Abstract

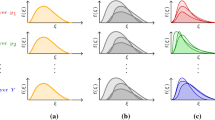

This paper formally introduces and studies a non-cooperative multi-agent game under uncertainty. The well-known Nash equilibrium is employed as the solution concept of the game. While there are several formulations of a stochastic Nash equilibrium problem, we focus mainly on a two-stage setting of the game wherein each agent is risk-averse and solves a rival-parameterized stochastic program with quadratic recourse. In such a game, each agent takes deterministic actions in the first stage and recourse decisions in the second stage after the uncertainty is realized. Each agent’s overall objective consists of a deterministic first-stage component plus a second-stage mean-risk component defined by a coherent risk measure describing the agent’s risk aversion. We direct our analysis towards a broad class of quantile-based risk measures and linear-quadratic recourse functions. For this class of non-cooperative games under uncertainty, the agents’ objective functions can be shown to be convex in their own decision variables, provided that the deterministic component of these functions have the same convexity property. Nevertheless, due to the non-differentiability of the recourse functions, the agents’ objective functions are at best directionally differentiable. Such non-differentiability creates multiple challenges for the analysis and solution of the game, two principal ones being: (1) a stochastic multi-valued variational inequality is needed to characterize a Nash equilibrium, provided that the players’ optimization problems are convex; (2) one needs to be careful in the design of algorithms that require differentiability of the objectives. Moreover, the resulting (multi-valued) variational formulation cannot be expected to be of the monotone type in general. The main contributions of this paper are as follows: (a) Prior to addressing the main problem of the paper, we summarize several approaches that have existed in the literature to deal with uncertainty in a non-cooperative game. (b) We introduce a unified formulation of the two-stage SNEP with risk-averse players and convex quadratic recourse functions and highlight the technical challenges in dealing with this game. (c) To handle the lack of smoothness, we propose smoothing schemes and regularization that lead to differentiable approximations. (d) To deal with non-monotonicity, we impose a generalized diagonal dominance condition on the players’ smoothed objective functions that facilitates the application and ensures the convergence of an iterative best-response scheme. (e) To handle the expectation operator, we rely on known methods in stochastic programming that include sampling and approximation. (f) We provide convergence results for various versions of the best-response scheme, particularly for the case of private recourse functions. Overall, this paper lays the foundation for future research into the class of SNEPs that provides a constructive paradigm for modeling and solving competitive decision making problems with risk-averse players facing uncertainty; this paradigm is very much at an infancy stage of research and requires extensive treatment in order to meet its broad applications in many engineering and economics domains.

Similar content being viewed by others

References

Aghassi, M., Bertsimas, D.: Robust game theory. Math. Program. 107, 231–273 (2006)

Bensoussan, A.: Points de Nash dans le cas de fontionnelles quadratiques et jeux differentiels linèaires a \(N\) personnes. SIAM J. Control 12, 460–499 (1974)

Ben-Tal, A., El Ghaoui, L., Nemirovsky, A.: Robust Optimization. Princeton University Press, Princeton (2009)

Birge, J.R., Louveaux, F.: Introduction to Stochastic Programming. Springer Series in Operations Research. Springer, New York (1997)

Birge, J.R., Pollock, S.M., Qi, L.: A quadratic recourse function for the two-stage stochastic program. In: Yang, X., Mees, A.I., Fisher, M., Jennings, L. (eds.) Progress in Optimization. Applied Optimization, Kluwer Academic Publishers, Netherlands vol. 39, pp. 109–121 (2000)

Bonnans, J.F., Shapiro, A.: Perturbation Analysis of Optimization Problems. Springer, New York (2000)

Bunn, D., Oliveira, F.: Modeling the impact of market interventions on the strategic evolution of electricity markets. Oper. Res. 56, 1116–1130 (2008)

Chen, X., Fukushima, M.: Expected residual minimization method for stochastic linear complementarity problems. Math. Oper. Res. 30, 1022–1038 (2005)

Chen, X., Wets, R.J.B., Zhang, Y.: Stochastic variational inequalities: residual minimization smoothing/sample average approximations. SIAM J. Optim. 22, 649–673 (2012)

Chen, X., Qi, L.Q., Womersley, R.S.: Newton’s method for quadratic stochastic programs with recourse. J. Comput. Appl. Math. 60(1995), 29–46 (1995)

