Abstract

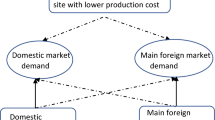

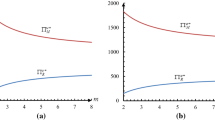

A multinational company may move production to a foreign country to take advantage of low manufacturing cost, and/or experience tax savings. Transfer prices play an important and strategic role on income shifting by multinational companies. In this paper, we construct a framework for optimal decision making in global supply chains with uncertain and price-dependent demand, propose methods to improve global supply chain parties’ performance, and explore schemes to integrate global supply chains. The optimal pricing and offshoring decisions are investigated for different situations where the low foreign production cost and low foreign tax rate exist or only one of them is available. The case of low foreign tax rate without the advantage of low foreign production cost provides the most interesting findings that partial offshoring dominates when a certain threshold is met. In addition, the double marginalization is examined in decentralized global supply chains similar to the mechanism in newsvendor problems. Due to the existence of the tax jurisdiction, the double marginalization cannot be completely eliminated by coordinating schemes. Finally, the traditional buy back contract is found to be unable to coordinate global supply chains, while a modified sales sharing contract can improve the performance of the global supply chain.

Similar content being viewed by others

References

Abdallah, W. M. (1989). International transfer pricing policies: Decision making guidelines for multinational companies. New York: Quorum.

Arntzen, B. C., Brown, G. G., Harrison, T. P., & Trafton, L. L. (1995). Global supply chain management at digital equipment corporation. Interfaces, 25(1), 69–93.

Autrey, R. L., & Bova, F. (2012). Gray markets and multinational transfer pricing. The accounting review, 87, 393–421.

Baldenius, T., Melumad, N. D., & Reichelsein, S. (2004). Integrating managerial and tax objectives in transfer pricing. The accounting review, 79, 591–615.

Bhatnagar, R., Mehta, P., & Teo, C. (2011). Coordination of planning and scheduling decisions in global supply chains with dual supply modes. International Journal of Production Economics, 131, 473–482.

Bogataj, D., & Bogataj, M. (2011). The role of free economic zones in global supply chains - a case of reverse logistics. International Journal of Production Economics, 131, 365–371.

Cachon, G. P. (2003). Supply chain coordination with contracts. In A. G. de Kok & S. C. Graves (Eds.), Supply Chain Management: Design, Coordination and Operation (pp. 229–340). Amsterdam: Elsevier.

Cachon, G. P., & Kok, A. G. (2007). Implementation of the newsvendor model with clearance pricing: How to (and how not to estimate a salvage value). Manufacturing & Service Operations Management, 9, 276–290.

Chen, F., & Krass, D. (2001). Analysis of supply contracts with minium total order quantity commitments and non-stationary demands. European Journal of Operational Research, 131, 302–333.

Cohen, M. A., Fisher, M., & Jaikumar, R. (1989). International manufacuturing and distribution networks: A normative model framework. In K. Ferdows (Ed.), Managing International Manufacturing (pp. 67–93). Amsterdam: North-Holland.

Davidson, P. (2010). Some manufacturing heads back to USA. USA Today, Aug 2010.

De Mooij, R. A., & Ederveen, S. (2003). Taxation and foreign direct investment: A synthesis of empirical research. International Tax and Public Finance, 10, 673–693.

Erickson, G. M. (2012). Transfer pricing in a dynamic marketing-operations interface. European Journal of Operational Research, 216, 326–333.

Ernst & Young (2010–2013). Global transfer pricing surveys. Tech. rep.

Federgruen, A., & Heching, A. (1999). Combined pricing and inventory control under uncertainty. Operations Research, 47(3), 454–475.

Feng, Q. (2010). Integrating Dynamic Pricing and Replenishment Decisions Under Supply Capacity Uncertainty. Management Science, 56(12), 2154–2172.

Goetschalckx, M., Vidal, C., & Dogan, K. (2002). Modeling and design of global logistics systems: A review of integrated strategic and tactical models and design algorithms. European Journal of Operational Research, 143(1), 1–18.

