Abstract

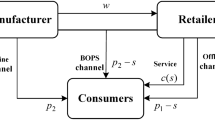

This paper considers a two-stage supply chain in which a supplier serves a set of stores in a retail chain. We consider a two-stage Stackelberg game in which the supplier must set price discounts for each period of a finite planning horizon under uncertainty in retail-store demand. As a mechanism to stimulate sales, the supplier offers periodic off-invoice price discounts to the retail chain. Based on the price discounts offered by the supplier, and after store demand uncertainty is resolved, the retail chain determines individual store order quantities in each period. Because the supplier offers store-specific prices, the retailer may ship inventory between stores, a practice known as diverting. We demonstrate that, despite the resulting bullwhip effect and associated costs, a carefully designed price promotion scheme can improve the supplier’s profit when compared to the case of everyday low pricing (EDLP). We model this problem as a stochastic bilevel optimization problem with a bilinear objective at each level and with linear constraints. We provide an exact solution method based on a Reformulation-Linearization Technique (RLT). In addition, we compare our solution approach with a widely used heuristic and another exact solution method developed by Al-Khayyal (Eur. J. Oper. Res. 60(3):306–314, 1992) in order to benchmark its quality.

Similar content being viewed by others

Notes

We define L P as the number of periods within the supplier’s “promotion time window,” i.e., the number of periods during which the supplier offers a discount. Because L P may equal L, the supplier may in principle offer a discount in any period. However, as noted in Blattberg and Neslin (1989), price promotions that are too frequent tend to lose their effectiveness. Thus, in practical contexts, supplier’s tend to engage in cyclical planning, wherein they tend to offer promotions periodically. As a result, we envision our model as being applied periodically, where, without loss of generality, we assume that promotions are implemented during the first L P periods of the planning horizon.

While we recognize that the pass-through rates are decision variables set by the retailer, we assume fixed values in our model for model tractability. Thus, when using this model for decision making, the supplier must parameterize on the pass-through rate in order to determine (at least approximately) the values that the retailer is likely to apply.

References

Ahuja, R. K., Magnanti, T. L., & Orlin, J. B. (1993). Network flows: theory, algorithms, and applications. New York: Prentice-Hall.

Ailawadi, K., Farris, P. W., & Shames, E. (1999). Trade promotion: essential to selling through resellers. Sloan Management Review, 41(1), 83–92.

Al-Khayyal, F. A. (1992). Generalized bilinear programming: part I. Models, applications and linear programming relaxation. European Journal of Operational Research, 60(3), 306–314.

Al-Khayyal, F. A., & Falk, J. E. (1983). Jointly constrained biconvex programming. Mathematics of Operations Research, 8(2), 273–286.

Al-Khayyal, F. A., Larsen, C., & Van Voorhis, T. (1995). A relaxation method for nonconvex quadratically constrained quadratic programs. Journal of Global Optimization, 6(3), 215–230.

Arcelus, F. J., & Srinivasan, G. (1998). Ordering policies under one time only discount and price sensitive demand. IIE Transactions, 30(11), 1057–1064.

Ardalan, A. (1991). Combined optimal price and optimal inventory replenishment policies when a sale results in increase in demand. Computers & Operations Research, 18(8), 721–730.

Ardalan, A. (1994). Optimal prices and order quantities when temporary price discounts result in increase in demand. European Journal of Operational Research, 72(1), 52–61.

Bell, D. R., & Drèze, X. (2002). Changing the channel: a better way to do trade promotions. MIT Sloan Management Review, 43(2), 42–49.

Ben-Ayed, O. (1993). Bilevel linear programming. Computers & Operations Research, 20(5), 485–501.

Berry, J. (1992). Diverting: Trade diverting is becoming ever more widespread as it grows, so does mistrust between retailer and manufacturer. Adweek’s Marketing Week, 33(20).

Besanko, D., Dubé, J. P., & Gupta, S. (2005). Own-brand and cross-brand retail pass-through. Marketing Science, 24(1), 123–137.

Blattberg, R. C., & Neslin, S. A. (1989). Sales promotion: the long and the short of it. Marketing Letters, 1(1), 81–97.

Blattberg, R. C., Eppen, G. D., & Lieberman, J. (1981). A theoretical and empirical evaluation of price deals for consumer nondurables. The Journal of Marketing, 45(1), 116–129.

