Abstract

Robust optimization (RO) is a distribution-free worst-case solution methodology designed for uncertain maximization problems via a max-min approach considering a bounded uncertainty set. It yields a feasible solution over this set with a guaranteed worst-case value. As opposed to a previous conception that RO is conservative based on optimal value analysis, we argue that in practice the uncertain parameters rarely take simultaneously the values of the worst-case scenario, and thus introduce a new performance measure based on simulated average values. To this end, we apply the adjustable RO (AARC) to a single new product multi-period production planning problem under an uncertain and bounded demand so as to maximize the total profit. The demand for the product is assumed to follow a typical life-cycle pattern, whose length is typically hard to anticipate. We suggest a novel approach to predict the production plan’s profitable cycle length, already at the outset of the planning horizon. The AARC is an offline method that is employed online and adjusted to past realizations of the demand by a linear decision rule (LDR). We compare it to an alternative offline method, aiming at maximum expected profit, applying the same LDR. Although the AARC maximizes the profit against a worst-case demand scenario, our empirical results show that the average performance of both methods is very similar. Further, AARC consistently guarantees a worst profit over the entire uncertainty set, and its model’s size is considerably smaller and thus exhibit superior performance.

Similar content being viewed by others

References

Arrow K, Harris T, Marschak J (1951) Optimal inventory policy. Econometrica 19(3):250–272

Barthe F, Gamboa F, Lozada-chang L, Rouault A (2010) Generalized dirichlet distributions on the ball and moments. Alea 7:319–340

Ben-Tal A, Nemirovski A (2002) Robust optimization—methodology and applications. Math Progr 92(3):453–480

Ben-Tal A, Goryashko A, Guslitzer E, Nemirovski A (2004) Adjustable robust solutions of uncertain linear programs. Math Progr 99(2):351–376

Ben-Tal A, Golany B, Nemirovski A, Vial J (2005) Retailer-supplier flexible commitments contracts: a robust optimization approach. MSOM 7(3):248–271

Bertsimas D, Sim M (2004) The price of robustness. Oper Res 52(1):35–53

Bertsimas D, Thiele A (2006) A robust optimization approach to inventory theory. Oper Res 54(1):150–168

Bertsimas D, Iancu DA, Parrilo PA (2010) Optimality of affine policies in multistage robust optimization. Math Oper Res 35(2):363–394

Bertsimas D, Brown DB, Caramanis C (2011) Theory and applications of robust optimization. SIAM Rev 53(3):464–501

Bes C, Sethi SP (1988) Concepts of forecast and decision horizons: applications to dynamic stochastic optimization problems. Math Oper Res 13(2):295–310

Chan LM, Shen ZM, Simchi-Levi D, Swann JL (2004) Coordination of pricing and inventory decisions: a survey and classification. In: Simchi-Levi D, Wu SD, Shen M (eds) Handbook of quantitative supply chain analysis. Springer, US, pp 335–392

Dvoretzky A, Kiefer J, Wolfowitz J (1952) The inventory problem: I. Case of known distributions of demand. Econometrica 20(2):187–222

Gallego G, Moon I (1993) The distribution free newsboy problem: review and extensions. J Oper Res Soc 44(8):825–834

Gallego G, Ryan J, Simchi-Levi D (2001) Minimax analysis for finite-horizon inventory models. IIE Trans 33(10):861–874

Goh J, Hall NG (2013) Total cost control in project management via satisficing. Manag Sci 59(6):1354–1372

Iancu DA, Trichakis N (2014) Pareto efficiency in robust optimization. Manag Sci 60(1):130–147

Kasugai H, Kasegai T (1960) Characteristics of dynamic maximin ordering policy. J Oper Res Soc Jpn 3(1):11–26

Levi R, Roundy R, Shmoys D (2007) Provably near-optimal sampling-based policies for stochastic inventory control models. Math Oper Res 32(4):821–839

Nahmias S (1982) Perishable inventory theory: a review. Oper Res 30(4):680–708

Rink D, Swan J (1979) Product life cycle research: a literature review. J Bus Res 7(3):219–242

