Abstract

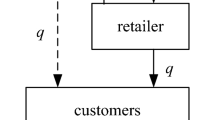

We examine a supply chain in which a manufacturer supplies a single product to a retailer who faces two forms of customer returns. We compare the impact of these two forms of customer returns on the decisions and profits of the manufacturer and the retailer under various types of channel interaction: Manufacturer Stackelberg (MS), Vertical Nash (VN), and Retailer Stackelberg (RS). We find that when the level of customer returns that are proportional to quantity sold is extremely high, the retailer prefers the MS rather than the RS channel interaction. We also examine the impact of the asymmetric customer returns information on the decisions of the manufacturer and the retailer and on profits under MS and VN channel interactions. We show that in the MS case, the retailer can decide whether or not to share customer returns information with its manufacturer without knowing the manufacturer’s estimates of customer returns and in the VN case, both the retailer and the manufacturer can decide whether or not to share/acquire the information based on observation of the other’s behavior. The issues of sharing this information are also discussed.

Similar content being viewed by others

References

Anderson, E. T., Hansen, K., & Simister, D. (2009a). The option value of returns: theory and empirical evidence. Marketing Science, 28, 405–423.

Anderson, E. T., Hansen, K., Simister, D., & Wang, L. K. (2009b). How are demand and returns related? Theory and empirical evidence. Working paper, Kellogg School of Management, Northwestern University.

Biederman, D. (2005). Many happy returns. Journal of Commerce, December, 1–3.

Blanchard, D. (2005). Moving forward in reverse. Logistics Today, 46, 1.

Blanchard, D. (2007). Supply chains also work reverse. Industry Week, May 1.

Bonifield, C., Cole, C., & Schultz, R. (2010). Product returns on the internet: a case of mixed signals? Journal of Business Research, 63, 1058–1065.

Chen, J. (2011). The impact of sharing customer returns information in a supply chain with/without a buyback policy. European Journal of Operational Research, 213, 478–488.

Chen, J., & Bell, P. C. (2009). The impact of customer returns on pricing and order decisions. European Journal of Operational Research, 195, 280–295.

Chiang, W. K., Chhajed, D., & Hess, J. (2003). Direct marketing, indirect revenues: a strategic analysis of dual-channel supply chain design. Management Science, 49, 1–20.

Choi, C. S. (1991). Price competition in a channel structure with a common retailer. Marketing Science, 10, 271–296.

Choi, T. M., & Sethi, S. (2010). Innovative quick response programmes: a review. International Journal of Production Economics, 127, 1–12.

Esmaeili, M., Aryanezhad, M., & Zeephongsekul, P. (2009). A game theory approach in seller-buyer supply chain. European Journal of Operational Research, 195, 442–448.

Ferguson, M., Guide, M. Jr., & Souza, G.C. (2006). Supply chain coordination for false failure returns. Manufacturing & Service Operations Management, 8, 376–393.

Fiala, P. (2005). Information sharing in supply chain. Omega, 33, 419–423.

Hess, J., & Mayhew, G. (1997). Modeling merchandise returns in direct marketing. Journal of Direct Marketing, 11, 20–35.

Jeuland, A., & Shugan, S. (1983). Managing channel profits. Marketing Science, 2, 239–272.

Ketzenberg, M. E., Rosenzweig, E. D., Marucheck, A. E., & Metters, R. D. (2007). A framework for the value of information in inventory replenishment. European Journal of Operational Research, 182, 1230–1250.

Lau, H. S., & Lau, A. (1999). Manufacturer’s pricing strategy and return policy for a single period commodity. European Journal of Operational Research, 116, 291–304.

Lau, A., Lau, H. S., & Zhou, Y. W. (2007). A stochastic and asymmetric information framework for a dominant manufacturer supply chain. European Journal of Operational Research, 176, 295–316.

Lee, E., & Staelin, R. (1997). Vertical strategic interaction: implications for channel pricing strategy. Marketing Science, 16, 185–207.

McGuire, T., & Staelin, R. (1983). An industry equilibrium analysis of downstream vertical integration. Marketing Science, 2, 161–191.

Mitra, S. (2007). Revenue management for remanufactured products. Omega, 35, 553–562.

Mostard, J., & Teunter, R. (2006). The newsboy problem with resalable returns: a single period model and case study. European Journal of Operational Research, 169, 81–96.

Pasternack, B. A. (1985). Optimal pricing and returns policies for perishable commodities. Marketing Science, 4, 166–176.

Petersen, A., & Kumar, V. (2010). Can product returns make you money? MIT Sloan Management Review, 51, 85–89.

Pralle, A., & Stalk, G. Jr. (2006). Returns: the ugly ducklings of retail. The Boston Consulting Group’s report.

Rogers, D. S., & Tibben-Lembke, R. S. (1999). Going backwards: reverse logistics trends and practices. Pittsburgh: Reverse Logistics Executive Council.

Rogers, D. S., Lambert, D. M., Croxton, K., & Garcia-Dastugue, S. (2002). The returns management process. International Journal of Logistics Management, 13, 1–18.

Roy, C. (2009). Debunking the myths of customer returns and the use of liquidation channels. Retail/Catalog Online Integration. http://www.retailonlineintegration.com/article/debunking-myths-customer-returns-use-liquidation-channels-409310/1.

Sciarrotta, T. (2003). How PHILIPS reduced returns. Supply Chain Management Review, 7, 32–38.

Strauss, M. (2006). Returns a $10-billion pain. Globe and Mail, November, B-7.

Vlachos, D., & Dekker, R. (2003). Return handling options and order quantities for single period products. European Journal of Operational Research, 151, 38–52.

Wang, J., Lau, H. S., & Lau, A. (2009). When should a manufacturer share truthful manufacturing cost information with a dominant retailer? European Journal of Operational Research, 197, 266–286.

Yao, D. Q., & Liu, J. J. (2005). Competitive pricing of mixed retail and e-tail distribution channels. Omega, 33, 235–247.

Yuan, X. M., & Cheung, K. L. (1996). Modeling returns of merchandise in an inventory system. OR Spektrum, 20, 147–154.

Yue, X., & Raghunathan, S. (2006). The impacts of the full returns policy on a supply chain with information asymmetry. European Journal of Operational Research, 180, 630–647.

Loss Prevention Research Council (2008). Customer returns in the retail industry.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 4

(A.1) and (A.2) give that when \(1 + 2c - 2\overline{\beta} > 0\), \(\frac{\partial \varPi_{M}^{\mathit{VN}}[w^{\mathit{VN}^{*}}(\overline{\alpha} ,\overline{\beta} )]}{\partial \overline{\alpha}} < 0\) and \(\frac{\partial \varPi_{R}^{\mathit{VN}}[w^{\mathit{VN}^{*}}(\overline{\alpha} ,\overline{\beta} )]}{\partial \overline{\alpha}} > 0\) while \(\frac{\partial \varPi_{M}^{\mathit{VN}}[w^{\mathit{VN}^{*}}(\overline{\alpha} ,\overline{\beta} )]}{\partial \overline{\alpha}} > 0\) and \(\frac{\partial \varPi_{R}^{\mathit{VN}}[w^{\mathit{VN}^{*}}(\overline{\alpha} ,\overline{\beta} )]}{\partial \overline{\alpha}} < 0\) when \(1 + 2c - 2\overline{\beta} < 0\). Equations (19) and (20) also give:

□

Rights and permissions

About this article

Cite this article

Chen, J., Bell, P.C. The impact of customer returns on supply chain decisions under various channel interactions. Ann Oper Res 206, 59–74 (2013). https://doi.org/10.1007/s10479-013-1326-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1326-3