Abstract

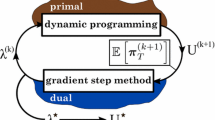

We consider risk-averse formulations of stochastic linear programs having a structure that is common in real-life applications. Specifically, the optimization problem corresponds to controlling over a certain horizon a system whose dynamics is given by a transition equation depending affinely on an interstage dependent stochastic process. We put in place a rolling-horizon time consistent policy. For each time step, a risk-averse problem with constraints that are deterministic for the current time step and uncertain for future times is solved. To each uncertain constraint corresponds both a chance and a Conditional Value-at-Risk constraint. We show that the resulting risk-averse problems are numerically tractable, being at worst conic quadratic programs. For the particular case in which uncertainty appears only on the right-hand side of the constraints, such risk-averse problems are linear programs. We show how to write dynamic programming equations for these problems and define robust recourse functions that can be approximated recursively by cutting planes. The methodology is assessed and favourably compared with Stochastic Dual Dynamic Programming on a real size water-resource planning problem.

Similar content being viewed by others

Notes

The authors specially acknowledge the good will and availability of Débora Dias Jardim Penna.

We adopt the convention 1 MWMonth \(=\frac{365.25{\small {\times }}24}{12}\) MWh \(=730.5\) MWh.

If \(X\) is a continuous random variable for which lower values are preferred, its Value-at-Risk of level \({\varepsilon _{\scriptstyle \mathtt{p }}}\) is given by \(\textit{VaR}_{{\varepsilon _{\scriptstyle \mathtt{p }}}}(X):=F_{X}^{-1}(1-{\varepsilon _{\scriptstyle \mathtt{p }}})\) for any \({\varepsilon _{\scriptstyle \mathtt{p }}}\in [0,1]\).

Table 1 Central and dispersion characteristics of the total cost (R$)

References

Artzner, P., Delbaen, F., Eber, J.-M., Heath, D.: Coherent measures of risk. Math. Finance 9, 203–228 (1999)

Beaulieu, N., Abu-Dayya, A., MacLane, P.: Estimating the distribution of a sum of independent lognormal random variables. IEEE Trans. Commun. 43(12), 2869–2873 (1995)

Ben-Tal, A., Goryashko, A., Guslitzer, E., Nemirovski, A.: Adjustable robust solutions of uncertain linear programs. Math. Program. 99, 351–376 (2004)

Ben-Tal, A., Nemirovski, A.: Robust solutions of uncertain linear programs. Oper. Res. Lett. 25, 1–13 (1999)

Ben-Tal, A., Nemirovski, A.: Selected topics in robust convex optimization. Math. Program. 112(1), 125–158 (2008). (Electronic)

Bertsimas, D., Thiele, A.: A robust optimization approach to inventory theory. Oper. Res. 54(1), 150–168 (2006)

Birge, J., Louveaux, F.: Introduction to Stochastic Programming. Springer, New York (1997)

Brignol, S., Rippault, G.: Risk management applied to weekly generation scheduling. IEEE Winter Meet. Proc. 1, 465–470 (1999)

Chao, H., Poncet, A., Yuen, C.: Handling infeasibilities when applying Benders decomposition to scheduling optimization. WSEAS Trans. Power Syst. 1(7), 1209–1216 (2006)

Charnes, A., Cooper, W: Chance-constrained programming. Manag. Sci. 6, 73–79 (1959/1960)

Charnes, A., Cooper, W.: Chance constraints and normal deviates. J. Am. Stat. Assoc. 57, 134–148 (1962)

Charnes, A., Cooper, W.: Deterministic equivalents for optimizing and satisficing under chance constraints. Oper. Res. 11, 18–39 (1963)

Chen, Z.-L., Powell, W.B.: A convergent cutting-plane and partial-sampling algorithm for multistage stochastic linear programs with recourse. J. Optim. Theory Appl. 102, 497–524 (1999)

Croley, T.: A manual for hydrologic time series deseasonalization and serial dependence reduction. Iowa Institute of Hydraulic Research Report, The University of Iowa, Report No. 199 (1977). http://www.iihr.uiowa.edu/products/pubvid/publications.php

Dentcheva, D., Ruszczyński, A.: Optimization with stochastic dominance constraints. SIAM J. Optim. 14(2), 548–566 (2003). (Electronic)

Dentcheva, D., Ruszczyński, A., Shapiro, A.: Lectures on Stochastic Programming. SIAM, Philadelphia (2009)

Eichhorn, A., Römisch, W.: Dynamic risk management in electricity portfolio optimization via polyhedral risk functionals. In: Power and Energy Society General Meeting—Conversion and Delivery of Electrical Energy in the 21st Century, 2008 IEEE, pp. 1–8 (2008)

Eichhorn, A., Römisch, W., Wegner, I.: Polyhedral risk measures in electricity portfolio optimization. PAMM Proc. Appl. Math. Mech. 4, 7–10 (2004)

Fodstad, M., Midthun, K., Romo, F., Tomasgard, A.: Optimization models for the natural gas value chain. In: Geometric Modelling, Numerical Simulation, and Optimization, pp. 521–558. SINTEF, Trondheim (2007)

Guigues, V.: SDDP for some interstage dependent risk averse problems and application to hydro-thermal planning. Comput. Optim. Appl. (2011). Available at http://www.optimization-online.org/DB_HTML/2011/03/2970.html

