Abstract

This paper proposes a multi-stage stochastic programming model to explore optimal options strategies for international portfolios with overall risk management on Greek letters, extending existing Greek-based analysis to dynamic and nondeterministic programming under uncertainty. The contribution to the existing literature are overall control on the time-varying Greek letters, state-contingent decision dynamics in consistent with the projected outcomes of the changing information, and a holistic view for optimizing the portfolio of assets and options. Empirical results show the model possesses considerable benefits in terms of larger profit margins, greater stability of returns and higher hedging efficiency compared to traditional methods.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.Notes

Readers can refer to Chap. 17 of “Options, futures and other derivatives” (7th ed.) written by John C. Hull.

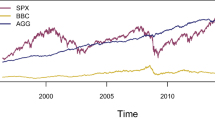

There are three reasons for us to choose this period for simulation. Firstly, it contains both downturns and upturns in underlying market. Secondly, the subprime crisis swept across the United States, the European Union and Japan along with other major financial markets since August 2007, providing a good platform to test whether our model can escape or endure such severe market shocks. Thirdly, since the problem is considered from the view of a Chinese investor, the effect of series reforms of deepening the international investment and exchange rate mechanism appears gradually since October 2007.

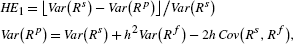

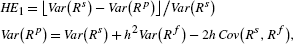

Hedging efficiency indicator is designed to measure the effect of hedging. We give the following two indicators in terms of minimum risk case and maximum utility case, respectively. In the framework of minimum risk case, we apply the formula proposed by Ederington (1979), defined as follows:

where Var(R s), Var(R f) present the variance of the proportional change rate of exchange rates and the variance of the log returns of currency options, h represents the optimal risk-minimizing hedge ratio. The higher the indicator HE1, the better the hedging effect.

We also calculate a second indicator for the hedging efficiency, defined as follows:

$$\mathit{HE}_2=\bigl[ 1-E\bigl(R^p\bigr)/E\bigl(R^s\bigr)\bigr]\big/ \big[1-\mathit{Var}\bigl(R^p\bigr)\bigr]\big/\mathit{Var}\bigl(R^s\bigr), \qquad E\bigl(R^p\bigr)=E\bigl(R^s\bigr)-hE\bigl(R^f\bigr)$$where E(R s), E(R f), present the expectation of the proportional change rate of exchange rates and the expectation of the log returns of currency options, h represents the optimal mean-risk hedge ratio. Lower value of the indicator HE 2 indicates better hedging efficiency.

Traders usually ensure that their portfolios are Delta-neutral firstly. Whenever the opportunity arises, they improve Gamma and Vega. Gamma is the rate of change of Delta with respect to the price of the underlying asset, which states the stability of Delta. If Gamma is large, Delta is highly sensitive to the stock price, and then it will be quite risky to leave a Delta-neutral portfolio unchanged. Vega is the rate of change of the value of a derivatives portfolio with respect to volatility. As to Theta and Rho, since they are less important compared to Delta, Gamma and Vega, we take Theta as an example to show the effect of risk adjustment.

The upside potential and downside risk ratio (UP_ratio) is proposed by Sortino and Van der Meer (1991), which is a more appropriate measure for risk-adjusted performance. This ratio contracts the average excess return over some target with a measure of shortfall from the same benchmark, as suggested by Sortino et al. (1999).

We use the risk-free rate of three-month US T-bills as the benchmark. Let r t be the realized return of a portfolio in month t=1,2,…,T of the simulation period 10/2007–12/2009. Let ρ t be the return of the benchmark (risk-free asset) at the same period. Then the UP ratio can be measured as follows:

$$\mathit{UP}\_\mathit{ratio}=\frac{1}{T}\sum^T_{t=1}\max[0,r_t-\rho_t]\Big/ \sqrt{\frac{1}{T}\sum^T_{t=1}\bigl( \max[0,\rho_t-r_t] \bigr)^2 } . $$

References

Abdelaziz, F. B., Aouni, B., & Fayedh, R. E. (2007). Multi-objective stochastic programming for portfolio selection. European Journal of Operational Research, 177(3), 1811–1823.

Ahn, D., Boudoukh, J., Richardson, M., & Whitelaw, R. (1999). Optimal risk management using options. Journal of Finance, 54(1), 359–375.

Aliprantis, C., Brown, D., & Werner, J. (2000). Minimum-cost portfolio insurance. Journal of Economic Dynamics and Control, 24(11–12), 1703–1719.

