Abstract

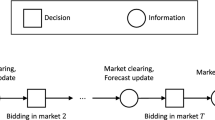

We consider an electricity generator making offers of energy into an electricity pool market over a horizon of several trading periods (typically a single trading day). The generator runs a set of generating units with given start-up costs, shut-down costs and operating ranges. At the start of each trading period the generator must submit to the pool system operator a new supply curve defining quantities of offered energy and the prices at which it wants these dispatched. The amount of dispatch depends on the supply curve offered along with the offers of the other generators and market demand, both of which are random, but do not change in response to the actions of the generator we consider. After dispatch the generator determines which units to run in the current trading period to meet the dispatch. The generator seeks a supply function that maximizes its expected profit. We describe an optimization procedure based on dynamic programming that can be used to construct optimal offers in successive time periods over a fixed planning horizon.

Similar content being viewed by others

References

Anderson, E.J., Philpott, A.B.: Optimal offer construction in electricity markets. Mathematics of Operations Research, 27 (1), 82–100 (2002)

Anderson, E.J., Philpott, A.B.: Using supply functions for offering generation into an electricity market. Operations Research, 50, 477–489 (2002)

Anderson, E.J., Philpott, A.B.: Estimation of electricity market distribution functions. Annals of Operations Research, 121, 21–32 (2003)

Anderson, E.J., Xu, H.: Necessary and sufficient conditions for optimal offers in electricity markets. SIAM J. on Control and Optimization, 41 (4), 1212–1228 (2002)

Anderson, E.J., Xu, H.:

-Optimal bidding in an electricity market with discontinuous market distribution function. Under review by SIAM J. on Control and Optimization, 44 (4), 1391–1418 (2005)

-Optimal bidding in an electricity market with discontinuous market distribution function. Under review by SIAM J. on Control and Optimization, 44 (4), 1391–1418 (2005)Carøe, C.C., Nowak, M.P., Römisch,W., Schultz, R.: Power scheduling in a hydro-thermal system under uncertainty. In: Proceedings of the 13th Power System Computation Conference, Trondheim, 1999, pp. 1086–1092

Carøe, C.C., Schultz, R.: Dual decomposition in stochastic integer programming. Operations Research Letters, 24, 37–45 (1999)

Gollmer, R., Nowak, M.P., Römisch, W., Schultz, R.: Unit commitment in power generation - a basic model and some extensions. Annals of Operations Research, 96, 167–189 (2000)

Green, R.J.: Increasing competition in the British electricity spot market. J. Indust. Economics, 44 (2), (1996)

Klemperer, P.D., Meyer, M.A. Supply function equilibria in oligopoly under uncertainty. Econometrica, 57 (6), 1243–1277 (1989)

Neame, P.J. , Philpott, A.B., Pritchard, G.: Offer stack optimization in electricity pool markets. Operations Research, 51 (3), 397–408 (2003)

Nowak, M.P., Römisch, W.: Stochastic Lagrangian relaxation applied to power scheduling in a hydro-thermal system under uncertainty. Annals of Operations Research, 100, 251–272 (2000)

Nowak, M.P., Schultz, R., Westphalen, M.: A stochastic integer programming model for incorporating day-ahead trading of electricity into hydro-thermal unit commitment. Optimization and Engineering, 6, 163–176 (2005)

Nürnberg, R., Römisch, W.: A two-stage planning model for power scheduling in a hydro-thermal system under uncertainty. Optimization and Engineering, 3, 355–378 (2002)

Pritchard, G.: The must-run dispatch auction in an electricity market. Energy Economics, 24, 199–216 (2002)

Pritchard, G., Zakeri, G., Philpott, A.B.: Non-parametric estimation of market distribution functions in electricity pool markets. http://www.esc.auckland.ac.nz/EPOC/publications.html (2005)

Römisch, W., Schultz, R.: Multistage stochastic integer programs: an introduction. In: Grötschel, M, Krumke, S.O, Rambau, J, (eds.) Online Optimization of Large Scale Systems. Springer, Berlin, 2001, pp. 581–600

Sheble, G.B., Fahd, G.N.: Unit commitment literature synopsis. IEEE Transactions on Power Systems, 9, 128–135 (1994)

Supatgiat, C., Zhang, R.Q., Birge, J.R.: Equilibrium values in a competitive power exchange market. Computational Economics, 17, 93–121 (2001)

Takriti, S., Birge, J.R., Long, E.: A stochastic model for the unit commitment problem. IEEE Transactions on Power Systems, 11, 1497–1508 (1996)

Takriti, S., Krasenbrink, B., Wu, L.S.-Y.: Incorporating fuel constraints and electricity spot prices into the stochastic unit commitment problem. Operations Research, 48, 268–280 (2000)

Tully, F.R., Kaye, R.J.: Unit commitment in competitive electricity markets using genetic algorithms. In: Proceedings of the IEE Japan Power and Energy Conference, Osaka, 1996

Valenzuela, J., Mazumdar, M.: Commitment of electric power generators under stochastic market prices. In: Operations Research, 51 (6), 880–893 (2003)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Philpott, A., Schultz, R. Unit commitment in electricity pool markets. Math. Program. 108, 313–337 (2006). https://doi.org/10.1007/s10107-006-0713-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10107-006-0713-9

-Optimal bidding in an electricity market with discontinuous market distribution function. Under review by SIAM J. on Control and Optimization, 44 (4), 1391–1418 (2005)

-Optimal bidding in an electricity market with discontinuous market distribution function. Under review by SIAM J. on Control and Optimization, 44 (4), 1391–1418 (2005)