Abstract

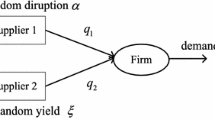

This paper analyzes purchasing strategies for retailers regarding the best timing and amount of purchases when operating under combined timing and quantity flexibility contracts in an environment of uncertain prices. To decrease the computational complexity and make the procedure adaptable to the case of multiple suppliers, we introduce, analyze, and compare a “time strategy” and a “target strategy” and then develop a hybrid “adaptive target strategy” to facilitate and improve the purchasing decision for the case of option contracts with generally rising prices. The adaptive target strategy is simpler and more intuitive than the traditional binomial lattice method, while the risk of failing to meet a target profit can also easily be calculated. We then extend the solution procedure to maximize expected profits in an environment of selecting among multiple suppliers with potentially different price processes, and we further provide risk analysis to help determine a good estimate for the number of option contracts from different suppliers to generate in order to create adequate risk protection. Numerical analysis demonstrates how the number of candidate suppliers impacts the expected profit and the risk. Monte Carlo simulation results demonstrate that the developed solution procedures provide satisfying outcomes and that the calculation is fast, even for multiple-dimension and multiple-supplier cases.

Similar content being viewed by others

References

Avery, W., Brown, G. G., Rosenkranz, J. A., & Wood, R. K. (1992). Optimization of purchase, storage and transmission contracts for natural gas utilities. Operations Research, 40(3), 446–462.

Bassok, Y., & Anupindi, R. (1997). Analysis of supply contracts with total minimum commitment. IIE Transactions, 29(5), 373–381.

Berling, P., & Rosling, K. (2005). The effects of financial risks on inventory policy. Management Science, 51(2), 1804–1816.

Bertocchi, M., Moriggia, V., & Dupačová, J. (2006). Horizon and stages in applications of stochastic programming in finance. Annals of Operations Research, 142(1), 63–78.

Bjerksund, P., & Steinar, E. (1990). Managing investment opportunities under price uncertainty: from “last chance” to “wait and see” strategies. Financial Management, 19(3), 65–84.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–654.

Brandao, L. E., & Dyer, J. S. (2005). Decision analysis and real options: a discrete time approach to real option valuation. Annals of Operations Research, 135(1), 21–39.

Chen, F., & Song, J. S. (2001). Optimal policies for multiechelon inventory problems with Markov-modulated demand. Operations Research, 49(2), 226–237.

Cox, J. C., Ross, S. A., & Rubinstein, M. (1979). Options pricing: a simplified approach. Journal of Financial Economics, 7(3), 229–263.

Dassios, A. (1995). The distribution of the quantile of a Brownian motion with drift and the pricing of related path-dependent options. The Annals of Applied Probability, 5(2), 389–398.

Fotopoulos, S. B., Hu, X., & Munson, C. L. (2008). Flexible supply contracts under price uncertainty. European Journal of Operational Research, 191(1), 253–263.

Gan, X., Sethi, S., & Yan, H. (2005). Channel coordination with a risk-neutral supplier and a downside-risk-averse retailer. Production and Operations Management, 14(1), 80–89.

He, S., Chaudhry, S. S., Lei, Z., & Baohua, W. (2009). Stochastic vendor selection problem: chance-constrained and genetic algorithms. Annals of Operations Research, 168(1), 169–179.

Karatzas, I., & Shreve, S. E. (1988). Brownian motion and stochastic calculus. New York: Springer.

Katz, P., Sadrian, A., & Tendick, P. (1994). Telephone companies analyze price quotations with Bellcore’s PDSS software. Interfaces, 24(1), 50–63.

Li, C., & Kouvelis, P. (1999). Flexible and risk-sharing supply contracts under price uncertainty. Management Science, 45(10), 1378–1398.

Li, S., Murat, A., & Huang, W. (2009). Selection of contract suppliers under price and demand uncertainty in a dynamic market. European Journal of Operational Research, 198(3), 830–847.

Martínez-de-Albéniz, V., & Simchi-Levi, D. (2005). A portfolio approach to procurement contracts. Production and Operations Management, 14(1), 90–114.

McMillan, J. (1992). Organizing a network of subcontractors. In Games, strategies and managers (Chap. 13). New York: Oxford University Press.