Annaert, J., Deelstra, G., Heyman, D., & Vanmaele, M. (2007). Risk management of a bond portfolio using options. Insurance: Mathematics and Economics, 41(3), 299–316.

Beltratti, A., Laurant, A., & Zenios, S. (2004). Scenario modeling for selective hedging strategies. Journal of Economic Dynamics and Control, 28(5), 955–974.

Blomvall, J., & Lindberg, P. (2003). Back-testing the performance of an actively managed option portfolio at the Swedish stock market, 1990–1999. Journal of Economic Dynamics and Control, 27(6), 1099–1112.

Barro, D., & Canestrelli, E. (2009). Tracking error: a multistage portfolio model. Annals of Operations Research, 165(1), 47–66.

Brennan, M., & Cao, H. (1996). Information, trade, and derivative securities. Review of Financial Studies, 9(1), 163–208.

Carr, P., Jin, X., & Madan, D. (2001). Optimal investing in derivative securities. Finance and Stochastics, 5(1), 33–59.

Chen, W., Sim, M., Sun, J., & Teo, C. P. (2010). From CVaR to uncertainty set: implications in joint chance-constrained optimization. Operations Research, 58(2), 470–485.

Consigli, G., & Dempster, M. A. H. (1998). Dynamic stochastic programming for asset-liability management. Annals of Operations Research, 81(0), 131–162.

Consiglio, A., & Staino, A. (2012). A stochastic programming model for the optimal issuance of government bonds. Annals of Operations Research, 193(1), 159–172.

Dupačová, J., Gröwe-Kuska, N., & Römisch, W. (2003). Scenario reduction in stochastic programming. Mathematical Programming, 95(3), 493–511.

Dupačová, J., & Polívka, J., (2009). Asset-liability management for Czech pension funds using stochastic programming. Annals of Operations Research, 165(1), 5–28.

Ederington, L. (1979). The hedging performance of the new futures markets. Journal of Finance, 36, 157–170.

Ferstl, R., & Weissensteiner, A. (2010). Cash management using multi-stage stochastic programming. Quantitative Finance, 10(2), 209–219.

Ferstl, R., & Weissensteiner, A. (2011). Asset-liability management under time-varying investment opportunities. Journal of Banking & Finance, 35(1), 182–192.

Gao, P. W. (2009). Options strategies with the risk adjustment. European Journal of Operational Research, 192(3), 975–980.

Gaivoronski, A. A., Krylov, S., & Van der Wijst, N. (2005). Optimal portfolio selection and dynamic benchmark tracking. European Journal of Operational Research, 163(1), 115–131.

Geyer, A., Hanke, M., & Weissensteiner, A. (2011). Scenario tree generation and multi-asset financial optimization problems (Working paper). Italy: Free University of Bolzano.

Golub, B., Holmer, M., McKendall, R., Pohlman, L., & Zenios, S. (1995). A stochastic programming model for money management. European Journal of Operational Research, 85(2), 282–296.

Haugh, M., & Lo, A. (2001). Asset allocation and derivatives. Quantitative Finance, 1(1), 45–72.

Hilli, P., Koivu, M., Pennanen, T., & Ranne, A. (2007). A stochastic programming model for asset liability management of a Finnish pension company. Annals of Operations Research, 152(1), 115–139.

Heitsch, H., & Römisch, W. (2003). Scenario reduction algorithms in stochastic programming. Computational Optimization and Applications, 24(2–3), 187–206.

Heitsch, H., & Römisch, W. (2009). Scenario tree reduction for multistage stochastic programs. Computational Management Science, 6(2), 117–133.

Hochreiter, R., Pflug, Ch. G. (2007). Financial scenario generation for stochastic multi-stage decision processes as facility location problems. Annals of Operations Research, 152(1), 257–272.

Horasanli, M. (2008). Hedging strategy for a portfolio of options and stocks with linear programming. Applied Mathematics and Computation, 199(2), 804–810.

Høyland, K., Kaut, M., & Stein, W. (2003). A heuristic for moment-matching scenario generation. Computational Optimization and Applications, 24(2–3), 169–185.

Høyland, K., & Wallace, S. W. (2001). Generating scenario trees for multistage decision problems. Management Science, 47(2), 2952307.

Jorion, P. (1994). Mean-variance analysis of currency overlays. Financial Analysts Journal, May/June, 48–56.

