Abstract

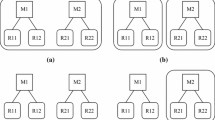

We examine supply chain contracts for two competing supply chains selling a substitutable product, each consisting of one manufacturer and one retailer. Both manufacturers are Stackelberg leaders and the retailers are followers. Manufacturers in two competing supply chains may choose different contracts, either a wholesale price contract in which the retailer’s demand forecasting information is not shared, or a revenue-sharing contract in which the retailer’s demand forecasting information is shared. Under supply chain competition and demand uncertainty, we identify which contract is more advantageous for each supply chain, and under what circumstances.

Similar content being viewed by others

References

Arshinder, K. A., & Deshmukh, S. G. (2008). Supply chain coordination: perspectives, empirical studies and research directions. Int J Prod Econ, 115, 316–335.

Atkins, D., & Zhao, X. (2003). Supply chain structure under price and service competition. Working paper. Sauder School of Business, University of British Columbia.

Barnes, D. (2006). Competing supply chains are the future. Financial Times (November 8).

Cachon, G. P. (2003). Handbooks in operations research and management science: supply chain management. In Supply chain coordination with contracts. Amsterdam: North-Holland.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: strengths and limitations. Manag Sci, 51, 30–44.

Chen, F. (2003). Information sharing and supply chain coordination. In A. G. de Kok & S. C. Graves (Eds.), Handbooks in operations research and management science (Vol. 11, pp. 341–421). Amsterdam: Elsevier.

Corbett, J., & Tang, C. (1999). Designing supply contracts: contract type and information asymmetric. In S. Tayur, R. Ganeshan, & M. Magazine (Eds.), Quantitative models for supply chain management. Dordrecht: Kluwer.

Coughlan, A. T. (1985). Competition and cooperation in marketing channel choice: theory and application. Mark Sci, 4, 110–129.

Gerchak, Y., & Wang, Y. (2004). Revenue-sharing vs. wholesale-price contracts in assembly systems with random demand. Prod Oper Manag, 1, 23–31.

Giannoccaro, I., & Pontrandolfo, P. (2004). Supply chain coordination by revenue sharing contracts. Int J Prod Econ, 89, 131–139.

Giannoccaro, I., & Pontrandolfo, P. (2009). Negotiation of the revenue sharing contract: an agent-based systems approach. Int J Prod Econ, 122, 558–566.

Ha, A., & Tong, S. (2008). Contracting and information sharing under supply chain competition. Manag Sci, 4, 701–715.

James, D., Jr. (1999). Revenue-sharing, demand uncertainty, and vertical control of competitions. Working paper. Northwestern University, Kellogg Graduate School of Management.

Lariviere, M. A. (2003). Supply chain contracting and coordination with stochastic demand. In S. Tayur, R. Ganeshan, & M. Magazine (Eds.), Quantitative models for supply chain management (pp. 233–268). Dordrecht: Kluwer.

Lee, C. H., & Rhee, B. (2010). Coordination contracts in the presence of positive inventory financing costs. Int J Prod Econ, 124, 331–339.

Li, J., & Liu, L. (2006). Supply chain coordination with quantity discount policy. Int J Prod Econ, 101, 89–98.

McGuire, T., & Staelin, W. R. (1983). An industry equilibrium analysis of downstream vertical integration. Mark Sci, 2, 161–191.

Moorthy, K. S. (1988). Decentralization in channels. Mark Sci, 7, 335–355.

Pasternack, B. A. (1985). Optimal pricing and returns policies for perishable commodities. Mark Sci, 4, 166–176.

Raju, J., & Roy, A. (2000). Market information and firm performance. Manag Sci, 46, 1075–1084.

Ryu, S., Tsukishima, T., & Onari, H. (2009). A study on evaluation of demand information-sharing methods in supply chain. Int J Prod Econ, 120, 162–175.

Spengler, J. (1950). Vertical integration and antitrust policy. J Polit Econ, 50, 347–352.

Tsay, A. (1999). Quantity-flexibility contract and supplier-customer incentives. Manag Sci, 45, 1339–1358.

Tsay, A., Nahmias, S., & Agrawal, N. (2003). Modeling supply chain contracts: a review. In S. Tayur, R. Ganeshan, & M. Magazine (Eds.), Quantitative models for supply chain management (pp. 299–336). Dordrecht: Kluwer (Chap. 10).

Vives, X. (1984). Duopoly information equilibrium: Cournot and Bertrand. J Econ Theory, 34, 71–94.

Wang, X., & Liu, L. (2007). Coordination in a retailer-led supply chain through option contract. Int J Prod Econ, 110, 115–127.

Wu, Q., & Chen, H. (2003). Chain-chain competition under demand uncertainty. Working paper. The University of British Columbia.

