RY, Kroese DP (2017) Simulation and the Monte Carlo method (3rd edition). Wiley, Hoboken

Šebo J (2018) Pension Benefit Statement—the case of Slovakia. In: Presentation on the “consumer protection and supervision in the financial services” conference. ISCAP, Porto, 18–19 June 2018

Šebo J, Šebová Ľ (2016) Suboptimality of immediate annuitization in private pension schemes. Ekonomický časopis 64(2):169–190

Šebo J, Virdzek T, Šebová L (2015) Saving strategies revalued: is bond pension fund really a safe pension vehicle? In: Proceedings of the 20th international conference on theoretical and practical aspects of public finance 2015, pp 244–249

Šebo J, Melicherčík I, Mešťan M, Králik I (2017) Aktívna správa úspor v systéme starobného dôchodkového sporenia. Wolters Kluwer, Bratislava

Stańko D (2015) The concept of target retirement income: supervisory challenges. IOPS working papers on effective pensions supervision, No. 25

Vajargah KF, Shoghi M (2015) Simulation of stochastic differential equation of geometric Brownian motion by quasi-Monte Carlo method and its application in prediction of total index of stock market and value at risk. Math Sci 9(3):115–125

Van Meerten H, Van Zanden JJ (2018) Pensions and the PEPP: the necessity of an EU approach. Eur Co Law 3:66–72

Wiersem FU (2008) Brownian motion calculus. Wiley, Hoboken

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank several anonymous reviewers, for their recommendations which improved the manuscript.

Rights and permissions

About this article

Cite this article

Mešťan, M., Králik, I., Žofaj, M. et al. Projections of pension benefits in supplementary pension saving scheme in Slovakia. Cent Eur J Oper Res 29, 687–712 (2021). https://doi.org/10.1007/s10100-019-00669-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-019-00669-2