Bronnenberg, B. J., Dhar, S. K., & Dubé, J. P. (2005). Market structure and the geographic distribution of brand shares in consumer package goods industries. University of Chicago Mimeograph.

Bronnenberg, B. J., Dhar, S. K., & Dubé, J. P. (2007). Consumer packaged goods in the united states: national brands, local branding. Journal of Marketing Research, 44(1), 4–13.

Cheng, F., & Sethi, S. P. (1999). A periodic review inventory model with demand influenced by promotion decisions. Management Science, 45(11), 1510–1523.

Desai, V. S. (1992). Marketing-production decisions under independent and integrated channel structure. Annals of Operations Research, 34(1), 275–306.

Drèze, X., & Bell, D. R. (2003). Creating win-win trade promotions: theory and empirical analysis of scan-back trade deals. Marketing Science, 22(1), 16–39.

Gómez, M. I., Rao, V. R., & McLaughlin, E. W. (2007). Empirical analysis of budget and allocation of trade promotions in the US supermarket industry. Journal of Marketing Research, 44(3), 410–424.

Knowledge@Wharton (2001). Pay-for-performance trade promotions can ease friction between manufacturers and retailers. http://knowledge.wharton.upenn.edu/article.cfm?articleid=409&source=rss.

Lee, H. L., Padmanabhan, V., & Whang, S. (1997). Information distortion in a supply chain: the bullwhip effect. Management Science, 43(4), 546–558.

MEI Computer Technology Group Inc. (2010). Technology Group Inc. Rebounding economy has CPG firms looking to win back customers as nearly half will spend more on trade promotions this year. http://www.prnewswire.com/news-releases/rebounding-economy-has-cpg-firms-looking-to-win-back-customers-as-nearly-half-will-spend-more-on-trade-promotions-this-year-96877409.html.

Miller, R. (1997). Does everyone have a price. Marketing, 30(3).

Murry, J. P. Jr., & Heide, J. B. (1998). Managing promotion program participation within manufacturer-retailer relationships. The Journal of Marketing, 62(1), 58–68.

Muu, L. D., & Quy, N. V. (2003). A global optimization method for solving convex quadratic bilevel programming problems. Journal of Global Optimization, 26(2), 199–219.

MWPVL International Inc. (2010). The grocery distribution center network in North America. http://www.mwpvl.com/html/grocery_distribution_network.html.

Neslin, S. A., Powell, S. G., & Stone, L. S. (1995). The effects of retailer and consumer response on optimal manufacturer advertising and trade promotion strategies. Management Science, 41(5), 749–766.

Petrik, M., & Zilberstein, S. (2011). Robust approximate bilinear programming for value function approximation. Journal of Machine Learning Research, 12, 3027–3063.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: a review with extensions. Operations Research, 47(2), 183–194.

Sherali, H. D., & Alameddine, A. (1992). A new reformulation-linearization technique for bilinear programming problems. Journal of Global Optimization, 2(4), 379–410.

Sherali, H. D., & Shetty, C. M. (1980). A finitely convergent algorithm for bilinear programming problems using polar cuts and disjunctive face cuts. Mathematical Programming, 19(1), 14–31.

Sogomonian, A. G., & Tang, C. S. (1993). A modeling framework for coordinating promotion and production decisions within a firm. Management Science, 39(2), 191–203.

Su, Y., & Geunes, J. (2012). Price promotions, operations cost, and profit in a two-stage supply chain. Omega.

Thowsen, G. T. (1975). A dynamic, nonstationary inventory problem for a price/quantity setting firm. Naval Research Logistics Quarterly, 22(3), 461–476.

Upasani, A., & Uzsoy, R. (2008). Incorporating manufacturing lead times in joint production-marketing models: a review and some future directions. Annals of Operations Research, 161(1), 171–188.

Vicente, L. N., Calamai, P. H., & Júdice, J. J. (1992). Generation of disjointly constrained bilinear programming test problems. Computational Optimization and Applications, 1(3), 299–306.

Wen, U. P., & Hsu, S. T. (1991). Linear bi-level programming problems–a review. Journal of the Operational Research Society, 42(2), 125–133.