Gravelle, J. (2010). Tax Havens: International tax avoidance and evasion. Congressional Research Service, 7–5700.

Halperin, R., & Srinishi, B. (1987). The effect of the U.S. income tax regulations’ transfer pricing rules on allocative efficiency. The Accounting Review, 62(4), 686–706.

Hirshleifer, J. (1956). On the economics of transfer pricing. Journal of Business, 29, 172–184.

Horst, T. (1972). The theory of the multinational firm: optimal behavior under different tariff and tax rates. Journal of Political Economy, 79(5), 1059–1072.

Hsu, V., & Zhu, K. (2011). Tax-effective supply chain decisions under China’s export-oriented tax policies. Manufacturing & Service Operations Management, 13(2), 163–179.

Kouvelis, P., & Gutierrez, G. (1997). The newsvendor problem in a global market: optimal centralized and decentralized control policies for a two-market stochastic inventory system. Management Science, 43(5), 571–585.

Leng, M., & Parlar, M. (2012). Transfer pricing in a multidivisional firm: A cooperative game analysis. Operations Research Letters, 40, 364–369.

Lerner, A. P. (1934). The concept of monopoly and the measurement of monopoly power. Review of Economic Studies, 1(3), 157–175.

Meixell, M., & Gargeya, V. B. (2005). Global supply chain design: A literature review and critique. Transportation Research, 41(6), 531–550.

Moser, H. (2011). Reshoring initiative—bring manufacturing back home. Brooks, Oct. 2011

Mutti, J. (2003). Foreign Direct Investment and Tax competition. Washington: IIE Press.

Nieckels, L. (1976). Transfer pricing in Multinational Firms: A heuristic programming approach and a case study. New York: Wiley.

OECD (1979, 1995, 1996, 1997). Transfer pricing guidelines for multinational enterprises and tax administrations. Paris: OECD.

Perron, S., et al. (2010). Exact and heuristic solutions of the global supply chain problem with transfer pricing. European Journal of Operational Research, 202, 864–879.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: a review with extensions. Operations Research, 47(2), 183–194.

Prasad, S., & Sounderpandian, J. (2003). Factors influencing global supply chain efficiency: implications for information systems. Supply Chain Management, 8(3/4), 241–250.

Schnabel, J. (2011). Deriving competitive advantage from real exchange rate changes. Competitive Review, 21(3), 322–327.

Shunko, M., & Gavirneni, S. (2007). Role of transfer prices in global supply chains with random demands. Journal of Industrial and Management Optimization, 3(1), 99–117.

Shunko, M., et al. (2010). Transfer Pricing and Offshoring in Global Supply Chains. Working paper.

Song, Y., Ray, S., & Li, S. (2008). Structural properties of buyback contracts for price-setting newsvendors. Manufacturing & Service Operations Management, 10(1), 1–18.

Song, Y., Ray, S., & Boyaci, T. (2009). Optimal dynamic joint inventory-pricing control for multiplicative demand with fixed order costs and lost sales. Operations Research, 57(1), 245–250.

Souza, G. C., et al. (2004). Coordinating sales and raw materials discounts in a global supply chain. Production and Operations Management, 13(1), 34–45.

Toyota (2011). http://www.toyoland.com.

Vidal, C. J., & Goetschalckx, M. (2001). A global supply chain model with transfer pricing and transportation cost allocation. European Journal of Operational Research, 129, 134–158.

Wang, Y. (2006). Joint pricing-production decisions in supply chains of complementary products with uncertain demand. Operations Research, 54, 1110–1127.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Theorem 1

Consider the first partial derivatives of π(P,T,z) taken with respect to T: \(\frac{\partial\pi}{\partial T} = y(P)z(t_{L} - t_{F})\). The function is monotone increasing in T when t L >t F and monotone decreasing in T when t L <t F . Following the sequential procedure in Petruzzi and Dada (1999), we have \(T_{c}^{*} = T_{U}\) when t L >t F , and \(T_{c}^{*} = c_{F}\) if t L <t F . In addition, any feasible transfer price T is optimal when t L =t F . We have three cases as follows.