Ruiter FD, Ben-Tal A, Brekelmans R, Hertog DD (2014) Adjustable robust optimizations with decision rules based on inexact revealed data. Discussion paper 2014–003, Tilburg University, Center for Economic Research

Scarf HE (1958) A min–max solution of an inventory problem. In: Arrow KJ (ed) Studies in the mathematical theory of inventory and production. Stanford University Press, California, pp 201–209

Scarf HE (1960) The optimality of (s, s) policies in the dynamic inventory problem. In: Arrow KJ, Karlin S, Suppes P (eds) Mathematical methods in the social sciences. Stanford University Press, California, pp 196–202

Scarf HE (1963) A survey of analytic techniques in inventory theory. In: Scarf HE, Gilford DM, Shelly MW (eds) Multistage inventory models and techniques. Stanford University Press, California, pp 185–225

See CT, Sim M (2010) Robust approximation to multiperiod inventory management. Oper Res 58(3):583–594

Shapiro A, Dentcheva D, Ruszczynski A (2009) Lectures on stochastic programming: modeling and theory. SIAM, Philadelphia

Veinott A (1966) On the optimality of (s, s) inventory policies: new conditions and a new proof. SIAM J Appl Math 14(5):1067–1083

Zipkin P (2000) Foundations of inventory management. McGraw-Hill, Boston

Acknowledgments

The authors thank the editors and two anonymous referees for their insightful comments and suggestions on this paper. Their input led to significant improvement in the authors’ work. We are grateful to the editors for suggesting the comparison to the MCL-RO method. The first author is grateful to Boris Bachelis for his kindness and patience in introducing her to the RO software. She also expresses her gratitude for Shimrit Shtern on many fruitful discussions and support.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Demand simulations

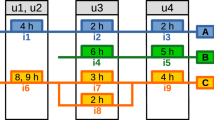

In order to examine the performance of the different methods under demand uncertainty we used demand simulations from the uncertainty set. For several uncertainty levels \(\rho \), \(l=3\) sets of k=100 demand vectors were generated, each vector consisting of T=12 entries to represent a twelve month planning horizon. Each set corresponds to a different distribution, with parameters, that were chosen to explore the effect of symmetric as well as non-symmetric demand distributions.

1.1.1 \(U_{box}\)

The entries were generated from a linearly transformed Beta distribution with specific shape parameters supported by the uncertainty set for the demand as shown in Table 4. The distributions’ parameters were chosen to explore the effect of symmetric as well as non-symmetric demand distributions.

1.1.2 \(U_{ellip}\)

The demand vectors were generated according to the Generalized Dirichlet distributions (Barthe et al. 2010) on the ball. It is a generalization of the beta distribution to a multivariate distribution. We used the same shape parameter as described in Table 4.

1.2 Cost parameters

The cost parameters are all set relatively to the production cost \(c_t\), which was set to 1 for all t. The life-cycle pattern of the demand affects the structure of the selling price vector m. At first, the price is high and it is decreasing according to the life-cycle pattern’s sequential stages. In addition, we assumed that the penalty on shortage p satisfies \(p_t=0.5m_t\) for all t. Accordingly, the salvage value was set to \(s=m_T=0.8\). These aforementioned cost parameters are identical for all the different sets: C1, C2, and C3. These sets differ in the holding cost vector h. The set C2 has a constant h, which is again set relatively to the production cost vector c. Whereas in sets C1 and C3 we examine the trade-off between the holding and penalty costs by changing the holding cost vector h according to a specific ratio \(\frac{h_t}{p_t}\),which was set to 0.1 and 1.5, respectively. Table 5 shows the cost parameters in use. Note, that the initial inventory level \(I_0\) was set to zero.

Rights and permissions

About this article

Cite this article

Melamed, M., Ben-Tal, A. & Golany, B. On the average performance of the adjustable RO and its use as an offline tool for multi-period production planning under uncertainty. Comput Manag Sci 13, 293–315 (2016). https://doi.org/10.1007/s10287-016-0250-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-016-0250-9