Chen, X., Womersley, R.S.: Random test problems and parallel methods for quadratic programs and quadratic stochastic programs. Optim. Methods Softw. 13, 275–306 (2000)

Cottle, R.W., Pang, J.S., Stone, R.E.: The Linear Complementarity Problem. SIAM Classics in Applied Mathematics, vol. 60, Philadelphia (2009) [Originally published by Academic Press, Boston (1992)]

Dantzig, G.B.: Linear programming under uncertainty. Manag. Sci. 1, 197–206 (1955)

Ehrenmann, A., Smeers, Y.: Generation capacity expansion in a risky environment: a stochastic equilibrium analysis. Oper. Res. 59, 1332–1346 (2011)

Facchinei, F., Kanzow, C.: Generalized Nash equilibrium problems. Ann. Oper. Res. 175, 177–211 (2010)

Facchinei, F., Pang, J.S.: Finite-Dimensional Variational Inequalities and Complementarity Problems. Springer, New York (2003)

Facchinei, F., Pang, J.S.: Nash equilibria: the variational approach. In: Eldar, Y., Palomar, D. (eds.) Convex Optimization in Signal Processing and Communications, pp. 443–493. Cambridge University Press, Cambridge (2009)

Facchinei, F., Pang, J.S., Scutari, G.: Non-cooperative games with minmax objectives. Comput. Optim. Appl. 59, 85–112 (2014)

Fang, H., Chen, X., Fukushima, M.: Stochastic \(\text{ R }_0\) matrix linear complementarity problems. SIAM J. Optim. 18, 482–506 (2007)

Gabriel, S.A., Fuller, J.D.: A Benders decomposition method for solving stochastic complementarity problems with an application in energy. Comput. Econ. 35, 301–329 (2010)

Genc, T.S., Reynolds, S.S., Sen, S.: Dynamic oligopolistic games under uncertainty: a stochastic programming approach. J. Econ. Dyn. Control 31, 55–80 (2007)

Guddat, J.: Stability in convex quadratic parametric programming. Mathematische Operationsforschung und Statistik 7, 223–245 (1976)

Gürkan, G., Ozdemir, O., Smeers, Y.: Generation capacity investments in electricity markets: perfect competition. CentER Discussion Paper, Vol. 2013–045. Tilburg: Econometrics

Gürkan, G., Özge, A.Y., Robinson, S.M.: Sample-path solution of stochastic variational inequalities. Math. Program. 84, 313–333 (1999)

Gürkan, G., Pang, J.S.: Approximations of Nash equilibria. Math. Program. Ser. B 117, 223–253 (2009)

Harker, P.T., Pang, J.S.: Finite-dimensional variational inequality and nonlinear complementarity problems: a survey of theory, algorithms and applications. Math. Program. Ser. B 48, 161–220 (1990)

Hayashi, S., Yamashita, N., Fukushima, M.: Robust Nash equilibria and second-order cone complementarity problems. J. Nonlinear Convex Anal. 6, 283–296 (2005)

Higle, J., Sen, S.: Stochastic Decomposition: A Statistical Method for Large Scale Stochastic Linear Programming. Springer, New York (1996)

Jiang, H., Xu, H.: Stochastic approximation approaches to the stochastic variational inequality problem. IEEE Trans. Autom. Control 53, 1462–1475 (2008)

Jofré, A., Wets, R.J.B.: Variational convergence of bivariate functions: lopsided convergence. Math. Program. B 116, 275–295 (2009)

Jofré, A., Wets, R.J.B.: Variational convergence of bivariate functions: motivating applications. SIAM J. Optim. 24, 1952–1979 (2014)

Kall, P.: Stochastic Linear Programming. Springer, Berlin (1976)

Kall, P., Mayer, J.: Stochastic Linear Programming. International Series in Operations Research & Management Science, vol. 156. Springer, New York (2011)

Kall, P., Wallace, S.W.: Stochastic Programming. Wiley, Chichester (1994)

Kannan, A., Shanbhag, U.V., Kim, H.M.: Strategic behavior in power markets under uncertainty. Energy Syst. 2, 115–141 (2011)