Guigues, V.: Robust production management. Optim. Eng. 10, 505–532 (2009)

Guigues, V., Ndiaye, P., Oustry, F., Romanet, F., Aïd, R.: Robust mid-term power generation management. Optim. 58(3), 351–371 (2009)

Guigues, V., Römisch, W.: Sampling-based decomposition methods for multistage stochastic programs based on extended polyhedral risk measures. SIAM J. Optim. 22, 286–312 (2012)

Guigues, V., Sagastizábal, C.: Exploiting structure of autoregressive processes in risk-averse multistage stochastic linear programs. Oper. Res. Lett. (2012). doi:10.1016/j.orl.2012.09.001

Guigues, V., Sagastizábal, C.: The value of rolling horizon policies for risk-averse hydro-thermal planning. Euro. J. Oper. Res. 217, 129–140 (2012)

Klein Haneveld, W.: Duality in Stochastic Linear and Dynamic Programming, Volume 274 of Lecture Notes in Economics and Mathematical Systems. Springer, Berlin (1986)

Klein Haneveld, W., Vlerk, M.: Integrated chance constraints: reduced forms and algorithm. Comput. Manag. Sci. 3(4), 245–269 (2006)

Krasenbrink, B., Takriti, S., Wu, L.S.-Y.: Incorporating fuel constraints and electricity spot prices into the stochastic unit commitment problem. Oper. Res. 48, 268–280 (2000)

Kuhn, D., Wiesemann, W., Georghiou, A.: Primal and dual linear decision rules in stochastic and robust optimization. Math. Program. 130(1), 177–209 (2011)

Maceira, M.E., Damázio, J.: The use of PAR(p) model in the stochastic dual dynamic programming optimization scheme used in the operation planning of the Brazilian hydropower system. In: VIII International Conference on Probabilistic Methods Applied to Power Systems, pp. 397–402 (2004)

Maceira, M.E., Damázio, J., Costa, F., Melo, A.: Chain of models for setting the energy dispatch and spot price in the Brazilian power system. In: System Computation Conference—PSCC’02, Sevilla, Spain, pp. 1–4 (2002)

Mo, B., Gjelsvik, A., Grundt, A.: Integrated risk management of hydro power scheduling and contract management. IEEE Trans. Power Syst. 16(2), 216–221 (2001)

Pereira, M., Pinto, L.: Multi-stage stochastic optimization applied to energy planning. Math. Program. 52(2), 359–375 (1991)

Pflug, G., Römisch, W.: Modeling, Measuring and Managing Risk. World Scientific Publishing, Hackensack (2007)

Philpott, A., de Matos, V.: Dynamic sampling algorithms for multi-stage stochastic programs with risk aversion (2010). Available at http://www.optimization-online.org/DB_HTML/2010/12/2861.html

Philpott, A., Guan, Z.: On the convergence of stochastic dual dynamic programming and related methods. Oper. Res. Lett. 36(4), 450–455 (2008)

Prékopa, A.: Stochastic Programming, Volume 324 of Mathematics and its Applications. Kluwer, Dordrecht (1995)

Rockafellar, R.T., Uryasev, S.: Conditional value-at-risk for general loss distributions. J. Bank. Finance 26(7), 1443–1471 (2002)

Ruszczyński, A., Shapiro, A. (eds.): Stochastic Programming, Volume 10 of Handbooks in Operations Research and Management Science. Elsevier, Amsterdam (2003)

Ruszczyński, A., Shapiro, A.: Conditional risk mappings. Math. Oper. Res. 31(3), 544–561 (2006)

Sen, S., Yu, L., Genc, T.: A stochastic programming approach to power portfolio optimization. Oper. Res. 54, 55–72 (2006)

Shapiro, A.: On a time consistency concept in risk averse multi-stage stochastic programming. Oper. Res. Lett. 37, 143–147 (2009)

Shapiro, A.: Analysis of stochastic dual dynamic programming method. Eur. J. Oper. Res. 209, 63–72 (2011)

Wallace, S.W., Fleten, S.-E.: Stochastic Programming Models in Energy. Handbooks in Operations Research and Management Science. North Holland, Amsterdam (2003)

Wu, J., Mehta, N., Zhang, J.: A flexible lognormal sum approximation method. In: Proceedings IEEE Global Telecommunications Conference GLOBECOM’05, vol. 6, pp. 3413–3417 (2005)

Zanjani, M.K., Nourelfath, M., Aït-Kadi, D.: A multi-stage stochastic programming approach for production planning with uncertainty in the quality of raw materials and demand. Technical Report, CIRRELT (2009)

Acknowledgments

We would like to thank the three reviewers and the Associate Editor for beneficial comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

The first author’s research was supported by CNPq grant No. 382.851/07-4. The work of the second author was partially supported by grants CNPq 303840/2011-0, AFOSR FA9550-08-1-0370, NSF DMS 0707205, PRONEX-Optimization, and FAPERJ. Claudia Sagastizábal: On leave from INRIA Rocquencourt, France.

Rights and permissions

About this article

Cite this article

Guigues, V., Sagastizábal, C. Risk-averse feasible policies for large-scale multistage stochastic linear programs. Math. Program. 138, 167–198 (2013). https://doi.org/10.1007/s10107-012-0592-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10107-012-0592-1