Yao, D., Yue, X., & Wang, X. (2005). The impact of information sharing on a return policy with the addition of a direct channel. Int J Prod Econ, 97, 196–209.

Acknowledgements

The authors gratefully acknowledge the support grants from the National Natural Science Foundation of China (NSFC), #70772070 and #70932005, and from the Natural Sciences and Engineering Research Council of Canada.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

For a given w i , with (7), the second order conditions of (8) and (9) show that there exist a unique optimal w i and p i . Taking partial derivative of (8) and (9) w.r.t. p i and w i , respectively. Setting these first order conditions to be 0:

where j=3−i.

With (A.1) and (A.2), we can obtain:

□

Proof of Proposition 2

With (7) and (14), it is to prove that there exists a unique optimal p i . Taking partial derivative of (14) w.r.t. p i and setting these two first order conditions to be 0. Thus, the vertical Stackelberg equilibriums of retail prices are:

Solving two equations in (A.3), we have

□

Proof of Proposition 3

For supply chain, the second order conditions are necessary and sufficient for the unique optimal p i (i=1,2) and w 2. The equilibrium of prices are:

Solving (A.4), (A.5), and (A.6), we have

□

Proof of Proposition 4

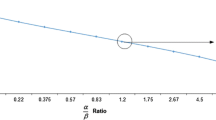

With 0<r<1 and 0<t<1, (A.7) gives that when θ<θ 1, \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) while \(EM_{i}^{\mathit{RR}} < EM_{i}^{\mathit{WW}}\) if θ>θ 1.

Equation (A.8) gives that when θ>θ 4, \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\) while \(ER_{i}^{\mathit{RR}} < ER_{i}^{\mathit{WW}}\) if θ<θ 4. Further,

Equation (A.9) gives that when θ 1>θ 4 if 0<r<0.4226 while θ 1<θ 4 if 0.4226<r<1. Therefore, when 0<r<0.4226 and θ 4<θ<θ 1, \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\), implying both manufacturers and retailers in the two competing supply chains have an incentive to adopt a revenue-sharing contract with sharing retailers’ demand forecasting information; otherwise, there are two cases:

Case I

If 0<r<0.4226 and θ 1>θ 4,

-

a.

when θ>θ 1, \(EM_{i}^{\mathit{RR}} < EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\), manufacturers will not offer a revenue-sharing contract;

-

b.

when θ<θ 4, \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} < ER_{i}^{\mathit{WW}}\), retailers will not accept a revenue-sharing contract.

Case II

If 0.4226 < r<1 and θ 1<θ 4,

-

a.

when θ>θ 4, \(EM_{i}^{\mathit{RR}} < EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\), manufacturers will not offer a revenue-sharing contract;

-

b.

when θ<θ 1, \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} < ER_{i}^{\mathit{WW}}\), retailers will not accept a revenue-sharing contract;

-

c.

when \(\theta_{1} < \theta < \theta_{4}, EM_{i}^{\mathit{RR}} < EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} < ER_{i}^{\mathit{WW}}\), both manufacturers and retailers have no incentive to move to adopt a revenue-sharing contract.

Cases I and II indicate that under those conditions, a wholesale price contract is preferred by either manufacturers, or retailers, or both. □

Proof of Corollary 1

With

Thus, the value of coordination of the two supply chains shrinks. In addition, from (A.9) in the proof of Proposition 4, we have that r=0.4226 gives θ 1−θ 4=0. From (A.7) and (A.8), we can conclude that the value of coordination of the two supply chains finally disappears at r=0.4226, where \(EM_{i}^{\mathit{RR}} = EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} = ER_{i}^{\mathit{WW}}\). □

Proof of Corollary 2

This means that the retailers’ revenue share (θ) can start with a higher value (∂θ 1/∂v>0 and ∂θ 1/∂t>0) and it is possible for the retailers to negotiate a higher revenue share (∂θ 4/∂v>0 and ∂θ 4/∂t>0) as v and t increase. In addition,

Equations (A.10) and (A.11) give that when 0<r<0.4226, both ∂(θ 1−θ 4)/∂v<0 and ∂(θ 1−θ 4)/∂t<0. Thus, as t and v increase, the room (θ 1−θ 4) for negotiating a higher θ shrinks. □

Proof of Proposition 5

This yields that when θ<θ 3 , we have \(EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) while \(EM_{1}^{\mathit{RW}} < EM_{1}^{\mathit{WW}}\) when θ>θ 3.

which yields that when θ>θ 6, we have \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}\) while \(ER_{1}^{\mathit{RW}} < ER_{1}^{\mathit{WW}}\) when θ<θ 6.

Also,

gives that when 0<r<0.7507,θ 3>θ 6 while 0.7507<r<1, θ 3<θ 6.