Kannan, A., Shanbhag, U.V., Kim, H.M.: Addressing supply-side risk in uncertain power markets: stochastic Nash models, scalable algorithms and error analysis. Optim. Methods Softw. 28, 1095–1138 (2013)

Koshal, J., Nedic, A., Shanbhag, U.V.: Regularized iterative stochastic approximation methods for stochastic variational inequality problems. IEEE Trans. Autom. Control 58, 594–609 (2013)

Kulkarni, A.A., Shanbhag, U.V.: Recourse-based stochastic nonlinear programming: properties and Benders-SQP algorithms. Comput. Optim. Appl. 51, 77–123 (2012)

King, A.J., Rockafellar, R.T.: Asymptotic theory for solutions in statistical estimation and stochastic programming. Math. Oper. Res. 18, 148–162 (1993)

Lau, K.K., Womersley, R.S.: Multistage quadratic stochastic programming. J. Comput. Appl. Math. 129, 105–138 (2001)

Lee, G.M., Tam, N.N., Yen, N.D.: Quadratic Programming and Affine Variational Inequalities: A Qualitative Study. Springer e-book, New York (2005)

Lin, G.H., Fukushima, M.: Stochastic equilibrium problems and stochastic mathematical programs with equilibrium constraints: a survey. Pac. J. Optim. 6, 455–482 (2010)

Louveaux, F.V.: Piecewise convex programs. Math. Program. 15, 53–62 (1978)

Luna, J.P., Sagastizábal, C., Solodov, M.: Complementarity and game-theoretical models for equilibria in energy markets: deterministic and risk-averse formulations. Chapter 10. In: Kovacevic, R., Pflug, G., Vespucci, M. (eds.) International Series in Operations Research and Management Science, vol. 199, pp. 237–264. Springer, Berlin (2014)

Luna, J.P., Sagastizábal, C., Solodov, M.: An approximation scheme for a class of risk-averse stochastic equilibrium problems. Math. Program. 157, 451–481 (2016)

Meng, F., Sun, J., Goh, M.: A smoothing sample average approximation method for stochastic optimization problems with CVaR risk measure. Comput. Optim. Appl. 50, 379–401 (2011)

Nash, J.F.: Equilibrium points in n-person games. Proc. Natl. Acad. Sci. 36, 48–49 (1950)

Nash, J.F.: Non-cooperative games. Ann. Math. 54, 286–295 (1951)

Nishimura, R., Hayashi, S., Fukushima, M.: Robust Nash equilibria in N-person noncooperative games: uniqueness and reformulation. Pac. J. Optim. 5, 237–259 (2009)

Nishimura, R., Hayashi, S., Fukushima, M.: Semidefinite complementarity reformulation for robust Nash equilibrium problems with Euclidean uncertainty sets. J. Glob. Optim. 53, 107–120 (2012)

Ogryczak, W., Ruszczyński, A.: Dual stochastic dominance and related mean-risk models. SIAM J. Optim. 13, 60–78 (2002)

Pang, J.S., Fukushima, M.: Quasi-variational inequalities, generalized Nash equilibria, and multi-leader-follower games. Comput. Manag. Sci. 1, 21–56 (2005). (with erratum)

Polyak, B.T.: Introduction to Optimisation. Optimization Software Inc, New York (1987)

Ravat, U.: On the Analysis of Stochastic Optimization and Variational Inequality Problems. Ph.D. dissertation. Department of Industrial and Systems Engineering, University of Illinois at Urbana-Champaign (2014)

Ravat, U., Shanbhag, U.V.: On the characterization of solution sets of smooth and nonsmooth convex stochastic Nash games. SIAM J. Optim. 21, 1168–1199 (2011)

Rockafellar, R.T., Royset, J.O.: Measures of residual risk with connections to regression, risk tracking, surrogate models, and ambiguity. SIAM J. Optim. 25, 1179–1208 (2015)

Rockafellar, R.T., Uryasev, S.: Optimization of conditional value-at-risk. J. Risk 2, 21–41 (2000)

Rockafellar, R.T., Uryasev, S.: Conditional value-at-risk for general loss distributions. J. Bank. Financ. 7, 1143–1471 (2002)

Rockafellar, R.T., Uryasev, S., Zabarankin, M.: Optimality conditions in portfolio analysis with general deviation measures. Math. Program. Ser. B 108, 515–540 (2006)