Klaassen, P. (1998). Financial asset-pricing theory and stochastic programming models for asset/liability management: a synthesis. Management Science, 44(1), 31–48.

Klaassen, P. (2002). Comment on “Generating scenario trees for multistage decision problems”. Management Science, 48(11), 1512–1516.

Korn, R., & Trautmann, S. (1999). Optimal control of option portfolios and applications. OR Spectrum, 21, 123–146.

Kouwenberg, R. (2001). Scenario generation and stochastic programming models for asset liability management. European Journal of Operational Research, 134(2), 279–292.

Kusy, M. I., & Ziemba, W. T. (1986). A bank asset and liability management model. Operational Research, 34, 356–376.

Liu, J., & Pan, J. (2003). Dynamic derivative strategies. Journal of Financial Economics, 69(3), 401–430.

Miller, N., & Ruszczyński, A. (2008). Risk-adjusted probability measures in portfolio optimization with coherent measure of risk. European Journal of Operational Research, 191(1), 193–206.

Muck, M. (2010). Trading strategies with partial access to the derivatives market. Journal of Banking & Finance, 34(6), 1288–1298.

Natarajan, K., Pachamanova, D., & Sim, M. (2009). Constructing risk measures from uncertainty sets. Operations Research, 57(5), 1129–1141.

Papahristodoulou, C. (2004). Options strategies with linear programming. European Journal of Operational Research, 157(1), 246–256.

Rasmussen, K. M., & Clausen, J. (2007). Mortgage loan portfolio optimization using multi-stage stochastic programming. Journal of Economic Dynamics and Control, 31(3), 742–766.

Rendleman, R. J. (1995). An LP approach to option portfolio selection. Advances in Futures and Options Research, 8, 31–52.

Rockafellar, R., & Uryasev, S. (2002). Conditional value-at-risk for general distributions. Journal of Banking & Finance, 26(7), 1443–1471.

Sinha, P., & Johar, A. (2010). Hedging Greeks for a portfolio of options using linear and quadratic programming (Working paper). Delhi: University of Delhi.

Sortino, F., & Van der Meer, R. (1991). Downside risk—capturing what’s at stake in investment situations. Journal of Portfolio Management, 17(4), 27–31.

Sortina, F., Van der Meer, R., & Plantinga, A. (1999). The Dutch triangle—a framework to measure upside potential relative to downside risk. Journal of Portfolio Management, 26(1), 50–58.

Topaloglou, N., Vladimirou, H., & Zenios, S. A. (2002). CVaR models with selective hedging for international asset allocation. Journal of Banking & Finance, 26(7), 1535–1561.

Topaloglou, N., Vladimirou, H., & Zenios, S. A. (2008a). A dynamic stochastic programming model for international portfolio management. European Journal of Operational Research, 185(3), 1501–1524.

Topaloglou, N., Vladimirou, H., & Zenios, S. A. (2008b). Pricing options on scenario trees. Journal of Banking & Finance, 32(2), 283–298.

Topaloglou, N., Vladimirou, H., & Zenios, S. A. (2011). Optimizing international portfolios with options and forwards. Journal of Banking & Finance, 35(12), 3188–3201.

Wu, J., & Sen, S. (2000). A stochastic programming model for currency option hedging. Annals of Operations Research, 100(1–4), 227–250.

Wu, F., Li, H. Z., Chu, L. K., Sculli, D., & Gao, K. (2009). An approach to the valuation and decision of ERP investment projects based on real options. Annals of Operations Research, 168(1), 181–203.

Zenios, S. A. (1993). A model for portfolio management with mortgage-backed securities. Annals of Operations Research, 43(6), 337–356.

Zenios, S. A., & Ziemba, W. T. (2006). Handbook of asset and liability management. Series of handbooks in finance. Amsterdam: Elsevier.

Zhao, Y., & Ziemba, W. (2008). Calculating risk neutral probabilities and optimal portfolio policies in a dynamic investment model with downside risk control. European Journal of Operational Research, 185(3), 1525–1540.

Ziemba, W. T., & Mulvey, J. M. (1998). Worldwide asset and liability modeling. Cambridge: Cambridge University Press.

Acknowledgements

The authors would like to thank the National Natural Science Foundation of China for financial support with projects No. 70831001 and 71173008.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yin, L., Han, L. Options strategies for international portfolios with overall risk management via multi-stage stochastic programming. Ann Oper Res 206, 557–576 (2013). https://doi.org/10.1007/s10479-013-1375-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1375-7