Case 1 t L >t F . Substitute \(T_{c}^{*} = T_{U}\) into the profit function, we have,

Let

it is easy to see that \(\frac{\partial\pi(T_{c}^{*},P,z)}{\partial P} < 0\ \forall P > P_{c}^{*}\) and \(\frac{\partial\pi(T_{c}^{*},P,z)}{\partial P} < 0\ \forall P < P_{c}^{*}\), thus \(P_{c}^{*}\) is the unique maximum of \(\pi (T_{c}^{*},P,z)\) given z. If we define \(M \equiv\frac{(1 - t_{L})T_{U} - (1 - t_{F})(T_{U} - c_{F})}{1 - t_{L}}\), the optimal retail price can be expressed as \(P_{c}^{*} = \frac{bzM}{(b - 1)(z - \varLambda(z))}\).

Following the tax regulation, we should examine if the suggested optimal retail price and transfer price make the local company a non-negative profit. In fact, we have the following the following profit function of the local company via substituting \(P_{c}^{*}\) and \(T_{c}^{*}\) into Eq. (1),

Therefore, as long as \(T_{U} \le\frac{bc_{F}(1 - t_{F})}{b(1 - t_{F}) - (1 - t_{L})}\), the non-negativity of local profit can be guaranteed. In the case that the transfer price has a high upper limit, the company should sacrifice partial of the tax benefit and set the ultimate transfer price to be threshold, i.e., \(T_{c}^{*} = \frac{bc_{F}(1 - t_{F})}{b(1 - t_{F}) - (1 - t_{L})}\). For the ease of future expression, in the notation M, we declare that T U denotes the true upper limit T U if the inequality is satisfied or the threshold \(\frac{bc_{F}(1 - t_{F})}{b(1 - t_{F}) - (1 - t_{L})}\) otherwise.

Furthermore, the transfer price should not be higher than the retail price, i.e., T≤P. Such inequality leads to \(T_{c}^{*} \le\frac{Kc_{F}(1 - t_{F})}{K(t_{L} - t_{F}) + (1 - t_{L})}\). Let \(T_{ \le P} = \frac{Kc_{F}(1 - t_{F})}{K(t_{L} - t_{F}) + (1 - t_{L})}\), we can show that T ≤P >c F .

We give out the optimal z as follows. The optimal profit function is

Except the scale (1−t L ), the structure of \(\pi (T_{c}^{*},P_{c}^{*},z)\) is same with that in Theorem 2 of Petruzzi and Dada (1999). Thus, if b≥2 and \(r(z) = \frac{\phi(z)}{1 - \varPhi(z)}\) is increasing for A≤z≤B, which implies 2r(z)2+dr(z)/dz>0, there is a unique optimal value \(z_{c}^{*}\) which satisfies \(\varPhi (z_{c}^{*}) = \frac{z_{c}^{*} + (b - 1)\varLambda(z_{c}^{*})}{bz_{c}^{*}}\).

Case 2 t L <t F . \(T_{c}^{*} = c_{F}\), \(\frac{\partial\pi (T_{c}^{*},P,z)}{\partial P} = (1 - t_{L})\frac{y(P)}{P}[ - (b - 1)P(z - \varLambda(z)) + bzc_{F}]\). Let \(P_{c}^{*} = \frac{bzc_{F}}{(b - 1)(z - \varLambda(z))}\), which is the unique maximizer of \(\pi(T_{c}^{*},P,z)\) given z. In addition, according to Proposition 2 later, \(P_{c}^{*}\) is a qualified retail price which makes the local company owns a positive profit.

