Abstract

This paper deals with an economic order quantity (EOQ) model for uncertain demand when capacity of own warehouse (OW) is limited and the rented warehouse (RW) is considered, if needed. The expected average cost function is formulated for both continuous and discrete distributions of demand function by trading off holding costs and stock out penalty. The model is justified by suitable illustrations for various types of distributions.

Similar content being viewed by others

References

Adida, E., & Perakis, G. (2010). Dynamic pricing and inventory control: robust vs. stochastic uncertainty models-a computational study. Annals of Operations Research, 181, 125–157.

Arcelus, F. J., Pakkala, T. P. M., & Srinivasan, G. (2006). On the interaction between retailers inventory policies and manufacturer trade deals in response to supply-uncertainty occurrences. Annals of Operations Research, 143, 45–58.

Artalejo, J. R., Krishnamoorthy, A., & Lopez-Herrero, M. J. (2006). Numerical analysis of (s,S) inventory systems with repeated attempts. Annals of Operations Research, 141, 67–83.

Chen, M. S., & Chuang, C. C. (2000). An extended newsboy problem with shortage-level constraints. International Journal of Production Economics, 67, 269–277.

Chen, S., & Geunes, J. (2013). Optimal allocation of stock levels and stochastic customer demands to a capacitated resource. Annals of Operations Research, 203, 33–54.

Chou, Y. C., & Chung, H. J. (2009). Service-based capacity strategy for manufacturing service duopoly of differentiated prices and lognormal random demand. International Journal of Production Economics, 121, 162–175.

Chung, K., & Huang, T. (2007). The optimal retailer’s ordering policies for deteriorating items with limited storage capacity under trade credit financing. International Journal of Production Economics, 106, 127–146.

Chung, K., Her, C., & Lin, S. (2009). A two-warehouse inventory model with imperfect quality production processes. Computers & Industrial Engineering, 56, 193–197.

Demirag, O. C., Chen, Y. F., & Yang, Y. (2013). Production-inventory control policy under warm/cold state-dependent fixed costs and stochastic demand: partial characterization and heuristics. Annals of Operations Research, 208, 531–556.

Federgruen, A., & Wang, M. (2013). Monotonicity properties of a class of stochastic inventory systems. Annals of Operations Research, 208, 155–186.

Hariga, M. (2011). Inventory models for multi-warehouse systems under fixed and flexible space leasing contracts. Computers & Industrial Engineering, 61, 744–751.

Hsieh, C. C., & Lu, Y. T. (2010). Manufacturer’s return policy in a two-stage supply chain with two risk-averse retailers and random demand. European Journal of Operational Research, 207, 514–523.

Jammernegga, W., & Kischkab, P. (2013). The price-setting newsvendor with service and loss constraints. Omega, 41, 326–335.

Johansen, S. G., & Thorstenson, A. (1993). Optimal and approximate (Q,r) inventory policies with lost sales and gamma distribution lead time. International Journal of Production Economics, 30(31), 179–194.

Kalpakam, S., & Shanthi, S. (2006). A continuous review perishable system with renewal demands. Annals of Operations Research, 143, 211–225.

Lee, C., & Hsu, S. (2009). A two-warehouse production model for deteriorating inventory items with time-dependent demands. European Journal of Operational Research, 194, 700–710.

Lee, C., & Ma, C. (2000). Optimal inventory policy for deteriorating items with two-warehouse and time-dependent demands. Production Planning & Control, 11, 689–696.

Li, J., Enginarlar, E., & Meerkov, S. M. (2004). Random demand satisfaction in unreliable production–inventory–customer systems. Annals of Operations Research, 126, 159–175.

Liang, Y., & Zhou, F. (2011). A two-warehouse inventory model for deteriorating items under conditionally permissible delay in payment. Applied Mathematical Modelling, 35, 2221–2231.

Liao, J., & Huang, K. (2010). Deterministic inventory model for deteriorating items with trade credit financing and capacity constraints. Computers & Industrial Engineering, 59, 611–618.

Liberopoulos, G., Pandelis, D. G., & Hatzikonstantinou, O. (2013). The stochastic economic lot sizing problem for non-stop multi-grade production with sequence-restricted setup changeovers. Annals of Operations Research, 209, 179–205.