Messina, V., & Bosetti, V. (2006). Integrating stochastic programming and decision tree techniques in land conversion problems. Annals of Operations Research, 142(1), 243–258.

Milner, J. M., & Kouvelis, P. (2005). Order quantity and timing flexibility in supply chains: the role of demand characteristics. Management Science, 51(6), 970–985.

Nagali, V., Hwang, J., Sanghera, D., Gaskins, M., Pridgen, M., Thurston, T., Mackenroth, P., Branvold, D., Scholler, P., & Shoemaker, G. (2008) Procurement risk management (PRM) at Hewlett-Packard Company. Interfaces, 38(1), 51–60.

Øksendal, B. (1995). Stochastic differential equations. New York: Springer.

Paschalidis, J. C., Liu, Y., Cassandras, C. G., & Panayiotou, C. (2004). Inventory control for supply chains with service level constraints: a synergy between large deviations and perturbation analysis. Annals of Operations Research, 126(1–4), 231–258.

Peleg, B., Lee, H. L., & Hausman, W. H. (2002). Short-term e-procurement strategies versus long-term contracts. Production and Operations Management, 11(4), 458–479.

Ruszczyński, A. & Shapiro, A. (Eds.) (2003). Stochastic programming. Handbooks in operations research and management science (Vol. 10). Amsterdam: Elsevier.

Seifert, R. W., Thonemann, U. W., & Hausman, W. H. (2004). Optimal procurement strategies for online spot markets. European Journal of Operational Research, 152(3), 781–799.

Sethi, S. P., Yan, H., & Zhang, H. (2004). Quantity flexibility contracts: optimal decisions with information updates. Decision Sciences, 35(4), 691–711.

Shiryaev, A. N., Kabanov, Y. M., Kramkov, D. O., & Melnikov, A. V. (1994). Toward the theory of pricing of options of both European and American types. II. Continuous time. Theory of Probability and Its Applications, 39(1), 61–102.

Tibben-Lembke, R. S. (2004). N-period contracts with ordering constraints and total minimum commitments: optimal and heuristic solutions. European Journal of Operational Research, 156(2), 353–374.

Tsay, A. A. (1999). The quantity flexibility contract and supplier-customer incentives. Management Science, 45(10), 1339–1358.

Wu, J., & Sen, S. (2000). A stochastic programming model for currency option hedging. Annals of Operations Research, 100(1–4), 227–249.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs of propositions

Appendix: Proofs of propositions

Proof of Proposition 1

Proof of Proposition 2

Let v=[ln(R)−ln(C(0))−θt]/σ, then R=C(0)exp(θt+σv).

Proof of Proposition 3

We use \(\pi_{2}^{C}( x )\) to represent the profit for the target strategy with any level x≤0 under the commitment contract. Then

Taking the expected value on both sides:

When \(\theta\le - \frac{\sigma^{2}}{2}\), according to (A1),

When \(\theta > - \frac{\sigma^{2}}{2}\), according to (A1),

Therefore, under commitment contracts, the optimal decision using the target strategy never provides a higher expected profit than the optimal decision using the time strategy.

Proof of Proposition 4

Taking the expected value of (9) on both sides:

As x is chosen to maximize (14), the profit at x satisfies R−C(0)e x≥0. Therefore:

When θ 0≤0,we get\(\theta\le - \frac{\sigma^{2}}{2}\), according to (A1),

Proof of Proposition 5

According to (14),

When θ 0≥0, we get \(\theta\ge - \frac{\sigma^{2}}{2}\), for any t≥0

So \(\max_{x}E[ \tilde{\pi}_{2}^{O}( x ) ] \ge E[ \tilde{\pi}_{2}^{O}( 0 ) ] \ge E[ \pi_{1}^{O}( t ) ]\) for any t≥0.

Rights and permissions

About this article

Cite this article

Hu, X., Munson, C.L. & Fotopoulos, S.B. Purchasing decisions under stochastic prices: Approximate solutions for order time, order quantity and supplier selection. Ann Oper Res 201, 287–305 (2012). https://doi.org/10.1007/s10479-012-1194-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-012-1194-2