Now, we substitute \(P_{c}^{*}\) into \(\pi(T_{c}^{*},P,z)\) and optimize over z. \(\pi(T_{c}^{*},P_{c}^{*},z) = (1 - t_{L}) [ y(P_{c}^{*})z(P_{c}^{*} - c_{F}) - P_{c}^{*}y(P_{c}^{*})\varLambda(z) ]\). We have the same optimal conditions and same optimal solution \(z_{c}^{*}\) as that in case 1. □

Proof of Proposition 1

Simply follow the Theorem 2 of Petruzzi and Dada (1999). □

Proof of Theorem 2

Based on Proposition 2, we substitute \(P_{d}^{*}(z,T)\) and \(z_{d}^{*}\) into π(T), and take the first order condition with respect to T, then we have

where \(K = \frac{bz}{(b - 1)[z - \varLambda(z)]} > 0\), thus azK(KT)−(b+1)>0 for all feasible values, therefore π is unimodal in T. Considering the transfer price should meet the condition c F ≤T≤P, we have \(T_{d}^{*} = \frac{bc_{F}(1 - t_{F})}{b(1 - t_{F}) - (t_{L} - t_{F})}\) if t L >t F . Note that \(\frac{bc_{F}(1 - t_{F})}{b(1 - t_{F}) - (t_{L} - t_{F})} \le c_{F}\) if t L ≤t F , but we need the transfer price not less than the foreign manufacturing cost, thus \(T_{d}^{*} = c_{F}\) if t L ≤t F . □

Proof of Theorem 3

Only the proof of (1b) is shown here. According to the proof of Theorem 1, given λ and T, the optimal retail price is in the form of

Then taking the first order condition with respect to T and λ, respectively

Let \(Q = \frac{c_{F}(1 - t_{F}) - (1 - t_{L})c_{L}}{t_{L} - t_{F}}\). When t L >t F and c L <c F , Q>c F . If T U ≤Q, \(\frac{\partial\pi(\lambda)}{\partial\lambda} < 0\) for any λ≥0. We conclude that no offshoring exists when T U ≤Q.

On the other side, if T U >Q, we have \(\frac{\partial\pi(\lambda )}{\partial\lambda} |_{\lambda= 0,T > Q} > 0\) which assures that given any T>Q, π(Δλ)>π(λ=0), i.e, a profit jump at λ=0, where Δλ refers to a small value. Note that π(λ=0) denotes the profit from no offshoring.

But the transfer price T can’t be an arbitrary value; It should satisfy another two conditions besides T>Q: (I) π L (T)≥0 and (II) T≤P. Recall that the retail price is in the form P(λ,T)=K(λT+(1−λ)c L ). Given any T>Q, lim λ→0 P(λ,T)=Kc L . Therefore, if Kc L >Q, there exists λ>0 and P(λ,T)≥T is satisfied.

The criterion π L (T)≥0 requests \(T \le\frac{(1 - \lambda)(1 - t_{L})c_{L} + \lambda bc_{F}(1 - t_{F})}{\lambda [ b(1 - t_{F}) - (t_{L} - t_{F}) ]}\). Taking into account the total profit increases as T increases, the form of the optimal transfer price must be like

Along with the criterion T(λ)≤P, i.e.,

we can deduct the optimal λ ∗ if it exists. To be specific,

where

If c L <c F and t L >t F , we have \(\bar{a} > 0\) and \(\bar{c} < 0\), thus the shape of the quadratic curve (Eq. (9)) is upward, so if \(\frac{ - \bar{b} + \sqrt{\bar{b}^{2} - 4\bar{a}\bar{c}}}{2\bar{a}} \le1\), i.e., Kb−(K+b)≥0, the optimal solution is \(\lambda^{*} = \frac{ - \bar{b} + \sqrt{\bar{b}^{2} - 4\bar{a}\bar{c}}}{2\bar{a}}\). □

Proof of Theorem 4

Similar to the proof of Theorem 3 except that the Proposition 3 has to be considered. □

Proof of Discussion 1

Due to the constraint T≤P, we have to explore the optimal solution from two different conditions, i.e., Path A: looking for a best T with an endogenous optimal λ(T), and Path B: looking for a best λ with an endogenous optimal T(λ).