Okyay, H. K., Karaesmen, F., & Özekici, S. (2013). Newsvendor models with dependent random supply and demand. Optimization Letters. doi:10.1007/s11590-013-0616-7.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the news vendor problem: a review with extension. Operations Research, 47, 183–194.

Rossi, R., Tarim, S. A., Hnich, B., & Prestwich, S. (2012). Constraint programming for stochastic inventory systems under shortage cost. Annals of Operations Research, 195, 49–71.

Sana, S. S. (2011). The stochastic EOQ model with random sales price. Applied Mathematics and Computation, 218, 239–248.

Sana, S. S., Mondal, S. K., Sarkar, B. K., & Chaudhuri, K. S. (2011). Two-warehouse inventory model on pricing decision. International Journal of Management Science and Engineering Management, 6, 403–416.

Taleizadeh, A. A., Niaki, S. T. A., & Makui, A. (2012). Multiproduct multiple-buyer single vendor supply chain problem with stochastic demand, variable lead-time, and multi-chance constraint. Expert Systems with Applications, 39, 5338–5348.

Wang, C. H. (2010). Some remarks on an optimal order quantity and reorder point when supply and demand are uncertain. Computers & Industrial Engineering, 58, 809–813.

Xiao, T., Jin, J., Chen, G., Shi, J., & Xie, M. (2010). Ordering wholesale pricing and lead-time decisions in a three-stage supply chain under demand uncertainty. Computers & Industrial Engineering, 59, 840–852.

Zhang, G. (2010). The multi-product newsboy problem with supplier quantity discounts and a budget constraint. European Journal of Operational Research, 206, 350–360.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: When q≥W(≠φ)

Let I r (t) is on-hand inventory at RW, I w (t) is on-hand inventory at OW and I s (t) is shortage level at time t. Here, two cases may arise for uncertain demand (x):

1.1 A.1 Case I: when shortage does not occur, i.e., q≥x

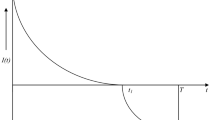

As the demand over the period [0,T] is x, the demand per unit time is x/T. The stock at Rw is cleared first. Thereafter, the stock at OW is used to adjust the demand of the customers. Now, the on-hand inventories are:

and

Using I r (t r )=0, we have t r =(q−W)T/x. Now, I w (T)≥0 implies q≥x. Therefore, the average inventory cost at RW is \(\mathrm{Inv}_{r}^{1} = \frac{c_{r}}{T} \int_{0}^{t_{r}} \{ ( q-W ) - \frac{xt}{T} \} dt = \frac{c_{r}}{2x} ( q-W )^{2}\) and the average inventory cost at OW is

1.2 A.2 Case 2: when shortage occurs

In this situation, q≤x, the on-hand inventories and shortage are as follows:

and

Now, I r (t r )=0 implies t r =(q−W)T/x and I w (t r +t w )=0 implies t w =WT/x. Therefore, the average inventories and shortage are:

and

The expected average cost, combining case 1 and case 2, we have

Appendix B: When q≤W(≠φ)

In this case, RW is not needed. Let I w (t) is on-hand inventory at OW and I s (t) is shortage level at time t. Here, two cases may arise for uncertain demand (x):

2.1 B.3 Case 1: when shortage does not occur, i.e., q≥x

As the demand over the period [0,T] is x, the demand per unit time is x/T. The stock at Rw is cleared first. Thereafter, the stock at OW is used to adjust the demand of the customers. Now, the on-hand inventory is:

Now, I w (T)≥0 implies q≥x. Therefore, the average inventory cost at OW is \(\mathrm{Inv}_{w}^{1} = \frac{c_{h}}{T} [ \int_{0}^{T} \{ q- \frac{xt}{T} \} dt ] = c_{h} [ q- \frac{x}{2} ]\).

2.2 B.4 Case 2: when shortage occurs

In this situation, q≤x, the on-hand inventory and shortage are as follows:

and

Now, I w (t w )=0 implies t w =qT/x. Therefore, the average inventory and shortage are:

The expected average cost, combining Case 1 and Case 2, we have

Rights and permissions

About this article

Cite this article

Sana, S.S. An EOQ model for stochastic demand for limited capacity of own warehouse. Ann Oper Res 233, 383–399 (2015). https://doi.org/10.1007/s10479-013-1510-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1510-5