Further, from (12), (13), (26), and (27), we have:

Therefore, when 0<r<0.7507 and θ 6<θ<θ 3, \(EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}, EM_{2}^{\mathit{RW}} < EM_{2}^{\mathit{WW}}\) and \(ER_{2}^{\mathit{RW}} < ER_{2}^{\mathit{WW}}\). Therefore, if both competing supply chains currently are offering a wholesale price contract and if the retailer 1 can negotiate a revenue share in the range θ 6<θ<θ 3, supply chain 1 has an incentive to move first to sign a revenue-sharing contract that hurts the profits of the manufacturer and the retailer in supply chain 2; otherwise, there are two cases:

Case I

If 0<r<0.7507 and θ 3>θ 6,

-

a.

when θ>θ 3, \(EM_{1}^{\mathit{RW}} < EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}\), manufacturer 1 will not offer a revenue-sharing contract;

-

b.

when θ<θ 6, \(EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} < ER_{1}^{\mathit{WW}}\), retailer 1 will not accept a revenue-sharing contract.

Case II

If 0.7507 < r<1 and θ 3<θ 6,

-

a.

when θ>θ 6, \(EM_{1}^{\mathit{RW}} < EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}\), manufacturer 1 will not offer a revenue-sharing contract;

-

b.

when \(\theta < \theta_{3}, EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} < ER_{1}^{\mathit{WW}}\), retailer 1 will not accept a revenue-sharing contract;

-

c.

when θ 3<θ<θ 6, \(EM_{1}^{\mathit{RW}} < EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} < ER_{1}^{\mathit{WW}}\), both manufacturer 1 and retailer 1 have no incentive to move to adopt a revenue-sharing contract.

With (A.12) and (A.13), Cases I and II indicate that under those conditions, a wholesale price contract is preferred by either manufacturers, or retailers, or both in two competing supply chains. □

Proof of Proposition 6

gives that when \(\theta < \theta_{2}, EM_{2}^{\mathit{RR}} > EM_{2}^{\mathit{RW}}\) while \(EM_{2}^{\mathit{RR}} < EM_{2}^{\mathit{RW}}\) when θ>θ 2.

gives that when θ>θ 5, \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\) while \(ER_{2}^{\mathit{RR}} < ER_{2}^{\mathit{RW}}\) if θ<θ 5.

Also,

gives that when 0<r<0.9194, θ 2>θ 5; otherwise, θ 2<θ 5. Also, (17), (18), (24), and (25) give:

Therefore, when 0<r<0.9194 and θ 5<θ<θ 2, \(EM_{2}^{\mathit{RR}} > EM_{2}^{\mathit{RW}}\), \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\), \(EM_{1}^{\mathit{RR}} < EM_{1}^{\mathit{RW}}\), and \(ER_{1}^{\mathit{RR}} < ER_{1}^{\mathit{RW}}\). That is, if supply chain 1, which is currently adopting a revenue-sharing contract, competes with supply chain 2, which has a wholesale price contract, supply chain 2 is motivated to sign a revenue-sharing contract to compete with supply chain 1. Such action will result in a loss in profits for both the manufacturer and the retailer in supply chain 1 [(A.14) and (A.15)]; otherwise, there are two cases.

Case I

If 0<r<0.9194 and θ 2>θ 5,

-

a.

when θ>θ 2, \(EM_{2}^{\mathit{RR}} < EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\), manufacturer 2 will not offer a revenue-sharing contract;

-

b.

when θ<θ 5, \(EM_{2}^{\mathit{RR}} > EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} < ER_{2}^{\mathit{RW}}\), retailer 2 will not accept a revenue-sharing contract.

Case II

If 0.9194<r<1 and θ 2<θ 5,

-

a.

when \(\theta > \theta_{5}, EM_{2}^{\mathit{RR}} < EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\), manufacturer 2 will not offer a revenue-sharing contract;

-

b.

when θ<θ 2, \(EM_{2}^{\mathit{RR}} > EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} < ER_{2}^{\mathit{RW}}\), retailer 2 will not accept a revenue-sharing contract;

-

c.

when θ 2<θ<θ 5, \(EM_{2}^{\mathit{RR}} < EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} < ER_{2}^{\mathit{RW}}\), both manufacturer 2 and retailer 2 have no incentive to move to adopt a revenue-sharing contract.

With (A.14) and (A.15), Cases I and II indicate that under above conditions, either manufacturer 2, or retailer 2, or both, prefer a wholesale price contract and has no incentive to sign a revenue-sharing contract. □

Proof of Corollary 4

which gives θ 2>θ 3.

□

Proof of Corollary 5

Rights and permissions

About this article

Cite this article

Ai, X., Chen, J. & Ma, J. Contracting with demand uncertainty under supply chain competition. Ann Oper Res 201, 17–38 (2012). https://doi.org/10.1007/s10479-012-1227-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-012-1227-x