Abstract

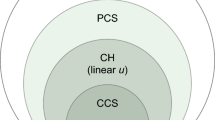

In this paper, we use reinforcement learning (RL) techniques to determine dynamic prices in an electronic monopolistic retail market. The market that we consider consists of two natural segments of customers, captives and shoppers. Captives are mature, loyal buyers whereas the shoppers are more price sensitive and are attracted by sales promotions and volume discounts. The seller is the learning agent in the system and uses RL to learn from the environment. Under (reasonable) assumptions about the arrival process of customers, inventory replenishment policy, and replenishment lead time distribution, the system becomes a Markov decision process thus enabling the use of a wide spectrum of learning algorithms. In this paper, we use the Q-learning algorithm for RL to arrive at optimal dynamic prices that optimize the seller’s performance metric (either long term discounted profit or long run average profit per unit time). Our model and methodology can also be used to compute optimal reorder quantity and optimal reorder point for the inventory policy followed by the seller and to compute the optimal volume discounts to be offered to the shoppers.

Similar content being viewed by others

References

Abounadi, J., D. Bertsekas, and V. Borkar. (1996) “Learning algorithms for Markov decision processes with average cost.” Technical report, Lab. for Info. and Decision Systems, M.I.T., USA.

Bertsekas, D. P. and J. Tsitsiklis. (1996). Neuro-dynamic Programming. Boston, MA, USA: Athena Scientific.

Brooks, C., R. Fay, R. Das, J. K. MacKie-Mason, J. Kephart, and E. Durfee. (1999). “Automated strategy searches in an electronic goods market: Learning and complex price schedules.” In: Proceedings of the First ACM Conference on Electronic Commerce (EC-99), 31–40.

Carvalho, A. and M. Puttman. (2003). Dynamic Pricing and Reinforcement Learning, URL: gg.nwu.edu/academic/deptprog/meds-dep/OR-Seminars/Puterman.pdf

DiMicco, J. M., A. Greenwald, and P. Maes. (2002). “Learning Curve: A Simulation-based Approach to Dynamic Pricing.”

Elmaghraby, W. and P. Keskinocak. (2002). “Dynamic Pricing: Research Overview, Current Practices and Future Directions, URL: http://www.isye.gatech.edu/pinar/dynamic-pricing.pdf.

Gupta, M., K. Ravikumar, and M. Kumar. (2002). “Adaptive strategies for price markdown in a multi-unit descending price auction: A comparative study.” In: Proceedings of the IEEE Conference on Systems, Man, and Cybernetics 373–378.

Hu, J. and Y. Zhang. (2002). “Online Reinformcenet Learning in Multiagent Systems, URL: cimon.rochester.edu/public-html/papers/priceagent1.pdf

Mcgill, J. and G. van Ryzin. (1999). “Revenue management: Research overview and prospects.” Transportation Science 33 (2), 233–256.

Narahari, Y., C. Raju, and S. Shah. (2003). “Dynamic Pricing Models for Electronic Business.” Technical report, Electronic Enterprises Laboratory, Department of Computer Science an d Automation, Indian Institute of Science.

Salop, S. and J. Stiglitz. (1982) “The theory of sales: A simple model of equilibrium price dispersion with identical agents.” The American Economic Review 72 (5), 1121–1130.

Singh, S. (1994). “Learning to solve Markovian Decision Processes.” Ph.d dissertation, University of Michigan, Ann Arbor.

Smith, B., D. Gunther, B. Rao, and R. Ratliff. (2001). “E-commerce and operations research in airline planning, marketing, and distribution.” Interfaces 31 (2).

Smith, M., J. Bailey, and E. Brynjolfsson. (2000). Understanding Digital Markets: Review and Assessment. Cambridge, MA: MIT Press.

Sutton, R. S. and A. G. Barto. (1998). Reinforcement Learning: An Introduction. Cambridge, MA: MIT Press.

Swann, J. (1999). “Flexible Pricing Policies: Introduction and a Survey of Implementation in Various Industries.” Technical Report Contract Report CR-99/04/ESL, General Motors Corporation.

Varian, H. R. (1980). “A Model of Sales.” The American Economic Review pp. 651–659.

Watkins, C. J. C. H. and P. Dayan. (1992). “Q-learning.” Machine Learning 8, 279–292.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Raju, C.V.L., Narahari, Y. & Ravikumar, K. Learning dynamic prices in electronic retail markets with customer segmentation. Ann Oper Res 143, 59–75 (2006). https://doi.org/10.1007/s10479-006-7372-3

Issue Date:

DOI: https://doi.org/10.1007/s10479-006-7372-3