Rockafellar, R.T., Uryasev, S., Zabarankin, M.: Generalized deviations in risk analysis. Financ. Stoch. 10, 51–74 (2006)

Rockafellar, R.T., Wets, R.J.-B.: Stochastic variational inequalities: single-stage to multistage. Math. Program. Ser. B (2016). doi:10.1007/s10107-016-0995-5

Rockafellar, R.T., Wets, R.J.-B.: On the interchange of subdifferentiation and conditional expectation for convex functionals. Stochastics 7, 173–182 (1982)

Ruszczynski, A., Shapiro, A. (eds.): Handbooks in Operations Research and Management Science: Stochastic Programming, vol. 10. Elsevier, Amsterdam (2003)

Ruszczynski, A., Shapiro, A.: Optimization of convex risk functions. Math. Oper. Res. 31, 433–452 (2006)

Schiro, D.A., Hobbs, B.F., Pang, J.S.: Perfectly competitive capacity expansion games with risk-averse participants. Comput. Optim. Appl. 65, 511–539 (2015)

Schiro, D.A., Pang, J.S., Shanbhag, U.V.: On the solution of affine generalized Nash equilibrium problems with shared constraints by Lemke’s method. Math. Program. Ser. A 146, 1–46 (2013)

Scutari, G., Facchinei, F., Palomar, D.P., Pang, J.S.: Flexible design of cognitive radio wireless systems: from game theory to variational inequality theory. IEEE Signal Process. Mag. 26, 107–123 (2009)

Shanbhag, U.V., Pang, J.S., Sen, S.: Inexact best-response schemes for stochastic Nash games: linear convergence and Iteration complexity analysis. In: Proceedings of the IEEE Conference on Decision and Control, pp. 3591–3596 (2016)

Shanbhag, U.V.: Decomposition and Sampling Methods for Stochastic Equilibrium Problems. Ph.D. thesis. Department of Management Science and Engineering (Operations Research), Stanford University (2006)

Shanbhag, U.V.: Stochastic Variational Inequality Problems: Applications, Analysis, and Algorithms. INFORMS Tutorials in Operations Research, pp. 71–107 (2013)

Shapiro, A., Dentcheva, D., Ruszczynski, A.: Lectures on Stochastic Programming: Modeling and Theory. SIAM Publications, Philadelphia (2009)

Walkup, D., Wets, R.: Stochastic program with recourse. SlAM Appl. Math. 15, 1299–1314 (1967)

Wang, J.: Lipschitz continuity of objective functions in stochastic programs with fixed recourse and its applications. Math. Program. Study 27, 145–152 (1986)

Wang, W.: Sample Average Approximation of Risk-averse Stochastic Programs. Ph.D. thesis. Department of Industrial and Systems Engineering. Georgia Institute of Technology (2007)

Wets, R.J.B.: Programming under uncertainty: the equivalent convex program. SIAM J. Appl. Math. 14, 89–105 (1966)

Wets, R.J.B.: Characterization theorems for stochastic programs. Math. Program. 2, 166–175 (1972)

Yao, J., Adler, I., Oren, S.S.: Modeling and computing two-settlement oligopolistic equilibrium in a congested electricity network. Oper. Res. 56, 34–47 (2008)

Yousefian, F., Nedich, A., Shanbhag, U.V.: Self-tuned stochastic approximation schemes for non-Lipschitzian stochastic multi-user optimization and Nash games. IEEE Trans. Autom. Control. 61, 1753–1766 (2016). doi:10.1109/TAC.2015.2478124

Author information

Authors and Affiliations

Corresponding author

Additional information

The work of Jong-Shi Pang and Suvrajeet Sen was based on research partially supported by the U.S. National Science Foundation Grant CMMI-1538605. In addition, the work of Pang was also based on research partially supported by the U.S. National Science Foundation Grant CMMI-1402052. The work of Uday V. Shanbhag was based on research partially supported by the U.S. National Science Foundation CAREER Award CMMI-1246887.

Rights and permissions

About this article

Cite this article

Pang, JS., Sen, S. & Shanbhag, U.V. Two-stage non-cooperative games with risk-averse players. Math. Program. 165, 235–290 (2017). https://doi.org/10.1007/s10107-017-1148-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10107-017-1148-1