Xiao, T., Yu, G., Sheng, Z., & Xia, Y. (2005). Coordination of a supply chain with one-manufacturer and two-retailers under demand promotion and disruption management decisions. Annals of Operations Research, 135(1), 87–109.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 A.1 Decomposition of uncapacitated minimum cost flow problem

This section provides a proof that an uncapacitated minimum cost flow problem can be decomposed into a set of shortest path problems.

Theorem 1

A single-origin, N-destination uncapacitated minimum cost flow problem can be decomposed into N shortest path problems that do not depend on the demand level.

Proof

Assume without loss generality that we have a directed network G=(V,E), where V={0,1,…,N} is the set of nodes and E is the set of arcs. Each arc (i,j)∈E has an associated cost c ij that denotes the cost per unit flow on that arc. We also assume that each arc has an infinite capacity, i.e., there is no upper bound on the maximum amount that can flow on any arc. The network has a unique node 0, called the source, with supply \(\sum_{i=1}^{N} d_{i}\). For each nonsource node i∈V, we associate with it a demand level d i (≥0). The single-origin N-destination uncapacitated minimum cost flow problem is to determine a minimum cost flow through the uncapacitated network in order to satisfy demands at the N nonsource nodes from available supplies at the source node 0. The decision variables in this problem are arc flows, and we represent the flow on an arc (i,j)∈E by x ij . The single-origin N-destination uncapacitated minimum cost flow problem can be formulated as follows:

The flow decomposition theorem (Ahuja et al. 1993) implies that the flow x ij on each arc (i,j)∈E can be decomposed by destination, with \(x_{ij}^{l}\) representing of flow on arc (i,j) used to satisfy demand at node l. With this notation, we can reformulate the single-origin N-destination uncapacitated minimum cost flow problem as follows:

By definition, we have \(x_{ij} = \sum_{l=1}^{L} x_{ij}^{l}\). Suppose we define variables \(y_{ij}^{l}=\frac{x_{ij}^{l}}{d_{l}}\). Using these, the single-origin N-destination uncapacitated minimum cost flow problem can be expressed as follows:

In this above formulation, the set of feasible solutions Y can be decomposed into N sets Y 1,Y 2,…,Y N, where

By observation, the variables for each subset do not appear in any other set. Consequently, we can decompose UMCP″ into N shortest path problems which do not depend on the demand level in the following formulation:

After solving all of these N shortest path problems, we can obtain the solutions to the original UMCP using the following relationship:

□

1.2 A.2 Detailed Al-Khayyal approach

The detailed Al-Khayyal branch-and-bound algorithm is shown in Algorithm 2. After initializing the branch-and-bound tree in line 1, the algorithm repeats the Main Step in the while loop in lines 2–29 until the optimality gap is less than a predetermined value ϵ. At the start of each iteration k of the while loop, a node (u,v) is selected and removed from tree T k in line 3. In lines 4 and 5, the linear program LP(Ω (u,v)) is solved to obtain the solution \(\bar{\varLambda}\) and the corresponding optimal value \(\varPhi (\bar{\varLambda})\) is assigned to UB k . In lines 6–16, the current iteration lower bound LB k is obtained and the partitioning index (p,q) is found by checking the optimality and the feasibility of the solution \(\bar{\varLambda}\). After finding (p,q), partition the region Ω (u,v) into two mutually exclusive and exhaustive subregions in lines 18–21. At the end of the while loop, the branch-and-bound tree is updated by three types of operations in lines 22–27. Included here are

-

1.

update the lower bound of the problem if LB<LB k as follows:

$$\mathit{LB} \gets \mathit{LB}_k \text{ and } \bigl(x^*,y^*,z^*,\pi^*\bigr) \gets ( \bar{x},\bar{y},\bar{z},\bar{\pi}); $$ -

2.

update the node set at iteration k as

$$T_k \gets T_k -\bigl\{ (m,n)\in T_k: \mathit{UB}^{(m,n)} \leq \mathit{LB}\bigr\} ; $$ -

3.

update the upper bound of the problem as

$$\mathit{UB} =\max \bigl\{ \mathit{UB}^{(m,n)}, \forall (m,n) \in T_{k+1}\bigr\} . $$

Rights and permissions

About this article

Cite this article

Su, Y., Geunes, J. Multi-period price promotions in a single-supplier, multi-retailer supply chain under asymmetric demand information. Ann Oper Res 211, 447–472 (2013). https://doi.org/10.1007/s10479-013-1485-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1485-2