Path A: Based on Proposition 3, substituting \(P_{cd}^{*}(z_{cd}^{*})\) and \(z_{cd}^{*}\) into π(T,λ), and taking the first order condition with respect to T, we can prove that π is unimodal in T, and

When t L >t F and c L <c F , π(T ∗(λ),λ) is decreasing in λ from the evidence

Note that the constraint Q≤T≤P should be taken into account before constructing the optimal solutions. T≤P is equivalent to the following inequality by simple algebraic derivation:

where

If c L <c F and t L >t F , we have \(\tilde{a} > 0\) and \(\tilde{c} < 0\), thus the shape of the quadratic curve (Eq. (11)) is upward, so the minimal feasible value of λ is optimal, i.e., \(\lambda^{*} = \frac{ - \tilde{b} + \sqrt{\tilde{b}^{2} - 4\tilde{a}\tilde{c}}}{2\tilde{a}}\). If T ∗(λ ∗)<Q, there is no optimum (due to \(\frac{\partial T^{*}(\lambda)}{\partial\lambda} < 0\)) from the path A, noticing that

increases as λ decreases.

Path B: Similarly, given T, we can easily find the optimal offshoring proportion λ

Again, the optimal solution must meet T≤P, which is equivalent to the following inequality by simple algebraic derivation:

where

Under the situation c L <c F and t L >t F , we have \(\hat {a} > 0\), \(\hat{b} < 0\) and \(\hat{c} < 0\), so there is a feasible range for T. More important, Q makes equality. When Kc L >Q, the optimal transfer price is in the form

We refer π A and π B to the total profits derived from Path A and B, respectively. Hence,

while

In fact, we can prove \(\lambda_{B}^{*}(T_{A}^{*}(\lambda_{A}^{*})) < \lambda_{A}^{*}\), but the solution (\(\lambda_{B}^{*}(T_{A}^{*}(\lambda_{A}^{*})),T_{A}^{*}(\lambda_{A}^{*})\)) is not feasible due to an invalid P<T, though bringing a higher profit. Therefore, the comparison π A and π B simply makes decision on the optimal solution for the headquarters. □

Proof of Theorem 5

Given fixed P,z, and T, consider the first partial derivatives of π L taken with respect to λ:

-

(1)

If c L <c F , it is easy to see c L −T<c F −T≤0, thus \(\frac{\partial\pi_{L}}{\partial\lambda} < 0\). The optimal \(\lambda_{dc}^{*}\) for the retailer is \(\lambda_{dc}^{*} = 0\), i.e., no offshoring.

-

(2)

If c L >c F , then \(\lambda_{dc}^{*} = 0\) given T>c L , \(\lambda_{dc}^{*} = 1\) given c F ≤T<c L , and ∀λ∈[0,1] is optimal given T=c L . Note that the retailer and headquarters play a Stackelberg game, where the headquarters act as the leader. Given the retailer’s response function, we analysis the decision of the headquarters.

Consider the first partial derivatives of π taken with respect to T:

$$\frac{\partial\pi(P,T,z,\lambda(P,T,z))}{\partial T} = y(P)z\lambda (t_{L} - t_{F}) $$It is easy to find that if t L <t F , then \(T_{dc}^{*} = c_{F}\), and \(\lambda_{dc}^{*} = 1\);

-

(2a)

if t L >t F , we discover that the local company makes decision on λ depending on the difference between c L and the transfer price to be set by the headquarters. Therefore, when c L >min{T U ,T L+}, \(\lambda_{dc}^{*} = 1\), and all other optimal solutions are same as Theorem 1(a). Otherwise, offshoring occurs.

-

(2b)

if t L <t F , the optimal solutions are same as in Theorem 1(b).

□

Proof of Theorem 6

Proof is similar to Theorem 5 except that Proposition 1 should be considered here. □

Rights and permissions

About this article

Cite this article

Wang, Z., Gao, W. & Mukhopadhyay, S.K. Impact of taxation on international transfer pricing and offshoring decisions. Ann Oper Res 240, 683–707 (2016). https://doi.org/10.1007/s10479-013-1489-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1489-y